Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of December 2023, January and February 2024

November 14 2023 - 8:00AM

Business Wire

Legg Mason Partners Fund Advisor, LLC announced today that

certain closed end funds have declared their distributions for the

months of December 2023, January and February 2024.

The following dates apply to the distribution schedule

below:

Month

Record Date

Ex-Dividend Date

Payable Date

December

12/21/2023

12/20/2023

12/29/2023

January

1/24/2024

1/23/2024

2/1/2024

February

2/22/2024

2/21/2024

3/1/2024

Ticker

Fund Name

Month

Amount

Type

Change from Previous

Distribution

WDI

Western Asset Diversified Income Fund

December

$0.14300

Income

$0.00300

January

$0.14300

Income

February

$0.14300

Income

HIX

Western Asset High Income Fund II Inc.

December

$0.04900

Income

-

January

$0.04900

Income

February

$0.04900

Income

HIO

Western Asset High Income Opportunity Fund

Inc.

December

$0.03550

Income

-

January

$0.03550

Income

February

$0.03550

Income

HYI

Western Asset High Yield Defined

Opportunity Fund Inc.

December

$0.09500

Income

-

January

$0.09500

Income

February

$0.09500

Income

EHI

Western Asset Global High Income Fund

Inc.

December

$0.06700

Income

-

January

$0.06700

Income

February

$0.06700

Income

GDO

Western Asset Global Corporate Defined

Opportunity Fund Inc.

December

$0.10200

Income

-

January

$0.10200

Income

February

$0.10200

Income

IGI

Western Asset Investment Grade Defined

Opportunity Trust Inc.

December

$0.06950

Income

$0.00100

January

$0.06950

Income

February

$0.06950

Income

DMO

Western Asset Mortgage Opportunity Fund

Inc.

December

$0.12000

Income

$0.00500

January

$0.12000

Income

February

$0.12000

Income

SBI

Western Asset Intermediate Muni Fund

Inc.

December

$0.03100

Income

$0.00750

January

$0.03100

Income

February

$0.03100

Income

MMU

Western Asset Managed Municipals Fund

Inc.

December

$0.04150

Income

$0.00500

January

$0.04150

Income

February

$0.04150

Income

MHF

Western Asset Municipal High Income Fund

Inc.

December

$0.02200

Income

$0.00120

January

$0.02200

Income

February

$0.02200

Income

This press release is not for tax reporting purposes but is

being provided to announce the amount of each Fund’s distributions

that have been declared by the Board of Directors. In early 2024

and 2025, after definitive information is available, each Fund will

send shareholders a Form 1099-DIV, if applicable, specifying how

the distributions paid by each Fund during the prior calendar year

should be characterized for purposes of reporting the distributions

on a shareholder’s tax return (e.g., ordinary income, long-term

capital gain or return of capital).

Legg Mason Partners Fund Advisor, LLC is an indirect,

wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin

Resources”).

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ website at

www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of the Funds’ complete audited financial statements are

available free of charge upon request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Funds.

The Funds’ common shares are traded on the New York Stock

Exchange. Similar to stocks, Fund share price will fluctuate with

market conditions and, at the time of sale, may be worth more or

less than the original investment. Shares of closed-end funds often

trade at a discount to their net asset value, and can increase an

investor’s risk of loss. All investments are subject to risk,

including the risk of loss.

INVESTMENT PRODUCTS: NOT FDIC INSURED | NO BANK GUARANTEE | MAY

LOSE VALUE

Category: Distribution Related

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114941448/en/

Investor Contact: Fund Investor Services

1-888-777-0102

Western Asset High Incom... (NYSE:HIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

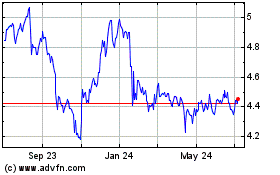

Western Asset High Incom... (NYSE:HIX)

Historical Stock Chart

From Nov 2023 to Nov 2024