Bonterra Energy Corp. Announces $24 Million Bought Deal Financing

June 10 2013 - 8:29AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES OF AMERICA

Bonterra Energy Corp. (Bonterra) (www.bonterraenergy.com) (TSX:BNE) announces

that it has entered into an agreement with a syndicate of Underwriters pursuant

to which the Underwriters have agreed to purchase on a bought deal basis 481,500

common shares at a price of $49.85 per Common Share (the "Issue Price") for

aggregate gross proceeds of approximately $24 million (the "Offering").

The net proceeds of the Offering will be used to increase Bonterra's capital

expenditure program to further develop and exploit its Cardium properties, and

for general corporate purposes.

The Offering is being made by a syndicate of underwriters led by FirstEnergy

Capital Corp. (the "Underwriters"). Bonterra has granted the Underwriters an

option (the "Over-Allotment Option") to purchase up to an additional 72,225

Common Shares at the Issue Price to cover over-allotments, if any, for

additional gross proceeds of approximately $3.6 million. The Over-Allotment

Option is exercisable in whole or in part at any time until 30 days after the

closing of the Offering. Prior to this Offering, Bonterra had approximately

30,620,946 common shares outstanding.

Pursuant to the Offering, the Common Shares will be offered in the provinces of

Alberta, British Columbia, Manitoba, Ontario and Saskatchewan, by way of a short

form prospectus and by way of private placement in the United States pursuant to

exemptions from the registration requirements pursuant to Rule 144A and/or

Regulation D of the United States Securities Act of 1933.

Closing of the Offering is expected to occur on or about July 2, 2013. The

Offering is subject to certain customary conditions including, but not limited

to, the receipt of all necessary approvals including the approval of the TSX.

Bonterra Energy Corp. is a conventional oil and gas corporation with operations

in Alberta, Saskatchewan and British Columbia. The shares are listed on The

Toronto Stock Exchange under the symbol "BNE".

Forward Looking Information

This press release contains certain statements or disclosures relating to

Bonterra that are based on the expectations of Bonterra as well as assumptions

made by and information currently available to Bonterra which may constitute

forward-looking information under applicable securities laws. In particular,

this press release contains forward-looking information related to the closing

date of the Offering and the anticipated use of net proceeds. Such forward

looking information involves material assumptions and known and unknown risks

and uncertainties, certain of which are beyond Bonterra's control. Many factors

could cause the performance or achievement by Bonterra to be materially

different from any future results, performance or achievements that may be

expressed or implied by such forward looking information. Bonterra's Annual

Information Form and other documents filed with securities regulatory

authorities (accessible through the SEDAR website at www.sedar.com) describe the

risks, material assumptions and other factors that could influence actual

results and which are incorporated herein by reference. Bonterra disclaims any

intention or obligation to publicly update or revise any forward looking

information, whether as a result of new information, future events or otherwise,

except as may be expressly required by applicable securities laws.

This news release does not constitute an offer to sell or the solicitation of an

offer to buy any securities in any jurisdiction. This news release is not an

offer for sale within the United States of any Common Shares or other securities

of Bonterra. Any offering of securities of Bonterra will not be registered under

the U.S. Securities Act and may not be offered or sold in the United States

absent registration under U.S. securities laws or an applicable exemption from

registration under such laws. These securities may not be sold in any state in

which such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such state.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb D. Thompson

CFO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

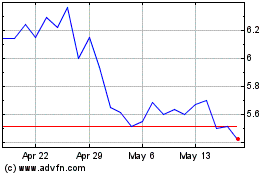

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

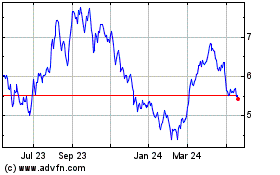

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024