Bonterra Energy Corp. Releases Pro Forma Data

December 17 2012 - 7:53AM

Marketwired Canada

In conjunction with today's conference call and webcast, Bonterra Energy Corp.

(TSX:BNE) (Bonterra) is releasing key pro forma data with regard to the

Definitive Agreement whereby Bonterra has agreed to acquire all of the issued

and outstanding common shares of Spartan.

Pro Forma Capitalization: Pre-Consolidation Post-Consolidation

----------------------------------------------------------------------------

Fully Diluted Shares 19.9 million 30.6 million

Market Capitalization(1) $1.3 billion

Enterprise Value(1) $1.5 billion

Pro Forma Net Debt $175 million

Monthly Dividend After Closing (Commencing March

2013) $0.28 per share

Pro Forma Tax Pools (2017 Tax Horizon) $570 million

----------------------------------------------------------------------------

Pro Forma Corporate Profile:

----------------------------------------------------------------------------

Oil and Liquids Weighting 77%

greater than 600

Drilling Locations horizontal locations

----------------------------------------------------------------------------

2013 Outlook:

----------------------------------------------------------------------------

Average Production 12,000 BOE per day

Operating Netbacks(2) $43.78 per BOE(3)

Forecast Cash Flow From Commodities $192 million

Capital Program $90 million

Dividend Payments ($0.28 per share effective March

31, 2013) $99 million

Beginning Net Debt $175 million

Ending Net Debt $170 million

2013 Ending Net Debt / Cash Flow Less than 1.0 x

----------------------------------------------------------------------------

(1) Based on the December 14, 2012 closing price of $42.75 per share.

(2) Assumes Cdn $81.88 average realized oil price and $3.54 AECO for natural gas

(includes $0.24 for positive quality adjustment), 10.2% royalty, $12.45 per BOE

operating cost and $2.92 per BOE G&A and interest cost.

(3) For every $5.00 realized oil price change (no change to natural gas price),

cash flow will change by approximately $15 million and the debt to cash flow

ratio will change by approximately 0.15 (pro forma of 1 to 1 will change to 1.13

to 1 or 0.82 to 1).

We invite all interested parties to join us on the upcoming conference call with

details as follows:

Date: Monday, December 17, 2012

Time: 8:30 a.m. MST (10:30 a.m. EST)

Dial-in: 416-340-2216 or toll free in North America 1-866-226-1792

Webcast: http://www.gowebcasting.com/4037

An archived recording of the conference call will be available until December

24, 2012 by dialing toll-free 1-800-408-3053 (Toronto local dial 905-694-9451)

and entering pass code 1312324. The conference call will also be archived on the

Bonterra website at www.bonterraenergy.com.

Through the combination, Bonterra and Spartan will hold an enviable suite of

light-oil assets concentrated in the Pembina region, which will be comprised of

a complimentary production base and a long-term inventory of drilling

opportunities that is anticipated to drive future growth. Bonterra, as

demonstrated by its past track record of increasing dividends and year-over-year

growth on a per share basis, has shown a strong ability to manage Pembina

Cardium assets to provide measured production growth while providing a

sustainable dividend to its shareholders. Bonterra's common shares are traded on

the Toronto Stock Exchange under the symbol BNE.

For further information about Bonterra, please visit our website at

www.bonterraenergy.com.

Cautionary Statements

Certain statements contained in this press release include statements which

contain words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "will", "believe" and similar expressions, statements

relating to matters that are not historical facts, and such statements of our

beliefs, intentions and expectations about development, results and events which

will or may occur in the future, constitute "forward-looking information" within

the meaning of applicable Canadian securities legislation and are based on

certain assumptions and analysis made by us derived from our experience and

perceptions. Forward-looking information in this press release includes, but is

not limited to: expected cash provided by continuing operations; future capital

expenditures, including the amount and nature thereof; oil and natural gas

prices and demand; expansion and other development trends of the oil and gas

industry; business strategy and outlook; expansion and growth of our combined

business and operations; and maintenance of existing supplier and partner

relationships; supply channels; accounting policies; credit risks; and other

such matters. Forward-looking information in this press release also includes,

but is not limited to, timing for completion of the transaction with Spartan and

the timing and amount of future dividend payments by Bonterra. In addition to

other factors and assumptions which may be identified in this press release,

assumptions have been made regarding and are implicit in, among other things,

the timely receipt of any required regulatory approvals (including Court and

shareholder approvals).

All such forward-looking information is based on certain assumptions and

analyses made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as well as other

factors we believe are appropriate in the circumstances. The risks,

uncertainties, and assumptions are difficult to predict and may affect

operations, and may include, without limitation: foreign exchange fluctuations;

equipment and labour shortages and inflationary costs; general economic

conditions; industry conditions; changes in applicable environmental, taxation

and other laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas companies to raise

capital; the effect of weather conditions on operations and facilities; the

existence of operating risks; volatility of oil and natural gas prices; oil and

gas product supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future obligations;

increased competition; stock market volatility; opportunities available to or

pursued by us; and other factors, many of which are beyond our control. The

foregoing factors are not exhaustive.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, this forward-looking information and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking information will transpire or occur, or if any of them do so,

what benefits will be derived therefrom. Except as required by law, Bonterra

disclaims any intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events or otherwise.

The term barrels of oil equivalent (BOE) may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet per barrel

(6mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All BOE conversions in the

report are derived from converting gas to oil in the ratio mix of six thousand

cubic feet of gas to one barrel of oil.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy securities in the United States, nor shall there be any sale of

the securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful. The Bonterra Shares to be offered have not been, and will not

be, registered under the U.S. Securities Act of 1933, as amended and may not be

offered or sold in the United States or to a U.S. person absent registration or

an applicable exemption from the registration requirements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

Chairman and CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb D. Thompson

CFO and Secretary

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

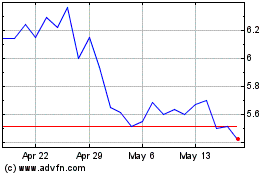

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

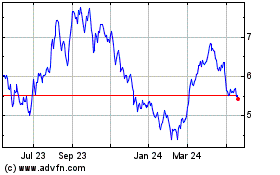

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024