Daylight Energy Announces Closing of West Acquisition, Provides Updated 2010 Guidance and Announces May & June 2010 Dividend

May 12 2010 - 8:27AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAW.

Daylight Energy Ltd. (TSX:DAY) ("Daylight" or the "Corporation") is pleased to

announce the closing of our acquisition of West Energy Ltd. ("West"). Daylight

also provides updated 2010 capital expenditure and production guidance and

announces a $0.05 monthly dividend per common share for May and June of 2010.

ACQUISITION OF WEST ENERGY LTD.

Daylight's acquisition of West continues our strategy of executing transactions

with near-term cash flow strength supported by long-term development potential

to provide growth opportunities for our shareholders. The acquired assets are

highly complementary to Daylight's Pembina operations and expand our position in

this active region of Alberta.

The transaction was approved at the annual and special meeting of West

shareholders and by the Court of Queen's Bench of Alberta on May 11, 2010. Over

99% of the votes cast by the West shareholders, present at the meeting in person

or by proxy, voted in favor of the transaction. Daylight has acquired all of the

issued and outstanding common shares of West through the cash payment of $115

million and the issuance of approximately 29 million Daylight common shares

which results in Daylight having approximately 204 million common shares

outstanding as at closing. It is expected that the West common shares will be

delisted from the TSX on or about May 17, 2010. Highlights of the West

acquisition include:

-- Increases Daylight's Cardium rights in the Pembina area to over 100 net

sections.

-- Adds unrisked drilling inventory of 80 to 160 horizontal Cardium light

oil locations to Daylight's inventory at Pembina.

-- Provides substantial light oil asset opportunities beyond the Cardium

horizontals, in particular the Belly River which has large original oil

in place and the potential to significantly improve recovery factors and

increase reserves.

-- Generates synergies and opportunities to reduce operating costs by

combining Daylight and West's existing light oil facilities, gathering

systems and infrastructure.

Daylight has also amended and restated our credit facilities to a capacity of

$650 million and as at closing, approximately $350 million is drawn against

these credit facilities. Daylight's balance sheet continues to provide

significant capacity and flexibility to fund our capital program while remaining

well positioned to execute on strategic acquisitions as they arise.

UPDATED 2010 GUIDANCE

Daylight also announces that we are maintaining our 2010 capital budget at $300

million and updates our production guidance for the 2010 year taking into

account the acquisition of West.

Our 2010 capital program has become more oil focused with reallocations across

our inventory of repeatable, low risk resource play projects in our key growth

areas of Pembina (Cardium light oil), West Central (Cardium light oil and

liquids rich natural gas) and Elmworth (natural gas). Daylight's 2010 drilling

program will continue to use and improve upon our successful horizontal drilling

techniques and innovative completion technologies that significantly contributed

to our recent operational success. Daylight's asset base, including the

production volumes acquired from West and our 2010 capital program, is expected

to deliver average production of 43,000 to 44,000 boe per day for 2010 with an

anticipated 2010 exit rate of over 47,000 boe per day (an increase of over 23%

from Q4 2009 production levels). Updated 2010 production guidance includes the

previously announced deferred on stream timing of over 20 million cubic feet

("mmcf") per day of new production capacity from our Q1 2010 capital program

until mid-Q4 2010 with an estimated impact of 1,000 to 1,500 boe per day on

Daylight's 2010 production volumes. This deferral is intended to allow Daylight

to take advantage of the strong initial flow rates of these wells at a later

time when Daylight management expects natural gas prices to be stronger.

Daylight's production volumes for the remainder of 2010 are expected to be

weighted approximately 45% to 50% towards oil and natural gas liquids ("NGLs")

with the balance consisting of natural gas. Daylight's current production,

including volumes acquired from West, is approximately 45,000 to 46,000 boe per

day.

CAPITAL EXPENDITURE PROGRAM

Daylight's 2010 capital expenditure program reflects a significantly increased

pace of investment in our Cardium horizontal light oil program, while continuing

to advance our other key resource play developments. Capital has been

reallocated to our core areas with the following geological zones and commodity

targets:

----------------------------------------------------------------------------

2010 Capital

Core Area Allocation Geological Zone & Commodity Target

----------------------------------------------------------------------------

Pembina $175 million Cardium (Horizontal) - Light Oil

----------------------------------------------------------------------------

West Central $ 75 million Bluesky (Horizontal) - Liquids Rich Natural Gas

Cardium (Horizontal) - Liquids Rich Natural Gas

Wilrich (Horizontal) - Natural Gas

Montney (Horizontal) - Natural Gas

Cretaceous (Multi-zone) - Natural Gas

----------------------------------------------------------------------------

Elmworth $ 50 million Cadomin (Horizontal) - Natural Gas

Nikanassin (Horizontal) - Natural Gas

Doe Creek (Horizontal) - Light Oil Uphole

Cretaceous (Multi-zone) - Natural Gas

----------------------------------------------------------------------------

Total $300 million

---------------------------

---------------------------

MAY & JUNE 2010 DIVIDEND

Daylight also announces that it will pay a cash dividend of $0.05 per common

share for the months of May and June 2010, as set forth below:

----------------------------------------------------------------------------

Dividend Payment Dividend Per

Record Date Ex-Dividend Date Date Share(i)

----------------------------------------------------------------------------

May 31, 2010 May 27, 2010 June 15, 2010 $0.05

June 30, 2010 June 28, 2010 July 15, 2010 $0.05

----------------------------------------------------------------------------

(i) The dividend is considered an "eligible dividend" for tax purposes.

The Board of Directors of Daylight has set the May and June dividend at $0.05

per common share per month. Daylight expects to pay a sustainable dividend on a

monthly basis, provided however that any decision to pay dividends on the common

shares will be made by the Board of Directors on the basis of Daylight funds

from operations, earnings, financial requirements, commodity price levels, legal

requirements and other conditions existing at such future times.

Daylight currently intends to designate all dividends to be "eligible dividends"

for the purposes of the Income Tax Act (Canada) such that shareholders who are

individuals will benefit from the enhanced gross-up and dividend tax credit

mechanism under the Income Tax Act (Canada).

Daylight is a growing intermediate oil, liquids rich natural gas and natural gas

producing company with a high quality suite of resource play assets in Western

Canada. Daylight's highly focused team utilizes technical expertise in

exploitation, development and acquisitions to create long-term value for

shareholders. The Daylight team has developed a multi-year inventory of

repeatable, low risk exploitation resource play projects with substantial

potential reserve additions on assets owned and controlled in the premier Deep

Basin area of Alberta and Northeast British Columbia. Daylight has approximately

204 million common shares currently outstanding which will trade on the TSX

under the symbol DAY. Daylight Series B, Series C, and Series D convertible

debentures trade on the TSX under the symbols DAY.DB.B, DAY.DB.C and DAY.DB.D,

respectively.

An updated corporate presentation is available on Daylight's website at

www.daylightenergy.com.

ADVISORY:

Forward-Looking Information and Statements

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking statements or

information. More particularly and without limitation, this press release

contains forward-looking statements and information concerning: the anticipated

timing of the delisting of West's common shares from the Toronto Stock Exchange;

anticipated capital expenditures in connection with Daylight's 2010 capital

expenditure program; anticipated production levels for the balance of 2010 and

exit production rates for 2010; anticipated production levels by product type

for the balance of 2010 and exit 2010; expectations regarding future dividends

declared and paid on the common shares; the timing of bringing additional

production on-stream and the benefits thereof; anticipated future natural gas

prices; and expected initial production rates of certain deferred natural gas

production.

The forward-looking statements and information in this press release are based

on certain key expectations and assumptions made by Daylight, including

expectations and assumptions concerning: prevailing and future commodity prices

and exchange rates; applicable royalty rates and tax laws; future well

production rates; the performance of existing wells; application of existing

technologies and future advancements in technology to Daylight's operations and

drilling activities; the success obtained in drilling new wells; the inventory

of new drilling locations; the sufficiency of budgeted capital expenditures in

carrying out planned activities; the availability and cost of labour and

services; the receipt, in a timely manner, of regulatory and third party

approvals; and the ability of Daylight to achieve the benefits of the West

acquisition. Although Daylight believes that the expectations and assumptions on

which such forward-looking statements and information are based are reasonable,

undue reliance should not be placed on the forward-looking statements and

information because Daylight can give no assurance that they will prove to be

correct. There is no representation by Daylight that actual results achieved

during the periods identified in this press release will be the same in whole or

in part as those forecast.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. These include, but are not limited to the risks

associated with the oil and gas industry in general such as: operational risks

in development, exploration and production; delays or changes in plans with

respect to exploration or development projects or capital expenditures; the

uncertainty of reserve and resource (including original oil in place) estimates;

the uncertainty of estimates and projections relating to production, costs and

expenses; health, safety and environmental risks; commodity price and exchange

rate fluctuations; marketing and transportation of petroleum and natural gas and

loss of markets; environmental risks; competition; risks associated with

utilizing existing technologies and future technological advancements in

Daylight's operations and drilling activities; failure to realize the

anticipated benefits of acquisitions, including the West acquisition; risks

regarding the integration of West; incorrect assessment of the values of

acquisitions, including the West acquisition; ability to access sufficient

capital from internal and external sources; failure to obtain required

regulatory and other third party approvals; and changes in legislation,

including but not limited to tax laws, royalty rates and environmental

regulations.

Readers are cautioned that the foregoing list of factors is not exhaustive.

Additional information on these and other factors that could affect the

operations or financial results of Daylight are included in reports on file with

applicable securities regulatory authorities, including but not limited to

Daylight Resources Trust's annual information form for the year ended December

31, 2009 and the Notice of Annual and Special Meeting and Information Circular

and Proxy Statement dated April 7, 2010, each of which may be accessed on

Daylight Resources Trust's SEDAR profile at www.sedar.com.

The forward-looking statements and information contained in this press release

are made as of the date hereof and Daylight undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

Barrels of Oil Equivalent

"Boe" means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet

of natural gas. Boe's may be misleading, particularly if used in isolation. A

boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an

energy equivalency conversion method primarily applicable at the burner tip and

does not represent a value equivalency at the wellhead.

Original Oil in Place

"Original oil in place" as used in this press release means the total oil and

gas estimated to have originally existed in the earth's crust in naturally

occurring accumulations (also defined as "original resources" in the COGE

Handbook). Original oil in place includes both discovered and undiscovered

resources, and there is no certainty that any portion of the undiscovered

resources will be discovered and, if discovered, that any volumes will be

economically viable or technically feasible to recover or produce. Original oil

in place also includes volumes that have already been produced from such

accumulations. Readers should not unduly rely upon estimates of original oil in

place in terms of assessing the Daylight's reserves or recoverable resources.

All estimates of original oil in place contained in this presentation are based

upon internal estimates of management of Daylight.

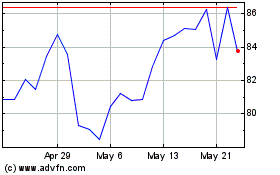

Ceridian HCM (TSX:DAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

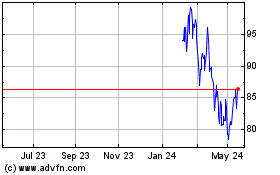

Ceridian HCM (TSX:DAY)

Historical Stock Chart

From Jul 2023 to Jul 2024