Bonterra Energy Corp. Enters Into Definitive Agreement to Combine With Spartan Oil Corp. and Spartan Terminates Merger With P...

December 12 2012 - 5:30AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Bonterra Energy Corp. (TSX:BNE) ("Bonterra") and Spartan Oil Corp. (TSX:STO)

("Spartan") are pleased to announce that they have entered into an arrangement

agreement (the "Bonterra Arrangement Agreement") whereby Bonterra has agreed to

acquire all of the issued and outstanding common shares (the "Spartan Shares")

of Spartan (the "Bonterra Arrangement"). Pursuant to the terms of the Bonterra

Arrangement Agreement, holders ("Spartan Shareholders") of Spartan Shares will

receive 0.1169 (the "Exchange Ratio") of a Bonterra common share (the "Bonterra

Shares") for each Spartan Share held and will also benefit from their Bonterra

Share ownership as Bonterra has committed, subject to the completion of the

Bonterra Arrangement and the terms of the Bonterra Arrangement Agreement, to

increase its monthly dividend to $0.28 from $0.26 beginning March 2013.

Termination of Pinecrest Arrangement

In accordance with the terms of the arrangement agreement dated November 20,

2012 (the "Pinecrest Arrangement Agreement") between Spartan and Pinecrest

Energy Inc. ("Pinecrest"), the board of directors of Spartan (the "Spartan

Board") determined that the proposed Bonterra Arrangement constituted a

"superior proposal", as such term is defined in the Pinecrest Arrangement

Agreement and Spartan has provided notice of the proposed Bonterra Arrangement

to Pinecrest.

Pursuant to the Pinecrest Arrangement Agreement, Pinecrest waived its right to

revise its existing merger transaction with Spartan (the "Pinecrest

Arrangement") to match the consideration offered under the Bonterra Arrangement.

As a result, in accordance with the terms of the Pinecrest Arrangement

Agreement, Spartan terminated the Pinecrest Arrangement Agreement and paid to

Pinecrest the non-completion fee of $12.5 million. Spartan then entered into the

Bonterra Arrangement Agreement.

Bonterra Arrangement

Completion of the Bonterra Arrangement is subject to the satisfaction of a

number of conditions, including the receipt of requisite shareholder, court and

regulatory approvals. The Bonterra Arrangement will need to be approved by not

less than 66 2/3% of the votes cast by Spartan Shareholders (and by a majority

of votes cast by Spartan Shareholders after excluding the votes cast by certain

members of Spartan management), voting in person or by proxy, at a special

meeting expected to be held on or about January 25, 2013 (the "Spartan

Meeting"). In addition, the issuance of the Bonterra Shares in connection with

the Bonterra Arrangement is subject to the majority approval of the holders of

Bonterra Shares (the "Bonterra Share Issuance Resolution") pursuant to the

policies of the Toronto Stock Exchange voting in person or by proxy, at a

special meeting expected to be held on or about January 25, 2013 (the "Bonterra

Meeting"). The Bonterra Arrangement also requires the approval of the Court of

Queen's Bench of Alberta.

Under the terms of the Bonterra Arrangement Agreement, Spartan has agreed that

it will not solicit or initiate any inquiries or discussions regarding any other

business combination or sale of assets. Spartan has granted Bonterra the right

to match any superior proposals. The Bonterra Arrangement Agreement also

provides for a reciprocal non-completion fee of $12.5 million under certain

circumstances. For more information on the Bonterra Arrangement and the Bonterra

Arrangement Agreement refer to the full Bonterra Arrangement Agreement, a copy

of which will be filed by each of Bonterra and Spartan on SEDAR and will be

available for viewing under their respective profiles on www.sedar.com.

TD Securities Inc. is acting as financial advisor to Spartan in connection with

the Bonterra Arrangement and has provided the Spartan Board with its verbal

opinion that, subject to review of the final documentation, the consideration to

be received by the Spartan Shareholders is fair, from a financial point of view,

to the Spartan Shareholders. GMP Securities L.P. and Clarus Securities Inc.

acted as strategic advisors to Spartan.

The Spartan Board has unanimously approved the Bonterra Arrangement Agreement,

and, based on a fairness opinion provided by TD Securities Inc., determined that

the consideration to be received by Spartan Shareholders pursuant to the

Bonterra Arrangement is fair to Spartan Shareholders, determined that the

Bonterra Arrangement is in the best interests of Spartan, and unanimously

resolved to recommend that Spartan Shareholders vote in favour of the Bonterra

Arrangement. Management and directors of Spartan holding approximately 23.1% of

the issued and outstanding Spartan Shares have entered into support agreements

to vote their Spartan Shares in favour of the Bonterra Arrangement at the

Spartan Meeting.

The Bonterra board of directors (the "Bonterra Board") has unanimously approved

the Bonterra Arrangement Agreement and has determined that the Bonterra

Arrangement is in the best interests of Bonterra, and unanimously resolved to

recommend that Bonterra Shareholders vote in favour of the Bonterra Share

Issuance Resolution. Management and directors of Bonterra holding approximately

21.5% of the issued and outstanding Bonterra Shares have entered into support

agreements to vote their Bonterra Shares in favour of the Bonterra Share

Issuance Resolution at the Bonterra Meeting.

The mailing of a joint information circular to the Spartan Shareholders and

Bonterra Shareholders regarding the Spartan Meeting and Bonterra Meeting is

expected to occur in late December, 2012 or early January, 2013. The Spartan

Meeting, Bonterra Meeting and the closing of the Bonterra Arrangement are

expected to occur on or about January 25, 2013, provided that all shareholder,

court and regulatory approvals are obtained.

Transaction Summary

-- Pursuant to the Bonterra Arrangement, Spartan Shareholders will receive

consideration of 0.1169 Bonterra Shares for each Spartan Share held.

-- As a part of the Bonterra Arrangement, Bonterra has committed, subject

to the completion of the Bonterra Arrangement and the terms of the

Bonterra Arrangement Agreement, to increase its monthly dividend to

$0.28 from $0.26 beginning March 2013. Subject to the Bonterra

Arrangement closing prior to February 15, 2013, Spartan Shareholders

will also receive a $0.26 per Bonterra Share dividend on February 28,

2013. If Bonterra sustains its current effective yield of 7.2% following

the dividend increase, Spartan Shareholders can potentially realize an

incremental $0.43 of value per Spartan Share.

-- Based on the Exchange Ratio, it is currently anticipated that Bonterra

will issue approximately 10.7 million Bonterra Shares to the holders of

Spartan Shares.

Transaction Rationale

The merger of Bonterra's and Spartan's asset bases is of strong strategic value

for both groups of shareholders as the resulting company will have one of the

premier light-oil assets concentrated in the Pembina region, which will be

comprised of a complimentary production base and a long-term inventory of

drilling opportunities that is anticipated to drive future growth. The merger of

Spartan and Bonterra is a unique opportunity for Spartan Shareholders to

participate, through their approximately 35% ownership, in an established

dividend paying company that has a demonstrated history of per share production

and dividend growth through a variety of commodity cycles. The merger is

anticipated to be accretive for Bonterra on a financial and operating basis and

Bonterra expects to continue to demonstrate production per share growth and cash

flow per share growth while maintaining a strong balance sheet.

-- Bonterra is one of the premier dividend paying companies in the western

Canadian sedimentary basin and has increased its monthly dividend from

$0.12 to $0.26 cents over the past four years. The combination of

Spartan and Bonterra is a strategic consolidation opportunity that is

expected to benefit both sets of shareholders. Bonterra, as demonstrated

by its past track record of year-over-year growth on a per share basis,

has shown a strong ability to manage Pembina Cardium assets to provide

measured production growth while providing a sustainable dividend to its

shareholders.

-- Combined, Bonterra and Spartan will become one of the dominant light oil

producers in the Pembina area with a strong asset position of low-risk

development drilling opportunities. It is anticipated that the resulting

company will have the following characteristics:

-- a combined, sustainable, high-netback, production profile;

-- current production of 12,700 BOE/D (approximately 75% liquids

weighting) with Bonterra currently producing approximately 8,200

BOE/D and Spartan currently producing approximately 4,500 BOE/D;

-- post-flush production levels are anticipated to be approximately

11,500 BOE/D;

-- high working interest properties with company-owned infrastructure;

-- a strong balance sheet with an expected Debt / 2013 Cash Flow of

approximately 1.1x; and

-- a scalable, high quality, multi-year drilling inventory in excess of

10 years (assuming 4 wells per section), in the heart of the Pembina

area.

-- The Bonterra Arrangement is anticipated to be accretive to Bonterra

Shareholders on key financial and operational metrics.

-- It is anticipated that the Spartan Shareholders, through their

approximately 35% ownership in Bonterra following the Bonterra

Arrangement, will continue to realize further value creation through a

measured production growth profile and a growth-oriented dividend

policy.

Financial Advisory

AltaCorp Capital Inc. is acting as financial advisor to Bonterra in connection

with the Bonterra Arrangement. TD Securities Inc. is acting as financial advisor

to Spartan in connection with the Bonterra Arrangement. GMP Securities L.P. and

Clarus Securities Inc. acted as strategic advisors to Spartan.

Further Information

Bonterra is a conventional oil and gas corporation with operations in Alberta,

Saskatchewan and British Columbia.

Spartan is engaged in the business of acquiring crude oil and natural gas

properties and exploring for, developing and producing oil and natural gas in

western Canada. Spartan is uniquely positioned with a significant position in

two of the leading oil resource plays in western Canada, being the Cardium light

oil play in central Alberta and the Bakken light oil resource play in southeast

Saskatchewan.

Further information about Bonterra or Spartan may be found in their continuous

disclosure documents filed with Canadian securities regulators at www.sedar.com.

Cautionary Statements

The term barrels of oil equivalent ("BOE") may be misleading, particularly if

used in isolation. A BOE conversion ratio of six thousand cubic feet per barrel

(6mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All BOE conversions in the

report are derived from converting gas to oil in the ratio mix of six thousand

cubic feet of gas to one barrel of oil.

Certain information included in this press release constitutes forward-looking

information under applicable securities legislation. Forward-looking information

typically contains statements with words such as "anticipate", "believe",

"expect", "plan", "intend", "estimate", "propose", "project" or similar words

suggesting future outcomes or statements regarding an outlook. Forward-looking

information in this press release may include, but is not limited to, timing for

completion of the transaction with Bonterra and the timing and amount of future

dividend payments by Bonterra. Forward-looking information is based on a number

of factors and assumptions which have been used to develop such information but

which may prove to be incorrect. Although Bonterra and Spartan believe that the

expectations reflected in its forward-looking information are reasonable, undue

reliance should not be placed on forward-looking information because Bonterra

and Spartan can give no assurance that such expectations will prove to be

correct. In addition to other factors and assumptions which may be identified in

this press release, assumptions have been made regarding and are implicit in,

among other things, the timely receipt of any required regulatory approvals

(including Court and shareholder approvals). Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions which have been

used.

Forward-looking information is based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Spartan and

described in the forward-looking information. The forward-looking information

contained in this press release is made as of the date hereof and Bonterra and

Spartan undertake no obligation to update publicly or revise any forward-looking

information, whether as a result of new information, future events or otherwise,

unless required by applicable securities laws. The forward looking information

contained in this press release is expressly qualified by this cautionary

statement.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy securities in the United States, nor shall there be any sale of

the securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful. The Bonterra Shares to be offered have not been, and will not

be, registered under the U.S. Securities Act of 1933, as amended and may not be

offered or sold in the United States or to a U.S. person absent registration or

an applicable exemption from the registration requirements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO

(403) 262-5307

Bonterra Energy Corp.

Robb D. Thompson

CFO

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

Spartan Oil Corp.

Richard F. McHardy

President & CEO

(403) 457-4006

Spartan Oil Corp.

Michelle A. Wiggins

Vice President Finance & CFO

(403) 457-4006

(403) 457-4028 (FAX)

info@spartanoil.ca

www.spartanoil.ca

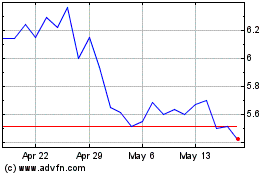

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2024 to Aug 2024

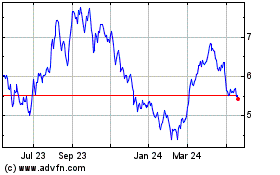

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Aug 2023 to Aug 2024