Standard & Poor's Initiates Factual Stock Report Coverage on Alexis Minerals Corporation

March 04 2010 - 9:00AM

Business Wire

Standard & Poor’s announced today that it has commenced

Factual Stock Report coverage on Alexis Minerals Corporation.

Alexis Minerals Corporation (TSE: AMC, OTCQX: AXSMF), is a

Canadian mining company engaged in the exploration, development and

acquisition of mineral properties, directly and indirectly through

joint ventures. The company owns one producing gold mine in

Val-d'Or and the right to earn a 100% interest in the Lac Pelletier

gold property in Rouyn-Noranda. Val-d’Or and Rouyn-Noranda are both

located in the Abitibi Mining District of Quebec, Canada. The

company’s third property is located in Snow Lake, Manitoba. These

locations are recognized as some of the world’s most prolific

mining regions.

The company currently has 1,345,122 ounces of gold Resources

(Measured, Indicated and Inferred). Proven and Probable Reserves

total 264,128 ounces of gold.

Alexis undertakes exploration in two mining camps in Quebec,

Val-d'Or (100% ownership of 212 square kilometers) and

Rouyn-Noranda (50% ownership of 785 square kilometers and in joint

venture with Xstrata Copper). In addition, the recent acquisition

of Garson Gold Corp. has given Alexis a third project area located

in the very prospective Snow Lake Mining Camp in Manitoba.

On January 22, 2010, Alexis Minerals announced that its bid to

acquire Garson Gold Corp. has now resulted in over 95% of Garson

shares being tendered to the offer. Alexis Minerals intends to

initiate the required actions that will result in Alexis owning

100% of the Garson Gold common shares. Alexis will complete a

feasibility study of the Snow Lake Mine (formerly the New Britannia

Mine) in 2010 as well as exploration across the properties.

During the third quarter, Alexis announced a 156% increase in

proven and probable reserves for its Lac Herbin gold mine in

Val-d'Or, Quebec, as confirmed in an independent NI 43-101

technical report. Total proven and probable reserves have been

evaluated at 617,374 tonnes at 7.36 g/t for a total of 146,007

ounces of gold. This result validated the minimum five-year mine

life and the associated positive cash flow for the Lac Herbin

Mine.

Additionally, Alexis has a second gold project underway with a

bulk sample program at Lac Pelletier, in Rouyn-Noranda, Quebec.

Proven and probable reserves there are estimated at 483,362t @7.60

g/t for 118,100 ounces of gold.

This report will also be accessible on an ongoing basis to the

investment community by scores of buy-side institutions and

sell-side firms that utilize S&P research and information

platforms daily. Millions of self-directed investors also have

access to the report via their e-brokerage accounts. Please visit

www.alexisminerals.com for additional information.

About Standard & Poor's Factual Stock Reports

This Standard & Poor’s service provides factual research

coverage enabling information about Alexis Minerals Corporation and

other securities to reach a wide investor audience of Buy and

Sell-side investors, helping them understand a company’s

fundamentals and business prospects. Currently profiling over 500

issuers, S&P Factual Stock Reports increase market awareness

for issuers in the investment community with insightful commentary

and key statistics/information. Updated weekly with the latest

pricing, trading volume, and other data, the reports include recent

developments, a financial review, key operating information,

Industry and peer comparisons, institutional holdings analysis,

Street Consensus and opinions, performance charts, business

summary, fundamental data, and news. Because coverage of these

reports is sponsored by the issuer, S&P does not offer

investment opinions concerning the advisability of investing in

these stocks.

Standard & Poor’s Factual Stock Reports are produced

separately from any other analytic activity of Standard &

Poor’s. Standard & Poor’s Factual Report research has no access

to non-public information received by other units of Standard &

Poor’s. Standard & Poor’s does not trade on its own

account.

Note: All U.S. and Canadian Companies listed on a National

Exchange (not covered by S&P’s STARS research) are eligible to

obtain this coverage.

About Standard & Poor's

Standard & Poor's, a division of The McGraw-Hill Companies

(NYSE: MHP), is the world's foremost provider of financial market

intelligence, including independent credit ratings, indices, risk

evaluation, investment research and data. With approximately 10,000

employees, including wholly owned affiliates, located in 23

countries, Standard & Poor's is an essential part of the

world's financial infrastructure and has played a leading role for

more than 140 years in providing investors with the independent

benchmarks they need to feel more confident about their investment

and financial decisions. For more information, visit

http://www.standardandpoors.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6201991&lang=en

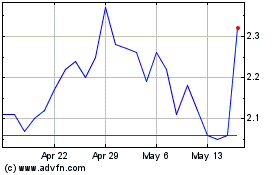

Arizona Metals (TSX:AMC)

Historical Stock Chart

From Jul 2024 to Aug 2024

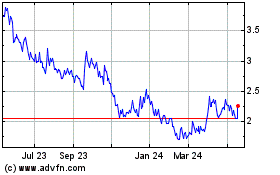

Arizona Metals (TSX:AMC)

Historical Stock Chart

From Aug 2023 to Aug 2024