0000895419false00008954192023-12-042023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 4, 2023

WOLFSPEED, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| North Carolina | 001-40863 | 56-1572719 |

(State or other jurisdiction of

incorporation) | (Commission File

Number) | (I.R.S. Employer

Identification Number) |

| | | | | | | | |

| 4600 Silicon Drive | |

| Durham | North Carolina | 27703 |

| (Address of principal executive offices) | (Zip Code) |

(919) 407-5300

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.00125 par value | WOLF | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On December 4, 2023, Wolfspeed, Inc. (“Wolfspeed”) issued a press release announcing the completion of the sale of certain assets comprising its radio frequency product line (“Wolfspeed RF”) to MACOM Technology Solutions Holdings, Inc. (“MACOM”) pursuant to the previously reported Asset Purchase Agreement dated August 22, 2023 by and between Wolfspeed and MACOM. The press release is furnished as Exhibit 99.1 and incorporated by reference into Item 7.01 of this Current Report on Form 8-K (the “Report”).

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that Section. Furthermore, the information in Item 7.01 of this Report shall not be deemed incorporated by reference into the filings of Wolfspeed under the Securities Act of 1933, as amended.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| WOLFSPEED, INC. |

| | | |

| | | |

| By: | | /s/ Bradley D. Kohn |

| | | Bradley D. Kohn |

| | | Senior Vice President and General Counsel |

Date: December 4, 2023

WOLFSPEED COMPLETES SALE OF RF BUSINESS TO MACOM

DURHAM, N.C. December 4, 2023 -- Wolfspeed, Inc. (NYSE: WOLF) today announced it completed the sale of its radio frequency business (“Wolfspeed RF”) to MACOM Technology Solutions Holdings, Inc. (Nasdaq: MTSI) effective December 2, 2023. Under the transaction terms, Wolfspeed received approximately $75 million in cash, subject to a customary purchase price adjustment, and 711,528 shares of MACOM common stock, which shares had a market value of approximately $60.8 million based on the closing price for MACOM’s common stock on December 1, 2023 as reported on the Nasdaq Global Select Market.

“The completed sale of Wolfspeed RF is the final step in our transformation, and we’re happy to say Wolfspeed is now the only pure-play silicon carbide semiconductor manufacturer in the industry,” said Gregg Lowe, Wolfspeed president and CEO. “As demand continues to accelerate across the automotive, industrial and renewable energy markets, we can now focus on innovation and capacity for our materials and power device businesses.”

Wolfspeed continues to drive the industry transition to silicon carbide with its ongoing capacity expansion, including the final build-out of the company’s Mohawk Valley Fab in New York, and construction of the John Palmour Manufacturing Center (the JP), the world’s largest silicon carbide materials factory in Siler City, North Carolina. The state-of-the-art, multi-billion-dollar facility is targeted to generate a more than 10-fold increase from Wolfspeed’s current silicon carbide production capacity on its Durham, North Carolina campus.

About Wolfspeed, Inc.

Wolfspeed (NYSE: WOLF) leads the market in the worldwide adoption of silicon carbide technologies. We provide industry-leading solutions for efficient energy consumption and a sustainable future. Wolfspeed’s product families include silicon carbide materials and power devices targeted for various applications such as electric vehicles, fast charging, 5G, and renewable energy and storage. We unleash the power of possibilities through hard work, collaboration and a passion for innovation. Learn more at www.wolfspeed.com.

Forward Looking Statements

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause Wolfspeed’s actual results to differ materially from those indicated in the forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the anticipated benefits of the transaction, including future financial and operating results. Actual results, including with respect to Wolfspeed’s realization of the value of MACOM’s stock received in connection with the transaction during and following the lapse of trading restrictions applicable to the shares, the continued growth of Wolfspeed’s materials and power products businesses, and the completion of Wolfspeed’s ongoing and announced expansion projects could differ materially due to a number of factors, including risks associated with divestiture transactions generally; fluctuations in the market price of MACOM’s common stock, including during the period in which trading restrictions apply to the shares prior to the transfer of control of Wolfspeed’s fabrication facility in Research Triangle Park, North Carolina (the RTP fab); the risk that a portion of the shares of MACOM common stock are forfeited by Wolfspeed in the event that the transfer of the RTP fab is not completed within four years following the closing date; issues, delays or complications in completing required carve-out activities to allow Wolfspeed RF to operate as part of MACOM after the closing, including incurring unanticipated costs to complete such activities; risks

associated with integration or transition of the operations, systems and personnel of Wolfspeed RF, each, as applicable, within the term of the post-closing transition services agreement between MACOM and Wolfspeed; unfavorable reaction to the sale by customers, competitors, suppliers and employees; the risk that costs associated with the transaction will be greater than Wolfspeed expects; risks associated with Wolfspeed’s expansion plans, including design and construction delays and cost overruns, timing and amount of government incentives actually received, issues in installing and qualifying new equipment and ramping production, poor production process yields and quality control, and potential increases to Wolfspeed’s restructuring costs; the risk that Wolfspeed does not meet its production commitments to those customers who provide it with capacity reservation deposits or similar payments; the risk that Wolfspeed may experience production difficulties that preclude it from shipping sufficient quantities to meet customer orders or that result in higher production costs, lower yields and lower margins; Wolfspeed’s ability to lower costs; the risk that Wolfspeed’s results will suffer if it is unable to balance fluctuations in customer demand and capacity, including bringing on additional capacity on a timely basis to meet customer demand; the risk that longer manufacturing lead times may cause customers to fulfill their orders with a competitor's products instead; risks associated with the ramp-up of production of new products; Wolfspeed’s ability to complete development and commercialization of products under development; the rapid development of new technology and competing products that may impair demand or render Wolfspeed’s products obsolete; and other factors discussed in Wolfspeed’s filings with the Securities and Exchange Commission (SEC), including Wolfspeed report on Form 10-K for the fiscal year ended June 25, 2023, and subsequent reports filed with the SEC. These forward-looking statements represent Wolfspeed's judgment as of the date of this release. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, Wolfspeed disclaims any intent or obligation to update any forward-looking statements after the date of this release, whether as a result of new information, future events, developments, changes in assumptions or otherwise.

Wolfspeed® is a registered trademark of Wolfspeed, Inc.

Media & Investor Relations Contact:

Tyler Gronbach

VP, External Affairs

919-407-4820

media@wolfspeed.com

investorrelations@wolfspeed.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

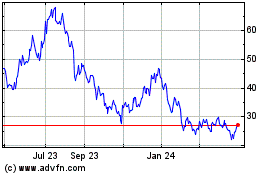

Wolfspeed (NYSE:WOLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

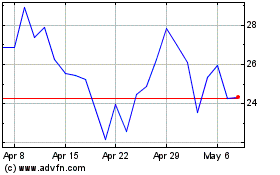

Wolfspeed (NYSE:WOLF)

Historical Stock Chart

From Jul 2023 to Jul 2024