Queensland Minerals Announces Transaction Update and New Shareholder Meeting Date

May 21 2010 - 2:33PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

Queensland Minerals Ltd. (TSX VENTURE:QML) (the "Company" or "Queensland"),

provides this updated news release, as required by the policies of the TSX

Venture Exchange (the "TSXV"), in respect of the proposed transaction that was

first announced on February 23, 2010 pursuant to which the Company will acquire

from Dundee Precious Metals ("DPM") the right, title and interest in mineral

licenses related to the Surdulica molydenum project, the Tulare copper and gold

project and the Karmanica gold project located in Serbia (hereinafter referred

to as the "Serbian Assets") and all other associated assets and liabilities. As

previously disclosed, the contemplated transaction will be effected by way of

the sale to Queensland of DPM's interest in all of the issued and outstanding

securities of Dundee Moly Company d.o.o., a company incorporated in Serbia (the

"Transaction") following a reorganization which will be subject to governmental

approvals and certain other conditions. The Company's shares have been halted

since the Transaction was initially announced.

Private Placement of Subscription Receipts

The Company is proceeding with the previously announced private placement of

subscription receipts ("Subscription Receipts") for minimum gross proceeds of

$10 million (the "Financing"). As previously announced, the Subscription

Receipts will be offered at a price of $0.30 each and will be exchangeable for

one Queensland common share and one half of one Queensland common share purchase

warrant. The offering will be made on a best efforts basis by Dundee Securities

Corporation and Paradigm Capital Inc., acting as co-lead agents, and Mirabaud

Securities LLP, GMP Securities L.P. and Cormark Securities Inc. as agents. The

Financing is expected to close on or about June 9, 2010.

Amended Letter of Intent

The previously announced letter of intent ("LOI") between the Company and DPM

has been amended to extend the deadline for entering into a definitive agreement

in respect of the Transaction to June 30, 2010.

Shareholders Meeting

The Company also announces its decision to cancel the previously announced

meeting of shareholders and has set new record and meeting dates. The Company

will hold its annual and special meeting of shareholders called to consider,

among other things, the Transaction on July 13, 2010. The record date for the

meeting has been set as June 11, 2010. Shareholders of record at the close of

business on the record date will be entitled to vote at the meeting.

About Queensland Minerals Ltd.: The Company is an exploration company with

mineral properties in the State of Queensland, Australia. Since becoming

TSXV-listed issuer in March 2007 upon completion of its initial public offering,

Queensland has carried out mineral exploration in Queensland, Australia through

its two wholly-owned subsidiaries. In late 2008, the Company halted all field

activities as a result of its limited financial resources, and the Company's

remaining project, has been on care and maintenance since. Subsequently, the

Company closed its Australian exploration office and has been engaged in seeking

new opportunities and financing for its next phase as a public company.

Additional information about the Company is available on the Company's website

(www.queenslandminerals.com) and on SEDAR at www.sedar.ca.

This press release contains forward-looking information. In particular, this

press release contains statements concerning the prospective Transaction and the

debt settlement. Although the Company believes in light of the experience of its

officers and directors, current conditions and expected future developments and

other factors that have been considered appropriate that the expectations

reflected in this forward-looking information are reasonable, undue reliance

should not be placed on them because the Company can give no assurance that they

will prove to be correct. Forward-looking information is subject to known and

unknown risks and uncertainties, and depends on assumptions and other factors,

all of which may cause actual results or events to differ materially from those

anticipated in such forward-looking information. The terms and conditions of the

prospective Transaction may change based on the Company's due diligence on the

respective companies and properties, the entering into a binding agreement for

the Transaction, regulatory and third party comments, consents and approvals and

the parties' ability to satisfy the conditions of the Transaction in the

required timeframes. The forward-looking statements contained in this press

release are made as of the date hereof and the Company undertakes no obligations

to update publicly or revise any forward-looking statements or information,

whether as a result of new information, future events or otherwise, unless so

required by applicable securities laws.

Completion of the Transaction is subject to a number of conditions, including

but not limited to, TSXV acceptance and shareholder approval in respect of the

Transaction. The Transaction cannot close until the required shareholder

approval is obtained. There can be no assurance that the Transaction will be

completed as proposed or at all.

Investors are cautioned that, except as disclosed in the Company management

information circular to be prepared in connection with the Transaction, any

information released or received with respect to the Transaction may not be

accurate or complete and should not be relied upon. Trading in the securities of

the Company should be considered highly speculative.

The TSXV has in no way passed upon the merits of the proposed Transaction and

has neither approved nor disapproved the contents of this press release

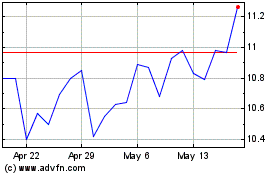

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

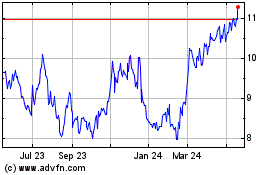

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024