DATA Communications Management Corp. (TSX: DCM; OTCQX: DCMDF)

(“DCM” or the "Company"), a leading provider of marketing and

business communication solutions to companies across North America,

is pleased to report the strongest growth in our business since

2018, with first quarter 2022 revenue up +11.1%, net income up

+111% and EBITDA up +28.9%, compared to the first quarter of 2021,

respectively. Details of this strong start to fiscal 2022 can be

found below.

FIRST QUARTER 2022 HIGHLIGHTS - BUILDING A BIGGER

BUSINESS

- Revenue for the first quarter of 2022 was $69.3 million, an

increase of 11.1%, compared to $62.4 million in the first quarter

of 2021;

- Gross profit was $20.3 million, an increase of 8.1%, compared

to $18.8 million in the first quarter of 2021;

- SG&A expenses were $13.6 million, down 8.5%, compared to

$14.9 million in the first quarter of 2021;

- Net income was $3.7 million, an increase of 111.0%, compared

with $1.8 million in the first quarter of 2021;

- EBITDA equal to Adjusted EBITDA of $9.4 million compared to

$7.3 million and $9.3 million, respectively, in the first quarter

of 2021, with EBITDA up 28.9% compared to last year; Adjusted

EBITDA in the first quarter of 2021 benefited from the add-back of

$3.4 million of restructuring expenses and included $1.9 million of

government grant income;

- No restructuring expenses or other “adjustments” to EBITDA in

the first quarter of 2022. The Company’s current outlook

anticipates no restructuring charges in the balance of fiscal

2022;

- Note: EBITDA and Adjusted EBITDA are not earnings measures

recognized by International Financial Reporting Standards (IFRS),

do not have any standardized meanings prescribed by IFRS and might

not be comparable to similar financial measures disclosed by other

issuers. EBITDA and Adjusted EBITDA should not be construed as

alternatives to net income (loss) determined in accordance with

IFRS as an indicator of DCM’s performance. For a description of the

composition of EBITDA and Adjusted EBITDA, why we believe such

measures are useful to investors and how we use those measures in

our business, together with a quantitative reconciliation of net

income (loss) to EBITDA and Adjusted EBITDA, respectively, see the

information under the heading “Non-IFRS Measures” and Table 3 of

DCM’s management’s discussion and analysis (MD&A) dated May 10,

2022 for the period ended March 31, 2022;

- Basic and diluted EPS of $0.08 compared with $0.04 in first

quarter of 2021; Adjusted EPS in the first quarter 2022 of $0.08,

compared to $0.06. Please see "Non-IFRS Measures" and Table 3

below.

FIRST QUARTER 2022 OPERATIONAL HIGHLIGHTS – BUILDING A BETTER

BUSINESS

- Continued progress paying down debt; total debt stood at $34.2

million as of March 31, 2022, down an additional 7.7% from December

31, 2021;

- DCM began trading on OTCQX under the symbol “DCMDF.” U.S.

investors can find current financial disclosure and Real-Time Level

2 quotes for the company on www.otcmarkets.com. “We believe that

trading on the OTCQX Market will provide enhanced visibility for us

in the U.S. public markets as well as improved liquidity for our

shareholders,” said Richard Kellam, President & Chief Executive

Officer of DCM.

- DCM hired Steve Livingstone to lead our Digital Asset

Management business. Steve brings an impressive 25 years of

experience selling complex enterprise software. Steve’s main focus

is moving our +$10 million in ASMBL opportunities through the sales

funnel while we continue to focus on our strategic shift from a

“print first” to a “digital first” company.

MANAGEMENT COMMENTARY

"As demonstrated by this strong first quarter, with revenue up

11.1% compared to last year, I am very pleased with the accelerated

momentum and high levels of client engagement the DCM team is

delivering. We expect this positive momentum to continue through

2022,” said Mr. Kellam.

“I am also happy to report our EBITDA of $9.4 million was up

28.6% compared to the first quarter last year of $7.3 million. We

had ZERO restructuring expenses this quarter, and no other

one-time, non-recurring costs or adjustments. Our current outlook

calls for no restructuring expenses throughout the balance of the

year. In fact, this is the highest “clean” quarterly EBITDA we’ve

reported for many years.”

“We are excited with our positive progress. As we have discussed

on every earnings call since I joined, we remain relentlessly

focused on continuing to build both a better and a bigger

business."

FIRST QUARTER 2022 EARNINGS CALL

The Company will host a conference call and webcast on

Wednesday, May 11, 2022, at 9.00 a.m. Eastern time. Mr. Kellam, and

James Lorimer, CFO, will present the first quarter 2022 results

followed by a live Q&A period.

Instructions on how to access both the webcast and telephone

call are available below. For those unable to join live, a replay

of the webcast will be available on the DCM Investor Relations

page.

DCM will be using Microsoft Teams to broadcast our earnings

call, which will be accessible via the options below:

Join on your computer or mobile app Click here to join

the meeting Or call in (audio only) +1

647-749-9154,,387296132# Canada, Toronto Phone Conference

ID: 387 296 132#

The Company’s full results will be posted on its Investor

Relations page and on www.sedar.com. A video message from Mr.

Kellam will also be posted on the Company’s website.

TABLE 1 The following table sets

out selected historical consolidated financial information for the

periods noted.

For the periods ended March 31, 2022

and 2021

January 1 to March 31,

2022

January 1 to March 31, 2021

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

(Restated)

Revenues

$

69,257

$

62,361

Gross profit

20,324

18,793

Gross profit, as a percentage of

revenues

29.3

%

30.1

%

Selling, general and administrative

expenses (1)

13,644

14,904

As a percentage of revenues

19.7

%

23.9

%

Adjusted EBITDA

9,448

9,288

As a percentage of revenues

13.6

%

14.9

%

Net income for the period

3,713

1,760

Adjusted net income

3,713

3,216

As a percentage of revenues

5.4

%

5.2

%

Basic and diluted earnings per

share

$

0.08

$

0.04

Adjusted net income per share, basic

and diluted

$

0.08

$

0.06

Weighted average number of common

shares outstanding, basic

44,062,831

43,911,885

Weighted average number of common

shares outstanding, diluted

46,748,077

45,157,904

(1)

Selling, general and administrative expenses ("SG&A")

and deferred income tax expense include the impact of the IFRS

Interpretations Committee’s agenda decision regarding configuration

or customization costs in a cloud computing arrangement. Prior

periods have been retrospectively restated to derecognize

previously capitalized costs in accordance with IAS 8 Accounting

Policies, Changes in Accounting Estimates and Errors. Refer to note

3 of the condensed interim consolidated financial statements for

the period ended March 31, 2022 for further details on the impact

of the amended accounting standard.

TABLE 2 The following table

provides reconciliations of net income to EBITDA and of net income

to Adjusted EBITDA for the periods noted.

EBITDA and Adjusted EBITDA

reconciliation

For the periods ended March 31, 2022

and 2021

January 1 to March 31,

2022

January 1 to March 31, 2021

(in thousands of Canadian dollars,

unaudited)

(Restated)

Net income for the period (1)

$

3,713

$

1,760

Interest expense, net

1,255

1,412

Amortization of transaction costs

87

145

Current income tax expense

1,138

546

Deferred income tax (recovery) expense

(1)

487

(21

)

Depreciation of property, plant and

equipment

780

806

Amortization of intangible assets (1)

408

445

Depreciation of the ROU Asset

1,580

2,239

EBITDA

$

9,448

$

7,332

Restructuring expenses

—

3,407

Other income

—

(1,451

)

Adjusted EBITDA

$

9,448

$

9,288

(1)

SG&A and deferred income tax expense include the impact

of the IFRS Interpretations Committee’s agenda decision regarding

configuration or customization costs in a cloud computing

arrangement. Prior periods have been retrospectively restated to

derecognize previously capitalized costs in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors.

Refer to note 3 of the condensed interim consolidated financial

statements for the period ended March 31, 2022 for further details

on the impact of the amended accounting standard.

TABLE 3 The following table

provides reconciliations of net (loss) income to Adjusted net

(loss) income and a presentation of Adjusted net (loss) income per

share for the periods noted.

Adjusted net income

reconciliation

For the periods ended March 31, 2022

and 2021

January 1 to March 31,

2022

January 1 to March 31, 2021

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

(Restated)

Net income for the period(1)

3,713

1,760

Restructuring expenses

—

3,407

Other income

—

(1,451)

Tax effect of the above adjustments

—

(500)

Adjusted net income

3,713

3,216

Adjusted net income per share, basic

and diluted

0.08

0.06

Weighted average number of common

shares outstanding, basic

44,062,831

43,911,885

Weighted average number of common

shares outstanding, diluted

46,748,077

45,157,904

Number of common shares outstanding,

basic

44,062,831

43,938,480

Number of common shares outstanding,

diluted

46,748,077

45,184,499

(1)

SG&A and deferred income tax expense include the impact

of the IFRS Interpretations Committee’s agenda decision regarding

configuration or customization costs in a cloud computing

arrangement. Prior periods have been retrospectively restated to

derecognize previously capitalized costs in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors.

Refer to note 3 of the condensed interim consolidated financial

statements for the period ended March 31, 2022 for further details

on the impact of the amended accounting standard.

About DATA Communications Management Corp.

DCM is a marketing and business communications partner that

helps companies simplify the complex ways they communicate and

operate, so they can accomplish more with fewer steps and less

effort. For over 60 years, DCM has been serving major brands in

vertical markets including financial services, retail, healthcare,

energy, other regulated industries, and the public sector. We

integrate seamlessly into our clients’ businesses thanks to our

deep understanding of their needs, transformative tech-enabled

solutions, and end-to-end service offering. Whether we’re running

technology platforms, sending marketing messages, or managing print

workflows, our goal is to make everything surprisingly simple.

Additional information relating to DATA Communications

Management Corp. is available on www.datacm.com, and in the

disclosure documents filed by DATA Communications Management Corp.

on the System for Electronic Document Analysis and Retrieval

(SEDAR) at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance, objectives or achievements of DCM, or industry

results, to be materially different from any future results,

performance, objectives or achievements expressed or implied by

such forward-looking statements. When used in this press release,

words such as “may”, “would”, “could”, “will”, “expect”,

“anticipate”, “estimate”, “believe”, “intend”, “plan”, and other

similar expressions are intended to identify forward-looking

statements. These statements reflect DCM’s current views regarding

future events and operating performance, are based on information

currently available to DCM, and speak only as of the date of this

press release. These forward-looking statements involve a number of

risks, uncertainties and assumptions and should not be read as

guarantees of future performance or results, and will not

necessarily be accurate indications of whether or not such

performance or results will be achieved. Many factors could cause

the actual results, performance, objectives or achievements of DCM

to be materially different from any future results, performance,

objectives or achievements that may be expressed or implied by such

forward-looking statements. The principal factors, assumptions and

risks that DCM made or took into account in the preparation of

these forward-looking statements include: the COVID-19 Pandemic has

adversely affected, and may continue to adversely effect, our

business, operating results and financial condition and this

continuing adverse affect could be material; there is limited

growth in the traditional printing business, which may impact our

ability to grow our sales or even maintain historical levels of

sales of printed business communications documents; increases in

the cost of, and supply constraints related to, paper, ink and

other raw material inputs used by DCM, as well as increases in

freight costs, may adversely impact the availability of raw

materials and our production, revenues and profitability; our

ability to continue as a going concern is dependent upon

management’s ability to meet forecast revenue and profitability

targets for at least the next twelve months in order to comply with

our financial covenants under its credit facilities or to obtain

financial covenant waivers from our lenders if necessary; we may

not be successful in obtaining capital to fund our business plans

on satisfactory terms (or at all), including, without, limitation,

with respect to investments in digital innovation (such as the

development and successful marketing and sale of new digital

capabilities), capital expenditures, and potential acquisitions;

all of our outstanding indebtedness under our bank credit facility

is subject to floating interest rates, and therefore is subject to

fluctuations in interest rates; our credit agreements governing our

senior indebtedness contain numerous restrictive covenants that

limit us with respect to certain business matters, including,

without limitation, our ability to incur additional indebtedness,

re-pay certain indebtedness, pay dividends, make investments, sell

or otherwise dispose of assets and merge or consolidate with

another entity; we may not be able to successfully implement our

digital growth strategy on a timely basis or at all; competition

from competitors supplying similar products and services, some of

whom have greater economic resources than us and are

well-established suppliers; and our operating results are sensitive

to economic conditions, which can have a significant impact on us,

and uncertain economic conditions may have a material adverse

effect on our business, results of operations and financial

condition, including, without limitation, our ability to realize

the benefits expected from restructuring and business

reorganization initiatives, reducing costs, and reducing and paying

our long-term debt. Additional factors are discussed elsewhere in

this press release and under the headings "Liquidity and capital

resources" and “Risks and Uncertainties” in DCM’s management’s

discussion and analysis and in DCM’s other publicly available

disclosure documents, as filed by DCM on SEDAR (www.sedar.com).

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results may vary materially from those described

in this press release as intended, planned, anticipated, believed,

estimated or expected. Unless required by applicable securities

law, DCM does not intend and does not assume any obligation to

update these forward-looking statements.

NON-IFRS MEASURES

This press release includes certain non-IFRS measures as

supplementary information. Except as otherwise noted, when used in

this press release, EBITDA means earnings before interest and

finance costs, taxes, depreciation and amortization and Adjusted

EBITDA means EBITDA adjusted for restructuring expenses, and

one-time business reorganization costs. Adjusted net income (loss)

means net income (loss) adjusted for restructuring expenses,

onetime business reorganization costs, and the tax effects of those

items. Adjusted net income (loss) per share (basic and diluted) is

calculated by dividing Adjusted net income (loss) for the period by

the weighted average number of common shares of DCM (basic and

diluted) outstanding during the period. Adjusted EBITDA as a

percentage of revenues means Adjusted EBITDA divided by revenues

and Adjusted net income (loss) as a percentage of revenues means

adjusted net income (loss) divided by revenue, in each case for the

same period. In addition to net income (loss), DCM uses non-IFRS

measures and ratios, including Adjusted net income (loss), Adjusted

net income (loss) per share, Adjusted net income (loss) as a

percentage of revenues, EBITDA, Adjusted EBITDA and Adjusted EBITDA

as a percentage of revenues to provide investors with supplemental

measures of DCM’s operating performance and thus highlight trends

in its core business that may not otherwise be apparent when

relying solely on IFRS financial measures. DCM also believes that

securities analysts, investors, rating agencies and other

interested parties frequently use non-IFRS measures in the

evaluation of issuers. DCM’s management also uses non-IFRS measures

in order to facilitate operating performance comparisons from

period to period, prepare annual operating budgets and assess its

ability to meet future debt service, capital expenditure and

working capital requirements. Adjusted net income (loss), Adjusted

net income (loss) per share, EBITDA and Adjusted EBITDA are not

earnings measures recognized by IFRS and do not have any

standardized meanings prescribed by IFRS. Therefore, Adjusted net

income (loss), Adjusted net income (loss) per share, EBITDA and

Adjusted EBITDA are unlikely to be comparable to similar measures

presented by other issuers.

Investors are cautioned that Adjusted net income (loss),

Adjusted net income (loss) per share, EBITDA and Adjusted EBITDA

should not be construed as alternatives to net income (loss)

determined in accordance with IFRS as an indicator of DCM’s

performance. For a reconciliation of net income (loss) to EBITDA

and a reconciliation of net income (loss) to Adjusted EBITDA, see

Table 3 in the most recent Management's Discussion & Analysis

filed on www.sedar.com. For a reconciliation of net income (loss)

to Adjusted net income (loss) and a presentation of Adjusted net

income (loss) per share, see Table 4 in the Company's most recent

Management's Discussion & Analysis filed on www.sedar.com.

Condensed interim consolidated

statements of financial position

(in thousands of Canadian dollars,

unaudited)

March 31, 2022

December 31, 2021

$

$

(Restated)

Assets

Current assets

Cash and cash equivalents

985

901

Trade receivables

53,762

51,567

Inventories

15,335

12,133

Prepaid expenses and other current

assets

2,463

2,580

Income taxes receivable

309

—

72,854

67,181

Non-current assets

Other non-current assets

600

625

Deferred income tax assets

4,860

5,465

Restricted cash

—

515

Property, plant and equipment

7,807

8,416

Right-of-use assets

33,198

33,476

Pension assets

2,385

2,531

Intangible assets

3,634

4,042

Goodwill

16,973

16,973

142,311

139,224

Liabilities

Current liabilities

Trade payables and accrued liabilities

41,763

37,589

Current portion of credit facilities

16,265

11,743

Current portion of promissory notes

—

—

Current portion of lease liabilities

6,121

6,123

Provisions

1,272

3,280

Income taxes payable

1,444

841

Deferred revenue

2,465

3,269

69,330

62,845

Non-current liabilities

Provisions

1,110

1,196

Credit facilities

17,246

24,556

Lease liabilities

32,728

32,976

Pension obligations

6,743

7,499

Other post-employment benefit plans

2,996

2,971

130,153

132,043

Equity

Shareholders’ equity / (Deficiency)

Shares

256,478

256,300

Warrants

881

881

Contributed surplus

2,847

2,791

Translation reserve

160

173

Deficit

(248,208)

(252,282)

12,158

7,863

142,311

139,906

Condensed interim consolidated

statements of operations

(in thousands of Canadian dollars, except

per share amounts, unaudited)

For the three months ended

March 31, 2022

For the three months ended March

31, 2021

$

$

(Restated)

Revenues

69,257

62,361

Cost of revenues

48,933

43,568

Gross profit

20,324

18,793

Expenses

Selling, commissions and expenses

7,048

6,666

General and administration expenses

6,596

8,238

Restructuring expenses

—

3,407

13,644

18,311

Income before finance costs, other

income and income taxes

6,680

482

Finance costs

Interest expense on long term debt and

pensions, net

691

718

Interest expense on lease liabilities

564

694

Debt modification losses and prepayment

fees

—

—

Amortization of transaction costs

87

145

1,342

1,557

Other income

Government grant income

—

1,908

Other income

—

1,452

Income before income taxes

5,338

2,285

Income tax expense

Current

1,138

546

Deferred

487

(21)

1,625

525

Net income for the period

3,713

1,760

Other comprehensive income:

Items that may be reclassified

subsequently to net income

Foreign currency translation

(13)

(23)

(13)

(23)

Items that will not be reclassified to

net income

Re-measurements of pension and other

post-employment benefit obligations

479

1,256

Taxes related to pension and other

post-employment benefit adjustment above

(118)

(318)

361

938

Other comprehensive income for the

period, net of tax

348

915

Comprehensive income for the

period

4,061

2,675

Basic earnings per share

0.08

0.04

Diluted earnings per share

0.08

0.04

Condensed interim consolidated

statements of cash flows

(in thousands of Canadian dollars,

unaudited)

For the three months ended

March 31, 2022

For the three months ended March

31, 2021

$

$

(Restated)

Cash provided by (used in)

Operating activities

Net income for the period

3,713

1,760

Items not affecting cash

Depreciation of property, plant and

equipment

780

806

Amortization of intangible assets

408

445

Depreciation of right-of-use-assets

1,580

2,239

Interest expense on lease liabilities

564

694

Share-based compensation expense

56

316

Pension expense

109

119

Loss on disposal of intangible assets

—

8

Loss on disposal of property, plant and

equipment

11

—

Provisions

—

3,407

Amortization of transaction costs and debt

modification losses

87

145

Accretion of non-current liabilities and

capitalized interest expense

(33)

(190)

Other post-employment benefit plans

expense

68

59

Income tax expense

1,625

525

8,968

10,333

Changes in working capital

(1,885)

4,147

Contributions made to pension plans

(240)

(241)

Contributions made to other

post-employment benefit plans

(43)

(23)

Provisions paid

(2,094)

(2,924)

Income taxes refund (paid)

16

(720)

4,722

10,572

Investing activities

Purchase of property, plant and

equipment

(213)

(83)

Purchase of intangible assets

—

(122)

Proceeds on disposal of property, plant

and equipment

31

—

(182)

(205)

Financing activities

Decrease in restricted cash

515

—

Proceeds from credit facilities

101

—

Repayment of credit facilities

(2,943)

(7,191)

Repayment of promissory notes

—

(176)

Lease payments

(2,129)

(2,993)

(4,456)

(10,360)

Change in Cash during the

period

84

7

Cash and cash equivalents – beginning

of period

901

578

Effects of foreign exchange on cash

balances

—

14

Cash and cash equivalents – end of

period

985

599

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220510006444/en/

Mr. Richard Kellam President and Chief Executive Officer DATA

Communications Management Corp. Tel: (905) 791-3151 Mr. James E.

Lorimer Chief Financial Officer DATA Communications Management

Corp. Tel: (905) 791-3151 ir@datacm.com

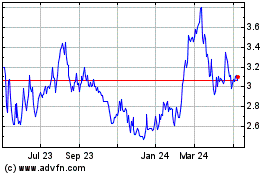

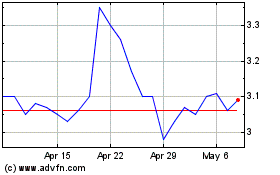

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jul 2023 to Jul 2024