Bonterra Energy Corp. (Bonterra) (www.bonterraenergy.com) (TSX:BNE)

is pleased to provide an operational update including 2012

highlights, the results of its independent reserve report prepared

by Sproule Associates Limited with an effective date of December

31, 2012 and its 2013 budget and guidance.

In 2012, Bonterra maintained its focus on providing investors

with a sustainable pace of development, continued growth on a per

share basis and stable monthly income through its dividend policy

paying out $3.12 per share during the year. The company will

maintain this corporate strategy in 2013 by continuing to pursue

the development of its lower risk, high return opportunities;

predominantly through its horizontal drilling program on its

significant Cardium light oil play.

In addition, Bonterra recently completed the acquisition of

Spartan Oil Corp. (Spartan), increasing its current production to

approximately 13,500 BOE per day that due to a present flush

production will reduce to an average of approximately 12,000 BOE

per day from the January 25, 2013 acquisition date to December 31,

2013. The company's large, concentrated asset base in the Cardium

now totals 250.3 gross (193.7 net) sections, positioning Bonterra

as one of the most dominant light-oil, dividend paying companies in

the Canadian energy sector. The company currently estimates that it

has a greater than 10 year drilling inventory (using four wells per

section) that will allow Bonterra to sustain its current business

model offering both solid growth and yield to its shareholders.

2012 Operational Highlights

-- Record average daily production for the full year of 6,727 barrels of

oil equivalent (BOE) per day (67 percent oil and liquids), an increase

of 6.0 percent over the same period in 2011.

-- Record average daily production of 7,728 BOE per day in the fourth

quarter, an increase of 14.8 percent when compared to the fourth quarter

of 2011.

-- Production per share increased to 0.124 BOE per share, an increase of

4.2 percent over 2011.

-- Proved plus Probable (P+P) reserves of 45.0 million BOE (approximately

75 percent oil and liquids), a 9.4 percent increase over December 2011

reserves of 41.1 million BOE.

-- Added a total of 6.3 million BOE (P+P) reserves which equates to 2.5

times 2012 production.

-- Reserves per share (P+P) increased 7.0 percent to 2.28 BOE per share

compared to 2.13 BOE per share in the prior year.

-- Reserve life index of 18.0 years on P+P basis and 13.7 years on a proved

basis continues to remain above industry average.

The Company has not released its audited 2012 financial results

therefore the numbers provided above are currently estimates and

unaudited.

2013 Corporate Guidance

Bonterra closed the acquisition of Spartan in January, 2013 and

the following guidance is based on the combined entity.

-- The Board of Directors has approved a capital development program of

$90.0 million which mainly targets light oil prospects through its

Cardium horizontal drill program.

-- Currently 29 gross (28.1 net) operated wells are planned. Bonterra will

also participate in drilling 13 gross (4.3 net) non-operated wells

during 2013.

-- Bonterra's full year production levels are expected to average between

12,000 and 12,200 BOE per day.

-- Operating costs are expected to average approximately $15.00 per BOE on

an annualized basis.

-- The dividend payout ratio is estimated to range between 50 and 65

percent of funds flow in 2013. As previously announced, Bonterra will be

increasing the dividend to $0.28 per share beginning with the dividend

that will be paid on March 31, 2013. Bonterra's Board of Directors and

management will continue to take into account production volumes and

commodity prices in determining monthly dividend amounts and will

consider increasing the dividend should crude oil pricing remain

favourable coupled with anticipated production increases.

-- Bonterra's present net debt to cash flow from operations on a pro forma

basis is approximately 1.0:1.0.

-- Bonterra has approximately $570 million in tax pools, extending the

company's estimated tax horizon to 2016.

Bonterra's capital development program may be affected by items

such as drilling results, commodity prices, and industry,

regulatory and economic conditions. The Board of Directors and

management will regularly review the capital program during the

year and will make any adjustments to the amount and targets if

required. The corporate guidance for 2013 is based on estimated

future crude oil and natural gas prices and as such, guidance

estimates may fluctuate with changes in commodity prices. Capital

expenditure guidance excludes potential acquisitions which will be

separately considered and evaluated.

Well Positioned for Continued Growth in 2013

In 2012, Bonterra's focus to developing its Cardium acreage

shifted to main pool development. The company drilled 32 gross

(22.6 net) horizontal wells during the year. Bonterra has

identified 600 gross (464 net) possible horizontal locations within

its acreage. 105 gross (80.8 net) horizontal proved undeveloped

locations are reflected in Bonterra's 2012 reserve report

constituting a three-year drilling program. Bonterra intends to

focus the majority of its $90 million 2013 capital program on

realizing value from its Cardium assets through a sustainably paced

horizontal drill program.

Bonterra closed the acquisition of Spartan on January 25, 2013.

The acquisition advances Bonterra's strategic objective to maintain

and consolidate its position in the Cardium while continuing to

exploit this large resource play. The Spartan properties are a

strong geographical fit to Bonterra's asset base, have significant

operational synergies and provide additional drilling inventory

over the long-term. Bonterra has completed extensive geological

mapping of the Spartan land base and have fully integrated the

assets into its capital program. The Spartan assets are expected to

increase the company's liquids weighting and the corporate

production profile in 2013 is anticipated to be approximately 75

percent light oil and natural gas liquids which should result in

increased netbacks for the combined entity.

Bonterra has continued to improve and refine its development of

the Cardium to both increase well performance and reserve

recoveries while minimizing costs. In 2012, the company

transitioned to water-based fracs which has significantly reduced

overall well costs and increased per well production results. In

2013, Bonterra is currently targeting drilling, completion,

equipping and tie-in costs to average approximately $2.7 million

per well.

Full year production levels in 2013 are expected to average in a

range of 12,000 to 12,200 BOE per day. Bonterra intends to manage

its corporate decline through the prudent use of capital and

selective timing of its drilling program over the course of the

year to deliver sustainable and consistent growth to its

shareholders while continuing to provide income in the form of its

monthly dividend.

Corporate Reserves Information (Prior to the Acquisition of

Spartan Oil Corp.)

Bonterra engaged the services of Sproule Associates Limited to

prepare a reserve evaluation with an effective date of December 31,

2012. The gross reserve figures from the following tables represent

Bonterra's ownership interest before royalties and before

consideration of the Company's royalty interests. Tables may not

add due to rounding.

Summary of Gross Oil and Gas Reserves as of December 31,

2012

Light and Natural

Medium Natural Gas

Oil Gas Liquids BOE(1)

Reserve Category: (Mbbl) (MMcf) (Mbbl) (MBOE)

----------------------------------------------------------------------------

PROVED

Developed Producing 14,415.7 33,037 1,365.7 21,287.6

Developed Non-Producing 366.3 2,629 51.8 856.3

Undeveloped 8,151.6 13,592 573.5 10,990.4

----------------------------------------------------------------------------

TOTAL PROVED 22,933.6 49,258 1,991.0 33,134.3

PROBABLE 8,013.1 18,963 724.0 11,897.6

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 30,946.7 68,221 2,715.0 45,031.9

----------------------------------------------------------------------------

Reconciliation of Company Gross Reserves by Principal Product

Type as of December 31, 2012

Light and Medium Oil and

Natural Gas Liquids Natural Gas

----------------------------------------------------------------------------

Proved plus Proved plus

Proved Probable Proved Probable

(Mbbl) (Mbbl) (Mmcf) (Mmcf)

----------------------------------------------------------------------------

December 31, 2011 21,160.1 30,492.4 41,822 63,941

Extension 1,142.7 1,403.6 1,279 1,624

Improved Recovery 4,482.4 5,792.5 7,769 10,039

Technical Revisions (883.1) (3,470.0) 403 (5,052)

Discoveries - - - -

Acquisitions 770.0 1,200.3 2,685 3,769

Dispositions - - - -

Economic factors (158.7) (168.4) (564) (1,964)

Production (1,588.8) (1,588.8) (4,136) (4,136)

----------------------------------------------------------------------------

December 31, 2012 24,924.6 33,661.7 49,258 68,221

----------------------------------------------------------------------------

BOE(1)

--------------------------------------------------

Proved Plus

Proved Probable

(MBOE) (MBOE)

--------------------------------------------------

December 31, 2011 28,130.4 41,149.2

Extension 1,355.9 1,674.3

Improved Recovery 5,777.2 7,465.7

Technical Revisions (815.9) (4,312.0)

Discoveries - -

Acquisitions 1,217.5 1,828.5

Dispositions - -

Economic factors (252.7) (495.7)

Production (2,278.1) (2,278.1)

--------------------------------------------------

December 31, 2012 33,134.3 45,031.9

--------------------------------------------------

Summary of Net Present Values of Future Net Revenue as of

December 31, 2012

Net Present Value Before

Income Taxes

Discounted at (% per Year)

($ Millions) 0% 5% 10%

----------------------------------------------------------------------------

Reserve Category:

----------------------------------------------------------------------------

PROVED

Developed Producing 841,883 542,926 406,536

Developed Non-Producing 26,822 16,496 11,488

Undeveloped 393,061 191,499 96,203

----------------------------------------------------------------------------

TOTAL PROVED 1,261,766 750,921 514,227

PROBABLE 614,596 235,981 118,681

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 1,876,362 986,902 632,909

----------------------------------------------------------------------------

Finding, Development and Acquisition (FD&A) Costs

The Company has historically been active in its capital

development program. Over three years, Bonterra has incurred the

following FD&A (3) costs excluding Future Development

Costs:

2012

FD&A 2011 FD&A 2010 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(4)

----------------------------------------------------------------------------

Proved Reserve Net

Additions $ 16.05$ 33.22$ 13.89$ 16.22

Proved plus Probable

Reserve Net Additions $ 13.64$ 15.38$ 13.02$ 14.79

----------------------------------------------------------------------------

Over three years, Bonterra has incurred the following FD&A

(3) costs including Future Development Costs:

2012

FD&A 2011 FD&A 2010 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(5)

----------------------------------------------------------------------------

Proved Reserve Net

Additions $ 20.91$ 57.53$ 21.98$ 19.47

Proved plus Probable

Reserve Net Additions $ 21.62$ 35.40$ 19.19$ 17.92

----------------------------------------------------------------------------

(1) Barrels of Oil Equivalent may be misleading, particularly if

used in isolation. A BOE conversion ratio of 6 MCF: 1 bbl is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead.

(2) The aggregate of the exploration and development costs

incurred in the most recent financial year and the change during

that year in estimated future development costs generally will not

reflect total finding and development costs related to reserve

additions for that year.

(3) FD&A costs are net of proceeds of disposal and the

FD&A costs per BOE are based on reserves acquired net of

reserves disposed of.

(4) Three year average is calculated using three year total

capital costs and reserve additions on both a Proved and Proved

plus Probable basis.

(5) Three year average is calculated using three year total

capital costs and reserves additions on both a Proved and Proved

plus Probable basis plus the average change in future capital costs

over the three year period.

Certain financial and operating information, such as production

information, finding and development costs and net asset values,

included in this press release for the quarter and year ended

December 31, 2012 are based on estimated unaudited financial

results for the year and are subject to the same limitations as

discussed under Forward Looking Statements set out below. These

estimated amounts may change upon the completion of audited

financial statements for the year ended December 31, 2012 and

changes could be material. All reserve numbers provided above are

Bonterra's interest before royalties.

It should not be assumed that the estimates of future net

revenue presented in the above tables represent the fair market

value of the reserves. There is no assurance that the forecast

prices and costs assumptions will be attained and variances could

be material. Estimates of reserves and future net revenues for

individual properties may not reflect the same confidence level as

estimates of reserves and future net revenues for all properties

due to the effects of aggregation.

Caution Regarding Engineering Terms:

Disclosure provided herein in respect of barrels of oil

equivalent (BOE) may be misleading, particularly if used in

isolation. In accordance with NI 51-101, a BOE conversion ratio of

6 MCF to 1 barrel has been used in all cases in this disclosure.

This BOE conversion ratio is based on an energy equivalency

conversion method primarily available at the burner tip and does

not represent a value equivalency at the wellhead.

Caution Regarding Forward Looking Information:

Certain information set forth in this press release, including

management's assessment of Bonterra's future plans and operations,

contains forward-looking statements. By their nature,

forward-looking statements are subject to numerous risks and

uncertainties, some of which are beyond Bonterra's control,

including the impact of general economic conditions, industry

conditions, volatility of commodity prices, currency fluctuations,

imprecision of reserve estimates, environmental risks, competition

from other industry participants, the lack of availability of

qualified personnel or management, stock market volatility and

ability to access sufficient capital from internal and external

sources. Readers are cautioned that the assumptions used in the

preparation of such information, although considered reasonable at

the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking statements.

Bonterra's actual results, performance or achievement could differ

materially from those expressed in, or implied by these

forward-looking statements, and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do so, what

benefits that Bonterra will derive therefrom. Bonterra disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contacts: Bonterra Energy Corp. George F. Fink Chairman and CEO

(403) 262-5307 (403) 265-7488 (FAX) Bonterra Energy Corp. Robb M.

Thompson CFO and Secretary (403) 262-5307 (403) 265-7488 (FAX)

Bonterra Energy Corp. Kirsten Lankester Manager, Investor Relations

(403) 262-5307 (403) 265-7488 (FAX)info@bonterraenergy.com

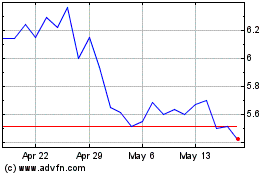

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

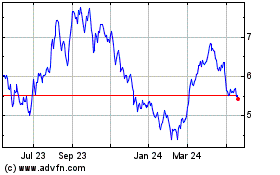

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024