Andrew Peller Limited (TSX:ADW.A)(TSX:ADW.B) (the "Company") announced today

continuing strong results for the three and nine months ended December 31, 2010.

THIRD QUARTER HIGHLIGHTS:

- Sales up 4.2% on solid performance through majority of trade channels

- Stronger Canadian dollar and benefits from cost containment initiatives

results in improved profitability

- Gross profit margin improves to 38.3% of sales from 35.3% last year

- EBITA up 20.5% to $10.3 million

- Cash flow from operating activities increases to $10.8 million for the

nine month period

- Working capital rises to $36.6 million from $30.0 million at March 31,

2010

Sales for the third quarter of fiscal 2011 rose 4.2% to $75.0 million from $71.9

million in the prior year period. For the first nine months of fiscal 2011 sales

were $208.5 million, up from $203.9 million in fiscal 2010. Ongoing initiatives

to grow sales of the Company's blended varietal table and premium wines through

provincial liquor boards, the introduction of new products and improved

performance at the Company's estate wineries were partially offset by additional

taxation levied by the Province of Ontario on sales of cellared in Canada wine

sold through the Company's retail stores and lower than anticipated sales of

personal winemaking products.

Gross profit as a percentage of sales improved to 38.3% for the three months

ended December 31, 2010 from 35.3% in the same period last year. For the first

nine months of fiscal 2011 gross profit was 39.1% compared to 36.3% for the same

period in the prior fiscal year. The increases in gross profit in fiscal 2011

were due to the lower cost to the Company of purchasing United States dollars

and Euros and the Company's successful cost control initiatives which served to

reduce operating and packaging expenses. Management remains focused on efforts

to enhance production efficiency and productivity to further improve overall

profitability.

"The third quarter of our fiscal year is typically our strongest period, and we

were pleased to have generated such solid sales growth through this year's

holiday season," commented John Peller, President and CEO. "Our premium and

ultra-premium wines are achieving strong sales momentum through all trade

channels, while recently introduced new products are augmenting our overall

revenue increases. Looking ahead, we anticipate continued growth in both revenue

and profitability as consumer confidence increases, the markets for Canadian

wines remain strong, and through our successful initiatives to contain our

costs."

Selling and administrative expenses rose in the third quarter of fiscal 2011,

and as a percentage of sales were 24.6% compared to 23.5% in the same quarter

last year. For the nine months ended December 31, 2010 selling and

administrative expenses were 25.7% as a percentage of sales compared to 24.9%

for the same period last year. The increase in expenses is primarily the result

of higher sales and marketing investments in the current fiscal year compared

with the prior year.

Interest expense through the first nine months of fiscal 2011 declined compared

to last year due primarily to the reduction in debt from the proceeds of sale of

the Company's beer business, proceeds from the sale of certain non-core

vineyards during the first quarter of fiscal 2011 and lower interest rates on

short and long-term debt.

The Company incurred non-cash gains for the three months ended December 31, 2010

of $0.3 million compared to $1.1 million in the same period last year. The

non-cash gains related to mark-to-market adjustments on an interest rate swap

and foreign exchange contracts. For the first nine months of fiscal 2011 the

Company incurred a loss of $0.2 million compared to a gain of $2.4 million in

the prior year period. Under CICA accounting standards, these financial

instruments must be reflected in the Company's financial statements at fair

value each reporting period. These instruments are considered to be effective

economic hedges and have enabled management to mitigate the volatility of

changing costs and interest rates during the year.

Other expenses incurred in the first nine months of fiscal 2011 relate to

one-time costs on a net write-down of a BC vineyard where vines were damaged by

an early and severe frost in the fall of 2009, and in maintaining the Company's

Port Moody facility which was closed effective December 31, 2005. These costs

were partially offset by other income of $0.3 million related to the gain on the

sale of the Okanagan vineyard in the first quarter of fiscal 2011.

Net and comprehensive earnings from continuing operations, excluding the gains

on derivative financial instruments and other expenses for the three and nine

months ended December 31, 2010, were $4.7 million and $11.6 million,

respectively, compared to $3.7 million and $7.8 million, respectively, for the

comparable prior year periods. During the third quarter of fiscal 2010 the

Company sold its beer business and accounted for the sold business as a

discontinued operation, recording on after-tax gain on the sale of approximately

$11.9 million. Net and comprehensive earnings from continuing operations were

$4.9 million ($0.33 per Class A Share) and $10.7 million ($0.73 per Class A

Share) for the three and nine months ended December 31, 2010, respectively,

compared to $3.6 million ($0.25 per Class A Share) and $8.7 million ($0.60 per

Class A Share) for the same comparable periods in fiscal 2010.

Strengthened Financial Position

Working capital was $36.6 million as at December 31, 2010 compared to $30.0

million at March 31, 2010 and $31.0 million at December 31, 2009. As at December

31, 2010, total bank indebtedness and long-term debt decreased compared to March

31, 2010 and December 31, 2009 due primarily to increased cash flow from

operating activities due to higher net earnings partially offset by higher

levels of working capital. On May 25, 2010 the Company sold approximately six

acres of vineyard in the Okanagan Valley. The proceeds of approximately $0.8

million were also used to reduce bank indebtedness.

With the decrease in bank debt, the Company's debt to equity ratio decreased to

0.83:1 compared to 0.90:1 at the end of fiscal 2010 and 0.97:1 at the end of the

prior year's third quarter. Shareholders' equity at December 31, 2010 rose to

$120.7 million or $8.11 per common share compared to $113.7 million or $7.63 per

common share at March 31, 2010 and $114.2 million or $7.67 per common share at

December 31, 2009. The increase in shareholders' equity is due primarily to

higher net earnings from continuing operations for the period.

Prestigious Awards

The Company also announced today that its Andrew Peller Signature Series

Cabernet Sauvignon 2007 had been awarded the Warren Winiarski Trophy for Best

Red Wine at the 2010 International Wine and Spirits Competition (IWSC) in

London, England. The IWSC, now in its 41st year, is the oldest, largest and one

of the best-supported international wine tasting competitions in the world.

Wines from over 80 countries were blind tasted by experienced judging panels and

all underwent rigorous chemical and microbiological analysis.

In addition, the Company announced that Frank Dodd, Chef at the Company's

Hillebrand Estate Winery Restaurant, had been awarded the honour of Ontario's

Gold Medal Plate Champion for 2010. He competed against the best chefs from

restaurants across the province. Chef Dodd will now represent Hillebrand at the

Canadian Culinary Championships to be held in Kelowna B.C. in February 2011.

"We are very proud to have been awarded these prestigious honours, a true

reflection of our passion to provide our estate winery guests and wine

connoisseurs with the highest standards of quality and excellence," Mr. Peller

concluded.

Financial Highlights (Unaudited)

(Complete consolidated financial statements to follow)

----------------------------------------------------------------------------

(in $000 except as otherwise stated) Three Months Nine Months

----------------------------------------------------------------------------

For the Period Ended December 31, 2010 2009 2010 2009

----------------------------------------------------------------------------

Sales 74,983 71,945 208,480 203,856

Gross profit 28,690 25,430 81,497 74,043

---------------------------------------

Gross profit (% of sales) 38.3% 35.3% 39.1% 36.3%

---------------------------------------

Selling general and administrative

expenses 18,412 16,903 53,507 50,818

Earnings before interest, taxes,

amortization, unrealized loss (gain)

and other expenses 10,278 8,527 27,990 23,225

Unrealized loss (gain) on derivative

financial instruments (342) (1,103) 174 (2,443)

Other expenses 38 1,247 1,076 1,247

Net and comprehensive earnings from

continuing operations 4,908 3,588 10,650 8,688

Net and comprehensive earnings from a

discontinued operation - 11,940 - 12,335

---------------------------------------

Net and comprehensive earnings 4,908 15,528 10,650 21,023

---------------------------------------

Earnings per share from continuing

operations - Class A $0.33 $0.25 $0.73 $0.60

Earnings per share - basic and

diluted - Class A $0.33 $1.07 $0.73 $1.45

Dividend per share - Class A (annual) $ 0.330 $ 0.330 $ 0.330 $ 0.330

Dividend per share - Class B (annual) $ 0.288 $ 0.288 $ 0.288 $ 0.288

---------------------------------------

Cash provided by operations (after

changes in non-cash working capital

items) (5,337) (1,218) 10,838 7,204

---------------------------------------

Working capital 36,560 31,033

Shareholders' equity per share $8.11 $7.67

----------------------------------------------------------------------------

Andrew Peller Limited ('APL' or the 'Company') is a leading producer and

marketer of quality wines in Canada. With wineries in British Columbia, Ontario

and Nova Scotia, the Company markets wines produced from grapes grown in

Ontario's Niagara Peninsula, British Columbia's Okanagan and Similkameen Valleys

and from vineyards around the world. The Company's award-winning premium and

ultra-premium VQA brands include Peller Estates, Trius, Hillebrand, Thirty

Bench, Sandhill, Calona Vineyards Artist Series and Red Rooster. Complementing

these premium brands are a number of popularly priced varietal wine brands

including Peller Estates French Cross in the East, Peller Estates Proprietors

Reserve in the West, Copper Moon, XOXO and Croc Crossing. Hochtaler, Domaine

D'Or, Schloss Laderheim, Royal and Sommet are our key value priced wine blends.

The Company imports wines from major wine regions around the world to blend with

domestic wine to craft these popularly priced and value priced wine brands. With

a focus on serving the needs of all wine consumers, the Company produces and

markets premium personal winemaking products through its wholly-owned

subsidiary, Global Vintners Inc., the recognized world leader in personal

winemaking products. Global Vintners distributes products through over 250

Winexpert and Wine Kitz authorized retailers and franchisees and more than 600

independent retailers across Canada, United States, United Kingdom, New Zealand

and Australia. Global Vintners award-winning premium and ultra-premium

winemaking brands include Selection, Vintners Reserve, Island Mist, Kenridge,

Cheeky Monkey, Ultimate Estate Reserve, Traditional Vintage and Artful

Winemaker. The Company owns and operates more than 100 well-positioned

independent retail locations in Ontario under the Vineyards Estate Wines, Aisle

43 and WineCountry Vintners store names. The Company also owns Grady Wine

Marketing Inc. based in Vancouver, and The Small Winemaker's Collection Inc.

based in Ontario; both of these wine agencies are importers of premium wines

from around the world and are marketing agents for these fine wines. The

Company's products are sold predominantly in Canada with a focus on export sales

for our icewine products.

Net earnings from continuing operations before other expenses is defined as net

earnings before the net unrealized gain on financial instruments, other expenses

and net earnings from a discontinued operation, all adjusted by income tax rates

as calculated below:

(in $000) Three Months Nine Months

----------------------------------------------------------------------------

Period ended December 31, 2010 2009 2010 2009

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net and comprehensive earnings

(loss) 4,908 15,528 10,650 21,023

----------------------------------------------------------------------------

Unrealized (gain) loss on financial

instruments (342) (1,103) 174 (2,443)

----------------------------------------------------------------------------

Other expenses 38 1,247 1,076 1,247

----------------------------------------------------------------------------

Income tax effect on the above 79 (37) (288) 352

----------------------------------------------------------------------------

Net income from a discontinued

operation - (11,940) - (12,335)

----------------------------------------------------------------------------

Net earnings from continuing

operations before other expenses 4,683 3,695 11,612 7,844

----------------------------------------------------------------------------

The Company utilizes EBITA (defined as earnings before interest, amortization,

unrealized derivative (gain) loss, other expenses, income taxes and net earnings

from a discontinued operation). EBITA is not a recognized measure under GAAP.

Management believes that EBITA is a useful supplemental measure to net earnings,

as it provides readers with an indication of cash available for investment prior

to debt service, capital expenditures and income taxes. Readers are cautioned

that EBITA should not be construed as an alternative to net earnings determined

in accordance with GAAP as an indicator of the Company's performance or to cash

flows from operating, investing and financing activities as a measure of

liquidity and cash flows. In addition, the Company's method of calculating EBITA

may differ from the methods used by other companies and, accordingly, may not be

comparable to measures used by other companies.

Andrew Peller Limited common shares trade on the Toronto Stock Exchange (symbols

ADW.A and ADW.B).

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain "forward-looking statements"

within the meaning of applicable securities laws, including the "safe harbour

provision" of the Securities Act (Ontario) with respect to Andrew Peller Limited

( the "Company") and its subsidiaries. Such statements include, but are not

limited to, statements about the growth of the business in light of the

Company's recent acquisitions; its launch of new premium wines; sales trends in

foreign markets; its supply of domestically grown grapes; and current economic

conditions. These statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially from those

included in the forward-looking statements. The words "believe", "plan",

"intend", "estimate", "expect" or "anticipate" and similar expressions, as well

as future or conditional verbs such as "will", "should", "would" and "could"

often identify forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and financial

performance. With respect to forward-looking statements contained in this news

release, the Company has made assumptions and applied certain factors regarding,

among other things: future grape, glass bottle and wine prices; its ability to

obtain grapes, imported wine, glass and its ability to obtain other raw

materials; fluctuations in the U.S./Canadian dollar exchange rates; its ability

to market products successfully to its anticipated customers; the trade balance

within the domestic Canadian wine market; market trends; reliance on key

personnel; protection of its intellectual property rights; the economic

environment; the regulatory requirements regarding producing, marketing,

advertising and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing competition.

These forward-looking statements are also subject to the risks and uncertainties

discussed in this news release, in the "Risk Factors" section and elsewhere in

the Company's MD&A and other risks detailed from time to time in the publicly

filed disclosure documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of future

performance and involve risks, uncertainties and assumptions which could cause

actual results to differ materially from those conclusions, forecasts or

projections anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue reliance on

these forward-looking statements. The Company's forward-looking statements are

made only as of the date of this news release, and except as required by

applicable law, the Company undertakes no obligation to update or revise these

forward-looking statements to reflect new information, future events or

circumstances or otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS

These financial statements have not been reviewed by our auditors

(in thousands of dollars) December 31 March 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2010 2010

$ $

----------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 28,776 22,902

Inventories 91,649 89,693

Prepaid expenses and other assets 2,513 2,429

Income taxes recoverable - 1,327

--------------------------

122,938 116,351

Property, plant and equipment 92,651 95,728

Intangibles and other assets 13,679 14,164

Goodwill 37,473 37,473

--------------------------

266,741 263,716

--------------------------

--------------------------

Liabilities

Current Liabilities

Bank indebtedness (Note 6) 50,358 48,877

Accounts payable and accrued liabilities 27,177 28,229

Dividends payable 1,197 1,197

Income taxes payable 738 -

Current derivative financial instruments 1,575 1,922

Current portion of long-term debt (Note 6) 5,333 6,158

--------------------------

86,378 86,383

Long-term debt (Note 6) 44,037 47,633

Long-term derivative financial instruments 2,189 1,667

Employee future benefits 3,992 4,530

Future income taxes 9,421 9,838

--------------------------

146,017 150,051

--------------------------

Shareholders' Equity

Capital Stock 7,375 7,375

Retained Earnings 113,349 106,290

--------------------------

120,724 113,665

--------------------------

266,741 263,716

--------------------------

--------------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

Consolidated Statements of Earnings,

Comprehensive Earnings and Retained

Earnings

These financial statements have not been

reviewed by our auditors

(in thousands of dollars, except per For the Three For the Nine

share amounts) Months Ended Months Ended

December 31 December 31

2010 2009 2010 2009

$ $ $ $

--------------------------------------------------------- -----------------

Sales 74,983 71,945 208,480 203,856

Cost of goods sold, excluding

amortization 46,293 46,515 126,983 129,813

-------- -------- -------- --------

Gross profit 28,690 25,430 81,497 74,043

Selling and administration 18,412 16,903 53,507 50,818

-------- -------- -------- --------

Earnings before interest and

amortization 10,278 8,527 27,990 23,225

Interest 1,605 1,401 5,432 5,947

Amortization of plant, equipment and

intangible assets 2,050 2,164 6,104 6,174

-------- -------- -------- --------

Earnings before other items 6,623 4,962 16,454 11,104

Net unrealized losses (gains) on

derivative financial instruments (342) (1,103) 174 (2,443)

Other expenses (Note 4) 38 1,247 1,076 1,247

-------- -------- -------- --------

Earnings before income taxes 6,927 4,818 15,204 12,300

-------- -------- -------- --------

Provision for (recovery of) income taxes

Current 1,887 1,492 4,971 3,331

Future 132 (262) (417) 281

-------- -------- -------- --------

2,019 1,230 4,554 3,612

-------- -------- -------- --------

Net and comprehensive earnings for the

period from continuing operations 4,908 3,588 10,650 8,688

Net and comprehensive earnings for the

period from a discontinued operation - 11,940 - 12,335

-------- -------- -------- --------

Net and comprehensive earnings for the

period 4,908 15,528 10,650 21,023

Retained earnings- Beginning of period 109,638 92,517 106,290 89,416

Dividends:

Class A and Class B (1,197) (1,197) (3,591) (3,591)

-------- -------- -------- --------

Retained earnings - End of period 113,349 106,848 113,349 106,848

-------- -------- -------- --------

-------- -------- -------- --------

Net earnings per share from continuing

operations

Basic and diluted

Class A shares 0.33 0.25 0.73 0.60

-------- -------- -------- --------

-------- -------- -------- --------

Class B shares 0.30 0.21 0.64 0.52

-------- -------- -------- --------

-------- -------- -------- --------

Net earnings per share from discontinued

operation

Basic and diluted

Class A shares 0.00 0.82 0.00 0.85

-------- -------- -------- --------

-------- -------- -------- --------

Class B shares 0.00 0.72 0.00 0.74

-------- -------- -------- --------

-------- -------- -------- --------

Net earnings per share

Basic and diluted

Class A shares 0.33 1.07 0.73 1.45

-------- -------- -------- --------

-------- -------- -------- --------

Class B shares 0.30 0.93 0.64 1.26

-------- -------- -------- --------

-------- -------- -------- --------

ANDREW PELLER LIMITED

Consolidated Statements of Cash Flows

These financial statements have not been For the Three For the Nine

reviewed by our auditors Months Ended Months Ended

(in thousands of dollars) December 31 December 31

2010 2009 2010 2009

$ $ $ $

--------------------------------------------------------- -----------------

Cash provided by (used in)

Operating activities

Net earnings for the period 4,908 3,588 10,650 8,688

Items not affecting cash:

Loss on disposal of property and

equipment - - 678 -

Amortization of plant, equipment and

intangibles 2,050 2,164 6,104 6,174

Employee future benefits (304) (113) (538) (566)

Net unrealized (gains) losses on

derivative financial instruments (342) (1,103) 174 (2,443)

Non cash impairment charge - 1,247 - 1,247

Future income tax provision (recovery) 132 (262) (417) 281

Amortization of deferred financing

costs 34 53 404 77

-------- -------- -------- --------

6,478 5,574 17,055 13,458

Changes in non-cash working capital

items related to operations (Note 5): (11,815) (6,792) (6,217) (6,254)

-------- -------- -------- --------

(5,337) (1,218) 10,838 7,204

-------- -------- -------- --------

Investing activities

Acquisition of businesses - - (825) (825)

Proceeds from disposal of property and

equipment - - 766 -

Purchase of property, plant and

equipment (1,759) (1,477) (4,669) (4,434)

-------- -------- -------- --------

(1,759) (1,477) (4,728) (5,259)

-------- -------- -------- --------

Financing activities

Increase in deferred financing costs - (911) - (911)

Increase in bank indebtedness 9,627 3,202 1,481 4,411

Payment to partially unwind a derivative

financial instrument - (1,600) - (1,600)

Repayment of long-term debt (1,334) (18,751) (4,000) (21,417)

Dividends paid (1,197) (1,197) (3,591) (3,591)

-------- -------- -------- --------

7,096 (19,257) (6,110) (23,108)

-------- -------- -------- --------

Cash used in continuing operations - (21,952) - (21,163)

Cash provided from discontinued

operation - 21,952 - 21,163

-------- -------- -------- --------

Cash at beginning and end of period - - - -

-------- -------- -------- --------

-------- -------- -------- --------

Supplemental disclosure of cash flow

information

Cash paid (received) during the period

from continuing operations for

Interest 1,581 1,537 5,426 6,072

Income taxes 826 (2,707) 2,905 (3,519)

Cash paid during the period from

discontinued operation for

Income taxes - 34 - 757

Cash paid (received) during the period

for

Interest 1,581 1,537 5,426 6,072

Income taxes 826 (2,673) 2,905 (2,762)

The accompanying notes are an integral part of these interim consolidated

financial statements

Notes to the Interim Consolidated Financial Statements

December 31, 2010 and 2009

(in thousands of dollars)

UNAUDITED

1. Summary of Significant Accounting Policies

The interim consolidated financial statements have been prepared in accordance

with accounting principles generally accepted in Canada. The note disclosure for

these interim consolidated financial statements only presents material changes

to the disclosure found in the Company's audited consolidated financial

statements for the years ended March 31, 2010 and 2009. These interim

consolidated financial statements should be read in conjunction with those

consolidated financial statements and follow the same accounting policies as the

audited consolidated financial statements. In the opinion of management, the

accompanying unaudited interim consolidated financial statements contain all

adjustments necessary to present fairly, in all material respects the financial

position of the Company as at December 31, 2010 and for the three and nine-month

periods then ended.

2. Seasonality

The third quarter of each year is historically the strongest in terms of sales,

gross profit and net earnings due to increased consumer purchasing of the

Company's products during the holiday season.

3. Discontinued operations

During fiscal 2010, the Company entered into an agreement to dispose of its

ownership interests in Granville Island Brewing Company Ltd. and Mainland

Beverage Distribution Ltd. (collectively referred to as "GIBCO") effective

October 1, 2009.

In connection with the sale of GIBCO, the Company continues to manufacture

product for the purchaser. In doing so, the Company incurred and was fully

reimbursed for expenses in the amount of $351 and $1,812 for the three and nine

months ended December 31, 2010.

Other financial information relating to the discontinued operation is as follows:

Condensed statement of net earnings from discontinued operation

For the three For the nine

months ended months ended

December 31 December 31

2009 2009

$ $

----------------------------------------------------------------------------

Sales - 10,509

Cost of goods sold - 5,452

----------------------------

Gross profit - 5,057

Selling and administration 30 4,293

Amortization - 213

Gain on sale of discontinued operation (13,337) (13,337)

----------------------------

Earnings before income taxes 13,307 13,888

Provision for income taxes 1,367 1,553

----------------------------

Net earnings from discontinued operation 11,940 12,335

----------------------------

----------------------------

Included in cost of goods sold is $nil and $2,015 for the three and nine months

ended December 31, 2009 respectively for costs relating to manufacturing

services provided by a related company.

Condensed statement of cash flows from discontinued operation

For the three For the nine

months ended months ended

December 31 December 31

2009 2009

$ $

----------------------------------------------------------------------------

Cash used in operating activities (1,335) (2,124)

Cash provided by (used in) investing activities 23,287 23,287

Cash provided by (used in) financing activities - -

----------------------------

21,952 21,163

----------------------------

----------------------------

4. Other (income) expenses

During the second quarter, it became evident that approximately 98 acres of

vines developed by the Company on leased land in Oliver, British Columbia were

irreparably damaged. The Company wrote down vineyards included in property,

plant and equipment related to this vine damage in the amount of $1,712 and

inventories in the amount of $260. The Company is insured for a portion of the

loss and has recorded an amount receivable of $694 based on an estimate of its

entitlement under the insurance policy. The pre-tax loss recorded as a result of

the damaged vines is $1,278.

Also included in other (income) expenses is a gain in the amount of $340 pre-tax

related to the sale of a portion of a vineyard on May 25, 2010. The proceeds

from the sale were $766.

5. Changes in non-cash working capital items

The change in non-cash working capital items is comprised of the change in the

following items:

For the three For the three For the nine For the nine

months ended months ended months ended months ended

December 31 December 31 December 31 December 31

2010 2009 2010 2009

$ $ $ $

----------------------------------------------------------------------------

Accounts receivable (2,363) (3,787) (5,180) (5,013)

Inventories (992) (2,276) (1,956) 3,220

Prepaid expenses and

other assets 81 439 (84) (1,028)

Accounts payable and

accrued liabilities (9,602) (3,063) (1,062) (7,981)

Income taxes

payable/recoverable 1,061 1,895 2,065 4,548

--------------------------------------------------------

(11,815) (6,792) (6,217) (6,254)

--------------------------------------------------------

--------------------------------------------------------

6. Bank indebtedness and long-term debt

On August 27, 2010, the Company modified the terms of its short-term loan

facility. The modified facility matures on August 26, 2011 (previously -

November 9, 2010) and incurs interest at the Royal Bank of Canada prime rate

plus 2.00% (previously - plus 2.75%).

The Company's interest rate on its term loan is currently 5.64% and is fixed by

an interest rate swap. The Company also pays additional interest of 0.50% based

on leverage and a funding premium of 0.80%.

7. Comparative Figures

Certain of the prior year balances have been restated to conform with the

current year's presentation.

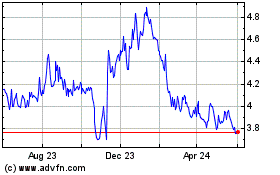

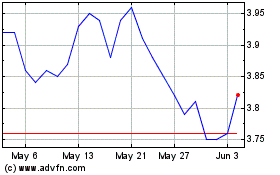

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024