Shares of Denison Mines and Uranium Resources Face Strong Downward Pressure

September 30 2011 - 8:16AM

Marketwired

Uranium stocks have struggled this month as prices for the

radioactive material have plunged. According to the latest

quarterly report by Resource Capital Research, uranium prices are

down 27 per cent over the past three months and 23 per cent over

the past year. The Paragon Report examines investing opportunities

in the Uranium Industry and provides equity research on Denison

Mines Corporation (NYSE Amex: DNN) (TSX: DML) and Uranium

Resources, Inc. (NASDAQ: URRE). Access to the full company reports

can be found at:

www.paragonreport.com/DNN

www.paragonreport.com/URRE

Analyst group Resource Capital Research says the dynamics

driving the sector have changed in the aftermath of the meltdown,

with Germany planning to close all 17 of its nuclear power reactors

by 2022.

In the long term, prospects look brighter as China and the

United States drive the future of nuclear energy. China's long-term

planning agency announced that by 2020 it intended to raise nuclear

power's share of the country's total energy production to 112

gigawatts, or 7 percent, up from the previous target of 70

gigawatts. China's nuclear growth plan had come into question

following the tragic earthquake and nuclear disaster in Japan

earlier this year.

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the Uranium Industry register with us free

at www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Uranium explorers that suffered double-digit share price

percentage falls in the past one to three months include Cameco,

Denison Mines, Uranium One and Paladin.

Denison Mines Corp. is an intermediate uranium producer with

production in the U.S., combined with a diversified development

portfolio of projects in the U.S., Canada, Zambia and Mongolia. The

Company recorded a net loss of $13,749,000 or $0.04 per share for

the three months ended June 30, 2011 compared with net income of

$16,744,000 or $0.05 per share for the same period in 2010.

Uranium Resources Inc. explores for, develops and mines uranium.

Since its incorporation in 1977, URI has produced over 8 million

pounds of uranium by in-situ recovery (ISR) methods in the state of

Texas where the Company currently has ISR mining projects. For the

quarter that ended June 30, Uranium Resources said its net loss was

$2.7 million, or 3 cents a share, compared with a net loss of $1.72

million, or 3 cents a share, in the year-ago quarter.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

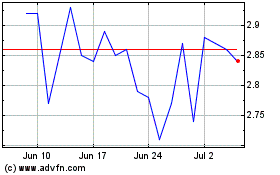

Denison Mines (TSX:DML)

Historical Stock Chart

From Jun 2024 to Jul 2024

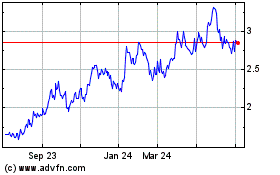

Denison Mines (TSX:DML)

Historical Stock Chart

From Jul 2023 to Jul 2024