Bonterra Energy Corp. (Bonterra or the Company) (www.bonterraenergy.com)

(TSX:BNE) is pleased to provide an operational update including 2013 highlights

and its ongoing Cardium development program as well as the results of its

independent reserve report prepared by Sproule Associates Limited with an

effective date of December 31, 2013.

Operational Highlights

-- Record average daily production for the full year of 12,190 barrels of

oil equivalent (BOE) per day (70.0 percent oil and liquids), an increase

of 81.9 percent over the same period in 2012.

-- Record average daily production of 12,456 BOE per day in the fourth

quarter, an increase of 62.5 percent when compared to the fourth quarter

of 2012.

-- Production per fully diluted share increased 18.5 percent to 0.147 BOE

per share from 0.124 BOE per share from the prior year.

-- The Board of Directors has approved a 2014 capital development program

of $120.0 million which mainly targets light oil prospects In the

Pembina Cardium Field, most notably focused on development in its

Carnwood area holdings.

-- Currently 56 gross (41.05 net) wells are planned for 2014. Bonterra

intends to spend approximately $72 million of its capital budget in the

Carnwood area, drilling 26 gross (25.5 net) wells and completing 30

wells (includes four wells which were drilled in 2013). In addition,

Bonterra has allocated approximately $13.4 million for infrastructure

optimizations and secondary recovery pilot projects.

-- The first Carnwood unit four well pad's (16-12-48-6) first full month of

production averaged 191 BOE per day per well. The second four well pad

(14-12-48-6) has just been placed on production, with the third four

well pad (09-02-48-6) to be placed on production by the end of February

2014.

-- Bonterra's full year production levels in 2014 are expected to average

between 12,400 and 12,700 BOE per day (72 percent oil and liquids).

-- Bonterra continues to pursue technological enhancements (including

longer horizontal lengths, increased frac densities, limited entry frac

design and a potential transition to cemented completions) in order to

reduce average well costs and improve recoveries.

The Company has not released its audited 2013 financial results therefore the

numbers provided are currently estimates and unaudited.

Corporate Reserves Information

Bonterra engaged the services of Sproule Associates Limited to prepare a reserve

evaluation with an effective date of December 31, 2013. The gross reserve

figures from the following tables represent Bonterra's ownership interest before

royalties and before consideration of the Company's royalty interests. Tables

may not add due to rounding.

Reserve Report Highlights

-- Increased proved plus probable reserves by 66.5 percent to 75.0 mmboe

(74 percent oil and liquids) and proved reserves by 63.3 percent to 54.1

mmboe (74 percent oil and liquids).

-- Total proved reserves represent 72.1 percent of total proved plus

probable reserves.

-- Reserves per fully diluted share (P+P) increased 8.3 percent to 2.47 BOE

per share compared to 2.28 BOE per share from the prior year.

-- Reserve life index of 16.9 years on P+P basis, 11.8 years on a proved

basis, and 6.9 years on a PDP basis (based on 2013 average production

rate of 12,190 BOE per day) continues to remain above industry average.

-- Booked reserves represent approximately 30 percent of Bonterra's current

potential inventory of undrilled locations.

Summary of Gross Oil and Gas Reserves as of December 31, 2013

Light and Natural Gas

Medium Oil Natural Gas Liquids BOE(1)

Reserve Category: (Mbbl) (MMcf) (Mbbl) (MBOE)

----------------------------------------------------------------------------

PROVED

Developed Producing 20,015 51,518 1,905 30,506

Developed Non-Producing 457 1,180 39 692

Undeveloped 16,655 30,372 1,180 22,897

----------------------------------------------------------------------------

TOTAL PROVED 37,127 83,070 3,124 54,096

PROBABLE 14,174 33,120 1,191 20,885

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 51,301 116,190 4,315 74,981

----------------------------------------------------------------------------

Reconciliation of Company Gross Reserves by Principal Product

Type as of December 31, 2013

Light and Medium

Oil and Natural

Gas Liquids Natural Gas BOE(1)

----------------------------------------------------------------------------

Proved Proved Proved

plus plus Plus

Proved Probable Proved Probable Proved Probable

(Mbbl) (Mbbl) (MMcf) (MMcf) (MBOE) (MBOE)

----------------------------------------------------------------------------

December 31,

2012 24,925 33,662 49,258 68,221 33,134 45,032

Extension 826 1,207 1,839 2,727 1,133 1,662

Infills 3,155 4,115 5,140 6,658 4,012 5,225

Improved

Recovery 0 0 0 0 0 0

Technical

Revisions (423) (1,482) 12,832 15,563 1,716 1,112

Discoveries 0 0 0 0 0 0

Acquisitions 14,751 21,077 22,116 31,115 18,437 26,263

Dispositions 0 0 0 0 0 0

Economic

factors 131 150 (102) (82) 114 136

Production (3,114) (3,114) (8,013) (8,013) (4,449) (4,449)

----------------------------------------------------------------------------

December 31,

2013 40,251 55,616 83,070 116,190 54,096 74,981

----------------------------------------------------------------------------

Summary of Net Present Values of Future Net Revenue as of December 31, 2013

Net Present Value Before Income Taxes

Discounted at (% per Year)

($ Millions) 0% 5% 10%

----------------------------------------------------------------------------

Reserve Category:

----------------------------------------------------------------------------

PROVED

Developed Producing 1,390,356 931,047 711,393

Developed Non-Producing 32,856 25,609 21,496

Undeveloped 897,711 487,517 288,092

----------------------------------------------------------------------------

TOTAL PROVED 2,320,923 1,444,173 1,020,981

PROBABLE 1,203,225 485,064 249,468

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 3,524,148 1,929,237 1,270,449

----------------------------------------------------------------------------

Finding, Development and Acquisition (FD&A) Costs

The Company has historically been active in its capital development program.

Over three years, Bonterra has incurred the following FD&A(3) costs excluding

Future Development Costs:

2013 FD&A 2012 FD&A 2011 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(4)

----------------------------------------------------------------------------

Proved Reserve

Net Additions $ 23.63 $ 13.64 $ 33.22 $ 22.01

Proved plus

Probable Reserve

Net Additions $ 20.12 $ 16.05 $ 15.38 $ 19.11

----------------------------------------------------------------------------

Over three years, Bonterra has incurred the following FD&A(3) costs including

Future Development Costs:

2013 FD&A 2012 FD&A 2011 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(5)

----------------------------------------------------------------------------

Proved Reserve

Net Additions $ 24.80 $ 20.91 $ 57.53 $ 23.26

Proved plus

Probable Reserve

Net Additions $ 21.06 $ 21.62 $ 35.40 $ 20.22

----------------------------------------------------------------------------

Finding and Development (F&D) Costs

Over three years, Bonterra has incurred the following F&D(3) costs excluding

Future Development Costs:

2013 F&D 2012 F&D 2011 F&D

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(4)

----------------------------------------------------------------------------

Proved Reserve

Net Additions $ 17.10 $ 13.56 $ 33.06 $ 17.64

Proved plus

Probable Reserve

Net Additions $ 13.41 $ 18.79 $ 15.31 $ 15.24

----------------------------------------------------------------------------

Over three years, Bonterra has incurred the following F&D (3) costs including

Future Development Costs:

2013 F&D 2012 F&D 2011 F&D

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(5)

----------------------------------------------------------------------------

Proved Reserve

Net Additions $ 21.38 $ 22.26 $ 57.37 $ 20.51

Proved plus

Probable Reserve

Net Additions $ 17.04 $ 26.61 $ 35.33 $ 18.09

----------------------------------------------------------------------------

(1) Barrels of Oil Equivalent may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 MCF: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip

and does not represent a value equivalency at the wellhead.

(2) The aggregate of the exploration and development costs incurred in the

most recent financial year and the change during that year in estimated

future development costs generally will not reflect total finding and

development costs related to reserve additions for that year.

(3) FD&A and F&D costs are net of proceeds of disposal and the FD&A costs

per BOE are based on reserves acquired net of reserves disposed of.

(4) Three year average is calculated using three year total capital costs

and reserve additions on both a Proved and Proved plus Probable basis.

(5) Three year average is calculated using three year total capital costs

and reserves additions on both a Proved and Proved plus Probable basis

plus the average change in future capital costs over the three year

period.

Certain financial and operating information, such as production information,

finding and development costs and net asset values, included in this press

release for the quarter and year ended December 31, 2013 are based on estimated

unaudited financial results for the year and are subject to the same limitations

as discussed under Forward Looking Statements set out below. These estimated

amounts may change upon the completion of audited financial statements for the

year ended December 31, 2013 and changes could be material. All reserve numbers

provided above are Bonterra's interest before royalties.

It should not be assumed that the estimates of future net revenue presented in

the above tables represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be attained and

variances could be material. Estimates of reserves and future net revenues for

individual properties may not reflect the same confidence level as estimates of

reserves and future net revenues for all properties due to the effects of

aggregation.

Caution Regarding Engineering Terms:

Disclosure provided herein in respect of barrels of oil equivalent (BOE) may be

misleading, particularly if used in isolation. In accordance with NI 51-101, a

BOE conversion ratio of 6 MCF to 1 barrel has been used in all cases in this

disclosure. This BOE conversion ratio is based on an energy equivalency

conversion method primarily available at the burner tip and does not represent a

value equivalency at the wellhead.

Forward-looking Information

Certain statements contained in this release include statements which contain

words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "will", "believe" and similar expressions, relating to

matters that are not historical facts, and such statements of our beliefs,

intentions and expectations about development, results and events which will or

may occur in the future, constitute "forward-looking information" within the

meaning of applicable Canadian securities legislation and are based on certain

assumptions and analysis made by us derived from our experience and perceptions.

Forward-looking information in this release includes, but is not limited to:

expected cash provided by continuing operations; cash dividends; future capital

expenditures, including the amount and nature thereof; oil and natural gas

prices and demand; expansion and other development trends of the oil and gas

industry; business strategy and outlook; expansion and growth of our business

and operations; and maintenance of existing customer, supplier and partner

relationships; supply channels; accounting policies; credit risks; and other

such matters.

All such forward-looking information is based on certain assumptions and

analyses made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as well as other

factors we believe are appropriate in the circumstances. The risks,

uncertainties, and assumptions are difficult to predict and may affect

operations, and may include, without limitation: foreign exchange fluctuations;

equipment and labour shortages and inflationary costs; general economic

conditions; industry conditions; changes in applicable environmental, taxation

and other laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas companies to raise

capital; the effect of weather conditions on operations and facilities; the

existence of operating risks; volatility of oil and natural gas prices; oil and

gas product supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future obligations;

increased competition; stock market volatility; opportunities available to or

pursued by us; and other factors, many of which are beyond our control.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, this forward-looking information and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking information will transpire or occur, or if any of them do, what

benefits will be derived there from.

Except as required by law, Bonterra disclaims any intention or obligation to

update or revise any forward-looking information, whether as a result of new

information, future events or otherwise.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

The TSX does not accept responsibility for the accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

Chairman and CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb D. Thompson

CFO and Secretary

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

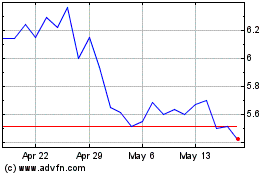

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024