UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

WISDOMTREE, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

ETFS CAPITAL LIMITED

GRAHAM TUCKWELL

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ETFS Capital Limited, a

Jersey company (“ETFS Capital”), together with the other participant in its proxy solicitation (collectively, “ETFS”),

has filed a definitive proxy statement and accompanying GOLD proxy card with the Securities and Exchange Commission (the “SEC”)

to be used to solicit votes AGAINST the election of certain directors of WisdomTree, Inc., a Delaware corporation (the “Company”),

at the Company’s 2024 annual meeting of stockholders.

Item 1: On May 28, 2024,

ETFS issued a Rebuttal Investor Presentation titled “Setting the Record Straight”, a copy of which is attached hereto as Exhibit

1 and incorporated herein by reference.

Item 2: On May 28, 2024,

ETFS issued the following press release:

ETFS Capital Publishes a Supplementary Presentation

Highlighting the WisdomTree Board’s Failure to Address ETFS Capital’s Claims that the Company’s Core ETF Business is

Undervalued

Stockholder Vote AGAINST Three Long-Tenured Directors

is a Referendum on the Company Running a Strategic Review Process to Maximize Stockholder Value

Visit www.UnlockWT.com to View ETFS Capital’s

Supplemental Presentation and Other Important Materials

NEW YORK, May 28, 2024 -- ETFS Capital Limited (“ETFS Capital”),

the largest combined owner of common stock, $0.01 par value (the “Common Stock”), and Series A Non-Voting Convertible Preferred

Stock (the “Series A Preferred Stock”) of WisdomTree, Inc. (“WisdomTree” or the “Company”) (NYSE:

WT), with ownership of approximately 10% of the outstanding Common Stock, which together with its Series A Preferred Stock would represent

approximately 18% of the Company’s outstanding Common Stock on an as-converted basis, today responded to WisdomTree’s May

23, 2024 investor presentation, with a supplemental presentation entitled “Setting the Record Straight”,1

which can also be viewed at www.UnlockWT.com.

Graham Tuckwell, ETFS Capital Chairman, commented:

“WisdomTree’s board of directors (the “Board”)

and management team continue to avoid addressing the central issue of ETFS Capital’s campaign –WisdomTree’s significant

discount to the value of the core ETF business according to our calculations.

Our campaign is a referendum against long-tenured directors and to demonstrate

stockholder support for a truly independent process to maximize stockholder value, by retaining a reputable bank to evaluate all options

to unlock value for stockholders. We have no agenda other than unlocking value for ALL WisdomTree stockholders.

1 https://www.unlockwt.com/campaign-materials

As the largest stockholder of WisdomTree, we have assumed the responsibility

of advocating on behalf of all stockholders, at our own expense. Over the past few years, we have engaged with the Board in good

faith and were successful in nominating and electing individuals to the Board, replacing the Company’s long-tenured former Chairman,

and pushing the Company into making much needed improvements to its approach to corporate governance.

However, WisdomTree has repeatedly found ways to contain and dilute independent

voices on the Board and defy the will of stockholders. As one example, following the Company’s 2023 Annual Meeting of Stockholders,

the Board appointed another long-tenured director, Win Neuger, as the new Chair, notwithstanding the fact that Mr. Neuger received the

most withheld votes of any incumbent director apart from former Chair Frank Salerno – who was voted off the Board by stockholders.

In addition, despite WisdomTree spending millions of dollars on DeFi initiatives,

stockholders have been given no information about critical metrics including the number of paying customers, revenue generation, asset

acquisition, or any other meaningful data points, as discussed in more detail in our prior soliciting material.

This year, we engaged privately with the Board in the hopes of ‘lowering

the temperature’ and finding a path to unlocking value at WisdomTree. The Board responded to our private proposals by issuing a

public press release and reverting to a familiar playbook – distract, deny and demonize.

It is clear to us that WisdomTree’s May 23, 2024, presentation

to stockholders was a continuation of its playbook and continued to avoid engaging with the central issue of our campaign, a flawed and

value destructive approach to capital allocation that has led to a significant undervaluation of the Company’s core-ETF business.

We invite you to review our presentation to investors and the supplemental

presentation we have published today for additional details and determine if stockholders can afford to lose another year of business-as-usual

under this Board and management team.”2

A copy of ETFS Capital’s presentations, letter to stockholders, definitive

proxy statement, and information on how to vote AGAINST the re-election of the Chairman Win Neuger, Director Anthony Bossone,

and CEO and Director Jonathan Steinberg on the GOLD proxy card or GOLD voting instruction form are available

at www.UnlockWT.com.

Stockholders who have questions or require assistance in voting their GOLD

proxy card, or need additional copies of ETFS Capital’s proxy materials, are encouraged to contact Saratoga Proxy Consulting LLC

at (888) 368-0379 or (212) 257-1311 or info@saratogaproxy.com

About ETFS Capital Limited

In November 2017, WisdomTree agreed to spend $611 million to acquire the

European ETC business of ETF Securities Limited (now called ETFS Capital Limited) for cash and shares, becoming the largest stockholder

in WisdomTree.

2 https://www.sec.gov/Archives/edgar/data/880631/000092189524001286/ex1dfan14a13246002_052124.pdf

ETFS Capital is an Australian-based holding company with a London-based

strategic investment company focused on growth opportunities across the ETF ecosystem. As part of its investment process, ETFS Capital

receives and analyses many dozens of business ideas and proposals within the ETF ecosphere each year and conducts in-depth technical and

commercial due diligence on the companies where it chooses to deploy capital. Thereafter it engages in a hands-on approach, as a partner

to management teams and Boards bringing its unparalleled industry-specific expertise for the benefit of those companies.

Investor Contact:

John Ferguson

Saratoga Proxy Consulting LLC

Toll free (888) 368-0379

+1-212-257-1311

info@saratogaproxy.com

www.UnlockWT.com

Media Contact:

Dan Gagnier / Riyaz Lalani

Gagnier Communications LLC

+1-646-569-5897

ETFS@gagnierfc.com

Item 3: On May 28, 2024,

ETFS posted the following material to www.UnlockWT.com:

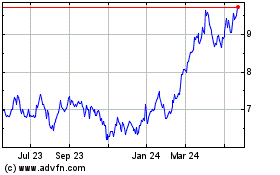

WisdomTree (NYSE:WT)

Historical Stock Chart

From Oct 2024 to Nov 2024

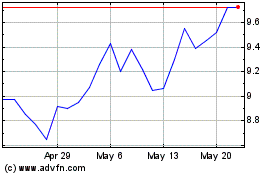

WisdomTree (NYSE:WT)

Historical Stock Chart

From Nov 2023 to Nov 2024