As filed with the Securities and Exchange Commission on January 29, 2024

Securities Act Registration No. 333-261721

Investment Company Act Registration No. 811-08709

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

REGISTRATION STATEMENT

UNDER

|

|

|

|

|

|

|

THE SECURITIES ACT OF 1933 |

|

☒ |

|

|

Pre-Effective Amendment No. |

|

☐ |

|

|

Post-Effective Amendment No. 3 |

|

☒ |

and/or

REGISTRATION STATEMENT

UNDER

|

|

|

|

|

|

|

THE INVESTMENT COMPANY ACT OF 1940 |

|

☒ |

|

|

Amendment No. 11 |

|

☒ |

Western Asset High Income Fund II Inc.

(Exact Name of Registrant as Specified in Charter)

620 Eighth

Avenue, 47th Floor

New York, New York 10018

(Address of Principal Executive Offices)

(888) 777-0102

(Registrant’s Telephone Number, Including Area Code)

Jane Trust

Franklin

Templeton

280 Park Avenue

New York, New York 10017

(Name and Address of Agent for Service)

Copies to:

|

|

|

| David W. Blass, Esq.

Ryan P. Brizek, Esq.

Simpson Thacher & Bartlett LLP

900 G Street NW

Washington, DC 20001 |

|

Marc A. De Oliveira, Esq.

Franklin Templeton 100

First Stamford Place Stamford, CT 06902 |

Approximate Date of Proposed Public Offering: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the

following box ☐.

If any of the securities being registered on this form will be offered on a delayed or continuous basis in

reliance on Rule 415 under the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box. ☒

If this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto, check the following

box ☒.

If this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that

will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box ☐.

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ☐.

It is proposed that this filing will become effective (check appropriate box)

| |

☐ |

when declared effective pursuant to Section 8(c) |

If appropriate, check the following box:

| |

☐ |

This post-effective amendment designates a new effective date for a previously filed registration statement.

|

| |

☐ |

This form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act and the Securities Act registration statement number of the earlier effective registration statement for the same offering is . |

| |

☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is . |

| |

☒ |

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is 333-261721. |

Check each box that appropriately characterizes the Registrant:

| |

☒ |

Registered Closed-End Fund

(closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| |

☐ |

Business Development Company (closed-end company that intends or has

elected to be regulated as a business development company under the Investment Company Act). |

| |

☐ |

Interval Fund (Registered Closed-End Fund or a Business Development

Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| |

☒ |

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

| |

☐ |

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| |

☐ |

Emerging Growth Company (as defined by Rule 12b-2 under the Securities

Exchange Act of 1934 (“Exchange Act”). |

| |

☐ |

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| |

☐ |

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing). |

The Registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that the Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such dates as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 3 to the Registration Statement on Form N-2 (File Nos. 333-261721 and 811-08709) of Western Asset High Income Fund II Inc.

(the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this

Post-Effective Amendment No. 3 consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits

to the Registration Statement. This Post-Effective Amendment No. 3 does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 3 shall become effective immediately

upon filing with the Securities and Exchange Commission. The contents of the Registration Statement are hereby incorporated by reference.

PART C

Other Information

Item 25.

Financial Statements and Exhibits

|

|

|

|

|

| (1) |

|

Financial Statements for the fiscal years April 30, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, and 2012 |

|

|

|

|

|

Part A |

|

Financial Highlights |

|

|

|

|

|

Part B |

|

Incorporated into Part B by reference to Registrant’s most recent Certified Shareholder Report on Form N-CSR, filed June 28, 2021 (File No. 811-0879): |

|

|

|

|

|

|

|

Schedule of Investments as of April 30, 2021 |

|

|

|

|

|

|

|

Statement of Assets and Liabilities as of April 30, 2021 |

|

|

|

|

|

|

|

Statement of Operations for the Year Ended April 30, 2021 |

|

|

|

|

|

|

|

Statement of Changes in Net Assets for the Year Ended April 30, 2021 |

|

|

|

|

|

|

|

Notes to Financial Statements for the Year Ended April 30, 2021 |

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm for the Year Ended April 30, 2021 |

|

|

|

| (2) |

|

Exhibits |

|

|

|

|

|

|

|

(a)(1) |

|

Amended and Restated Articles of Incorporation(1) |

|

|

|

|

|

(a)(2) |

|

Articles of Amendment, dated September 20, 2006(2) |

|

|

|

|

|

(b)(1) |

|

Third Amended and Restated Bylaws(3) |

|

|

|

|

|

(c) |

|

Not Applicable |

|

|

|

|

|

(d)(1) |

|

Articles V and VIII of Registrant’s Articles of Incorporation are incorporated herein by reference. |

|

|

|

|

|

(d)(2) |

|

Form of Subscription Certificate* |

|

|

|

|

|

(d)(3) |

|

Form of Notice of Guaranteed Delivery* |

|

|

|

|

|

(e) |

|

Dividend Reinvestment Plan(5) |

|

|

|

|

|

(f) |

|

Not Applicable |

|

|

|

|

|

(g)(1) |

|

Investment Management Agreement between the Registrant and Legg Mason Partners Fund Advisor, LLC(5) |

|

|

|

|

|

(g)(2) |

|

Subadvisory Agreement between Legg Mason Partners Fund Advisor, LLC and Western Asset Management Company, LLC(5) |

|

|

|

|

|

(g)(3) |

|

Subadvisory Agreement between Western Asset Management Company, LLC and Western Asset Management Company Limited(5) |

|

|

|

|

|

(g)(4) |

|

Subadvisory Agreement between Western Management Company, LLC and Western Asset Management Company Pte. Ltd.(5) |

C-1

|

|

|

|

|

|

|

(h) |

|

Sales Agreement(7) |

|

|

|

|

|

(i) |

|

Not Applicable |

|

|

|

|

|

(j)(1) |

|

Custodian Services Agreement with The Bank of New York Mellon, dated January 1, 2018(5) |

|

|

|

|

|

(j)(2) |

|

Amendment No. 9 to the Custodian Services Agreement, dated May 1, 2021, with The Bank of New York Mellon, dated January 1, 2018(5) |

|

|

|

|

|

(k)(1) |

|

Transfer Agency and Services Agreement with Computershare Inc., dated March 14, 2016(5) |

|

|

|

|

|

(k)(2) |

|

Amendment No. 9 to the Transfer Agency and Services Agreement, dated March 19, 2021, with Computershare Inc., dated March 14, 2016(5) |

|

|

|

|

|

(k)(3) |

|

Form of Subscription Agent Agreement between the Fund and Computershare Trust Company, N.A.* |

|

|

|

|

|

(k)(4) |

|

Form of Information Agent Agreement between the Fund and Georgeson Inc.* |

|

|

|

|

|

(k)(5) |

|

Form of Funds of Funds Investment Agreement(6) |

|

|

|

|

|

(k)(6) |

|

The Margin Loan and Security Agreement with Bank of America, N.A.(7)

|

|

|

|

|

|

(k)(7) |

|

Amendment No. 1 to the Margin Loan and Security Agreement with Bank of America, N.A.(7)

|

|

|

|

|

|

(l)(1) |

|

Opinion and Consent of Venable LLP(5) |

|

|

|

|

|

(l)(2) |

|

Opinion and Consent with respect to legality of Common Shares and Rights* |

|

|

|

|

|

(m) |

|

Not Applicable |

|

|

|

|

|

(n) |

|

Consent of Independent Registered Public Accounting Firm* |

|

|

|

|

|

(o) |

|

Not Applicable |

|

|

|

|

|

(p) |

|

Not Applicable. |

|

|

|

|

|

(q) |

|

Not Applicable |

|

|

|

|

|

(r)(1) |

|

Code of Ethics of the Fund and the Manager(5) |

|

|

|

|

|

(r)(2) |

|

Code of Ethics of Western Asset(5) |

|

|

|

|

|

(s) |

|

Filing Fee Table(5) |

|

|

|

|

|

(t) |

|

Power of Attorney(4) |

| (1) |

Filed on May 21, 1998 with Pre-Effective Amendment No. 2 to

the Registrant’s Registration Statement on Form N-2 (File Nos. 333-48351 and 811-08709) and incorporated by reference herein

|

| (2) |

Filed as Exhibit 99 to NSAR-B as filed with the Commission on

June 29, 2007 and incorporated herein by reference |

| (3) |

Filed on August 18, 2020 with Form 8-K and incorporated by

reference herein. |

| (4) |

Filed on December 17, 2021 with the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261721

and 811-08709) and incorporated by reference herein. |

| (5) |

Filed on March 18, 2022 with the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261721 and

811-08709) and incorporated by reference herein. |

| (6) |

Filed on April 8, 2022 with the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261721 and

811-08709) and incorporated by reference herein. |

| (7) |

Filed on December 9, 2022 with the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261721

and 811-08709) and incorporated by reference herein. |

Item 26. Marketing Arrangements

Reference is made to the sales agreement for the Registrant’s common stock incorporated by reference herein or the form of underwriting

agreement to be filed as an exhibit in a post-effective amendment to the Registrant’s Registration Statement and the section entitled “Plan of Distribution” contained in Registrant’s Prospectus incorporated by reference herein.

C-2

Item 27. Other Expenses of Issuance and Distribution

The following table sets forth the estimated expenses to be incurred in connection with the offering described in this Registration Statement:

|

|

|

|

|

| SEC registration fees |

|

$ |

16,222.50 |

|

| Financial Industry Regulatory Authority fees |

|

|

26,250 |

|

| Accounting fees and expenses |

|

|

8,000 |

|

| Legal fees and expenses |

|

|

295,000 |

|

| Printing and mailing fees |

|

|

15,040 |

|

| Miscellaneous |

|

|

434,150 |

|

|

|

|

|

|

| Total |

|

$ |

794,662.50 |

|

|

|

|

|

|

Item 28. Persons Controlled by or Under Common Control with Registrant

None.

Item 29. Number of Holders of

Securities

At February 28, 2022:

|

|

|

|

|

| Title of Class |

|

Number of

Record Holders |

|

| Common Stock, par value $0.001 per share |

|

|

14,882 |

|

Item 30. Indemnification

Maryland law permits a Maryland corporation to include in its charter a provision eliminating the liability of its directors and officers to

the corporation and its stockholders for money damages except for liability resulting from actual receipt of an improper benefit or profit in money, property or services or active and deliberate dishonesty that is established by a final judgment and

is material to the cause of action. The Registrant’s Charter contains such a provision that eliminates such liability to the maximum extent permitted by Maryland law. In addition, the Registrant has provisions in its Charter and the Bylaws that

authorize the Registrant, to the maximum extent permitted by Maryland law, to indemnify any present or former Director or officer from and against any claim or liability to which that person may become subject or which that person may incur by

reason of his or her status as a present or former Director or officer of the Registrant and to pay or reimburse their reasonable expenses in advance of final disposition of a proceeding. Pursuant to the Bylaws, absent a court determination that an

officer or Director seeking indemnification was not liable on the merits or guilty of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office, the decision by the Registrant to

indemnify such person will be based upon the reasonable determination of independent counsel or nonparty Independent Directors, after review of the facts, that such officer or Director is not guilty of willful misfeasance, bad faith, gross

negligence or reckless disregard of the duties involved in the conduct of his office.

Insofar as indemnification for liability arising

under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the Securities and Exchange

Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of

expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 31. Business and Other Connections of Adviser

The descriptions of the Manager, Western Asset, Western Asset Limited and Western Asset Singapore under the caption “Management

of the Fund” in the Prospectus and Statement of Additional Information of this registration statement are incorporated by reference herein. Information as to the directors and officers of the Manager, Western Asset, Western Asset Limited and

Western Asset Singapore, together with information as to any other business, profession, vocation or employment of a substantial nature engaged in by the directors and officers of the Manager, Western Asset, Western Asset Limited and Western Asset

Singapore in the last two years, is

C-3

included in their respective applications for registration as an investment adviser on Form ADV (File Nos. 801-66785,

801-08162, 801-21068 and 801-67298, respectively) filed under the Investment Advisers Act of 1940, as amended, and is

incorporated herein by reference.

Item 32. Location of Accounts and Records

The accounts and records of the Registrant are maintained at the office of the Registrant at 620 Eighth Avenue, New York, New York 10018.

Item 33. Management Services

Not

applicable.

Item 34. Undertakings

| |

3. |

The Registrant undertakes: |

(a) to file, during a period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(1) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(2) to reflect in the prospectus any facts or events after the effective date of the registration statement (or the most

recent post- effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement.

(3) to include any material information with respect to the plan of distribution not

previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided,

however, that paragraphs a(1), a(2), and a(3) of this section do not apply to the extent the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference into the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the

registration statement.

(b) that, for the purpose of determining any liability under the Securities Act, each post-effective amendment

to this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of those securities at that time shall be deemed to be the initial bona fide offering thereof;

(c) to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering;

C-4

(d) that, for the purpose of determining liability under the Securities Act to any purchaser:

(1) if the Registrant is relying on Rule 430B [17 CFR 230.430B]:

(A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of

providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the

date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new

effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that

is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date; or

(2) if the Registrant is subject to

Rule 430C: each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on

Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to

such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(e) that for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of

securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this

registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a

seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(1) any preliminary

prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424 under the Securities Act;

(2) free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or

referred to by the undersigned Registrant;

(3) the portion of any other free writing prospectus or advertisement

pursuant to Rule 482 under the Securities Act relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

C-5

(4) any other communication that is an offer in the offering made by the

undersigned Registrant to the purchaser

4. Registrant undertakes that, for the purpose of determining any liability under the Securities

Act:

(a) the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and

contained in the form of prospectus filed by the Registrant under Rule 424(b)(1) shall be deemed to be a part of this registration statement as of the time it was declared effective; and

(b) each post-effective amendment that contains a form of prospectus will be deemed to be a new registration statement relating to the

securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering thereof.

5. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference into the registration statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

6. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be

permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is

against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director,

officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

7. The Registrant undertakes to send by first class mail or other means designed to

ensure equally prompt delivery, within two business days of receipt of a written or oral request, any prospectus or Statement of Additional Information.

C-6

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended (the “1933 Act”) and the Investment Company Act of 1940, as

amended, the Registrant has duly caused this Amendment to the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York on the 29th day of January, 2024.

|

|

|

| WESTERN ASSET HIGH INCOME FUND II INC. |

|

|

| By: |

|

/s/ Jane Trust |

|

|

Chairman, Chief Executive Officer and President |

Pursuant to the requirements of the 1933 Act, this Amendment to the Registration Statement has been

signed by the following person in the capacity and on the date indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Jane Trust |

|

Chairman, Chief Executive Officer, President and Director (Principal Executive

Officer) |

|

January 29, 2024 |

| Jane Trust |

|

|

|

| /s/ Christopher Berarducci |

|

Principal Financial Officer (Principal Financial and Accounting Officer) |

|

January 29, 2024 |

| Christopher Berarducci |

|

|

|

| /s/ Robert D. Agdern* |

|

Director |

|

January 29, 2024 |

| Robert D. Agdern |

|

|

|

|

|

| /s/ Carol L. Colman* |

|

Director |

|

January 29, 2024 |

| Carol L. Colman |

|

|

|

|

|

| /s/ Daniel P. Cronin* |

|

Director |

|

January 29, 2024 |

| Daniel P. Cronin |

|

|

|

|

|

| /s/ Paolo M. Cucchi* |

|

Director |

|

January 29, 2024 |

| Paolo M. Cucchi |

|

|

|

|

|

| /s/ Eileen A. Kamerick* |

|

Director |

|

January 29, 2024 |

| Eileen A. Kamerick |

|

|

|

|

|

| /s/ Nisha Kumar* |

|

Director |

|

January 29, 2024 |

| Nisha Kumar |

|

|

|

|

|

| *By: |

|

/s/ Jane Trust |

|

|

Jane Trust |

|

|

As Agent or Attorney-in-fact |

January 29, 2024

The original power of attorney authorizing Jane Trust to execute this Registration Statement, and any amendments thereto, for the Directors of

the Registrant on whose behalf this Registration Statement are filed herewith as an exhibit to the Registrant’s Registration Statement on Form N-2.

EXHIBIT INDEX

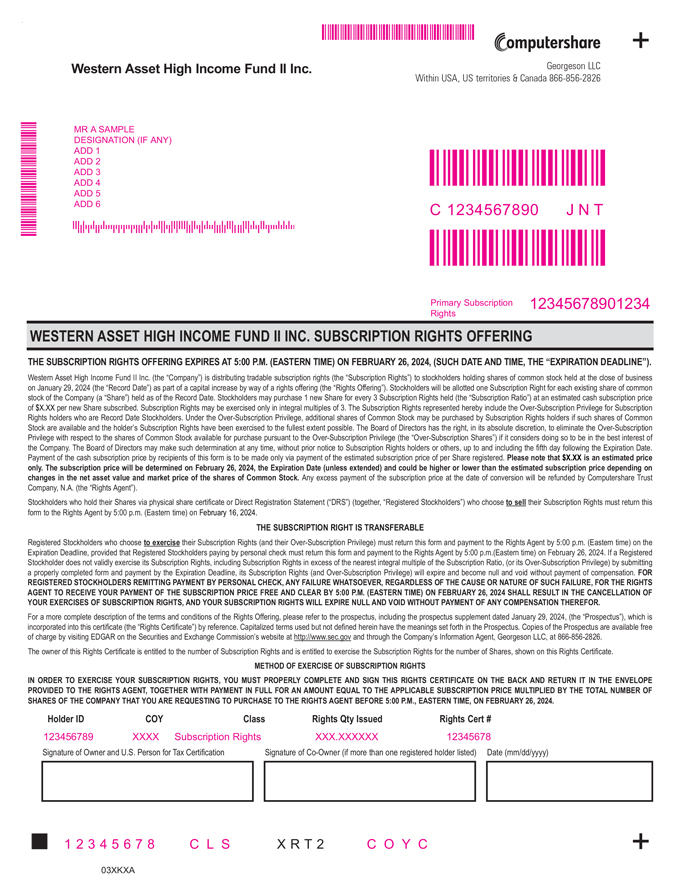

+ Western Asset High Income Fund II Inc. Georgeson LLC Within USA, US territories & Canada 866-856-2826 MRA SAMPLE DESIGNATION(IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 NNNNNNNNN ADD 6 C NNNNNN 1234567890 J N T Primary Subscription 12345678901234 Rights

WESTERN ASSET HIGH INCOME FUND II INC. SUBSCRIPTION RIGHTS OFFERING THE SUBSCRIPTION RIGHTS OFFERING EXPIRES AT 5:00 P.M. (EASTERN TIME) ON FEBRUARY 26, 2024, (SUCH DATE AND TIME, THE “EXPIRATION DEADLINE”). Western Asset High Income

Fund II Inc. (the “Company”) is distributing tradable subscription rights (the “Subscription Rights”) to stockholders holding shares of common stock held at the close of business on January 29, 2024 (the “Record

Date”) as part of a capital increase by way of a rights offering (the “Rights Offering”). Stockholders will be allotted one Subscription Right for each existing share of common stock of the Company (a “Share”) held as of the

Record Date. Stockholders may purchase 1 new Share for every 3 Subscription Rights held (the “Subscription Ratio”) at an estimated cash subscription price of $X.XX per new Share subscribed. Subscription Rights may be exercised only in

integral multiples of 3. The Subscription Rights represented hereby include the Over-Subscription Privilege for Subscription Rights holders who are Record Date Stockholders. Under the Over-Subscription Privilege, additional shares of Common Stock

may be purchased by Subscription Rights holders if such shares of Common Stock are available and the holder’s Subscription Rights have been exercised to the fullest extent possible. The Board of Directors has the right, in its absolute

discretion, to eliminate the Over-Subscription Privilege with respect to the shares of Common Stock available for purchase pursuant to the Over-Subscription Privilege (the “Over-Subscription Shares”) if it considers doing so to be in the

best interest of the Company. The Board of Directors may make such determination at any time, without prior notice to Subscription Rights holders or others, up to and including the fifth day following the Expiration Date. Payment of the cash

subscription price by recipients of this form is to be made only via payment of the estimated subscription price of per Share registered. Please note that $X.XX is an estimated price only. The subscription price will be determined on

February 26, 2024, the Expiration Date (unless extended) and could be higher or lower than the estimated subscription price depending on changes in the net asset value and market price of the shares of Common Stock. Any excess payment of the

subscription price at the date of conversion will be refunded by Computershare Trust Company, N.A. (the “Rights Agent”). Stockholders who hold their Shares via physical share certificate or Direct Registration Statement (“DRS”)

(together, “Registered Stockholders”) who choose to sell their Subscription Rights must return this form to the Rights Agent by 5:00 p.m. (Eastern time) on February 16, 2024. THE SUBSCRIPTION RIGHT IS TRANSFERABLE Registered

Stockholders who choose to exercise their Subscription Rights (and their Over-Subscription Privilege) must return this form and payment to the Rights Agent by 5:00 p.m. (Eastern time) on the Expiration Deadline, provided that Registered Stockholders

paying by personal check must return this form and payment to the Rights Agent by 5:00 p.m.(Eastern time) on February 26, 2024. If a Registered Stockholder does not validly exercise its Subscription Rights, including Subscription Rights in

excess of the nearest integral multiple of the Subscription Ratio, (or its Over-Subscription Privilege) by submitting a properly completed form and payment by the Expiration Deadline, its Subscription Rights (and Over-Subscription Privilege) will

expire and become null and void without payment of compensation. FOR REGISTERED STOCKHOLDERS REMITTING PAYMENT BY PERSONAL CHECK, ANY FAILURE WHATSOEVER, REGARDLESS OF THE CAUSE OR NATURE OF SUCH FAILURE, FOR THE RIGHTS AGENT TO RECEIVE YOUR PAYMENT

OF THE SUBSCRIPTION PRICE FREE AND CLEAR BY 5:00 P.M. (EASTERN TIME) ON FEBRUARY 26, 2024 SHALL RESULT IN THE CANCELLATION OF YOUR EXERCISES OF SUBSCRIPTION RIGHTS, AND YOUR SUBSCRIPTION RIGHTS WILL EXPIRE NULL AND VOID WITHOUT PAYMENT OF ANY

COMPENSATION THEREFOR. For a more complete description of the terms and conditions of the Rights Offering, please refer to the prospectus, including the prospectus supplement dated January 29, 2024, (the “Prospectus”), which is

incorporated into this certificate (the “Rights Certificate”) by reference. Capitalized terms used but not defined herein have the meanings set forth in the Prospectus. Copies of the Prospectus are available free of charge by visiting

EDGAR on the Securities and Exchange Commission’s website at http://www.sec.gov and through the Company’s Information Agent, Georgeson LLC, at 866-856-2826.

The owner of this Rights Certificate is entitled to the number of Subscription Rights and is entitled to exercise the Subscription Rights for the number of Shares, shown on this Rights Certificate. METHOD OF EXERCISE OF SUBSCRIPTION RIGHTS IN ORDER

TO EXERCISE YOUR SUBSCRIPTION RIGHTS, YOU MUST PROPERLY COMPLETE AND SIGN THIS RIGHTS CERTIFICATE ON THE BACK AND RETURN IT IN THE ENVELOPE PROVIDED TO THE RIGHTS AGENT, TOGETHER WITH PAYMENT IN FULL FOR AN AMOUNT EQUAL TO THE APPLICABLE

SUBSCRIPTION PRICE MULTIPLIED BY THE TOTAL NUMBER OF SHARES OF THE COMPANY THAT YOU ARE REQUESTING TO PURCHASE TO THE RIGHTS AGENT BEFORE 5:00 P.M., EASTERN TIME, ON FEBRUARY 26, 2024. Holder ID COY Class Rights Qty

Issued Rights Cert # 123456789 XXXX Subscription Rights XXX.XXXXXX 12345678 Signature of Owner and U.S. Person for Tax Certification Signature of Co-Owner (if more than one registered holder listed) Date

(mm/dd/yyyy) 12345678 CLS XR T2 COYC

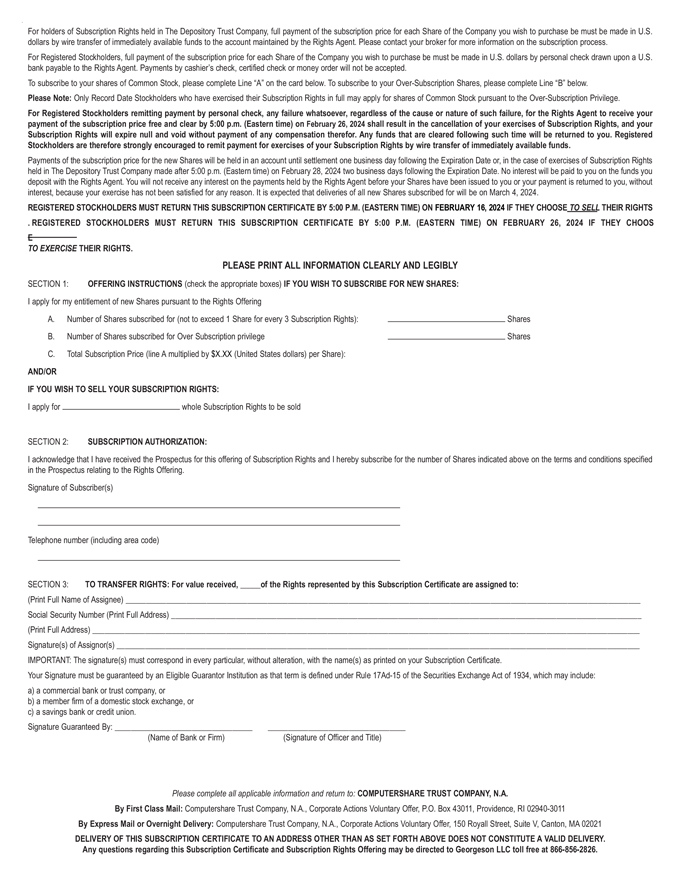

. For holders of Subscription Rights held in The Depository Trust Company, full payment of the subscription price for each Share of the

Company you wish to purchase be must be made in U.S. dollars by wire transfer of immediately available funds to the account maintained by the Rights Agent. Please contact your broker for more information on the subscription process. For Registered

Stockholders, full payment of the subscription price for each Share of the Company you wish to purchase be must be made in U.S. dollars by personal check drawn upon a U.S. bank payable to the Rights Agent. Payments by cashier’s check, certified

check or money order will not be accepted. To subscribe to your shares of Common Stock, please complete Line “A” on the card below. To subscribe to your Over-Subscription Shares, please complete Line “B” below. Please Note: Only

Record Date Stockholders who have exercised their Subscription Rights in full may apply for shares of Common Stock pursuant to the Over-Subscription Privilege. For Registered Stockholders remitting payment by personal check, any failure whatsoever,

regardless of the cause or nature of such failure, for the Rights Agent to receive your payment of the subscription price free and clear by 5:00 p.m. (Eastern time) on February 26, 2024 shall result in the cancellation of your exercises of

Subscription Rights, and your Subscription Rights will expire null and void without payment of any compensation therefor. Any funds that are cleared following such time will be returned to you. Registered Stockholders are therefore strongly

encouraged to remit payment for exercises of your Subscription Rights by wire transfer of immediately available funds. Payments of the subscription price for the new Shares will be held in an account until settlement one business day following the

Expiration Date or, in the case of exercises of Subscription Rights held in The Depository Trust Company made after 5:00 p.m. (Eastern time) on February 28, 2024 two business days following the Expiration Date. No interest will be paid to you

on the funds you deposit with the Rights Agent. You will not receive any interest on the payments held by the Rights Agent before your Shares have been issued to you or your payment is returned to you, without interest, because your exercise has not

been satisfied for any reason. It is expected that deliveries of all new Shares subscribed for will be on March 4, 2024. REGISTERED STOCKHOLDERS MUST RETURN THIS SUBSCRIPTION CERTIFICATE BY 5:00 P.M. (EASTERN TIME) ON FEBRUARY 16, 2024 IF

THEY CHOOSE TO SELL THEIR RIGHTS . REGISTERED STOCKHOLDERS MUST RETURN THIS SUBSCRIPTION CERTIFICATE BY 5:00 P.M. (EASTERN TIME) ON FEBRUARY 26, 2024 IF THEY CHOOS E TO EXERCISE THEIR RIGHTS. PLEASE PRINT ALL INFORMATION CLEARLY AND LEGIBLY

SECTION 1: OFFERING INSTRUCTIONS (check the appropriate boxes) IF YOU WISH TO SUBSCRIBE FOR NEW SHARES: I apply for my entitlement of new Shares pursuant

to the Rights Offering A. Number of Shares subscribed for

(not to exceed 1 Share for every 3 Subscription Rights):

Shares B. Number of Shares subscribed for Over Subscription

privilege Shares C. Total Subscription Price (line A

multiplied by $X.XX (United States dollars) per Share): AND/OR IF YOU WISH TO SELL YOUR SUBSCRIPTION RIGHTS: I apply for whole Subscription Rights to be sold SECTION

2: SUBSCRIPTION AUTHORIZATION: I acknowledge that I have received the Prospectus for this offering of Subscription Rights and I hereby subscribe for the

number of Shares indicated above on the terms and conditions specified in the Prospectus relating to the Rights Offering. Signature of Subscriber(s) Telephone number (including area code) SECTION 3: TO TRANSFER RIGHTS: For value received, _____of

the Rights represented by this Subscription Certificate are assigned to: (Print Full Name of Assignee) _______________________________________________________________________________________________________________________________ Social Security

Number (Print Full Address) ____________________________________________________________________________________________________________________ (Print Full Address)

_______________________________________________________________________________________________________________________________________ Signature(s) of Assignor(s)

_________________________________________________________________________________________________________________________________ IMPORTANT: The signature(s) must correspond in every particular, without alteration, with the name(s) as printed on

your Subscription Certificate. Your Signature must be guaranteed by an Eligible Guarantor Institution as that term is defined under Rule 17Ad-15 of the Securities Exchange Act of 1934, which may include: a) a

commercial bank or trust company, or b) a member firm of a domestic stock exchange, or c) a savings bank or credit union. Signature Guaranteed By: __________________________________ __________________________________ (Name of

Bank or Firm) (Signature of Officer and Title) Please complete all applicable information and return to: COMPUTERSHARE TRUST COMPANY, N.A. By First Class Mail: Computershare Trust Company, N.A., Corporate Actions Voluntary Offer, P.O. Box

43011, Providence, RI 02940-3011 By Express Mail or Overnight Delivery: Computershare Trust Company, N.A., Corporate Actions Voluntary Offer, 150 Royall Street, Suite V, Canton, MA 02021 DELIVERY OF THIS SUBSCRIPTION CERTIFICATE TO AN ADDRESS OTHER

THAN AS SET FORTH ABOVE DOES NOT CONSTITUTE A VALID DELIVERY. Any questions regarding this Subscription Certificate and Subscription Rights Offering may be directed to Georgeson LLC toll free at 866-856-2826.

Notice of Guaranteed Delivery

For Shares of Common Stock of

Western Asset High Income Fund II Inc.

Subscribed for Via Primary Subscription and the Over-Subscription Privilege

As set forth in the Prospectus Supplement, dated January 29, 2024, and the accompanying Prospectus, dated March 23, 2022 (collectively, the

“Prospectus”), this form or one substantially equivalent hereto may be used as a means of effecting subscription and payment for all shares of the Fund’s common stock, par value $0.001 per share (“Common Shares”), subscribed

for via the primary subscription and pursuant to the over-subscription privilege. Such form may be delivered by email, overnight courier, express mail or first class mail to the Subscription Agent and must be received prior to 5:00 p.m., Eastern

time, on February 26, 2024, as such date may be extended from time to time (the “Expiration Date”). The terms and conditions of the Offer set forth in the Prospectus are incorporated by reference herein. Capitalized terms used and not

otherwise defined herein have the meaning attributed to them in the Prospectus.

THE SUBSCRIPTION AGENT IS:

Computershare Trust Company, N.A.

|

|

|

|

|

| BY FIRST CLASS MAIL |

|

BY EXPRESS MAIL OR

OVERNIGHT COURIER: |

|

VIA EMAIL: |

| Western Asset High Income Fund II Inc.

c/o Computershare Trust Company, N.A.

P.O. Box 40311 Providence RI

02940-3011 |

|

Western Asset High Income Fund II Inc.

c/o Computershare Trust Company, N.A

150 Royall St – Suite V Canton

MA 02021 |

|

canoticeofguarantee@computershare.com |

DELIVERY OF THIS INSTRUMENT TO AN ADDRESS, OTHER THAN AS SET FORTH ABOVE, DOES NOT CONSTITUTE A VALID DELIVERY.

The New York Stock Exchange member firm or bank or trust company which completes this form must communicate this guarantee and the number of Common Shares

subscribed for in connection with this guarantee (separately disclosed as to the primary subscription and the over-subscription privilege) to the Subscription Agent and must deliver this Notice of Guaranteed Delivery, to the Subscription Agent,

prior to 5:00 p.m., Eastern time, on the Expiration Date, guaranteeing delivery of a properly completed and signed Subscription Certificate (which certificate must then be delivered to the Subscription Agent no later than the close of business of

the second business day after the Expiration Date). Failure to do so will result in a forfeiture of the Rights. Payment for the full estimated Subscription Price for the Common Shares subscribed for and/or requested must accompany this Notice of

Guaranteed Delivery.

GUARANTEE

The undersigned, a member firm of the New York Stock Exchange or a bank or trust company having an office or correspondent in the United States, guarantees

delivery to the Subscription Agent by no later than 5:00 p.m., Eastern time, on the second Business Day after the Expiration Date (February 26, 2024) unless extended, as described in the Prospectus) of a properly completed and executed Subscription

Certificate, as subscription for such Common Shares is indicated herein or in the Subscription Certificate. Participants should notify the Depositary prior to covering through the submission of a physical security directly to the Depositary based on

a guaranteed delivery that was submitted via the ASOP platform of The Depository Trust Company (“DTC”).

|

|

|

|

|

|

|

| Western Asset High Income

Fund II Inc. |

|

|

|

Broker Assigned Control # ____ |

|

|

|

|

| 1. Primary Subscription |

|

Number of Rights to be exercised |

|

Number of Common Shares under the Primary subscription requested for which you are guaranteeing delivery of Rights |

|

Payment to be made in connection with the Common Shares Subscribed for under the primary subscription |

|

|

|

|

|

|

_____ Rights |

|

_____ Common Shares (Rights ÷ by 3) |

|

$_____ |

|

|

|

|

| 2. Over-Subscription |

|

|

|

Number of Common Shares Requested Pursuant to the Over-Subscription Privilege |

|

Payment to be made in connection with the Common Shares Requested Pursuant to the Over-Subscription Privilege |

|

|

|

|

|

|

|

|

_____ Common Shares |

|

$_____ |

|

|

|

|

| 3. Totals |

|

Total Number of Rights to be Delivered |

|

Total Number of Common Shares Subscribed for and/or Requested |

|

|

|

|

|

|

|

|

_____ Rights |

|

_____ Common Shares |

|

$_____ Total Payment |

Method of delivery of the Notice of Guaranteed Delivery (circle one)

| |

B. |

Direct to Computershare Trust Company, N.A., as Subscription Agent |

Please reference below the registration of Rights to be delivered.

2

PLEASE ASSIGN A UNIQUE CONTROL NUMBER FOR EACH GUARANTEE SUBMITTED. This number needs to be referenced on any

direct delivery of Rights or any delivery through DTC.

|

|

|

| |

|

|

| Name of Firm |

|

Authorized Signature |

|

|

| DTC Participant Number

|

|

Title

|

|

|

| Address

|

|

Name (Please Type or Print)

|

|

|

| Zip Code

|

|

Phone Number

|

|

|

| Contact Name

|

|

Date

|

3

BENEFICIAL OWNER LISTING CERTIFICATION

Western Asset High Income Fund II Inc.

The undersigned, a bank, broker or other nominee holder of Rights (“Rights”) to purchase shares of the Fund’s common stock, par value $0.001

per share (“Common Shares”), of Western Asset High Income Fund II (the “Fund”) pursuant to the rights offering (the “Offer”) described and provided for in the Fund’s Prospectus Supplement, dated January 29,

2024, and the accompanying Prospectus, dated March 23, 2022 (collectively the “Prospectus”), hereby certifies to the Fund and to Computershare Trust Company, N.A., as Subscription Agent for such Offer, that for each numbered line

filled in below, the undersigned has exercised, on behalf of the beneficial owner thereof (which may be the undersigned), the number of Rights specified on such line pursuant to the primary subscription (as specified in the Prospectus) and such

beneficial owner wishes to subscribe for the purchase of additional Common Shares pursuant to the over-subscription privilege (as defined in the Prospectus), in the amount set forth in the third column of such line.

|

|

|

|

|

| Number of Record Date

Common Shares Owned |

|

NUMBER OF RIGHTS

exercised pursuant to the

Primary Subscription |

|

NUMBER OF

COMMON SHARES requested

pursuant to the Over-Subscription

Privilege |

| 1. |

|

|

|

|

| 2. |

|

|

|

|

| 3. |

|

|

|

|

| 4. |

|

|

|

|

| 5. |

|

|

|

|

| 6. |

|

|

|

|

| 7. |

|

|

|

|

| 8. |

|

|

|

|

| 9. |

|

|

|

|

| 10. |

|

|

|

|

|

|

|

|

|

| Name of Nominee Holder |

|

|

| By: |

|

|

|

|

| Name: |

|

|

|

|

| Title: |

|

|

|

|

| Dated: |

|

, 2024 |

|

|

|

|

|

| Provide the following information, if applicable: |

|

|

|

|

|

|

|

| |

|

|

|

|

| Depository Trust Corporation (“DTC”) Participant Number |

|

|

|

Name of Broker |

|

|

|

| |

|

|

|

|

| DTC Primary Subscription Confirmation Number(s) |

|

|

|

Address |

4

Subscription Agent Agreement

Between

Western Asset

High Income Fund II Inc.

And

Computershare Trust Company, N.A.

And

Computershare Inc.

Rev. May 2008

This SUBSCRIPTION AGENT AGREEMENT (this “Agreement”), dated as of [DATE] (the

“Effective Date”), is by and between Western Asset High Income Fund II Inc., a Maryland corporation (“Company”), and Computershare Trust Company, N.A., a federally chartered trust company (“Trust

Company”), and Computershare Inc., a Delaware corporation (“Computershare”, and together with Trust Company, “Agent”).

1.1 Company is making an offer (the “Subscription Offer”) to issue to holders of record of its outstanding shares of common stock, par value

$____ per share (the “Common Stock”), at the close of business on ___________ (the “Record Date”), the right to subscribe for and purchase (each, a “Right”, and collectively, the

“Rights”) shares of common stock (the “Additional Common Stock”) at an initial estimated purchase price of $______ per share of the Additional Common Stock (the “Subscription Price”), payable as

described on the Subscription Form (as defined below) sent to eligible shareholders, upon the terms and conditions set forth herein. The term “Subscribed” shall mean submitted for purchase from Company by a stockholder in accordance

with the terms of the Subscription Offer, and the term “Subscription(s)” shall mean any such submission. Company hereby appoints Agent to act as subscription agent in connection with the Subscription Offer and Agent hereby accepts

such appointment in accordance with and subject to the terms and conditions of this Agreement.

1.2 The Subscription Offer will expire at _________,

Eastern Time, on _______________ (the “Expiration Time”), unless Company shall have extended the period of time for which the Subscription Offer is open, in which event the term “Expiration Time” shall mean the

latest time and date at which the Subscription Offer, as so extended by Company from time to time, shall expire.

1.3 Company filed a shelf registration

statement relating to the Additional Common Stock with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “1933 Act”), on _____________, and such registration statement was declared effective on

____________. The terms of the Additional Common Stock are more fully described in the prospectus forming a part of the registration statement as it was declared effective. All terms used and not defined herein shall have the same meaning(s) as in

the prospectus.

1.4 Promptly after the Record Date, Company will furnish Agent with, or will instruct Agent, in its capacity as transfer agent for

Company, to prepare, a certified list in a format acceptable to Agent of holders of record of the Common Stock at the Record Date, including each such holder’s name, address, taxpayer identification number (“TIN”), share amount

with applicable tax lot detail, any certificate detail and information regarding any applicable account stops or blocks (the “Record Stockholders List”).

1.5 No later than the earlier of (i) forty-five (45) days after the Record Date or (ii) January 15 of the year following the year in which

the Record Date occurs, Company shall deliver to Agent written direction on the adjustment of cost basis for covered securities that arise from or are affected by the Subscription Offer in accordance with current Internal Revenue Service regulations

(see the Tax Instruction/Cost Basis Information Letter attached hereto as Exhibit B for additional information)

| 2. |

Subscription of Rights. |

2.1 The Rights entitle the holders to subscribe, upon payment of the Subscription Price, for shares of the Additional Common Stock at the rate of ____ share(s)

for each Right (the “Basic Subscription Privilege”). No fractional Rights will be issued, but the Subscription Offer includes a step-up privilege entitling the holder of fewer than ____ Rights

to subscribe for and pay the Subscription Price for one full share of the Common Stock.

Page 2

2.2 If subscribing shareholders who exercise their Rights in full are entitled to exercise an oversubscription

right, then Company shall provide Agent with instructions regarding the allocation to such shareholders of the Additional Common Stock after the initial allocation thereof.

2.3 Except as otherwise indicated to Agent by Company in writing, all of the Common Stock delivered hereunder upon the exercise of the Rights will be

delivered free of restrictive legends. Company shall, if applicable, inform Agent as soon as possible in advance as to whether any Common Stock issued hereunder is to be issued with restrictive legend(s) and, if so, Company shall provide the

appropriate legend(s) and a list identifying the affected shareholders, certificate numbers (if applicable) and share amounts for such affected shareholders.

| 3. |

Duties of Subscription Agent. |

3.1 Agent shall issue the Rights in accordance with this Agreement in the names of the holders of the Common Stock of record on the Record Date, keep such

records as are necessary for the purpose of recording such issuance(s), and furnish a copy of such records to Company.

3.2 Promptly after Agent receives

the Record Stockholders List, Agent shall:

(a) mail or cause to be mailed, by first class mail, to each holder of the Common Stock of

record on the Record Date whose address of record is within the United States of America and Canada, (i) a subscription form with respect to the Rights to which such stockholder is entitled under the Subscription Offer (the

“Subscription Form”), a form of which is attached hereto as Exhibit A, (ii) a copy of the prospectus and (iii) a return envelope addressed to Agent.

(b) At the direction of Company, mail or cause to be mailed, to each holder of the Common Stock of record on the Record Date whose address of

record is outside the United States of America and Canada, or is an A.P.O. or a F.P.O. address, a copy of the prospectus. Agent shall refrain from mailing the Subscription Form to any holder of the Common Stock of record on the Record Date whose

address of record is outside the United States of America and Canada, or is an A.P.O. or a F.P.O. address, and hold such Subscription Form for the account of such stockholder subject to such stockholder making satisfactory arrangements with Agent

for the exercise or other disposition of the Rights described therein, and effect the exercise, sale or delivery of such Rights in accordance with the terms of this Agreement if notice of such arrangements is received at or before 11:00 a.m.,

Eastern Time, on __________. In the event that a request to exercise the Rights is received from such a holder, Agent will consult with Company for instructions as to the number of shares of the Additional Common Stock, if any, Agent is authorized

to issue.

(c) Upon request by Company, Agent shall mail or deliver a copy of the prospectus (i) to each assignee or transferee of the

Rights upon receiving appropriate documentation satisfactory to Agent to register the assignment or transfer thereof and (ii) with shares of the Additional Common Stock when such are issued to persons other than the registered holder of the

Rights.

(d) Agent shall accept Subscriptions upon the due exercise of the Rights (including payment of the Subscription Price) on or prior

to the Expiration Time in accordance with the Subscription Form.

(e) Agent shall accept Subscriptions, without further authorization or

direction from Company, without procuring supporting legal papers or other proof of authority to sign (including, without limitation, proof of appointment of a fiduciary or other person acting in a representative capacity), and without signatures of

co-fiduciaries, co-representatives or any other person:

| |

(i) |

If the Right is registered in the name of a fiduciary and the Subscription Form is executed by such fiduciary,

provided, that the Additional Common Stock is to be issued in the name of such fiduciary; |

Page 3

| |

(ii) |

If the Right is registered in the name of joint tenants and the Subscription Form is executed by one of the

joint tenants, provided, that the Additional Common Stock is to be issued in the names of such joint tenants; or |

| |

(iii) |

If the Right is registered in the name of a corporation and the Subscription Form is executed by a person in a

manner which appears or purports to be done in the capacity of an officer or agent thereof, provided, that the Additional Common Stock is to be issued in the name of such corporation. |

| |

(f) |

Each document received by Agent relating to its duties hereunder shall be dated and time stamped when received

at the applicable address(es) as outlined in the offering documents. |

| |

(g) |

Agent shall, absent specific and mutually agreed upon instructions between Agent and Company, follow its normal

and customary procedures with respect to the acceptance or rejection of all Subscriptions received after the Expiration Time. Subscriptions not authorized to be accepted pursuant to this Section 3 and Subscriptions otherwise failing to comply

with the terms and conditions of the Subscription Form will be rejected and returned to the applicable shareholder. |

| |

(h) |

Company shall provide an opinion of counsel prior to the Expiration Time to set up a reserve of the Additional

Common Stock. The opinion shall state that all of the Additional Common Stock, or the transactions in which they are being issued, as applicable, are: |

| |

(i) |

Registered, or subject to a valid exemption from registration, under the 1933 Act, and all appropriate state

securities law filings have been made with respect to the Additional Common Stock, or alternatively, that the shares of the Additional Common Stock are “covered securities” under Section 18 of the 1933 Act; and |

| |

(ii) |

Validly issued, fully paid and non-assessable. |

| 4. |

Acceptance of Subscriptions. |

4.1 Following Agent’s first receipt of Subscriptions, on each business day, or more frequently if reasonably requested as to major tally figures, forward

a report by email to [________________] (the “Company Representative”) as to the following information, based upon a preliminary review (and at all times subject to a final determination by Company) as of the close of business on

the preceding business day or the most recent practicable time prior to such request, as the case may be: (i) the total number of shares of the Additional Common Stock Subscribed for; (ii) the total number of the Rights sold;

(iii) the total number of the Rights partially Subscribed for; (iv) the amount of funds received; and (v) the cumulative totals in categories (i) through (iv), above.

Page 4

4.2 As promptly as possible following the Expiration Time, advise the Company Representative by email of

(i) the number of shares of the Additional Common Stock Subscribed for and (ii) the number of shares of the Additional Common Stock unsubscribed for.

5.1 All funds received by Computershare pursuant to this Agreement that are to be distributed or applied by Computershare in accordance with the terms of this

Agreement (the “Funds”) shall be delivered to Computershare by 9:00 a.m. Eastern Time (“ET”) and in no event later than 12:00 p.m. ET on the Redemption Date. Funding after 9:00 a.m. ET but before 12:00 p.m. ET on

the Redemption Date may cause delays in payments to be made on the Redemption Date. Delivery of the Funds on any day after 12:00 p.m. ET will be subject to the terms of Section 5, below. Once received by Computershare, the Funds shall be held

by Computershare as agent for Company. Until paid or distributed in accordance with this Agreement, the Funds shall be deposited in one or more bank accounts to be maintained by Computershare in its name as agent for Company. Until paid pursuant to

this Agreement, Computershare may hold or invest the Funds through such accounts in: (i) bank accounts, short term certificates of deposit, bank repurchase agreements, and disbursement accounts with commercial banks with Tier 1 capital

exceeding $1 billion or with an average rating above investment grade by S&P (LT Local Issuer Credit Rating), Moody’s (Long Term Rating) and Fitch Ratings, Inc. (LT Issuer Default Rating) (each as reported by Bloomberg Finance L.P.),

(ii) cash management sweeps to AAA fixed NAV money market funds that comply with Rule 2a-7 of the Investment Company Act of 1940, (iii) funds backed by obligations of, or guaranteed by, the United States of

America, municipal securities, or (iv) debt or commercial paper obligations rated A-1 or P-1 or better by S&P Global Inc. (“S&P”) or

Moody’s Investors Service, Inc. (“Moody’s”), respectively.

5.2 Computershare will only draw upon the Funds in such account(s)

as required from time to time in order to make the payments for the Shares and any applicable tax withholding payments. Computershare shall have no responsibility or liability for any diminution of the Funds that may result from any deposit or

investment made by Computershare in accordance with this Section 3, including any losses resulting from a default by any bank, financial institution or other third party. Computershare may from time to time receive interest, dividends or

other earnings in connection with such deposits. Computershare shall not be obligated to pay such interest, dividends or earnings to Company, any holder or any other party.

5.3 Computershare is acting as agent hereunder and is not a debtor of Company in respect of the Funds.

5.4 In the case of late-day funding, which means delivery of the Funds to Computershare after 12:00 p.m. ET on any

day, regardless of whether such funding occurs prior to, or after, the Redemption Date as set forth in Section 5.1, above (“Late-Day Funding”), Federal Deposit Insurance or other bank

liquidity charges may apply in connection with the overnight deposit of the Funds with commercial banks. The parties hereto agree that any such charges assessed as a result of Late-Day Funding will be charged

to Company and Company hereby agrees to pay such charges.

5.5 Company agrees to deliver the Funds by wire to the account(s) listed on the attached

Exhibit B, which may be amended in writing from time to time.

| 6. |

Completion of Subscription Offer. |

6.1 Upon completion of the Subscription Offer, Agent shall request the transfer agent for the Common Stock to issue the appropriate number of shares of the

Additional Common Stock as required in order to effectuate the Subscriptions.

6.2 The Rights shall be issued in registered, book-entry form only. Agent

shall keep books and records of the registration, transfer and exchange of the Rights (the “Rights Register”).

Page 5

6.3 All of the Rights issued upon any registration of transfer or exchange of the Rights shall be the valid

obligations of Company, evidencing the same obligations and entitled to the same benefits under this Agreement as the Rights surrendered for such registration of transfer or exchange; provided, that until such transfer or exchange is registered in

the Rights Register, Company and Agent may treat the registered holder thereof as the owner for all purposes.

6.4 For so long as this Agreement shall be

in effect, Company will reserve for issuance and keep available free from preemptive rights a sufficient number of shares of the Additional Common Stock to permit the exercise in full of all of the Rights issued pursuant to the Subscription Offer.

6.5 Company shall take any and all action, including, without limitation, obtaining the authorization, consent, lack of objection, registration or

approval of any governmental authority, or the taking of any other action under the laws of the United States of America or any political subdivision thereof, to insure that all of the shares of the Additional Common Stock issuable upon the exercise

of the Rights (subject to payment of the Subscription Price) will be duly and validly issued and fully paid and non-assessable shares of the Common Stock, free from all preemptive rights and taxes, liens,

charges and security interests created by or imposed upon Company with respect thereto.

6.6 Company shall, from time to time, take all action necessary

or appropriate to obtain and keep effective all registrations, permits, consents and approvals of the Securities and Exchange Commission and any other governmental agency or authority and make such filings under federal and state laws, which may be

necessary or appropriate in connection with the issuance, sale, transfer and delivery of the Rights or the Additional Common Stock issued upon the exercise of the Rights.

7. Procedure for Discrepancies. Agent shall follow its regular procedures to attempt to reconcile any discrepancies between the

number of shares of Additional Common Stock that any Subscription Form may indicate are to be issued to a stockholder upon the exercise of the Rights and the number that the Record Stockholders List indicates may be issued to such stockholder. In

any instance where Agent cannot reconcile such discrepancies by following such procedures, Agent will consult with Company for instructions as to the number of shares of Additional Common Stock, if any, Agent is authorized to issue. In the absence

of such instructions, Agent is authorized not to issue any shares of Additional Common Stock to such stockholder and will return to the subscribing stockholder (at Agent’s option by either first class mail under a blanket surety bond or

insurance protecting Agent and Company from losses or liabilities arising out of the non-receipt or non-delivery of the Subscription Form or by registered mail insured

separately for the value of the applicable Rights) to such stockholder’s address as set forth in the Subscription Form, any Subscription Form delivered to Agent, any other documents delivered therewith and a letter explaining the reason for the

return of such documents.

| 8. |

Procedure for Deficient Items. |

8.1 Agent shall examine the Subscription Form(s) received by it as agent to ascertain whether they appear to have been completed and executed in accordance

with the Subscription Offer. In the event that Agent determines that any Subscription Form does not appear to have been properly completed or executed, or to be in proper form, or any other deficiency in connection with the Subscription Form appears

to exist, Agent shall follow, where possible, its regular procedures to attempt to cause such irregularity to be corrected. Agent is not authorized to waive any deficiency in connection with the Subscription, unless Company provides written

authorization to waive such deficiency.

8.2 If a Subscription Form specifies that shares of the Additional Common Stock are to be issued to a person

other than the person in whose name a surrendered Right is registered, Agent will not issue such shares until such Subscription Form has been properly endorsed with the signature guaranteed in a manner acceptable to Agent (or otherwise put in proper

form for transfer).

Page 6

8.3 If any such deficiency is neither corrected nor waived, Agent will return to the subscribing stockholder (at

Agent’s option by either first class mail under a blanket surety bond or insurance protecting Agent and Company from losses or liabilities arising out of the non-receipt or

non-delivery of the Subscription Form or by registered mail insured separately for the value of the applicable Rights) to such stockholder’s address as set forth in the Subscription Form, any Subscription

Form delivered to Agent, any other documents delivered therewith and a letter explaining the reason for the return of such documents.

9.1 Agent shall prepare and file with the appropriate governmental agency and mail to each stockholder, as applicable, all appropriate tax information forms,

including, but not limited to, Forms 1099-B, covering payments or any other distributions made by Agent pursuant to this Agreement during each calendar year, or any portion thereof, during which Agent performs

services hereunder, as described in the attached Exhibit B. Any cost basis or tax adjustments required after the Effective Time will incur additional fees.

9.2 With respect to any surrendering stockholder whose TIN has not been certified as correct, Agent shall deduct and withhold the appropriate backup

withholding tax from any payment made to such stockholder pursuant to the Internal Revenue Code.

9.3 Should any issue arise regarding federal income tax

reporting or withholding, Agent shall take such reasonable action as Company may reasonably request in writing. Such action may be subject to additional fees.

| 10. |

Authorizations and Protections. |

As agent for Company hereunder, Agent:

10.1 Shall have no duties

or obligations other than those specifically set forth herein or as may subsequently be agreed to in writing by Agent and Company;

10.2 Shall have no

obligation to deliver the Additional Common Stock unless Company shall have provided a sufficient number of shares of the Additional Common Stock to satisfy the exercise of the Rights by holders as set forth hereunder;

10.3 Shall be regarded as making no representations and having no responsibilities as to the validity, sufficiency, value, or genuineness of any certificates,

if applicable, or the Rights represented thereby surrendered hereunder or the Additional Common Stock issued in exchange therefor, and will not be required to or be responsible for and will make no representations as to, the validity, sufficiency,

value or genuineness of the Subscription Offer;

10.4 Shall not be obligated to take any legal action hereunder; if, however, Agent determines to take any

legal action hereunder, and where the taking of such action might, in Agent’s judgment, subject or expose it to any expense or liability, Agent shall not be required to act unless it shall have been furnished with an indemnity satisfactory to

it;

10.5 May rely on and shall be fully authorized and protected in acting or failing to act upon any certificate, instrument, opinion, notice, letter,

telegram, telex, facsimile transmission or other document or security delivered to Agent and believed by Agent to be genuine and to have been signed by the proper party or parties;

Page 7

10.6 Shall not be liable or responsible for any recital or statement contained in the Subscription Offer or any

other documents relating thereto;

10.7 Shall not be liable or responsible for any failure of the Company or any other party to comply with any of its

covenants and obligations relating to the Subscription Offer, including without limitation obligations under applicable securities laws;

10.8 Shall not

be liable to any holder of the Rights for any Additional Common Stock or dividends thereon or, if applicable, and any related unclaimed property that has been properly delivered to a public official pursuant to applicable abandoned property law;

10.9 May, from time to time, rely on written instructions provided by Company concerning the services provided hereunder. Further, Agent may apply to any

officer or other authorized person of Company for instruction, and may consult with legal counsel for Agent or Company with respect to any matter arising in connection with the services provided hereunder. Agent and its agents and subcontractors

shall not be liable and shall be indemnified by Company under Section 11.2 of this Agreement for any action taken or omitted by Agent in good faith reliance upon any Company instructions or upon the written advice or opinion of such counsel.

Agent shall not be held to have notice of any change of authority of any person, until receipt of written notice thereof from Company;

10.10 May rely on

and be fully authorized and protected in acting or failing to act upon (a) any guaranty of signature by an eligible guarantor institution that is a member or participant in the Securities Transfer Agents Medallion Program or other comparable

signature guarantee program or insurance program in addition to, or in substitution for, the foregoing; or (b) any law, act, regulation or any interpretation of the same even though such law, act, or regulation may thereafter have been altered,

changed, amended or repealed;

10.11 Either in connection with, or independent of the instruction term in Section 10.9, above, Agent may consult

counsel satisfactory to Agent (including internal counsel), and the advice of such counsel shall be full and complete authorization and protection in respect of any action taken, suffered or omitted by Agent hereunder in good faith and in reliance

upon the advice of such counsel;

10.12 May perform any of its duties hereunder either directly or by or through agents or attorneys; and

10.13 Is not authorized, and shall have no obligation, to pay any brokers, dealers, or soliciting fees to any person.

| 11. |

Representations, Warranties and Covenants. |

11.1 Agent. Agent represents and warrants to Company that:

| |

(a) |

Governance. Trust Company is a federally chartered trust company duly organized, validly existing, and

in good standing under the laws of the United States and Computershare is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and each has full power, authority and legal right to execute,

deliver and perform this Agreement; and |

| |

(b) |