Dundee Capital Markets Shareholders Approve Acquisition of Remainder of Company by Dundee Corporation

January 31 2012 - 2:15PM

Marketwired Canada

Dundee Corporation ("DC") (TSX:DC.A) and Dundee Capital Markets Inc. ("DCM")

(TSX:DCM) today jointly announce that shareholders of DCM approved the plan of

arrangement involving DCM, DC and 2309598 Ontario Limited. The arrangement

involves the acquisition of all of DCM's outstanding common shares (the "Common

Shares") not currently held by DC at a price of $1.125 per share by way of a

court approved plan of arrangement under the Business Corporations Act

(Ontario).

The special resolution approving the arrangement was approved this morning at a

special meeting of DCM shareholders by more than 98% of the votes cast by

holders of Common Shares. As required under Canadian securities laws, the

special resolution approving the arrangement was also approved by more than 95%

of the votes cast by minority shareholders of DCM. Final proxy results will be

made available on SEDAR at www.sedar.com.

Completion of the arrangement remains subject to certain conditions, including

the approval of the Ontario Superior Court of Justice. An application seeking a

final order approving the plan of arrangement under the Business Corporations

Act (Ontario) is scheduled to be heard by the Ontario Superior Court of Justice

on February 1, 2012. DCM and DC currently expect the closing to occur on

February 1, 2012 or shortly thereafter.

About Dundee Capital Markets Inc.

DCM is a full-service Canadian investment dealer with offices in Toronto,

Montreal, Vancouver, Calgary and London, England and whose principal businesses

include investment banking, mergers and acquisitions, institutional sales and

trading, investment, research, private client financial advisory and management

of investment products. DCM focuses on specific sectors, namely, resources, real

estate, infrastructure, agriculture and other special situations. DCM is the

asset manager of the CMP(TM) and Canada Dominion Resources flow-through limited

partnerships as well as CMP Gold Trust.

About Dundee Corporation

DC is an independent publicly traded Canadian asset management company. DC's

asset management activities are focused in the areas of DC's core competencies

and include real estate and infrastructure as well as energy, resources and

agriculture. Asset management activities are carried out by Ned Goodman

Investment Counsel Limited, a registered portfolio manager and exempt market

dealer across Canada and an investment fund manager in the province of Ontario,

and by DREAM, the asset management division of Dundee Realty Corporation. Asset

management activities will be supported by DC's ownership in DCM which is also

the asset manager of DC's flow-through limited partnership business carried out

through the "CMP", "CDR" and "Canada Dominion Resources" brands. DC also owns

and manages direct investments in these core focus areas, through ownership of

both publicly listed and private companies. Real estate operations are carried

out through DC's 70% ownership in Dundee Realty Corporation, an owner, developer

and manager of residential, commercial and recreational properties in North

America. Energy and resource operations include DC's 57% investment in Dundee

Energy Limited (formerly Eurogas Corporation), an oil and natural gas company

with a mandate to create long-term value through the development of high impact

energy projects. DC also holds several investments in the resource sector for

which it uses equity accounting.

Caution Concerning Forward-looking Statements

This news release includes certain statements that constitute "forward-looking

statements", and "forward-looking information" within the meaning of applicable

securities laws (collectively, "forward-looking statements"). These statements

include statements regarding DCM's intent, or the beliefs or current

expectations of DCM's officers and directors. Such statements are typically

identified by words such as "believe", "anticipate", "estimate", "project",

"intend", "expect", "may", "will", "plan", "should", "would", "contemplate",

"possible", "attempts", "seeks" and similar expressions. Forward-looking

statements may relate to DCM's future outlook and anticipated events or results.

By their very nature, forward-looking statements involve numerous assumptions,

inherent risks and uncertainties, both general and specific, and the risk that

predictions and other forward-looking statements will not prove to be accurate.

Do not unduly rely on forward-looking statements, as a number of important

factors, many of which are beyond DCM's control, could cause actual results to

differ materially from the estimates and intentions expressed in such

forward-looking statements. These factors include, but are not limited to: (a)

the inability of DCM to obtain (i) approval of the arrangement by the court, and

(b) the occurrence of any other event, change or other circumstance that could

give rise to the termination of the arrangement agreement, or the delay of

consummation of the arrangement or failure to complete the arrangement for any

other reason.

Forward-looking statements speak only as of the date those statements are made.

Except as required by applicable law, DCM does not assume any obligation to

update, or to publicly announce the results of any change to, any

forward-looking statement contained herein to reflect actual results, future

events or developments, changes in assumptions or changes in other factors

affecting the forward-looking statements.

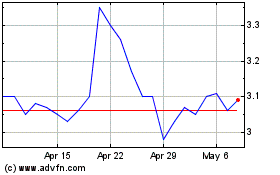

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

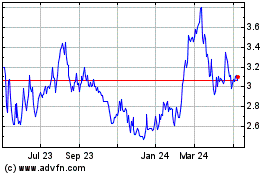

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jul 2023 to Jul 2024