Bonterra Energy Corp. Announces Offer for Spartan Oil Corp.

December 11 2012 - 7:47AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Bonterra Energy Corp.("Bonterra") (TSX:BNE), is pleased to announce that it has

made an offer (the "Offer") to Spartan Oil Corp. ("Spartan") pursuant to which

Bonterra will acquire all of the outstanding common shares of Spartan ("Spartan

Shares") in exchange for common shares of Bonterra ("Bonterra Shares") by way of

a plan of arrangement under the Business Corporations Act (Alberta) (the

"Arrangement"). The Arrangement will result in a dominant Cardium focused light

oil producer with interests in the Greater Pembina area of Alberta.

While negotiations are ongoing, a binding agreement has not yet been signed.

Therefore there can be no assurance that any transaction will result from these

discussions, or as to the timing, structure or terms of any transaction.

The merger of Bonterra's and Spartan's asset bases is of strong strategic value

for both of their respective shareholders as the resulting company will have one

of the premier light-oil assets concentrated in the Pembina region, which will

be comprised of a complimentary production base and a long-term inventory of

drilling opportunities that is anticipated to drive future growth. The merger of

Spartan and Bonterra is a unique opportunity for Spartan shareholders to

participate, through their approximately 35% ownership, in an established

dividend paying company that has demonstrable history of per share production

and dividend growth through a variety of commodity cycles. The merger is

anticipated to be accretive for Bonterra on a financial and operating basis and

Bonterra expects to continue to demonstrate production per share growth and cash

flow per share growth while maintaining a strong balance sheet.

Transaction Summary

-- Pursuant to the Offer, Spartan shareholders will receive consideration

of 0.1169 Bonterra Shares for each Spartan Share held (the "Exchange

Ratio"). Based on Bonterra's 30-day average closing price of $43.05, the

implied price per Spartan Share is $5.03.

-- As a part of the Arrangement, Bonterra has committed, subject to the

execution of the definitive agreement and completion of the Arrangement,

to increase its monthly dividend to $0.28 from $0.26 beginning March

2013. Subject to the transaction closing prior to February 15, 2013,

Spartan shareholders will also receive a $0.26 per Bonterra share

dividend on February 28, 2013. If Bonterra sustains its current

effective yield of 7.2% following the dividend increase, Spartan

shareholders can potentially realize an incremental $0.43 of value per

Spartan Share. This amount, combined with the above share consideration,

represents a 28% premium over the implied value of Spartan's share price

of $4.27 (as calculated by using the previous bidder's closing price as

at December 7, 2012 and the previous bidder's proposed exchange ratio).

-- Based on the Exchange Ratio, it is currently anticipated that Bonterra

will issue approximately 10.7 million Bonterra Shares to the holders of

Spartan Shares.

Transaction Rationale

-- Bonterra is one of the premier dividend paying companies in the western

Canadian sedimentary basin and has increased its monthly dividend from

12 cents to 26 cents over the past four years. The combination of

Spartan and Bonterra is a strategic consolidation opportunity that is

expected to benefit both sets of shareholders. Bonterra, as demonstrated

by its past track record of year-over-year growth on a per share basis,

has shown a strong ability to manage Pembina Cardium assets to provide

measured production growth while providing a sustainable dividend to its

shareholders.

-- Combined, Bonterra and Spartan would become one of the dominant light

oil producers in the Pembina area with a strong asset position of low-

risk development drilling opportunities. It is anticipated that the

resulting company will have the following characteristics:

-- A combined, sustainable, high-netback, production profile of

approximately 11,500 BOE/D (approximately 75% liquids weighting),

post declines from flush production (with Bonterra initially

producing approximately 8,200 BOE/D and Spartan initially producing

approximately 4,500 BOE/D)

-- A strong balance sheet with an expected Debt / 2013 Cash Flow of

approximately less than 1.1x

-- A scalable, high quality, multi-year drilling inventory in excess of

10 years (assuming 4 wells per section), in the heart of the Pembina

area

-- It is anticipated that the Spartan shareholders, through their

approximately 35% ownership in Bonterra post-Arrangement, will continue

to realize further value creation through a measured production growth

profile and a growth-oriented dividend policy.

Financial Advisory

AltaCorp Capital Inc. is acting as financial advisor to Bonterra in connection

with the Offer.

CAUTIONARY STATEMENTS

The term barrels of oil equivalent ("BOE") may be misleading, particularly if

used in isolation. A BOE conversion ratio of six thousand cubic feet per barrel

(6mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All BOE conversions in the

report are derived from converting gas to oil in the ratio mix of six thousand

cubic feet of gas to one barrel of oil.

FORWARD-LOOKING STATEMENTS

This press release contains certain statements or disclosures relating to

Bonterra that are based on the expectations of Bonterra as well as assumptions

made by and information currently available to Bonterra which may constitute

forward-looking information under applicable securities laws. All such

statements and disclosures, other than those of historical fact, which address

activities, events, outcomes, results or developments that Bonterra anticipates

or expects may, or will occur in the future (in whole or in part) should be

considered forward-looking information. In some cases, forward-looking

information can be identified by terms such as "forecast", "future", "may",

"will", "expect", "anticipate", "believe", "potential", "enable", "plan",

"continue", "contemplate", "pro-forma", or other comparable terminology. In

particular, this press release contains statements regarding the possible

acquisition by Bonterra of all of the outstanding shares of Spartan, the

indicative price of the Offer, the structure of the Arrangement, the anticipated

benefits of the Arrangement, transaction rationale and information regarding the

resulting company upon completion of the Arrangement. The foregoing statements

assume a definitive agreement will be reached between Bonterra and Spartan and

other required regulatory and shareholder approvals will be received, that there

will be no changes to the assets and liabilities of the combined entity

following the proposed Arrangement and that the anticipated benefits of and

rationale for the Arrangement will be achieved. There is no assurance that all

of the conditions to the transaction will be met and therefore there is a risk

that the transaction will not be completed in the form described above or at

all. Further, there is no assurance that the combined entity will achieve the

results set forth in this release or that the benefits of the Arrangement will

be realized. As such, many factors could cause the performance or achievement of

Bonterra to be materially different from any future results, performance or

achievements that may be expressed or implied by such forward-looking

statements. Because of the risks, uncertainties and assumptions contained

herein, readers should not place undue reliance on these forward-looking

statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb D. Thompson

CFO

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

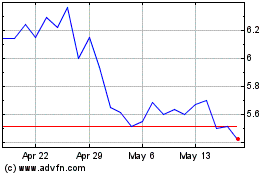

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

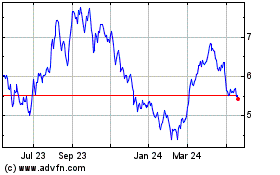

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024