Daylight Energy Announces the Sale of Non-Core Eastern Alberta Oil and Natural Gas Assets for $125 Million

June 30 2010 - 3:00AM

Marketwired Canada

Daylight Energy Ltd. ("Daylight" or the "Corporation") (TSX:DAY) today announced

it has reached an agreement with a private company, Gear Energy Ltd. ("Gear"),

to sell certain of Daylight's oil and natural gas assets in Eastern Alberta for

aggregate consideration of $125 million, consisting of $100 million in cash and

$25 million in equity.

Divestiture of this asset package is a continuation of Daylight's strategic

repositioning of our portfolio towards growth by monetizing non-core properties

and focusing financial and technical resources on core growth assets at Pembina,

West Central Alberta and Elmworth in the Deep Basin. Proceeds from this

transaction provide Daylight with additional balance sheet flexibility to pursue

strategic and capital investment opportunities as they arise. Daylight's

previously announced consolidated 2010 capital budget of $300 million remains

unchanged.

This asset package operating area includes the areas referred to as Bonnyville,

Halkirk, Lloydminster, Paradise, Sounding Lake, Vermillion and Wildmere.

Production from these assets during the first quarter of 2010 was approximately

2,300 barrels of oil equivalent per day and is predominantly heavy oil. Closing

of the transaction is subject to industry standard terms and conditions and

regulatory approvals, and is expected to occur by the middle of July, 2010 with

a July 1, 2010 effective date. Proceeds from this asset disposition will

initially be used to reduce outstanding indebtedness under Daylight's credit

facilities.

Gear Energy Ltd. is a private Calgary-based oil and gas company led by Don Gray

(Executive Chairman) and Rick Braund (Director), previously co-founders of Peyto

Energy Trust, and Ingram Gillmore (President & CEO), former VP Engineering at

ARC Energy Trust.

Daylight is a growing intermediate oil, liquids rich natural gas and natural gas

producing company with a high quality suite of resource play assets in Western

Canada. Daylight's highly focused team utilizes technical expertise in

exploitation, development and acquisitions to create long-term value for

shareholders. The Daylight team has developed a multi-year inventory of

repeatable, low risk exploitation resource play projects with substantial

potential reserve additions on assets owned and controlled in the premier Deep

Basin area of Alberta and Northeast British Columbia. Daylight has approximately

204 million Daylight Shares currently outstanding which trade on the Toronto

Stock Exchange ("TSX") under the symbol DAY. Daylight Series B, Series C, and

Series D convertible debentures trade on the TSX under the symbols DAY.DB.B,

DAY.DB.C and DAY.DB.D, respectively.

ADVISORY:

Forward-Looking Information and Statements

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking statements or

information. More particularly and without limitation, this press release

contains forward-looking statements and information concerning: the anticipated

timing of closing of the transaction and the anticipated use of proceeds to

Daylight from the transaction.

The forward-looking statements and information in this press release are based

on certain key expectations and assumptions made by Daylight. These expectations

include expectations regarding timing of completion of the transaction, which is

in turn based on certain assumptions that it believes are reasonable at this

time, including assumptions as to the timing of receipt of the necessary

regulatory and other third party approvals, and the time necessary to satisfy

the conditions to the closing of the transaction. These dates may change for a

number of reasons, including unforeseen delays in preparing necessary materials,

inability to secure necessary regulatory or other third party approvals in the

time assumed or the need for additional time to satisfy the conditions to the

completion of the transaction. Accordingly, readers should not place undue

reliance on the forward-looking statements and information contained in this

press release concerning these times.

Although Daylight believes that the expectations and assumptions on which such

forward-looking statements and information are based are reasonable, undue

reliance should not be placed on the forward-looking statements and information

because Daylight can give no assurance that they will prove to be correct.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. These risks include risks associated with

Daylight's business and operations, failure to obtain regulatory and other third

party approvals and failure to satisfy certain other conditions required to

complete the transaction. Readers are cautioned that the foregoing list of risk

factors is not exhaustive. Additional information on these and other factors

that could affect the business, operations or financial results of Daylight are

included in reports on file with applicable securities regulatory authorities,

including but not limited to Daylight Resources Trust's Annual Information Form

for the year ended December 31, 2009 and Daylight Resources Trust's Notice of

Annual and Special Meeting and Information Circular and Proxy Statement dated

April 7, 2010, each of which may be accessed on Daylight Resources Trust's (the

predecessor to Daylight) SEDAR profile at www.sedar.com.

The forward-looking statements and information contained in this press release

are made as of the date hereof and Daylight undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

Barrels of Oil Equivalent

"Boe" or " barrel of oil equivalent" means barrel of oil equivalent on the basis

of 1 boe to 6,000 cubic feet of natural gas. Boe's may be misleading,

particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000

cubic feet of natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

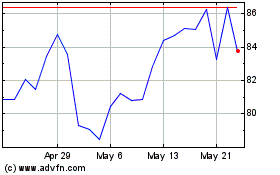

Ceridian HCM (TSX:DAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

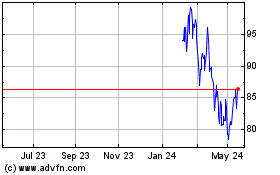

Ceridian HCM (TSX:DAY)

Historical Stock Chart

From Jul 2023 to Jul 2024