Crew Energy Inc. Announces Completion of Acquisition of Caltex Energy Inc. and the Addition of New Executive Officer

July 04 2011 - 8:00AM

Marketwired Canada

Crew Energy Inc. ("Crew" or the "Company") (TSX:CR) is pleased to announce the

successful completion of the acquisition by Crew of all of the outstanding

shares of Caltex Energy Inc. ("Caltex") pursuant to the previously announced

plan of arrangement (the "Arrangement").

Pursuant to the Arrangement effective July 1, 2011, the previous holders of the

shares of Caltex received, in the aggregate, approximately 33.6 million common

shares of Crew. After giving effect to the Arrangement, Crew has approximately

119.6 million common shares outstanding.

At closing Crew's current production is approximately 27,000 boe per day based

on field estimates. The Company confirms its previously stated 2011 guidance of

23,000 to 24,000 boe per day and a 2011 exit rate of between 32,500 and 34,500

boe per day. Crew plans to drill a total of 172 wells in 2011 with an

exploration and development capital budget of $330 million. The Company

estimates net combined debt at closing of the Arrangement of approximately $225

million and is pleased to announce the increase of its bank facility to $400

million.

Crew is also pleased to announce the addition of Mr. Rob Morgan to its executive

team as Senior Vice President and Chief Operating Officer. Mr. Morgan is a

professional engineer with over 25 years of technical, operations and management

experience in the oil and gas industry. Most recently he held the position of

Chief Operating Officer of a senior upstream oil and gas producer with

downstream refining operations. Prior to that Mr. Morgan held executive and

management positions at various upstream oil and gas companies with exposure to

heavy oil, light oil and liquids rich natural gas operations. Mr. Morgan

graduated from the University of Saskatchewan in 1985 with a BSc in Chemical

Engineering.

Advisory Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking information or

statements. More particularly and without limitation, this press release

contains forward looking statements and information concerning production

estimates, forecast 2011 production guidance, number of wells anticipated to be

drilled in 2011, 2011 capital expenditures and estimated combined net debt at

closing of the Arrangement. The forward-looking statements and information are

based on certain key expectations and assumptions made by Crew, including

expectations and assumptions concerning prevailing commodity prices and exchange

rates, applicable royalty rates and tax laws; future well production rates and

reserve volumes; the performance of existing wells; the success obtained in

drilling new wells; and the sufficiency of budgeted capital expenditures in

carrying out planned activities; and the availability and cost of labour and

services. Although Crew believes that the expectations and assumptions on which

such forward-looking statements and information are based are reasonable, undue

reliance should not be placed on the forward looking statements and information

because Crew can give no assurance that they will prove to be correct. Since

forward-looking statements and information address future events and conditions,

by their very nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to, the risks

associated with the oil and gas industry in general such as operational risks in

development, exploration and production; delays or changes in plans with respect

to exploration or development projects or capital expenditures; the uncertainty

of reserve estimates; the uncertainty of estimates and projections relating to

reserves, production, costs and expenses; health, safety and environmental

risks; commodity price and exchange rate fluctuations; marketing and

transportation; loss of markets; environmental risks; competition; incorrect

assessment of the value of acquisitions; failure to realize the anticipated

benefits of acquisitions; ability to access sufficient capital from internal and

external sources; failure to obtain required regulatory and other approvals; and

changes in legislation, including but not limited to tax laws, royalties and

environmental regulations.

Readers should not place undue reliance on the forward-looking statements and

information contained in this press release. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information on these and

other factors that could affect Crew's operations or financial results are

included in reports on file with applicable securities regulatory authorities

and may be accessed through the SEDAR website (www.sedar.com), or Crew's website

(www.crewenergy.com).

The forward-looking statements and information contained in this press release

are made as of the date hereof and Crew undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

Disclosure provided herein in respect of barrels of oil equivalent (boe) may be

misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf:1

Bbl is based on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the wellhead.

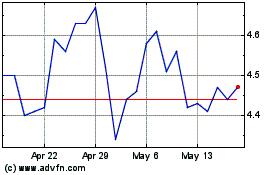

Crew Energy (TSX:CR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Crew Energy (TSX:CR)

Historical Stock Chart

From Nov 2023 to Nov 2024