Not for distribution to U.S. news wire services or dissemination in the United

States.

Bonterra Energy Corp. (Bonterra or the Company) (TSX:BNE) is pleased to announce

its financial and operational results for the three months and nine months ended

September 30, 2013. In addition, the Company is pleased to announce its Board of

Directors has approved both a 2014 capital expenditure program budgeted at $120

million and an increase to the monthly dividend to $0.29 per share beginning

with the November dividend payable December 31, 2013. The related unaudited

condensed consolidated financial statements and notes, as well as management's

discussion and analysis, are available on the System for Electronic Document

Analysis and Retrieval (SEDAR) at www.sedar.com and on Bonterra's website at

www.bonterraenergy.com.

Three months ended Nine Months ended

September September September September

As at and for the periods ended 30, 30, 30, 30,

($ 000s except for $ per share) 2013 2012 2013 2012

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FINANCIAL

Revenue - realized oil and gas

sales 78,946 35,204 224,758 103,146

Funds flow (1)(5) 46,874 21,705 138,215 60,633

Per share - basic 1.50 1.10 4.63 3.07

Per share - diluted 1.50 1.09 4.61 3.06

Payout ratio 56% 71% 53% 76%

Funds flow (2)(5) 46,874 21,705 142,034 60,633

Per share - basic 1.50 1.10 4.76 3.07

Per share - diluted 1.50 1.09 4.74 3.06

Payout ratio 56% 71% 52% 76%

Cash flow from operations 43,953 16,440 126,124 52,865

Per share - basic 1.41 0.83 4.22 2.68

Per share - diluted 1.40 0.83 4.21 2.67

Payout ratio 60% 94% 58% 87%

Cash dividends per share 0.84 0.78 2.48 2.34

Net earnings 19,690 7,746 47,504 27,129

Per share - basic 0.63 0.39 1.59 1.37

Per share - diluted 0.63 0.39 1.59 1.37

Capital expenditures and

acquisitions,

net of dispositions 34,025 27,360 83,262(4) 74,061(3)

Total assets 1,002,773 412,812

Working capital deficiency 43,681 49,808

Long-term debt 147,189 128,779

Shareholders' equity 671,528 169,839

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATIONS

Oil (barrels per day)(1) 7,310 4,108 7,727 3,912

NGLs (barrels per day)(1) 772 461 762 436

Natural gas (MCF per day)(1) 22,274 12,583 21,668 12,200

Total barrels of oil equivalent

per day (BOE)(1) 11,794 6,666 12,100 6,381

Total barrels of oil equivalent

per day (BOE)(2) 11,794 6,666 12,508 6,381

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Nine month figures for 2013 include the results of Spartan Oil Corp.

(Spartan) for the period of January 25, 2013 to September 30, 2013.

Production includes 249 days for Spartan and 273 days for Bonterra.

(2) Nine month figures for 2013 include the results of Spartan for the

period of January 1, 2013 to September 30, 2013. Production includes 273

days for Spartan and Bonterra.

(3) Includes an acquisition that closed on June 7, 2012 for $17,108,000.

(4) Includes the Spartan acquisition that closed on January 25, 2013 that

included $10,000,000 of acquired cash that reduced capital expenditures

from $61,643,000 excluding dispositions.

(5) Funds flow is not a recognized measure under IFRS. For these purposes,

the Company defines funds flow as funds provided by operations including

proceeds from sale of investments and investment income received

excluding the effects of changes in non-cash working capital items and

decommissioning expenditures settled.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

In 2013, Bonterra has maintained its focus on providing investors with continued

growth on a per share basis, a sustainable pace of development and monthly

income through its dividend policy. For the nine month period, Bonterra has

achieved record results in net earnings, funds flow, production volumes and the

monthly dividend rate despite one time charges with regard to royalties and

general and administrative costs totaling approximately $4.3 million. Quarter

over quarter financial results were somewhat negatively impacted by a number of

factors including planned decreased production volumes, royalty adjustments

relating to prior periods, lower natural gas prices, pipeline apportionments

which required the Company to shut-in production and an increase in oil

inventory. It should be noted the following comparatives use January 25, 2013 as

the date when Spartan production commenced. Highlights include:

-- Generated record funds flow in the first nine months of 2013 of $138.2

million ($4.63 per share), as compared to $60.6 million ($3.07 per

share) in the same period for 2012, an increase of 128.0 percent. Third

quarter funds flow was $46.9 million, a decrease of 7.3 percent over the

previous quarter, mainly attributable to a reduction of production

volumes of 6.6 percent (partially planned and partially for reason

outlined above);

-- Average daily production was 12,100 boe per day during the first nine

months of 2013, an increase of 89.6 percent over the first nine months

of 2012. In the third quarter of 2013, production averaged 11,794 boe

per day, a decrease of 6.6 percent over the second quarter of 2013. The

increased production year over year is mainly due to the Spartan

acquisition and better results from the Company's 2013 Cardium drill

program. The quarter over quarter decrease is mainly due to natural

production declines associated with flush production on wells drilled in

the first quarter. In addition, approximately 220 boe per day of

production was shut-in due to plant turnarounds and other facility

maintenance programs or stored in field inventory. Fourth quarter

production levels are anticipated to increase as the Company will record

a full quarter of production from wells drilled and tied-in during the

third quarter as well as new production associated with the fourth

quarter drilling program. Full year production guidance is maintained at

12,000 boe per day;

-- Operating costs for the first nine months of the year were $13.00 per

boe, a reduction of 18.8 percent over the same period in 2012. Quarter

over quarter operating costs per boe increased 28.6 percent mainly as a

result of scheduled facility and maintenance programs executed during

the quarter and lower production volumes. The Company continues to

anticipate annual operating costs to average $13.00 per boe for 2013 as

the majority of scheduled seasonal turnarounds and maintenance programs

have been completed and production volumes are anticipated to increase;

-- Paid out $0.84 per share in cash dividends to shareholders in Q3 2013

and $2.48 for the nine month period. This represents a payout ratio of

53 percent of funds flow for the nine month period which is on the low

end of the Company's payout ratio guidance of 50 to 65 percent of funds

flow; and

-- Completed a bought deal financing of 553,725 common shares at a price of

$49.85 per common share for gross proceeds of $27.6 million. The funds

were used to increase the 2013 capital development budget and to

decrease outstanding bank debt. Bonterra's net debt to cash flow ratio

at September 30, 2013 is 1.14 to 1 times providing the Company with one

of the strongest balance sheets amongst its peers leading to significant

financial flexibility. The Company continues to closely monitor this

ratio by managing its cash flow, capital expenditure ranges and dividend

payments and expects to remain well within its targeted guidance range

for 2013.

2014 CORPORATE GUIDANCE

-- The Board of Directors has approved a capital development program of

$120 million which will include the drilling of light oil wells,

infrastructure and gathering systems but excludes acquisitions.

Currently 56 gross (41.05 net) wells are planned with 28 gross (27.6

net) wells targeting the company's Carnwood play in the Pembina Cardium

field;

-- Full year production levels are expected to average between 12,400 and

12,700 BOE per day;

-- The corporate production profile is anticipated to be approximately 72

percent light oil and liquids and 28 percent natural gas (mainly

solution gas);

-- Operating costs are expected to be approximately $13.00 per BOE;

-- Bonterra anticipates fully funding its capital expenditure program out

of cash flow, proceeds from the exercise of employee stock options, sale

of investments and, if required, its bank borrowing facility;

-- The dividend payout ratio is estimated to range between 50 and 65

percent of funds flow in 2014. As above, Bonterra will be increasing the

dividend to $0.29 per share beginning with the dividend payable on

December 31, 2013. Bonterra's Board of Directors and management will

continue to take into account production volumes, commodity prices and

costs in determining monthly dividend amounts;

-- Bonterra will continue to maintain its balance sheet strength and

forecasts its net debt to annualized cash flow from operations to be

within a range of 1.0 to 1.5 times; and

-- Bonterra has approximately $578 million in tax pools, extending the

company's estimated tax horizon to 2016.

Bonterra's capital development program may be affected by items such as drilling

results, commodity prices, and industry, regulatory and economic conditions. The

Board of Directors and management will regularly review the capital program

during the year and will make any adjustments to the amount and targets if

required. The corporate guidance for 2014 is based on estimated future crude oil

and natural gas prices and as such, guidance estimates may fluctuate with

changes in commodity prices. Capital expenditure guidance excludes potential

acquisitions which will be separately considered and evaluated.

WELL POSITIONED FOR CONTINUED GROWTH IN 2014

In 2013, Bonterra's focus to developing its Cardium acreage shifted to main pool

development and the optimization of overall recoveries. The Company spent

approximately $95.7 million on its capital development program during the nine

months of the year and drilled 24 gross (23.8 net) operated Cardium horizontal

wells and twelve (2.7 net) non-operated wells. The third quarter was active for

the Company's drilling operations following spring break-up and included nine

gross (9.0 net) operated wells and 10 gross (2.4 net) non-operated wells. Fourth

quarter drilling is expected to include an additional 21 gross (9.9 net) wells

which will include six (5.9 net) operated wells in the Carnwood area.

Bonterra's drill program in the second half of the year is concentrated in the

Carnwood area in which its land position includes 38 gross (35 net) sections.

The Carnwood area was historically underdeveloped with vertical wells and is

characterized by high levels of original oil-in-place and low current

recoveries. The Carnwood area is expected to be developed at eight horizontal

wells per section which represents a drilling inventory of approximately 305

gross (280 net) locations in this one area of the Cardium alone.

Bonterra has delineated the outer edges of the Carnwood area with the

1-10-048-07 well on the western edge and the 03-34-047-05 well on the eastern

edge of the area. These wells have recorded some of Bonterra's best production

results to date and have produced 36,958 barrels of oil and 57,716 barrels of

oil, respectively, over a nine month cumulative period. During Q3 2013, Bonterra

drilled three additional wells in Carnwood of which one, the 04-34-047-05 well,

is currently on production with the other two expected to be tied-in and on

production in Q4 2013. This well is currently performing favourably with a 30

day rate of 300 boe per day, including 260 barrels of oil per day. With the

outer edges of the Carnwood area delineated, the Company now intends to target

increased well density throughout the area with a targeted pad drilling program

in Q4 2013 and into 2014.

Bonterra has successfully reduced costs and improved well performance through

the application of new drilling and completion technologies and efficient drill

programs. The 2014 capital development program's focus in the Carnwood area

signifies Bonterra's move towards a full field development exploitation strategy

with four well pad drilling comprising the majority of the program. Bonterra

intends to run two rigs in 2014 and will dedicate one rig solely to the Carnwood

area where the average number of days to drill a well will be approximately six

to nine days (24-32 days to drill a four well pad). In addition, Bonterra will

shift to drilling longer horizontal lengths of 1.5 miles (previously one mile)

and will increase frac density. As well, the Company has transitioned to a

cemented completion method with limited entry sleeves, which provides both

better frac placement control and drainage pattern. The focus on full field

development along with improvements to drilling and completion methods has

served to significantly decrease costs. Bonterra's average well cost is

anticipated to be $2.7 million in 2014.

Additional capital spending in 2014 will include reactivating a gas plant at

11-17-49-04 in the first quarter. The reactivation will reduce operating costs

as the Company will be able to redirect gas production from the Carnwood area to

this plant. As well, it is anticipated that a portion of the 2014 capital

development program will be allocated to two enhanced recovery pilot projects, a

waterflood and a gas flood on two different pads in the Carnwood area, to

examine the potential for secondary recovery methods on Bonterra's Cardium

lands. Enhanced recovery methods have the ability to significantly increase

reserve recovery and incremental value across a large portion of the Company's

asset base and the pilot projects are expected to begin in the first half of

2014.

OUTLOOK

Bonterra is committed to continue to create and deliver outstanding value on

behalf of its investors by pursuing the disciplined development of its light oil

targets in the Cardium zone to drive future growth. In 2014, the Company will

again focus on improving production rates, sustaining a consistent pace of

development and increasing project economics. The Company's conservative

financial management, strong operational execution and focus on sustainability

should allow Bonterra to continue to capitalize on its numerous opportunities,

pay a substantial dividend and maximize shareholder value. One issue that is of

concern to the Company and to the industry is the differential between WTI oil

prices and the realized price received by the Company. During the fourth

quarter, the differential has been fluctuating between $6.00 and $20.00 and will

have an effect on funds flow. The general industry consensus is that it will not

stay at this level for an extended period of time as additional oil is

increasingly being delivered by rail or additional pipeline capacity. However,

it will have an impact on fourth quarter 2013 results.

Management would like to take this opportunity to thank the Board of Directors

for its reliable counsel and investors for their continued support. Bonterra is

well-positioned with the capacity to continue delivering strong returns to

shareholders and looks forward to capitalizing on its many opportunities in the

last quarter of 2013 and into 2014.

CAUTIONARY STATEMENT

This summarized news release should not be considered a suitable source of

information for readers who are unfamiliar with Bonterra Energy Corp. and should

not be considered in any way as a substitute for reading the full report. For

the full report, please go to www.bonterraenergy.com.

USE OF NON-IFRS FINANCIAL MEASURES

Throughout this release the Company uses the terms "payout ratio" and "cash

netback" to analyze operating performance, which are not standardized measures

recognized under IFRS and do not have a standardized meaning prescribed by IFRS.

These measures are commonly utilized in the oil and gas industry and are

considered informative by management, shareholders and analysts. These measures

may differ from those made by other companies and accordingly may not be

comparable to such measures as reported by other companies.

The Company calculates payout ratio by dividing cash dividends paid to

shareholders by cash flow from operating activities, both of which are measures

prescribed by IFRS which appear on our statements of cash flows. We calculate

cash netback by dividing various financial statement items as determined by IFRS

by total production for the period on a barrel of oil equivalent basis.

FORWARD-LOOKING INFORMATION

Certain statements contained in this release include statements which contain

words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "will", "believe" and similar expressions, relating to

matters that are not historical facts, and such statements of our beliefs,

intentions and expectations about development, results and events which will or

may occur in the future, constitute "forward-looking information" within the

meaning of applicable Canadian securities legislation and are based on certain

assumptions and analysis made by us derived from our experience and perceptions.

Forward-looking information in this release includes, but is not limited to:

expected cash provided by continuing operations; cash dividends; future capital

expenditures, including the amount and nature thereof; oil and natural gas

prices and demand; expansion and other development trends of the oil and gas

industry; business strategy and outlook; expansion and growth of our business

and operations; and maintenance of existing customer, supplier and partner

relationships; supply channels; accounting policies; credit risks; and other

such matters.

All such forward-looking information is based on certain assumptions and

analyses made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as well as other

factors we believe are appropriate in the circumstances. The risks,

uncertainties, and assumptions are difficult to predict and may affect

operations, and may include, without limitation: foreign exchange fluctuations;

equipment and labour shortages and inflationary costs; general economic

conditions; industry conditions; changes in applicable environmental, taxation

and other laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas companies to raise

capital; the effect of weather conditions on operations and facilities; the

existence of operating risks; volatility of oil and natural gas prices; oil and

gas product supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future obligations;

increased competition; stock market volatility; opportunities available to or

pursued by us; and other factors, many of which are beyond our control.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, this forward-looking information and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by law, Bonterra

disclaims any intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events or otherwise.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

The TSX does not accept responsibility for the accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink, Chairman and CEO or

Robb M. Thompson, CFO and Secretary or

Kirsten Lankester, Manager, Investor Relations

(403) 265-7488 (FAX)

Telephone: (403) 262-5307

info@bonterraenergy.com

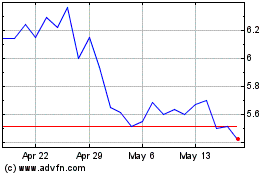

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024