Bonterra Energy Corp. Announces First Quarter 2014 Results

May 14 2014 - 5:35PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Bonterra Energy Corp. (www.bonterraenergy.com) (TSX:BNE) is pleased to announce

its operating and financial results for the three months ended March 31, 2014.

The related unaudited condensed financial statements and notes, as well as

management's discussion and analysis, are available on the System for Electronic

Document Analysis and Retrieval (SEDAR) at www.sedar.com and on Bonterra's

website at www.bonterraenergy.com.

HIGHLIGHTS

As at and for the three month

periods ended March 31, December 31, March 31,

($ 000s except $ per share) 2014 2013 2013 (1)

----------------------------------------------------------------------------

FINANCIAL

Revenue - realized oil and gas

sales 82,521 70,917 66,468

Funds flow (4) 54,414 43,359 40,726

Per share - basic 1.73 1.39 1.47

Per share - diluted 1.72 1.38 1.46

Payout ratio 50% 61% 53%

Cash flow from operations 49,094 47,772 40,726

Per share - basic 1.56 1.53 1.47

Per share - diluted 1.55 1.52 1.46

Payout ratio 56% 56% 53%

Cash dividends per share 0.87 0.85 0.80

Net earnings 23,041 15,254 12,695

Per share - basic 0.73 0.50 0.46

Per share - diluted 0.73 0.49 0.46

Capital expenditures and

acquisitions, net of

dispositions 54,236 25,965 39,506 (2)

Total assets 1,043,822 1,000,531 1,016,594

Working capital deficiency 62,488 35,895 31,519

Long-term debt 143,103 156,764 189,509

Shareholders' equity 678,224 667,641 658,062

----------------------------------------------------------------------------

OPERATIONS

Oil - barrels per day 7,567 7,964 7,459

- average price ($

per barrel) 96.53 80.88 84.20

NGLs - barrels per day 721 691 732

- average price ($

per barrel) 67.81 56.48 53.75

Natural gas - MCF per day 22,307 22,802 22,176

- average price ($

per MCF) 6.16 3.85 3.21

Total barrels of oil equivalent

per day (BOE) (3) 12,006 12,456 11,887

----------------------------------------------------------------------------

(1) Quarterly figures for Q1 2013 include the results of Spartan Oil Corp.

(Spartan) for the period of January 25, 2013 to March 31, 2013. Production

includes 65 days for Spartan and 90 days for Bonterra.

(2) Includes the Spartan acquisition that closed on January 25, 2013 that

included $10,000,000 of acquired cash that reduced capital expenditures from

$49,506,000.

(3) BOE may be misleading, particularly if used in isolation. A BOE

conversion ratio of 6 MCF: 1 bbl is based on an energy conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

(4) Funds flow is not a recognized measure under IFRS. For these purposes,

the Company defines funds flow as funds provided by operations including

proceeds from sale of investments and investment income received excluding

the effects of changes in non-cash working capital items and decommissioning

expenditures.

Q1 2014 HIGHLIGHTS

-- Production averaged 12,006 BOE per day for Q1 2014, with an exit rate at

March 31, 2014 of 13,100 BOE per day;

-- Generated record funds flow of $54.4 million ($1.73 per share) in Q1

2014 compared to $40.7 million ($1.47 per share) in Q1 2013 and $43.4

million ($1.39 per share) in Q4 2013;

-- Average Canadian dollar realized commodity prices were: crude oil $96.53

per barrel; natural gas liquids $67.81 per barrel and natural gas $6.16

per mcf;

-- Operating costs (excluding a non-recurring item) for Q1 2014 were $12.89

per BOE compared to $12.92 per BOE for Q1 2013 and $12.11 per BOE for Q4

2013;

-- Corporate netback increased to $50.37 per BOE compared to $37.76 per BOE

in Q1 2013 and $37.84 per BOE in Q4 2013;

-- Increased funds flow by approximately $10.2 million due to higher

realized netback compared to budget;

-- Paid out $0.87 per share in cash dividends in Q1 2014 compared to $0.80

in Q1 2013 and $0.85 in Q4 2013. This represents a payout ratio of 50%

in Q1 2014 on a funds flow basis which is the low end of the Company's

payout ratio guidance;

-- The Company's net debt to cash flow ratio was 1.05 to 1 times; and

-- Drilled 23 gross (17.2 net) horizontal wells with a 100 percent success

rate.

OPERATIONS

Bonterra spent $55,236,000 on its capital program, which is approximately 45

percent of the Company's anticipated capital program for 2014 primarily on 23

gross (17.2 net) wells. Currently, 37 gross (36.3 net) operated wells and 19

gross (4.7 net) non-operated horizontal wells are planned for 2014 in the

Pembina Cardium area, of which 26 gross (25.5 net) wells will be drilled in the

Carnwood area. Remaining capital will be directed to upgrading facilities,

compression and pipelines within Bonterra's Cardium land base.

The Company has scheduled six (5.9 net) drill locations to maintain its capital

drilling program through Q2 2014. This activity or other capital activities are

not usually possible in the second quarter because of spring break-up road bans

that temporarily prevents the Company from continuing its capital development

program. The drill locations selected for Q2 2014 are where existing road and

facility infrastructure is in place allowing the Company to drill, complete and

tie-in wells during this normal period of inactivity.

As the Company's operations continue to grow, Bonterra maintains its focus on

ensuring it has the necessary infrastructure in place to accommodate new

production. The Company has already increased its battery treating capacity in

the Carnwood area to 5,000 barrels of oil per day. In addition in April 2014 the

Company reactivated a wholly owned gas plant in the Keystone area. This gas

plant is expected to reduce operating costs and increase gas handling capacity

as it will allow the Company to redirect gas production from the Carnwood area

to this plant.

With the remaining 2014 drilling program and the March 31, 2014 exit rate of

13,100 BOE per day the Company is on track to reach or exceed its annual average

production guidance of 12,400 to 12,700 BOE per day.

FINANCIAL

Oil and natural gas prices continued to increase during the first quarter of

2014. The Company's average realized price for crude oil was $96.53 per barrel

in Q1 2014, an increase of 19 percent over the fourth quarter of 2013 and an

increase of 15 percent over the first quarter of 2013. Natural gas prices

averaged $6.16 per mcf for Q1 2014, $3.85 per mcf for Q4 2013 and $3.21 per mcf

for Q1 2013. As a result of this improved price environment, revenue and cash

flow from operations for the first three months of 2014 increased 24 percent and

21 percent, respectively, over the same period in 2013.

The Company's netback of $50.37 per BOE for Q1 2014 represents an increase of 33

percent over Q1 2013 and a 33 percent increase over Q4 2013.

Bonterra has maintained its focus on balance sheet strength and conservative

financial management. The Company believes it is vital to maintain its net debt

to cash flow ratio in the 1 to 1 to 1.5 to 1 times range. At March 31, 2014, the

Company was well within its guidance at 1.05 to 1 times and the Company will

continue to closely monitor this ratio by managing its cash flow, capital

expenditure ranges and dividend payment over the year to ensure that it remains

within its targeted guidance for the full year 2014.

OUTLOOK

Bonterra is very well-positioned for continued improvements in operational

performance and results well into the future. It has one of the largest

inventories of drilling locations in the industry. The Company looks forward to

maintaining its focus on the long-term development of its extensive and

high-quality Cardium assets and in the near-term, will execute on the Company's

highest economic return opportunities to maximize returns and enhance

shareholder value.

If production volumes and funds flow continue to increase the Board and

Management will give consideration to increasing the dividend, increasing

capital expenditures or reducing the debt or a combination of these options. The

Board and Management will continue to monitor the best combination of options to

increase shareholder value over the long term.

Bonterra Energy Corp. is a conventional oil and gas corporation with operations

in Alberta, Saskatchewan and British Columbia. The shares are listed on The

Toronto Stock Exchange under the symbol "BNE".

Cautionary Statement

This summarized news release should not be considered a suitable source of

information for readers who are unfamiliar with Bonterra Energy Corp. and should

not be considered in any way as a substitute for reading the full report.

For the full report, please go to www.bonterraenergy.com

Use of Non-IFRS Financial Measures

Throughout this press release, the Company uses the terms "payout ratio", "cash

netback" and "net debt" to analyze operating performance, which are not

standardized measures recognized under IFRS and do not have a standardized

meaning prescribed by IFRS. These measures are commonly used in the oil and gas

industry and are considered informative by management, shareholders and

analysts. These measures may differ from those made by other companies and

accordingly may not be comparable to such measures as reported by other

companies.

The Company calculates payout ratio by dividing cash dividends paid to

shareholders by cash flow from operating activities, both of which are measures

prescribed by IFRS which appear on our statements of cash flows. We calculate

cash netback by dividing various financial statement items as determined by IFRS

by total production for the period on a barrel of oil equivalent basis.

Frequently recurring terms

Bonterra uses the following frequently recurring terms in this press release:

"WTI" refers to West Texas Intermediate, a grade of light sweet crude oil used

as benchmark pricing in the United States; "MSW Stream Index" refers to the

mixed sweet blend that is the benchmark price for conventionally produced light

sweet crude oil in Western Canada; "bbl" refers to barrel; "NGL" refers to

Natural gas liquids; "MCF" refers to thousand cubic feet; "MMBTU" refers to

million British Thermal Units; and "BOE" refers to barrels of oil equivalent.

Disclosure provided herein in respect of a BOE may be misleading, particularly

if used in isolation. A BOE conversion ratio of 6 MCF: 1 bbl is based on an

energy conversion method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.

Numerical Amounts

The reporting and the functional currency of the Company is the Canadian dollar.

Forward-Looking Information

Certain statements contained in this press release include statements which

contain words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "will", "believe" and similar expressions, relating to

matters that are not historical facts, and such statements of our beliefs,

intentions and expectations about development, results and events which will or

may occur in the future, constitute "forward-looking information" within the

meaning of applicable Canadian securities legislation and are based on certain

assumptions and analysis made by us derived from our experience and perceptions.

Forward-looking information in this press release includes, but is not limited

to: expected cash provided by continuing operations; cash dividends; future

capital expenditures, including the amount and nature thereof; oil and natural

gas prices and demand; expansion and other development trends of the oil and gas

industry; business strategy and outlook; expansion and growth of our business

and operations; and maintenance of existing customer, supplier and partner

relationships; supply channels; accounting policies; credit risks; and other

such matters.

All such forward-looking information is based on certain assumptions and

analyses made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as well as other

factors we believe are appropriate in the circumstances. The risks,

uncertainties, and assumptions are difficult to predict and may affect

operations, and may include, without limitation: foreign exchange fluctuations;

equipment and labour shortages and inflationary costs; general economic

conditions; industry conditions; changes in applicable environmental, taxation

and other laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas companies to raise

capital; the effect of weather conditions on operations and facilities; the

existence of operating risks; volatility of oil and natural gas prices; oil and

gas product supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future obligations;

increased competition; stock market volatility; opportunities available to or

pursued by us; and other factors, many of which are beyond our control. The

foregoing factors are not exhaustive.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, this forward-looking information and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by law, Bonterra

disclaims any intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events or otherwise.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

The TSX does not accept responsibility for the accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO and Chairman of the Board

(403) 262-5307

Bonterra Energy Corp.

Robb D. Thompson

CFO and Secretary

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

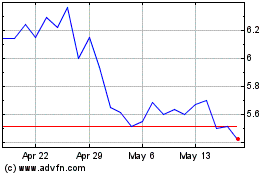

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

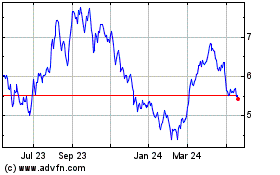

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024