- Increased quarterly cash distribution

by 2.9% sequentially, or 12% annually, to $0.3756 per unit, the

eleventh consecutive quarterly increase in distributions

- Acquired an additional 5% interest in

Westlake Chemical OpCo LP (“OpCo”) and concluded $113.9 million

follow-on equity offering

- Record quarterly net income

attributable to the Partnership of $13.4 million, or $0.47 per

unit

- Record quarterly MLP distributable cash

flow of $15.5 million

Westlake Chemical Partners LP (NYSE: WLKP) (the "Partnership")

today reported record net income attributable to the Partnership of

$13.4 million, or $0.47 per limited partner unit, for the three

months ended September 30, 2017, an increase of $4.7

million compared to third quarter 2016 net income attributable to

the Partnership of $8.7 million. The increase in net income

attributable to the Partnership as compared to the prior-year

period was primarily due to the Partnership’s increased ownership

of OpCo that was effective as of July 1, 2017, and increased

production at all of OpCo’s facilities, partially offset by certain

reimbursements received by OpCo from Westlake Chemical Corporation

(“Westlake”) in the third quarter of 2016 in accordance with the

Ethylene Sales Agreement between OpCo and Westlake. Cash flow from

operations in the third quarter of 2017 was $139.6 million, an

increase of $147.5 million compared to third quarter of 2016

cash flow from operations of $(7.9) million. The increase in cash

flow from operations was due to increased production at OpCo’s

facilities, a decrease in working capital and a decrease in

turnaround expenditures following the turnaround and 250 million

pound expansion project at OpCo’s Petro 1 facility in Lake Charles,

Louisiana, which was completed in July 2016. For the three months

ended September 30, 2017, MLP distributable cash flow was

a record $15.5 million, an increase of $8.7 million compared to

third quarter 2016 MLP distributable cash flow of

$6.8 million. The increase in MLP distributable cash flow as

compared to the prior-year period was due to the Partnership’s

increased ownership interest in OpCo, higher production volumes at

all of OpCo’s facilities and lower maintenance capital

expenditures.

The third quarter 2017 net income attributable to the

Partnership of $13.4 million, or $0.47 per limited partner

unit, increased by $3.4 million from second quarter 2017 net income

attributable to the Partnership of $10.0 million due to the

Partnership’s increased ownership interest in OpCo, which was

effective as of July 1, 2017. Third quarter 2017 cash flow from

operations of $139.6 million increased by $26.4 million compared to

second quarter 2017 cash flow from operations of

$113.2 million. The increase in cash flow from operations was

due to increased production at OpCo’s facilities and a decrease in

working capital. Third quarter 2017 MLP distributable cash flow of

$15.5 million increased by $4.5 million compared to second quarter

2017 MLP distributable cash flow of $11.0 million due to the

Partnership’s increased ownership interest in OpCo.

Net income attributable to the Partnership of $33.1 million, or

$1.23 per limited partner common unit, for the nine months ended

September 30, 2017, increased $3.0 million compared to

the first nine months of 2016 net income attributable to the

Partnership of $30.1 million. The increase in net income

attributable to the Partnership as compared to the prior-year

period was due to the Partnership’s increased ownership interest in

OpCo and increased production at all of OpCo’s facilities,

partially offset by certain reimbursements from Westlake under the

Ethylene Sales Agreement that were recorded in the first nine

months of 2016. Cash flow from operations in the first nine months

of 2017 was $401.9 million, an increase of $224.5 million

compared to the first nine months of 2016 cash flow from operations

of $177.4 million. This increase in cash flow from operations was

due to increased production at OpCo’s facilities, a decrease in

working capital and lower turnaround expenditures. For the nine

months ended September 30, 2017, MLP distributable cash

flow was $37.9 million, an increase of $17.3 million compared to

the first nine months of 2016 MLP distributable cash flow of

$20.6 million. The increase in MLP distributable cash flow as

compared to the prior-year period was due to the higher production

volumes, lower maintenance capital expenditures and the

Partnership’s increased ownership interest in OpCo.

On September 29, 2017, WLKP issued and sold 5,175,000

common units representing limited partner interests in the

Partnership for $113.9 million. The Partnership used the net

proceeds of the public offering and approximately $118.6 million of

borrowings under the $300.0 million senior unsecured revolving

credit agreement with Westlake Chemical Corporation (the “MLP

Revolver”) to acquire an additional 5% interest in OpCo for $229.2

million, effective as of July 1, 2017.

On November 1, 2017, the Board of Directors of

Westlake Chemical Partners GP LLC, the general partner of the

Partnership, announced a quarterly distribution for the third

quarter of 2017 of $0.3756 per limited partner unit to be payable

on November 29, 2017 to unit holders of record as of

November 14, 2017. The third quarter 2017 distribution

increased 12.0% compared to the third quarter 2016 distribution and

2.9% compared to the second quarter 2017 distribution. MLP

distributable cash flow provided coverage of 1.28x the declared

distributions for the third quarter of 2017 and reflects the

Partnership’s increased ownership interest in OpCo following the

dropdown transaction completed in September 2017.

OpCo's Ethylene Sales Agreement with Westlake is designed to

provide for stable and predictable cash flows. The agreement

provides that 95% of OpCo's ethylene production is sold to Westlake

for a cash margin of $0.10 per pound, net of operating costs,

maintenance capital expenditures and reserves for future turnaround

expenditures.

“We are pleased with OpCo’s performance for the quarter. This

quarter marks a milestone for the Partnership as we completed the

first follow-on offering since our initial public offering in

August 2014, and first dropdown transaction since May 2015. The

stability in earnings and cash flows provided by our sales

agreement with Westlake Chemical provide a foundation for continued

growth and we will continue to evaluate opportunities for us to

deliver value to our stakeholders,” said Albert Chao, President and

Chief Executive Officer.

The statements in this release and the related teleconference

relating to matters that are not historical facts, such as

distribution growth, are forward-looking statements. These

forward-looking statements are subject to significant risks and

uncertainties. Actual results could differ materially, based on

factors including, but not limited to, operating difficulties; the

volume of ethylene that we are able to sell; the price at which we

are able to sell ethylene; changes in the price and availability of

feedstocks; changes in prevailing economic conditions; actions of

Westlake Chemical Corporation; actions of third parties; inclement

or hazardous weather conditions, including flooding, and the

physical impacts of climate change; environmental hazards; changes

in laws and regulations (or the interpretation thereof); inability

to acquire or maintain necessary permits; inability to obtain

necessary production equipment or replacement parts; technical

difficulties or failures; labor disputes; difficulty collecting

receivables; inability of our customers to take delivery; fires,

explosions or other industrial accidents; our ability to borrow

funds and access capital markets; and other risk factors. For more

detailed information about the factors that could cause actual

results to differ materially, please refer to the Partnership's

Annual Report on Form 10-K for the year ended

December 31, 2016, which was filed with the SEC in

March 2017.

This release is intended to be a qualified notice under Treasury

Regulation Section 1.1446-4(b). Brokers and nominees should treat

one hundred percent (100.0%) of the Partnership's distributions to

non-U.S. investors as being attributable to income that is

effectively connected with a United States trade or

business. Accordingly, the Partnership's distributions to non-U.S.

investors are subject to federal income tax withholding at the

highest applicable effective tax rate.

Use of Non-GAAP Financial Measures

This release makes reference to certain “non-GAAP” financial

measures, such as MLP distributable cash flow and EBITDA, as

defined in Regulation G of the U.S. Securities Exchange Act of

1934, as amended. We report our financial results in accordance

with U.S. generally accepted accounting principles ("GAAP"), but

believe that certain non-GAAP financial measures, such as MLP

distributable cash flow and EBITDA, provide useful supplemental

information to investors regarding the underlying business trends

and performance of our ongoing operations and are useful for

period-over-period comparisons of such operations. These non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for, or superior to, the financial measures

prepared in accordance with GAAP. A reconciliation of MLP

distributable cash flow and EBITDA to net income and net cash

provided by operating activities can be found in the financial

schedules at the end of this release. We define distributable cash

flow as net income plus depreciation, amortization and disposition

of property, plant and equipment, less contributions from

turnaround reserves and maintenance capital expenditures. We define

MLP distributable cash flow as distributable cash flow less

distributable cash flow attributable to Westlake's noncontrolling

interest in OpCo and distributions attributable to incentive

distribution rights holder. MLP distributable cash flow does not

reflect changes in working capital balances. We define EBITDA as

net income before interest expense, income taxes, depreciation and

amortization. Because MLP distributable cash flow and EBITDA may be

defined differently by other companies in our industry, our

definition of MLP distributable cash flow and EBITDA may not be

comparable to similarly titled measures of other companies.

Westlake Chemical Partners LP

Westlake Chemical Partners is a limited partnership formed by

Westlake Chemical Corporation to operate, acquire and develop

ethylene production facilities and other qualified assets.

Headquartered in Houston, Texas, the Partnership owns an 18.3%

interest in Westlake Chemical OpCo LP. Westlake Chemical OpCo LP's

assets consist of three ethylene production facilities in Calvert

City, Kentucky, and Lake Charles, Louisiana and an ethylene

pipeline. For more information about Westlake Chemical Partners LP,

please visit http://www.wlkpartners.com.

Westlake Chemical Partners LP Conference Call Information:

A conference call to discuss Westlake Chemical Partners' third

quarter 2017 results will be held Tuesday,

November 7, 2017 at 12:00 PM Eastern Time (11:00 AM

Central Time). To access the conference call, dial (855) 765-5686

or (234) 386-2848 for international callers, approximately 10

minutes prior to the scheduled start time and reference passcode

97240040.

A replay of the conference call will be available beginning two

hours after its conclusion until 11:59 p.m. Eastern Time on

November 13, 2017. To hear a replay, dial (855) 859-2056

or (404) 537-3406 for international callers. The replay passcode is

97240040.

The conference call will also be available via webcast at:

https://edge.media-server.com/m6/p/zepzr3xx and the earnings

release can be obtained via the Partnership web page at:

http://investors.wlkpartners.com/event.

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) Three Months Ended

September 30, Nine Months Ended September

30, 2017 2016 2017

2016 (In thousands of dollars, except per unit

data) Revenue Net sales—Westlake Chemical Corporation

("Westlake") $ 258,049 $ 193,964 $ 711,968 $ 606,859 Net

co-product, ethylene and other sales—third parties 38,726

35,390 152,368 85,940 Total net sales 296,775

229,354 864,336 692,799 Cost of sales 201,372 142,553

571,401 407,203 Gross profit 95,403 86,801 292,935

285,596 Selling, general and administrative expenses 6,805

5,788 21,519 17,733 Income from operations

88,598 81,013 271,416 267,863

Other income (expense)

Interest expense—Westlake (6,190 ) (4,947 ) (17,592 ) (7,381 )

Other income, net 162 (13 ) 1,844 230 Income

before income taxes 82,570 76,053 255,668 260,712 Provision for

income taxes 325 194 925 890 Net income

82,245 75,859 254,743 259,822 Less: Net income attributable to

noncontrolling interests in Westlake Chemical OpCo LP ("OpCo")

68,860 67,198 221,619 229,733

Net

income attributable to Westlake Partners $ 13,385

$ 8,661 $ 33,124

$ 30,089 Net income per limited

partners unit attributable to Westlake Partners (basic and diluted)

Common units

$ 0.47 $ 0.32 $ 1.23 $ 1.11 Subordinated units $ — $ 0.32

$ 1.07 $ 1.11 Distributions declared

per unit $ 0.3756 $ 0.3353 $ 1.0955 $ 0.9780

MLP distributable cash flow $ 15,478 $ 6,833

$ 37,892 $ 20,643 Distribution declared

Limited partner units—public $ 6,803 $ 4,338 $ 16,116 $ 12,653

Limited partner units—Westlake 5,304 4,735 15,471 13,812 Incentive

distribution rights 498 91 1,052 139

Total distribution declared $ 12,605 $ 9,164 $ 32,639

$ 26,604 EBITDA $ 117,813 $ 107,290 $

359,762 $ 335,565

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

September 30, 2017 December 31,

2016 (In thousands of dollars) ASSETS Current

assets Cash and cash equivalents $ 17,249 $ 88,900 Receivable under

the Investment Management Agreement—Westlake Chemical Corporation

("Westlake") 119,009 — Accounts receivable, net—Westlake 60,405

126,977 Accounts receivable, net—third parties 16,651 12,085

Inventories 3,881 3,934 Prepaid expenses and other current assets

413 269 Total current assets 217,608 232,165

Property, plant and equipment, net 1,206,246 1,222,238 Other

assets, net 93,844 100,825

Total assets

$ 1,517,698 $ 1,555,228

LIABILITIES AND EQUITY Current liabilities (accounts

payable and accrued liabilities) $ 44,920 $ 37,777 Long-term debt

payable to Westlake 477,121 594,629 Other liabilities 2,178

1,859 Total liabilities 524,219 634,265 Common

unitholders—public 409,684 297,367 Common unitholder—Westlake

49,025 4,813 Subordinated unitholder—Westlake — 42,534 General

partner—Westlake (242,074 ) (242,430 ) Accumulated other

comprehensive income 226 200 Total Westlake Partners

partners' capital 216,861 102,484 Noncontrolling interest in OpCo

776,618 818,479 Total equity 993,479 920,963

Total liabilities and equity $

1,517,698 $ 1,555,228

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Nine Months Ended September 30, 2017

2016 (In thousands of dollars) Cash flows

from operating activities Net income $ 254,743 $ 259,822

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 86,502 67,472

Other balance sheet changes 60,671 (149,924 ) Net cash

provided by operating activities 401,916 177,370

Cash flows from investing activities Additions to property,

plant and equipment (56,607 ) (268,647 ) Proceeds from disposition

of assets 129 157 Proceeds from involuntary conversion of assets

1,672 — Receivables under The Investment Management Agreement -

Westlake (119,000 ) — Net cash used for investing activities

(173,806 ) (268,490 )

Cash flows from financing activities

Net proceeds from equity offerings 110,739 — Proceeds from debt

payable to Westlake 155,257 212,175 Repayment of debt payable to

Westlake (272,765 ) (1,098 ) Quarterly distributions to

noncontrolling interest retained in OpCo by Westlake (263,480 )

(188,736 ) Quarterly distributions to unitholders (29,512 ) (25,774

) Net cash used for financing activities (299,761 ) (3,433 ) Net

decrease in cash and cash equivalents (71,651 ) (94,553 ) Cash and

cash equivalents at beginning of the period 88,900 169,559

Cash and cash equivalents at end of the period $ 17,249

$ 75,006

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

RECONCILIATION OF MLP DISTRIBUTABLE

CASH FLOW TO NET INCOME

AND NET CASH PROVIDED BY OPERATING

ACTIVITIES

(Unaudited)

Three Months Ended June

30,

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2017 2016

2017 2016 (In thousands of

dollars) Net cash provided (used) by operating

activities $ 113,208 $ 139,630

$ (7,907 ) $ 401,916 $

177,370 Changes in operating assets and liabilities and

other (26,630 ) (57,222 ) 83,835 (146,810 ) 82,841 Deferred income

tax expense (108 ) (163 ) (69 ) (363 ) (389 )

Net Income

$ 86,470 $ 82,245

$ 75,859 $ 254,743

$ 259,822 Add: Depreciation, amortization and

disposition of property, plant and equipment 27,299 31,790 26,290

89,239 67,472 Less: Contribution to turnaround reserves (7,624 )

(7,778 ) (17,625 ) (22,641 ) (33,963 ) Maintenance capital

expenditures (9,764 ) (9,827 ) (21,747 ) (28,081 ) (103,609 )

Incentive distribution rights (323 ) (498 ) (91 ) (1,052 ) (139 )

Distributable cash flow attributable to noncontrolling interest in

OpCo (85,091 ) (80,454 ) (55,853 ) (254,316 ) (168,940 )

MLP

distributable cash flow $ 10,967 $

15,478 $ 6,833 $

37,892 $ 20,643

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

RECONCILIATION OF EBITDA TO NET INCOME

AND NET CASH

PROVIDED BY OPERATING

ACTIVITIES

(Unaudited)

Three Months Ended June

30,

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2017 2016

2017 2016 (In thousands of

dollars) Net cash provided (used) by operating

activities $ 113,208 $ 139,630

$ (7,907 ) $ 401,916 $

177,370 Changes in operating assets and liabilities and

other (26,630 ) (57,222 ) 83,835 (146,810 ) 82,841 Deferred income

tax expense (108 ) (163 ) (69 ) (363 ) (389 )

Net Income

$ 86,470 $ 82,245

$ 75,859 $ 254,743

$ 259,822 Add: Depreciation and amortization

27,299 29,053 26,290 86,502 67,472 Interest expense 5,942 6,190

4,947 17,592 7,381 Provision for income taxes 297 325

194 925 890

EBITDA $

120,008 $ 117,813 $

107,290 $ 359,762 $

335,565

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107005299/en/

Westlake Chemical Partners LPInvestorsSteve Bender,

713-585-2900orMediaL. Benjamin Ederington, 713-585-2900

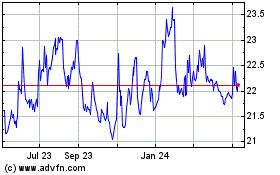

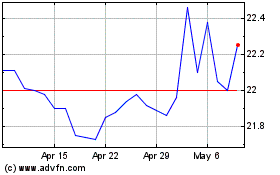

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Jul 2023 to Jul 2024