(All monetary figures are expressed in U.S. dollars unless otherwise stated)

Dundee Precious Metals Inc. ("DPM" or the "Company")

(TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) today reported second quarter 2011 net

earnings attributable to common shareholders of $9.1 million ($0.07 per share)

compared to $14.9 million ($0.12 per share) for the same period in 2010.

The quarter over quarter decrease in earnings was due primarily to lower

production and increased maintenance costs at the Namibia Smelter ("NCS"), as a

result of the scheduled maintenance shutdown of the Ausmelt furnace in April

2011, reduced unrealized gains related to Sabina Gold & Silver Corp. special

warrants, higher exploration expenses at Avala, a weaker U.S. dollar and lower

payable metals in concentrate sold due to the timing of shipments in 2010,

partially offset by stronger metal prices. A concentrate shipment of 5,812

tonnes originally scheduled for March 2010 was shipped in April 2010 resulting

in a decrease in concentrate inventories at Chelopech and increased deliveries

in the second quarter of 2010.

For the first half of 2011, the Company reported net earnings attributable to

common shareholders of $23.1 million ($0.19 per share) compared to a loss

attributable to common shareholders of $34.1 million ($0.30 per share) in the

corresponding period in 2010. This increase was primarily attributable to an

impairment provision of $50.6 million taken in 2010 as well as stronger metal

prices, higher deliveries of concentrates and higher payable metals in

concentrate sold partially offset by higher general and administrative expenses,

higher exploration expenses and unrealized losses on copper derivative

contracts.

"We continue to make good progress on the Chelopech expansion and improving

operational performance across each of our businesses," said Jonathan Goodman,

the Company's President and CEO. "Production during the second half of the year

is expected to be up significantly, in line with our annual guidance, and

together with current metal prices, should generate significant cash flow."

Concentrate production for the three and six months ended June 30, 2011 was

28,263 tonnes and 47,398 tonnes, respectively, representing a 27% and 7%

increase relative to the corresponding periods in 2010 reflecting increased

production at Chelopech and Deno Gold consistent with the continued ramp-up of

the mine and mill expansion at Chelopech and the completion of the mine and mill

expansion at Deno Gold in the fourth quarter of 2010.

Deliveries of concentrates of 25,059 tonnes in the second quarter of 2011 were

8% lower than the second quarter of 2010 due to the timing of shipments in 2010.

Year to date, deliveries of concentrates of 48,783 tonnes were 17% higher than

first half of 2010 driven by higher production.

Cash flow from operations, before changes in working capital, in the first half

of 2011 of $38.9 million were $23.1 million higher than the corresponding period

in 2010 due primarily to stronger metal prices and higher deliveries of

concentrates.

Capital expenditures in the second quarter and first half of 2011 of $25.6

million and $48.8 million increased 39% and 68%, respectively, over the

corresponding periods in 2010 due to the ramp-up of the mine and mill expansion

project in Chelopech, the purchase and refurbishment of a used oxygen plant that

will increase the efficiency of the Ausmelt furnace and spending on

environmental projects and upgrades to the smelter at NCS.

Detailed designs and cost estimates in respect of the Chelopech mine and mill

expansion project were completed in July 2011. The approximate cost of the

project is now $176 million, $26 million higher than the preliminary estimate of

$150 million previously communicated due to changes made in respect of the

conveyor and crusher design and the extension of the project schedule.

On May 10, 2011, Chelopech signed a $14.5 million long-term loan agreement with

Raiffeisenbank (Bulgaria) EAD. This agreement concludes a total of $81.25

million in long-term debt financing for the Chelopech mine and mill expansion.

As at June 30, 2011, the Company had substantial liquidity through its cash and

cash equivalents of $138.8 million and investments valued at $181.2 million.

The exploration programs at the Company's operating mines and through its

strategic investments in Serbia and Nunavut are progressing well and continue to

show potential to add significant value to the Company.

With the public hearings on the Krumovgrad gold project EIA now complete, a

decision by the Ministry of Environment and Waters is expected by the end of

2011, which is subject to appeal.

Key Financial and Operating Highlights

----------------------------------------------------------------------------

$ millions, except where noted

Three Months Six Months

------------------------------------

Ended June 30, 2011 2010 2011 2010

----------------------------------------------------------------------------

Revenue 69.1 60.9 137.5 81.4

Gross profit 19.4 18.4 42.0 17.2

Net earnings (loss) attributable to

common shareholders 9.1 14.9 23.1 (34.1)

Earnings (loss) per share 0.07 0.12 0.19 (0.30)

Cash flow from operations, before

changes in working capital 17.0 13.8 38.9 15.8

Concentrate produced (mt) 28,263 22,278 47,398 44,224

Metals in concentrate produced

Gold (ounces) 27,907 22,208 47,492 45,666

Copper ('000s pounds) 8,944 7,256 14,726 14,192

Zinc ('000s pounds) 5,002 3,897 9,763 7,860

Silver (ounces) 182,418 132,975 340,084 261,222

NCS - concentrate processed (mt) 39,274 45,881 77,806 45,881

Cash cost of sales per ounce of gold

sold, net of by-product credits (1)

Chelopech 91 265 21 408

Deno Gold 37 348 128 405

Cash cost per tonne ore processed (1)

Chelopech (excluding royalties) 49.06 47.04 49.97 51.55

Deno Gold (excluding royalties) 65.29 59.21 69.70 63.27

(1) Cash cost of sales per ounce of gold sold, net of by-product credits

and cash cost per tonne of ore processed are not defined measures under

International Financial Reporting Standards ("IFRS"). Refer to the

Management Discussion & Analysis for a reconciliation to IFRS cost of

sales.

DPM's second quarter reports, including its condensed interim unaudited

consolidated financial statements and management's discussion and analysis for

the three and six months ended June 30, 2011, are posted on the Company's

website at www.dundeeprecious.com and have been filed on Sedar at www.sedar.com.

An analyst conference call to discuss these results is scheduled for Friday July

29, 2011, at 8:30 a.m. (EST). The call will be webcast live (audio only) at:

http://www.gowebcasting.com/2507. Listen only telephone option at 416-695-6622

or North America Toll Free at 1-888-818-4097. Replay available at 905-694-9451

or North America Toll Free at 1-800-408-3053, passcode 3547687. The audio

webcast for this conference call will be archived and available on the Company's

website at www.dundeeprecious.com.

Dundee Precious Metals Inc. is a well-financed, Canadian based, international

gold mining company engaged in the acquisition, exploration, development, mining

and processing of precious metals. The Company's principal operating assets

include the Chelopech operation, which produces a gold, copper and silver

concentrate, located east of Sofia, Bulgaria; the Kapan operation, which

produces a gold, copper, zinc and silver concentrate, located in southern

Armenia; and the Tsumeb smelter, a concentrate processing facility located in

Namibia. DPM also holds interests in a number of developing gold properties

located in Bulgaria, Serbia, and northern Canada, including interests held

through its 51.4% owned subsidiary, Avala Resources Ltd., and its 11.6% interest

in Sabina Gold & Silver Corp.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that involve a number

of risks and uncertainties. Forward-looking statements include, but are not

limited to, statements with respect to the future price of gold, copper, zinc

and silver, the estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future production, costs

of production, capital expenditures, costs and timing of the development of new

deposits, success of exploration activities, permitting time lines, currency

fluctuations, requirements for additional capital, government regulation of

mining operations, environmental risks, unanticipated reclamation expenses,

title disputes or claims, limitations on insurance coverage and timing and

possible outcome of pending litigation. Often, but not always, forward-looking

statements can be identified by the use of words such as "plans", "expects", or

"does not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur or be

achieved.

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made, and they involve known and unknown

risks, uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially different from any

other future results, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others: the actual

results of current exploration activities; actual results of current reclamation

activities; conclusions of economic evaluations; changes in project parameters

as plans continue to be refined; future prices of gold, copper, zinc and silver;

possible variations in ore grade or recovery rates; failure of plant, equipment

or processes to operate as anticipated; accidents, labour disputes and other

risks of the mining industry; delays in obtaining governmental approvals or

financing or in the completion of development or construction activities,

fluctuations in metal prices, as well as those risk factors discussed or

referred to in Management's Discussion and Analysis under the heading "Risks and

Uncertainties" and other documents filed from time to time with the securities

regulatory authorities in all provinces and territories of Canada and available

at www.sedar.com. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be other factors

that cause actions, events or results not to be anticipated, estimated or

intended. There can be no assurance that forward-looking statements will prove

to be accurate, as actual results and future events could differ materially from

those anticipated in such statements. Unless required by securities laws, the

Company undertakes no obligation to update forward-looking statements if

circumstances or management's estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on forward-looking statements.

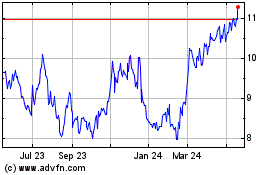

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

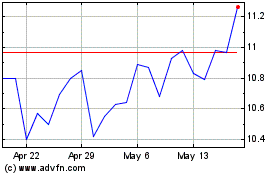

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024