International Securities Exchange and Weather Risk Solutions Announce Strategic Agreement

August 04 2009 - 7:55AM

Business Wire

The International Securities Exchange (ISE) and Weather Risk

Solutions, LLC (WRS), the developer of Hurricane Risk Landfall

Options (HuRLO™), today announced that they have entered into a

strategic agreement. ISE will receive a minority interest in WRS in

return for granting WRS the right to use ISE’s proprietary

Longitude technology.

WRS’s trading platform and ISE’s Longitude technology use

mutualized risk-sharing principles to aggregate liquidity and

produce fair and efficient market-driven prices to enable commodity

options trading in events and occurrences that do not have an

underlying cash market. WRS’s HuRLOs are commodity options that

enable individuals and businesses to hedge against financial risks

resulting from hurricane landfalls in an open, dynamic and

transparent financial market. HuRLOs are available to eligible

contract participants and are traded through WRS’s Internet-based

electronic trading platform and cleared by CME Clearing House, a

subsidiary of Chicago Mercantile Exchange, Inc.

Kenneth Horowitz, founder of WRS, said, “Our new strategic

relationship with ISE will support the next phase of WRS’s growth

and we look forward to leveraging ISE’s innovative Longitude

technology. We are very pleased that ISE has recognized the

potential of our unique offering which provides a simple way for

market participants to hedge against or speculate on the risk that

a hurricane will first make landfall on a selected county or region

on the U.S. Atlantic and Gulf coasts.”

Thomas Ascher, ISE’s Chief Strategy Officer, said, “ISE is

excited to partner with WRS and to gain a minority stake in such an

innovative organization. Through this agreement, we are well poised

to benefit from future growth in this untapped segment of the

commodity options market.”

About ISE

The International Securities Exchange (ISE) operates the world’s

largest equity options exchange and offers options trading on over

2,000 underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces that foster technology innovation and market

efficiency. Through minority investments, ISE participates in the

securities lending and equities markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly owned by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

About Weather Risk Solutions, LLC

Founded in 2002, Kenneth A. Horowitz, along with a group of

experts in atmospheric sciences, including former staff of the

National Hurricane Center and leading financial and economic

mathematicians, developed Hurricane Risk Landfall Options – HuRLO™

– which allow market participants to hedge against or speculate on

the financial risk that a selected coastal county or region on the

U.S. coast will be the first hit by a hurricane. HuRLOs are traded

through the WRS Electronic Trading Platform™ (www.HuRLOs.com), an

innovative Internet-based electronic trading platform that provides

pricing for individual HuRLOs, which are based on the buying

decisions of market participants. The dynamic and comprehensive

site also offers weather information from the National Hurricane

Center, the Weather Channel, AccuWeather and Weather

Underground.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6021401&lang=en

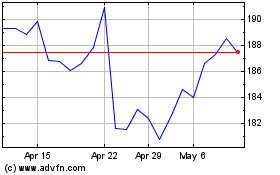

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Jun 2024 to Jul 2024

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Jul 2023 to Jul 2024