Cash Flow Continued to be Positive in Fourth

Quarter

Strong Balance Sheet Drives Ongoing Capital

Investments to Position Company for Long Term Success

Warrior Met Coal, Inc. (NYSE:HCC) (“Warrior” or the “Company”)

today announced results for the fourth quarter and full-year 2020.

Warrior is the leading dedicated U.S. based producer and exporter

of high quality metallurgical (“met”) coal for the global steel

industry.

Warrior reported a fourth quarter 2020 net loss of $33.7

million, or $0.66 per diluted share, compared to net income of

$20.8 million, or $0.41 per diluted share, in the fourth quarter of

2019. Adjusted net loss for the fourth quarter of 2020 was $0.63

per diluted share compared to adjusted net income of $0.32 per

diluted share in the fourth quarter of 2019. The Company reported

Adjusted EBITDA of $9.2 million in the fourth quarter of 2020,

compared to Adjusted EBITDA of $45.0 million in the fourth quarter

of 2019.

“Despite the ongoing impact of COVID-19 on met coal demand and

pricing worldwide, we were pleased to be cash flow positive again

in the fourth quarter and nearly breakeven for the year,” commented

Walt Scheller, CEO of Warrior. “We are carefully managing operating

costs to address the significant short-term headwinds. At the same

time, we are purposefully making capital investments in our mining

operations that will benefit the Company into the future. We are

strongly capitalized and well-positioned to restart our growth

trajectory when the global economy returns to higher steel

production, met coal demand and pricing.”

Warrior reported full year 2020 net loss of $35.8 million and

adjusted net loss of $34.8 million, or net loss of $0.70 per

diluted share and adjusted net loss of $0.68 per diluted share,

compared to net income of $301.7 million and adjusted net income of

$288.6 million, or net income of $5.86 per diluted share and

adjusted net income of $5.61 per diluted share, in 2019. The

Company reported Adjusted EBITDA of $108.3 million for the full

year 2020 compared to $485.7 million in 2019.

Operating Results

The Company produced 1.8 million short tons of met coal in the

fourth quarter of 2020 compared to 1.8 million short tons in the

fourth quarter of 2019. For the full year of 2020, the Company

produced 7.9 million short tons, or a decrease of 7.2% compared to

2019. Sales volume in the fourth quarter of 2020 was 2.2 million

short tons compared to 1.7 million short tons in the fourth quarter

of 2019. Sales volumes for the full year 2020 were 7.4 million

short tons, or a decrease of 7.0% compared to 2019. Inventory

levels rose to 998 thousand short tons at the end of December 31,

2020 from the 749 thousand short tons at the end of 2019.

Additional Financial Results

Total revenues were $212.3 million for the fourth quarter of

2020, including $206.3 million in mining revenues, which consisted

of met coal sales of 2.2 million short tons at an average net

selling price of $93.54 per short ton, net of demurrage and other

charges. This compares to total revenues of $204.9 million in the

fourth quarter of 2019. During the quarter, global met coal markets

continued to be weak in response to slow steel demand and other

macroeconomic issues in the global economy. The average net selling

price of the Company's met coal declined from $119.67 per short ton

in the fourth quarter of 2019 to $93.54 per short ton in the fourth

quarter of 2020. Despite a pullback in met coal prices, the Company

sold its met coal in the fourth quarter of 2020 at 102% of the

quarterly Australian premium low-volatility hard coking coal

(“HCC”) Platts Premium LV FOB Australian Index (the "Platts Index”)

price.

Cost of sales for the fourth quarter of 2020 was $191.5 million

compared to $142.7 million for the fourth quarter of 2019. Cash

cost of sales (including mining, transportation and royalty costs)

for the fourth quarter of 2020 were $190.4 million, or 92.3% of

mining revenues, compared to $141.9 million, or 71.7% of mining

revenues in the same period of 2019. Cash cost of sales

(free-on-board port) per short ton increased slightly to $86.37 in

the fourth quarter of 2020 from $85.74 in the fourth quarter of

2019. The full year 2020 cash cost of sales per short ton was

$83.74, which represented our lowest annual cash cost per short ton

since going public. This reflects our low and variable cost

structure and a focus on cost control during periods of depressed

met coal prices.

Selling, general and administrative expenses for the fourth

quarter of 2020 were $7.8 million, or 3.7% of total revenues.

Depreciation and depletion costs for the fourth quarter of 2020

were $39.3 million, or 18.5% of total revenues. Warrior incurred

net interest expense of $8.5 million during the fourth quarter of

2020. Income tax benefit was $10.8 million in the fourth quarter of

2020 due to a loss before income taxes of $44.5 million and

additional marginal gas well credits.

Cash Flow and Liquidity

The Company generated positive cash flows from operating

activities in the fourth quarter of 2020 of $30.5 million, despite

a low met coal pricing environment, compared to $24.5 million in

the fourth quarter of 2019. Capital expenditures and mine

development costs for the fourth quarter of 2020 were $29.3

million, resulting in positive free cash flow of $1.2 million. Cash

flows used in financing activities for the fourth quarter of 2020

were $5.9 million, primarily due to payments of capital lease

obligations of $3.3 million, and the payment of dividends of $2.6

million.

The Company generated $112.6 million of cash flows from

operating activities for the full year 2020 compared to $532.8

million in 2019. Capital expenditures and mine development costs

for the full year 2020 were $114.6 million. Cash flows provided by

financing activities for the full year 2020 were $14.1 million,

primarily due to a net $40.0 million of borrowings under the ABL

Facility. This was offset by payments of dividends of $10.4 million

and payments on capital lease obligations of $14.2 million.

Net working capital, excluding cash, for the fourth quarter of

2020 decreased by $20.0 million from the third quarter of 2020,

primarily reflecting a decrease in inventory due to higher sales

volume. Net working capital, excluding cash, for the full year 2020

decreased by $19.0 million from the prior year, primarily

reflecting lower accounts receivable, the collection of an income

tax refund partially offset by an increase in inventories and

prepaid expenses and other receivables.

The Company’s total liquidity as of December 31, 2020 was $243.5

million, consisting of cash and cash equivalents of $211.9 million

and available liquidity under its ABL Facility of $31.6 million,

net of borrowings of $40.0 million and outstanding letters of

credit of $9.4 million.

Capital Allocation

On February 18, 2021, the board of directors declared a regular

quarterly cash dividend of $0.05 per share, totaling approximately

$2.6 million, which will be paid on March 8, 2021 to stockholders

of record as of the close of business on March 1, 2021.

Company Outlook

Due to ongoing uncertainty related to the COVID-19 pandemic, the

Chinese ban on Australian coal and other potentially disruptive

factors, Warrior will not be providing full year 2021 guidance at

this time. We expect to return to providing guidance once there is

further clarity on these issues. We continue to evaluate the impact

of COVID-19 and these other potentially disruptive factors on our

business, although we believe that it is premature to speculate on

when the economies of the countries in which our customers are

located will reopen on a sustained basis and lead to a return of

normalized demand for met coal.

We continue to appropriately adjust our operational needs,

including managing expenses, capital expenditures, working capital,

cash flows and liquidity. We have delayed the development of the

Blue Creek project until at least the summer of 2021. This decision

was not based on changes in the perceived value of the project, but

rather on our short-term focus of preserving cash and liquidity.

Our Stock Repurchase Program also remains temporarily

suspended.

Use of Non-GAAP Financial Measures

This release contains the use of certain non-GAAP financial

measures. These non-GAAP financial measures are provided as

supplemental information for financial measures prepared in

accordance with GAAP. Management believes that these non-GAAP

financial measures provide additional insights into the performance

of the Company, and they reflect how management analyzes Company

performance and compares that performance against other companies.

These non-GAAP financial measures may not be comparable to other

similarly titled measures used by other entities. The definition of

these non-GAAP financial measures and a reconciliation of non-GAAP

to GAAP financial measures is provided in the financial tables

section of this release.

Conference Call

The Company will hold a conference call to discuss its fourth

quarter 2020 results today, February 24, 2020, at 4:30 p.m. ET. To

listen to the event live or access an archived recording, please

visit http://investors.warriormetcoal.com/. Analysts and

investors who would like to participate in the conference call

should dial 1-844-340-9047 (domestic) or 1-412-858-5206

(international) 10 minutes prior to the start time and reference

the Warrior Met Coal conference call. Telephone playback will also

be available from 6:30 p.m. ET February 24, 2020 until 6:30 p.m. ET

on March 5, 2020. The replay will be available by calling:

1-877-344-7529 (domestic) or 1-412-317-0088 (international) and

entering passcode 10150383.

About Warrior

Warrior is a U.S.-based, environmentally and socially minded

supplier to the global steel industry. It is dedicated entirely to

mining non-thermal met coal used as a critical component of steel

production by metal manufacturers in Europe, South America and

Asia. Warrior is a large-scale, low-cost producer and exporter of

premium met coal, also known as hard-coking coal (HCC), operating

highly efficient longwall operations in its underground mines based

in Alabama. The HCC that Warrior produces from the Blue Creek coal

seam contains very low sulfur, has strong coking properties and is

of a similar quality to coal referred to as the premium HCC

produced in Australia. The premium nature of Warrior’s HCC makes it

ideally suited as a base feed coal for steel makers and results in

price realizations near the Platts Index price. For more

information, please visit www.warriormetcoal.com.

Forward-Looking Statements

This press release contains, and the Company’s officers and

representatives may from time to time make, forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical facts, included in this press release that address

activities, events or developments that the Company expects,

believes or anticipates will or may occur in the future are

forward-looking statements, including statements regarding 2020

guidance, the impact of COVID-19 on its business and that of its

customers, sales and production growth, ability to maintain cost

structure, demand, the future direction of prices, expected capital

expenditures, future effective income tax rates and payment of cash

taxes, if any. The words “believe,” “expect,” “anticipate,” “plan,”

“intend,” “estimate,” “project,” “target,” “foresee,” “should,”

“would,” “could,” “potential,” or “outlook,” “guidance” or other

similar expressions are intended to identify forward-looking

statements. However, the absence of these words does not mean that

the statements are not forward-looking. These forward-looking

statements represent management’s good faith expectations,

projections, guidance or beliefs concerning future events, and it

is possible that the results described in this press release will

not be achieved. These forward-looking statements are subject to

risks, uncertainties and other factors, many of which are outside

of the Company’s control, that could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including, without limitation, fluctuations or changes

in the pricing or demand for the Company’s coal (or met coal

generally) by the global steel industry; the impact of COVID-19 on

its business and that of its customers, including the risk of a

decline in demand for the Company's met coal due to the impact of

COVID-19 on steel manufacturers, the inability of the Company to

effectively operate its mines and the resulting decrease in

production, the inability of the Company to ship its products to

customers in the case of a partial or complete shut-down of the

Port of Mobile; federal and state tax legislation; changes in

interpretation or assumptions and/or updated regulatory guidance

regarding the Tax Cuts and Jobs Act of 2017; legislation and

regulations relating to the Clean Air Act and other environmental

initiatives; regulatory requirements associated with federal, state

and local regulatory agencies, and such agencies’ authority to

order temporary or permanent closure of the Company’s mines;

operational, logistical, geological, permit, license, labor and

weather-related factors, including equipment, permitting, site

access, operational risks and new technologies related to mining;

the timing and impact of planned longwall moves; the Company’s

obligations surrounding reclamation and mine closure; inaccuracies

in the Company’s estimates of its met coal reserves; any

projections or estimates regarding Blue Creek, including the

expected returns from this project, if any, and the ability of Blue

Creek to enhance the Company's portfolio of assets, the Company's

expectations regarding its future tax rate as well as its ability

to effectively utilize its NOLs to reduce or eliminate its cash

taxes; the Company's ability to develop Blue Creek; the Company’s

ability to develop or acquire met coal reserves in an economically

feasible manner; significant cost increases and fluctuations, and

delay in the delivery of raw materials, mining equipment and

purchased components; competition and foreign currency

fluctuations; fluctuations in the amount of cash the Company

generates from operations, including cash necessary to pay any

special or quarterly dividend; the Company’s ability to comply with

covenants in its ABL Facility or indenture relating to its senior

secured notes; integration of businesses that the Company may

acquire in the future; adequate liquidity and the cost,

availability and access to capital and financial markets; failure

to obtain or renew surety bonds on acceptable terms, which could

affect the Company’s ability to secure reclamation and coal lease

obligations; costs associated with litigation, including claims not

yet asserted; and other factors described in the Company’s Form

10-K for the year ended December 31, 2020 and other reports filed

from time to time with the Securities and Exchange Commission (the

“SEC”), which could cause the Company’s actual results to differ

materially from those contained in any forward-looking statement.

The Company’s filings with the SEC are available on its website at

www.warriormetcoal.com and on the SEC's website at www.sec.gov.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, the Company does

not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. New factors emerge from time to time,

and it is not possible for the Company to predict all such

factors.

WARRIOR MET COAL, INC.

CONDENSED STATEMENTS OF

OPERATIONS

($ in thousands, except per

share)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

Revenues:

Sales

$

206,261

$

198,048

$

761,871

$

1,235,998

Other revenues

5,992

6,853

20,867

32,311

Total revenues

212,253

204,901

782,738

1,268,309

Costs and expenses:

Cost of sales (exclusive of items shown

separately below)

191,509

142,707

625,170

720,745

Cost of other revenues (exclusive of items

shown separately below)

11,469

6,481

33,736

29,828

Depreciation and depletion

39,279

23,678

118,092

97,330

Selling, general and administrative

7,774

7,964

32,879

37,014

Total costs and expenses

250,031

180,830

809,877

884,917

Operating (loss) income

(37,778

)

24,071

(27,139

)

383,392

Interest expense, net

(8,463

)

(6,542

)

(32,310

)

(29,335

)

Loss on early extinguishment of debt

—

—

—

(9,756

)

Other income

1,722

—

3,544

22,815

(Loss) income before income tax (benefit)

expense

(44,519

)

17,529

(55,905

)

367,116

Income tax (benefit) expense

(10,808

)

(3,222

)

(20,144

)

65,417

Net (loss) income

$

(33,711

)

$

20,751

$

(35,761

)

$

301,699

Basic and diluted net (loss) income per

share:

Net (loss) income per share—basic

$

(0.66

)

$

0.41

$

(0.70

)

$

5.87

Net (loss) income per share—diluted

$

(0.66

)

$

0.41

$

(0.70

)

$

5.86

Weighted average number of shares

outstanding—basic

51,190

51,051

51,168

51,363

Weighted average number of shares

outstanding—diluted

51,190

51,201

51,168

51,493

Dividends per share:

$

0.05

$

0.05

$

0.20

$

4.61

WARRIOR MET COAL, INC.

QUARTERLY SUPPLEMENTAL

FINANCIAL DATA AND

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

QUARTERLY SUPPLEMENTAL FINANCIAL

DATA:

For the three months ended

December 31,

For the twelve months ended

December 31,

(short tons in thousands)(1)

2020

2019

2020

2019

Tons sold

2,205

1,655

7,424

7,980

Tons produced

1,760

1,813

7,862

8,470

Gross price realization (2)

102

%

97

%

96

%

98

%

Average net selling price

$

93.54

$

119.67

$

102.62

$

154.89

Cash cost of sales (free on board port)

per short ton (3)

$

86.37

$

85.74

$

83.74

$

89.95

(1) 1 short ton is equivalent to 0.907185

metric tons.

(2) For the three and twelve months ended

December 31, 2020 and 2019, our gross price realization represents

a volume weighted-average calculation of our daily realized price

per ton based on gross sales, which excludes demurrage and other

charges, as a percentage of the Platts Index.

RECONCILIATION OF CASH COST OF SALES

(FREE-ON-BOARD PORT) TO COST OF SALES REPORTED UNDER U.S.

GAAP:

(in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

Cost of sales

191,509

142,707

625,170

720,745

Asset retirement obligation accretion and

valuation adjustments

(596

)

(399

)

(1,702

)

(1,519

)

Stock compensation expense

(477

)

(405

)

(1,789

)

(1,405

)

Cash cost of sales (free-on-board

port)(3)

$

190,436

$

141,903

$

621,679

$

717,821

(3) Cash cost of sales (free-on-board

port) is based on reported cost of sales and includes items such as

freight, royalties, labor, fuel and other similar production and

sales cost items, and may be adjusted for other items that,

pursuant to GAAP, are classified in the Condensed Statements of

Operations as costs other than cost of sales, but relate directly

to the costs incurred to produce met coal. Our cash cost of sales

per short ton is calculated as cash cost of sales divided by the

short tons sold. Cash cost of sales per short ton is a non-GAAP

financial measure which is not calculated in conformity with U.S.

GAAP and should be considered supplemental to, and not as a

substitute or superior to financial measures calculated in

conformity with GAAP. We believe cash cost of sales per ton is a

useful measure of performance and we believe it aids some investors

and analysts in comparing us against other companies to help

analyze our current and future potential performance. Cash cost of

sales per ton may not be comparable to similarly titled measures

used by other companies.

WARRIOR MET COAL, INC.

QUARTERLY SUPPLEMENTAL

FINANCIAL DATA AND RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(CONTINUED)

RECONCILIATION OF ADJUSTED EBITDA TO

AMOUNTS REPORTED UNDER U.S. GAAP:

For the three months ended

December 31,

For the twelve months ended

December 31,

(in thousands)

2020

2019

2020

2019

Net (loss) income

$(33,711

)

$

20,751

$

(35,761

)

$

301,699

Interest expense, net

8,463

6,542

32,310

29,335

Income tax (benefit) expense

(10,808

)

(3,222

)

(20,144

)

65,417

Depreciation and depletion

39,279

23,678

118,092

97,330

Asset retirement obligation accretion and

valuation adjustments

433

(10,327

)

2,631

(7,891

)

Stock compensation expense

1,968

1,602

7,602

5,820

Other non-cash accretion and valuation

adjustments

4,955

5,970

6,014

7,042

Loss on early extinguishment of debt

—

—

—

9,756

Other income and expenses

(1,429

)

—

(2,468

)

(22,815

)

Adjusted EBITDA (4)

$

9,150

$

44,994

$

108,276

$

485,693

Adjusted EBITDA margin (5)

4.3

%

22.0

%

13.8

%

38.3

%

(4) Adjusted EBITDA is defined as net

(loss) income before net interest expense, income tax (benefit)

expense, depreciation and depletion, non-cash asset retirement

obligation accretion and valuation adjustments, non-cash stock

compensation expense, other non-cash accretion and valuation

adjustments, loss on early extinguishment of debt and other income

and expenses. Adjusted EBITDA is not a measure of financial

performance in accordance with GAAP, and we believe items excluded

from Adjusted EBITDA are significant to a reader in understanding

and assessing our financial condition. Therefore, Adjusted EBITDA

should not be considered in isolation, nor as an alternative to net

(loss) income, (loss) income from operations, cash flows from

operations or as a measure of our profitability, liquidity or

performance under GAAP. We believe that Adjusted EBITDA presents a

useful measure of our ability to incur and service debt based on

ongoing operations. Furthermore, analogous measures are used by

industry analysts to evaluate our operating performance. Investors

should be aware that our presentation of Adjusted EBITDA may not be

comparable to similarly titled measures used by other

companies.

(5) Adjusted EBITDA margin is defined as

Adjusted EBITDA divided by total revenues.

RECONCILIATION OF ADJUSTED NET INCOME

(LOSS) TO AMOUNTS REPORTED UNDER U.S. GAAP:

(in thousands, except per share

amounts)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

Net (loss) income

$

(33,711

)

$

20,751

$

(35,761

)

$

301,699

Asset retirement obligation valuation

adjustments, net of tax

(238

)

(9,089

)

(238

)

(9,089

)

Other non-cash valuation adjustments, net

of tax

2,944

4,613

2,944

4,613

Loss on early extinguishment of debt, net

of tax

—

—

—

9,756

Other income and expenses, net of tax

(1,026

)

—

(1,772

)

(18,331

)

Adjusted net (loss) income(6)

$

(32,031

)

$

16,275

$

(34,827

)

$

288,648

Weighted average number of basic shares

outstanding

51,190

51,051

51,168

51,363

Weighted average number of diluted shares

outstanding

51,190

51,201

51,168

51,493

Adjusted basic net (loss) income per

share:

$

(0.63

)

$

0.32

$

(0.68

)

$

5.62

Adjusted diluted net (loss) income per

share:

$

(0.63

)

$

0.32

$

(0.68

)

$

5.61

(6) Adjusted net (loss) income is defined

as net (loss) income net of asset retirement obligation valuation

adjustment, other non-cash valuation adjustments, loss on early

extinguishment of debt and other income and expenses, net of tax

(based on each respective period's effective tax rate). Adjusted

net (loss) income is not a measure of financial performance in

accordance with GAAP, and we believe items excluded from adjusted

net (loss) income are significant to the reader in understanding

and assessing our results of operations. Therefore, adjusted net

(loss) income should not be considered in isolation, nor as an

alternative to net (loss) income under GAAP. We believe adjusted

net (loss) income is a useful measure of performance and we believe

it aids some investors and analysts in comparing us against other

companies to help analyze our current and future potential

performance. Adjusted net (loss) income may not be comparable to

similarly titled measures used by other companies.

WARRIOR MET COAL, INC.

CONDENSED STATEMENTS OF CASH

FLOWS

($ in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

OPERATING ACTIVITIES:

Net (loss) income

$

(33,711

)

$

20,751

$

(35,761

)

$

301,699

Non-cash adjustments to reconcile net

(loss) income to net cash provided by operating activities

31,294

15,220

109,796

174,859

Changes in operating assets and

liabilities:

Trade accounts receivable

(1,881

)

9,774

16,173

38,928

Income tax receivable

—

375

24,274

21,795

Inventories

30,422

(10,203

)

(13,465

)

(30,491

)

Prepaid expenses and other receivables

(13,468

)

(3,216

)

(19,374

)

3,864

Accounts payable

4,192

(5,340

)

15,361

13,409

Accrued expenses and other current

liabilities

763

(17,962

)

(3,936

)

(17,317

)

Other

12,862

15,150

19,558

26,068

Net cash provided by operating

activities

30,473

24,549

112,626

532,814

INVESTING ACTIVITIES:

Purchases of property, plant, and

equipment, and other

(15,429

)

(28,912

)

(87,488

)

(107,278

)

Mine development costs

(13,836

)

(4,994

)

(27,093

)

(23,392

)

Proceeds from sale of property, plant and

equipment and other

159

3

159

3,127

Other

—

—

6,233

(6,670

)

Net cash used in investing activities

(29,106

)

(33,903

)

(108,189

)

(134,213

)

FINANCING ACTIVITIES:

Net cash (used in) provided by financing

activities

(5,864

)

(6,766

)

14,096

(411,623

)

Net (decrease) increase in cash and cash

equivalents and restricted cash

(4,497

)

(16,120

)

18,533

(13,022

)

Cash and cash equivalents and restricted

cash at beginning of period

216,413

209,503

193,383

206,405

Cash and cash equivalents and restricted

cash at end of period

$

211,916

$

193,383

$

211,916

$

193,383

RECONCILIATION OF FREE CASH FLOW TO

AMOUNTS REPORTED UNDER U.S. GAAP:

(in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

Net cash provided by operating

activities

$

30,473

$

24,549

$

112,626

$

532,814

Purchases of property, plant and equipment

and mine development costs

(29,265

)

(33,906

)

(114,581

)

(130,670

)

Free cash flow (7)

$

1,208

$

(9,357

)

$

(1,955

)

$

402,144

Free cash flow conversion (8)

13.2

%

(20.8

)%

(1.8

)%

82.8

%

(7) Free cash flow is defined as net cash

provided by operating activities less purchases of property, plant

and equipment and mine development costs. Free cash flow is not a

measure of financial performance in accordance with GAAP, and we

believe items excluded from net cash provided by operating

activities are significant to the reader in understanding and

assessing our results of operations. Therefore, free cash flow

should not be considered in isolation, nor as an alternative to net

cash provided by operating activities under GAAP. We believe free

cash flow is a useful measure of performance and we believe it aids

some investors and analysts in comparing us against other companies

to help analyze our current and future potential performance. Free

cash flow may not be comparable to similarly titled measures used

by other companies.

(8) Free cash flow conversion is defined

as free cash flow divided by Adjusted EBITDA.

WARRIOR MET COAL, INC.

CONDENSED BALANCE

SHEETS

($ in thousands)

December 31,

2020

December 31,

2019

ASSETS

Current assets:

Cash and cash equivalents

$

211,916

$

193,383

Short-term investments

8,504

14,675

Trade accounts receivable

83,298

99,471

Income tax receivable

—

12,925

Inventories, net

118,713

97,901

Prepaid expenses and other receivables

45,052

25,691

Total current assets

467,483

444,046

Mineral interests, net

100,855

110,130

Property, plant and equipment, net

637,108

606,200

Non-current income tax receivable

—

11,349

Deferred income taxes

174,372

154,297

Other long-term assets

14,118

18,242

Total assets

$

1,393,936

$

1,344,264

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

59,110

$

46,436

Accrued expenses

86,108

65,755

Short term financing lease liabilities

14,385

10,146

Other current liabilities

10,715

6,615

Total current liabilities

170,318

128,952

Long-term debt

379,908

339,189

Asset retirement obligations

57,553

53,583

Long term financing lease liabilities

24,091

25,528

Other long-term liabilities

36,825

31,430

Total liabilities

668,695

578,682

Stockholders’ Equity:

Common stock, $0.01 par value per share

(Authorized -140,000,000 shares, 53,408,040 issued and 51,186,199

outstanding as of December 31, 2020 and 53,293,449 issued and

51,071,608 outstanding as of December 31, 2019)

534

533

Preferred stock, $0.01 par value per share

(10,000,000 shares authorized, no shares issued and

outstanding)

—

—

Treasury stock, at cost (2,221,841 shares

as of December 31, 2020 and December 31, 2019)

(50,576

)

(50,576

)

Additional paid in capital

249,746

243,932

Retained earnings

525,537

571,693

Total stockholders’ equity

725,241

765,582

Total liabilities and stockholders’

equity

$

1,393,936

$

1,344,264

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210224005845/en/

For Investors: Dale W. Boyles, 205-554-6129

dale.boyles@warriormetcoal.com

For Media: D'Andre Wright, 205-554-6131

dandre.wright@warriormetcoal.com

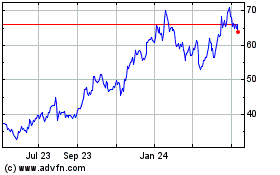

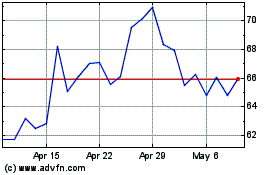

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Jul 2023 to Jul 2024