Bonterra Energy Corp. (Bonterra) (www.bonterraenergy.com) (TSX:BNE) is pleased

to provide an operational update including 2012 highlights, the results of its

independent reserve report prepared by Sproule Associates Limited with an

effective date of December 31, 2012 and its 2013 budget and guidance.

In 2012, Bonterra maintained its focus on providing investors with a sustainable

pace of development, continued growth on a per share basis and stable monthly

income through its dividend policy paying out $3.12 per share during the year.

The company will maintain this corporate strategy in 2013 by continuing to

pursue the development of its lower risk, high return opportunities;

predominantly through its horizontal drilling program on its significant Cardium

light oil play.

In addition, Bonterra recently completed the acquisition of Spartan Oil Corp.

(Spartan), increasing its current production to approximately 13,500 BOE per day

that due to a present flush production will reduce to an average of

approximately 12,000 BOE per day from the January 25, 2013 acquisition date to

December 31, 2013. The company's large, concentrated asset base in the Cardium

now totals 250.3 gross (193.7 net) sections, positioning Bonterra as one of the

most dominant light-oil, dividend paying companies in the Canadian energy

sector. The company currently estimates that it has a greater than 10 year

drilling inventory (using four wells per section) that will allow Bonterra to

sustain its current business model offering both solid growth and yield to its

shareholders.

2012 Operational Highlights

-- Record average daily production for the full year of 6,727 barrels of

oil equivalent (BOE) per day (67 percent oil and liquids), an increase

of 6.0 percent over the same period in 2011.

-- Record average daily production of 7,728 BOE per day in the fourth

quarter, an increase of 14.8 percent when compared to the fourth quarter

of 2011.

-- Production per share increased to 0.124 BOE per share, an increase of

4.2 percent over 2011.

-- Proved plus Probable (P+P) reserves of 45.0 million BOE (approximately

75 percent oil and liquids), a 9.4 percent increase over December 2011

reserves of 41.1 million BOE.

-- Added a total of 6.3 million BOE (P+P) reserves which equates to 2.5

times 2012 production.

-- Reserves per share (P+P) increased 7.0 percent to 2.28 BOE per share

compared to 2.13 BOE per share in the prior year.

-- Reserve life index of 18.0 years on P+P basis and 13.7 years on a proved

basis continues to remain above industry average.

The Company has not released its audited 2012 financial results therefore the

numbers provided above are currently estimates and unaudited.

2013 Corporate Guidance

Bonterra closed the acquisition of Spartan in January, 2013 and the following

guidance is based on the combined entity.

-- The Board of Directors has approved a capital development program of

$90.0 million which mainly targets light oil prospects through its

Cardium horizontal drill program.

-- Currently 29 gross (28.1 net) operated wells are planned. Bonterra will

also participate in drilling 13 gross (4.3 net) non-operated wells

during 2013.

-- Bonterra's full year production levels are expected to average between

12,000 and 12,200 BOE per day.

-- Operating costs are expected to average approximately $15.00 per BOE on

an annualized basis.

-- The dividend payout ratio is estimated to range between 50 and 65

percent of funds flow in 2013. As previously announced, Bonterra will be

increasing the dividend to $0.28 per share beginning with the dividend

that will be paid on March 31, 2013. Bonterra's Board of Directors and

management will continue to take into account production volumes and

commodity prices in determining monthly dividend amounts and will

consider increasing the dividend should crude oil pricing remain

favourable coupled with anticipated production increases.

-- Bonterra's present net debt to cash flow from operations on a pro forma

basis is approximately 1.0:1.0.

-- Bonterra has approximately $570 million in tax pools, extending the

company's estimated tax horizon to 2016.

Bonterra's capital development program may be affected by items such as drilling

results, commodity prices, and industry, regulatory and economic conditions. The

Board of Directors and management will regularly review the capital program

during the year and will make any adjustments to the amount and targets if

required. The corporate guidance for 2013 is based on estimated future crude oil

and natural gas prices and as such, guidance estimates may fluctuate with

changes in commodity prices. Capital expenditure guidance excludes potential

acquisitions which will be separately considered and evaluated.

Well Positioned for Continued Growth in 2013

In 2012, Bonterra's focus to developing its Cardium acreage shifted to main pool

development. The company drilled 32 gross (22.6 net) horizontal wells during the

year. Bonterra has identified 600 gross (464 net) possible horizontal locations

within its acreage. 105 gross (80.8 net) horizontal proved undeveloped locations

are reflected in Bonterra's 2012 reserve report constituting a three-year

drilling program. Bonterra intends to focus the majority of its $90 million 2013

capital program on realizing value from its Cardium assets through a sustainably

paced horizontal drill program.

Bonterra closed the acquisition of Spartan on January 25, 2013. The acquisition

advances Bonterra's strategic objective to maintain and consolidate its position

in the Cardium while continuing to exploit this large resource play. The Spartan

properties are a strong geographical fit to Bonterra's asset base, have

significant operational synergies and provide additional drilling inventory over

the long-term. Bonterra has completed extensive geological mapping of the

Spartan land base and have fully integrated the assets into its capital program.

The Spartan assets are expected to increase the company's liquids weighting and

the corporate production profile in 2013 is anticipated to be approximately 75

percent light oil and natural gas liquids which should result in increased

netbacks for the combined entity.

Bonterra has continued to improve and refine its development of the Cardium to

both increase well performance and reserve recoveries while minimizing costs. In

2012, the company transitioned to water-based fracs which has significantly

reduced overall well costs and increased per well production results. In 2013,

Bonterra is currently targeting drilling, completion, equipping and tie-in costs

to average approximately $2.7 million per well.

Full year production levels in 2013 are expected to average in a range of 12,000

to 12,200 BOE per day. Bonterra intends to manage its corporate decline through

the prudent use of capital and selective timing of its drilling program over the

course of the year to deliver sustainable and consistent growth to its

shareholders while continuing to provide income in the form of its monthly

dividend.

Corporate Reserves Information (Prior to the Acquisition of Spartan Oil Corp.)

Bonterra engaged the services of Sproule Associates Limited to prepare a reserve

evaluation with an effective date of December 31, 2012. The gross reserve

figures from the following tables represent Bonterra's ownership interest before

royalties and before consideration of the Company's royalty interests. Tables

may not add due to rounding.

Summary of Gross Oil and Gas Reserves as of December 31, 2012

Light and Natural

Medium Natural Gas

Oil Gas Liquids BOE(1)

Reserve Category: (Mbbl) (MMcf) (Mbbl) (MBOE)

----------------------------------------------------------------------------

PROVED

Developed Producing 14,415.7 33,037 1,365.7 21,287.6

Developed Non-Producing 366.3 2,629 51.8 856.3

Undeveloped 8,151.6 13,592 573.5 10,990.4

----------------------------------------------------------------------------

TOTAL PROVED 22,933.6 49,258 1,991.0 33,134.3

PROBABLE 8,013.1 18,963 724.0 11,897.6

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 30,946.7 68,221 2,715.0 45,031.9

----------------------------------------------------------------------------

Reconciliation of Company Gross Reserves by Principal Product Type as of

December 31, 2012

Light and Medium Oil and

Natural Gas Liquids Natural Gas

----------------------------------------------------------------------------

Proved plus Proved plus

Proved Probable Proved Probable

(Mbbl) (Mbbl) (Mmcf) (Mmcf)

----------------------------------------------------------------------------

December 31, 2011 21,160.1 30,492.4 41,822 63,941

Extension 1,142.7 1,403.6 1,279 1,624

Improved Recovery 4,482.4 5,792.5 7,769 10,039

Technical Revisions (883.1) (3,470.0) 403 (5,052)

Discoveries - - - -

Acquisitions 770.0 1,200.3 2,685 3,769

Dispositions - - - -

Economic factors (158.7) (168.4) (564) (1,964)

Production (1,588.8) (1,588.8) (4,136) (4,136)

----------------------------------------------------------------------------

December 31, 2012 24,924.6 33,661.7 49,258 68,221

----------------------------------------------------------------------------

BOE(1)

--------------------------------------------------

Proved Plus

Proved Probable

(MBOE) (MBOE)

--------------------------------------------------

December 31, 2011 28,130.4 41,149.2

Extension 1,355.9 1,674.3

Improved Recovery 5,777.2 7,465.7

Technical Revisions (815.9) (4,312.0)

Discoveries - -

Acquisitions 1,217.5 1,828.5

Dispositions - -

Economic factors (252.7) (495.7)

Production (2,278.1) (2,278.1)

--------------------------------------------------

December 31, 2012 33,134.3 45,031.9

--------------------------------------------------

Summary of Net Present Values of Future Net Revenue as of December 31, 2012

Net Present Value Before

Income Taxes

Discounted at (% per Year)

($ Millions) 0% 5% 10%

----------------------------------------------------------------------------

Reserve Category:

----------------------------------------------------------------------------

PROVED

Developed Producing 841,883 542,926 406,536

Developed Non-Producing 26,822 16,496 11,488

Undeveloped 393,061 191,499 96,203

----------------------------------------------------------------------------

TOTAL PROVED 1,261,766 750,921 514,227

PROBABLE 614,596 235,981 118,681

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 1,876,362 986,902 632,909

----------------------------------------------------------------------------

Finding, Development and Acquisition (FD&A) Costs

The Company has historically been active in its capital development program.

Over three years, Bonterra has incurred the following FD&A (3) costs excluding

Future Development Costs:

2012

FD&A 2011 FD&A 2010 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(4)

----------------------------------------------------------------------------

Proved Reserve Net

Additions $ 16.05$ 33.22$ 13.89$ 16.22

Proved plus Probable

Reserve Net Additions $ 13.64$ 15.38$ 13.02$ 14.79

----------------------------------------------------------------------------

Over three years, Bonterra has incurred the following FD&A (3) costs including

Future Development Costs:

2012

FD&A 2011 FD&A 2010 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(5)

----------------------------------------------------------------------------

Proved Reserve Net

Additions $ 20.91$ 57.53$ 21.98$ 19.47

Proved plus Probable

Reserve Net Additions $ 21.62$ 35.40$ 19.19$ 17.92

----------------------------------------------------------------------------

(1) Barrels of Oil Equivalent may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 MCF: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead.

(2) The aggregate of the exploration and development costs incurred in the most

recent financial year and the change during that year in estimated future

development costs generally will not reflect total finding and development costs

related to reserve additions for that year.

(3) FD&A costs are net of proceeds of disposal and the FD&A costs per BOE are

based on reserves acquired net of reserves disposed of.

(4) Three year average is calculated using three year total capital costs and

reserve additions on both a Proved and Proved plus Probable basis.

(5) Three year average is calculated using three year total capital costs and

reserves additions on both a Proved and Proved plus Probable basis plus the

average change in future capital costs over the three year period.

Certain financial and operating information, such as production information,

finding and development costs and net asset values, included in this press

release for the quarter and year ended December 31, 2012 are based on estimated

unaudited financial results for the year and are subject to the same limitations

as discussed under Forward Looking Statements set out below. These estimated

amounts may change upon the completion of audited financial statements for the

year ended December 31, 2012 and changes could be material. All reserve numbers

provided above are Bonterra's interest before royalties.

It should not be assumed that the estimates of future net revenue presented in

the above tables represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be attained and

variances could be material. Estimates of reserves and future net revenues for

individual properties may not reflect the same confidence level as estimates of

reserves and future net revenues for all properties due to the effects of

aggregation.

Caution Regarding Engineering Terms:

Disclosure provided herein in respect of barrels of oil equivalent (BOE) may be

misleading, particularly if used in isolation. In accordance with NI 51-101, a

BOE conversion ratio of 6 MCF to 1 barrel has been used in all cases in this

disclosure. This BOE conversion ratio is based on an energy equivalency

conversion method primarily available at the burner tip and does not represent a

value equivalency at the wellhead.

Caution Regarding Forward Looking Information:

Certain information set forth in this press release, including management's

assessment of Bonterra's future plans and operations, contains forward-looking

statements. By their nature, forward-looking statements are subject to numerous

risks and uncertainties, some of which are beyond Bonterra's control, including

the impact of general economic conditions, industry conditions, volatility of

commodity prices, currency fluctuations, imprecision of reserve estimates,

environmental risks, competition from other industry participants, the lack of

availability of qualified personnel or management, stock market volatility and

ability to access sufficient capital from internal and external sources. Readers

are cautioned that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on forward-looking

statements. Bonterra's actual results, performance or achievement could differ

materially from those expressed in, or implied by these forward-looking

statements, and, accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or occur, or if any

of them do so, what benefits that Bonterra will derive therefrom. Bonterra

disclaims any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

Chairman and CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb M. Thompson

CFO and Secretary

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

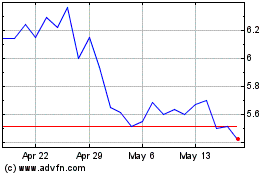

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024