|

|

|

|

|

Summary Prospectus November 1, 2013

|

|

|

JPMorgan SmartRetirement

®

Blend 2030 Fund

Class/Ticker: R5/JRBBX R6/JRBYX

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the

Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information, online at www.jpmorganfunds.com/funddocuments. You can also get this information at no cost by calling 1-800-480-4111 or by sending an

e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund. The Fund’s Prospectus and Statement of Additional Information, both dated November 1, 2013, are

incorporated by reference into this Summary Prospectus.

What is the goal of the Fund?

The Fund seeks high total return with a shift to current income and some capital appreciation over time as the Fund approaches and passes the target retirement date.

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(Expenses that you pay each year as a percentage of the value

of your investment)

|

|

|

|

|

Class R5

|

|

|

Class R6

|

|

|

Management Fees

|

|

|

0.30

|

%

|

|

|

0.30

|

%

|

|

Distribution (Rule

12b-1)

Fees

|

|

|

NONE

|

|

|

|

NONE

|

|

|

Other Expenses

|

|

|

5.15

|

|

|

|

2.55

|

|

|

Shareholder Service Fees

|

|

|

0.05

|

|

|

|

NONE

|

|

|

Remainder of Other Expenses

|

|

|

5.10

|

|

|

|

2.55

|

|

|

Acquired Fund Fees and Expenses (Underlying Fund)

|

|

|

0.43

|

|

|

|

0.43

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

5.88

|

|

|

|

3.28

|

|

|

Fee Waivers and/or Expense Reimbursements

1

|

|

|

(5.38

|

)

|

|

|

(2.83

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursements

1

|

|

|

0.50

|

|

|

|

0.45

|

|

|

1

|

The Fund’s adviser, administrator and distributor (the Service Providers) have contractually agreed to waive fees and/or reimburse expenses to the extent Total Annual

Fund Operating Expenses (excluding (1) dividend expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary expenses and expenses related to the Board of Trustees’ deferred

compensation plan incurred by the Fund and any underlying fund and (2) Acquired Fund Fees incurred by an underlying fund) exceed 0.50% and 0.45% of the average daily net assets of Class R5 and Class R6 Shares, respectively. This contract cannot be

terminated prior to 11/1/14 at which time the Service Providers will determine whether or not to renew or revise it.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods

indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses are equal to the total annual fund operating expenses after fee waivers and expense reimbursements shown in the fee table

through 10/31/14 and total annual fund operating expenses thereafter. Your actual costs may be higher or lower.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHETHER OR NOT YOU SELL YOUR SHARES, YOUR

COST WOULD BE:

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

CLASS R5 SHARES ($)

|

|

|

51

|

|

|

|

1,269

|

|

|

|

2,466

|

|

|

|

5,367

|

|

|

CLASS R6 SHARES ($)

|

|

|

46

|

|

|

|

744

|

|

|

|

1,466

|

|

|

|

3,382

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and

may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal period

(July 2, 2012 through June 30, 2013), the Fund’s portfolio turnover rate was 30% of the average value of its portfolio.

1

What are the Fund’s main investment strategies?

The JPMorgan SmartRetirement Blend 2030 Fund is a “fund of funds” that invests in other J.P. Morgan Funds and exchange traded funds (ETFs) that are

managed by unaffiliated investment advisers (unaffiliated ETFs) (collectively with the J.P. Morgan Funds, the underlying funds) and are generally intended for investors expecting to retire around the year 2030 (the target retirement year).

“Blend” in the Fund’s name means that the Fund’s adviser, J.P. Morgan Investment Management Inc. (JPMIM or the Adviser) uses underlying funds and strategies that attempt

to replicate performance of various indexes as well as actively-managed underlying funds and strategies.

The Fund is designed to provide exposure to a variety of asset classes through investments in underlying funds, and over time the Fund’s asset allocation strategy will change. The “glide path”

depicted in the chart below shows how the Fund’s strategic target allocations among asset classes and types of underlying funds generally become more conservative as it nears the target retirement year (i.e., more emphasis on fixed income funds

and less on equity funds). The table accompanying the picture is simply the glide path in tabular form.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Target Allocation

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years to Target Retirement Date

|

|

40+

|

|

|

35

|

|

|

30

|

|

|

25

|

|

|

20

|

|

|

15

|

|

|

10

|

|

|

5

|

|

|

0

|

|

|

-5

|

|

|

-10

|

|

|

Equity

|

|

|

85.0

|

%

|

|

|

85.0

|

%

|

|

|

85.0

|

%

|

|

|

85.0

|

%

|

|

|

77.5

|

%

|

|

|

70.0

|

%

|

|

|

60.0

|

%

|

|

|

49.5

|

%

|

|

|

31.5

|

%

|

|

|

31.5

|

%

|

|

|

31.5

|

%

|

|

U.S. Large Cap Equity

|

|

|

41.0

|

%

|

|

|

41.0

|

%

|

|

|

41.0

|

%

|

|

|

41.0

|

%

|

|

|

37.3

|

%

|

|

|

33.5

|

%

|

|

|

28.8

|

%

|

|

|

24.0

|

%

|

|

|

16.0

|

%

|

|

|

16.0

|

%

|

|

|

16.0

|

%

|

|

U.S. Small/Mid Cap Equity

|

|

|

9.5

|

%

|

|

|

9.5

|

%

|

|

|

9.5

|

%

|

|

|

9.5

|

%

|

|

|

8.8

|

%

|

|

|

8.0

|

%

|

|

|

6.8

|

%

|

|

|

5.5

|

%

|

|

|

3.5

|

%

|

|

|

3.5

|

%

|

|

|

3.5

|

%

|

|

REITs

|

|

|

6.0

|

%

|

|

|

6.0

|

%

|

|

|

6.0

|

%

|

|

|

6.0

|

%

|

|

|

5.5

|

%

|

|

|

5.0

|

%

|

|

|

4.5

|

%

|

|

|

4.0

|

%

|

|

|

2.5

|

%

|

|

|

2.5

|

%

|

|

|

2.5

|

%

|

|

International Equity

|

|

|

18.5

|

%

|

|

|

18.5

|

%

|

|

|

18.5

|

%

|

|

|

18.5

|

%

|

|

|

16.8

|

%

|

|

|

15.0

|

%

|

|

|

12.8

|

%

|

|

|

10.5

|

%

|

|

|

7.0

|

%

|

|

|

7.0

|

%

|

|

|

7.0

|

%

|

|

Emerging Markets Equity

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

9.3

|

%

|

|

|

8.5

|

%

|

|

|

7.3

|

%

|

|

|

5.5

|

%

|

|

|

2.5

|

%

|

|

|

2.5

|

%

|

|

|

2.5

|

%

|

|

Commodities & Global Natural Resources

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

1.0

|

%

|

|

|

3.0

|

%

|

|

|

3.0

|

%

|

|

|

3.0

|

%

|

|

Commodities

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.5

|

%

|

|

|

1.5

|

%

|

|

|

1.5

|

%

|

|

|

1.5

|

%

|

|

Global Natural Resources

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.5

|

%

|

|

|

1.5

|

%

|

|

|

1.5

|

%

|

|

|

1.5

|

%

|

|

Fixed Income

|

|

|

15.0

|

%

|

|

|

15.0

|

%

|

|

|

15.0

|

%

|

|

|

15.0

|

%

|

|

|

22.5

|

%

|

|

|

30.0

|

%

|

|

|

40.0

|

%

|

|

|

49.5

|

%

|

|

|

55.5

|

%

|

|

|

55.5

|

%

|

|

|

55.5

|

%

|

|

U.S. Fixed Income

|

|

|

9.0

|

%

|

|

|

9.0

|

%

|

|

|

9.0

|

%

|

|

|

9.0

|

%

|

|

|

15.5

|

%

|

|

|

22.0

|

%

|

|

|

31.0

|

%

|

|

|

35.5

|

%

|

|

|

33.5

|

%

|

|

|

33.5

|

%

|

|

|

33.5

|

%

|

|

Inflation Managed

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

3.0

|

%

|

|

|

7.5

|

%

|

|

|

7.5

|

%

|

|

|

7.5

|

%

|

|

High Yield

|

|

|

4.0

|

%

|

|

|

4.0

|

%

|

|

|

4.0

|

%

|

|

|

4.0

|

%

|

|

|

4.5

|

%

|

|

|

5.0

|

%

|

|

|

5.5

|

%

|

|

|

7.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

Emerging Markets Debt

|

|

|

2.0

|

%

|

|

|

2.0

|

%

|

|

|

2.0

|

%

|

|

|

2.0

|

%

|

|

|

2.5

|

%

|

|

|

3.0

|

%

|

|

|

3.5

|

%

|

|

|

4.0

|

%

|

|

|

4.5

|

%

|

|

|

4.5

|

%

|

|

|

4.5

|

%

|

|

Money Market/Cash and Cash Equivalents

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

Money Market/Cash and Cash Equivalents

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

0.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

|

|

10.0

|

%

|

Note: Above allocations may not sum to 100% due to rounding.

|

|

1

|

As of the date of this prospectus, the Fund utilizes underlying funds to implement its strategic target allocations although the Fund also has flexibility to utilize

direct investments in securities and derivatives to implement its strategic target allocations in the future.

|

2

The glide path shows the Fund’s long term strategic target allocations. The Fund’s actual

allocations may differ due to tactical allocations. The Adviser will use tactical allocations to take advantage of short to intermediate term opportunities through a combination of positions in underlying funds and direct investments, including

derivatives.

As a result of tactical allocations, the Fund may deviate from the strategic target allocations at any given time by up to

+/- 15%

for equity and fixed income,

+/-

20% for money market/cash and cash equivalents and +/- 5% for commodities and global natural resources. These ranges apply to

both the asset classes and types of underlying funds. Updated information concerning the Fund’s actual allocations to underlying funds and investments is available in the Fund’s shareholder reports and on the Fund’s website from time

to time.

The Adviser will review the Fund’s strategic target allocations shown in the glide path on at least an annual basis and may make

changes when it believes it is beneficial to the Fund, including, but not limited to, adding new asset classes, removing asset classes, changing the asset class allocations, changing the types of underlying funds or underlying fund allocations or

maintaining the strategic target allocations for longer or shorter periods of time. In allocating the Fund’s assets between actively-managed underlying funds and underlying funds that are designed to replicate an index (index funds), the

Adviser generally uses index funds for asset classes that are widely regarded as operating in efficient markets. In establishing the Fund’s strategic target allocations, the Adviser focuses on asset classes and underlying funds that the

Adviser believes would outperform the Fund’s benchmarks and peer group over the long term. The Adviser will also review its tactical decisions on a periodic basis and may make modifications in its discretion.

The Fund is a “to” target date fund. This means that the Fund intends to reach its most conservative strategic target allocations by the end of the

year of the target retirement date. When the strategic target allocations of the Fund are substantially the same as those of the JPMorgan SmartRetirement Blend Income Fund, the Fund may be merged into the JPMorgan SmartRetirement Blend Income Fund

at the discretion of the Fund’s Board of Trustees.

In addition to investing in underlying funds, the Fund may invest directly in securities

and other financial instruments, including derivatives. Such investments will be allocated to the appropriate asset class. Derivatives are instruments that have a value based on another instrument, exchange rate or index. The Fund may use

derivatives such as futures contracts to gain exposure to, or to overweight or underweight its investments among, various sectors or markets. The Fund may also use exchange traded futures for cash management and to gain market exposure pending

investment in underlying funds.

The Adviser may hire sub-advisers to manage any of the asset classes described above and to make direct

investments in securities and other financial instruments. When using

sub-advisers

to manage the Fund’s assets, the Adviser, subject to certain conditions and oversight by the Fund’s Board of

Trustees, will have the right to hire, terminate, or replace sub-advisers without shareholder approval.

The Fund’s Main Investment Risks

The Fund is subject to management risk and may not achieve its objective if the Adviser’s expectations regarding particular securities

or markets are not met. The Fund is exposed to the risks summarized below through both its direct investments and investments in underlying funds.

An investment in this Fund or any other fund may not provide a complete investment program. The suitability

of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial

goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Investment

Risk.

The Fund is not a complete retirement program and there is no guarantee that the Fund will provide sufficient retirement income to an investor. Meeting your retirement goals is dependent upon many factors including the amount you

save and the period over which you do so. You should consider your expected retirement date, individual retirement needs (i.e., how much money you expect to need), other expected income after retirement, inflation, other assets, and risk tolerance

in choosing whether to invest in the Fund. Your risk tolerance may change over time and the Adviser may change the Fund’s strategic target allocation model. It is important that you

re-evaluate

your

investment in the Fund periodically.

Investment Company and ETF Risk.

The Fund invests in other J.P. Morgan Funds and unaffiliated

ETFs as a primary strategy, so the Fund’s investment performance and risks are directly related to the performance and risks of the underlying funds. Shareholders will indirectly bear the expenses charged by the underlying funds. Because the

Fund’s Adviser or its affiliates provide services to and receive fees from certain of the underlying funds, the Fund’s investments in the underlying funds benefit the Adviser and/or its affiliates. In addition, the Fund may hold a

significant percentage of the shares of an underlying fund. As a result, the Fund’s investments in an underlying fund may create a conflict of interest. Certain ETFs and other underlying funds may not be actively managed. Securities may be

purchased, held

3

and sold by such funds when an actively managed fund would not do so. ETFs may trade at a price below their net asset value (also known as a discount).

Tactical Allocation Risk.

The Adviser has discretion to make short to intermediate term tactical allocations that increase or decrease the

exposure to asset classes and investments shown in the glide path. The Fund’s tactical allocation strategy may not be successful in adding value, may increase losses to the Fund and/or cause the Fund to have a risk profile different than

that portrayed in the glide path from time to time.

Index Strategy Risk.

The Fund uses index funds and other strategies that are not

actively managed and are designed to track the performance and holdings of a specified index. Securities may be purchased, held and sold by an index fund or as part of an indexing strategy at times when an actively managed fund would not do so.

There is also the risk that the underlying fund’s or strategy’s performance may not correlate with the performance of the index.

Equity Securities Risk.

Investments in equity securities (such as stocks) that are more volatile and carry more risks than some other forms of

investment. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting

individual companies, sectors or industries selected for the underlying fund’s portfolio or the securities market as a whole, such as changes in economic or political conditions. When the value of the underlying fund’s securities goes

down, the Fund’s investment in the underlying fund decreases in value.

General Market Risk.

Economies and financial markets

throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions.

Foreign Securities and Emerging Markets Risk.

Underlying funds that invest in foreign currencies and foreign issuers are subject to additional risks,

including political and economic risks, greater volatility, civil conflicts and war, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, expropriation and nationalization risks, and less

stringent investor protection and disclosure standards of foreign markets. In certain markets where securities and other instruments are not traded “delivery versus payment,” an underlying fund may not receive timely payment for

securities or other instruments it has delivered and may be subject to increased risk that the counterparty will fail to make payments when due or default completely. Events and evolving

conditions in certain economies or markets may alter the risks associated with investments tied to countries or regions that historically were perceived as comparatively stable becoming riskier

and more volatile. These risks are magnified in countries in “emerging markets.”

Income Securities Risk.

Investments in income

securities that will change in value based on changes in interest rates and are subject to the risk that a counterparty will fail to make payments when due or default. If rates rise, the value of these investments drops. Certain underlying funds

invest in variable and floating rate loan assignments and participations (Loans) and other variable and floating rate securities. Although these instruments are generally less sensitive to interest rate changes than other fixed rate instruments, the

value of floating rate Loans and other securities may decline if their interest rates do not rise as quickly, or as much, as general interest rates. Given the historically low interest rate environment, risks associated with rising rates are

heightened. Certain underlying funds invest in mortgage-related and asset-backed securities including

so-called

“sub-prime” mortgages that are subject to certain other risks including prepayment and

call risks. When mortgages and other obligations are prepaid and when securities are called, an underlying fund may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with

higher interest rates, resulting in an unexpected capital loss and/or a decrease in the amount of dividends and yield. Mortgage-related and asset-backed securities may: decline in value, face valuation difficulties, be more volatile and/or be

illiquid. The risk of default for “sub-prime” mortgages is generally higher than other types of mortgage-backed securities. The structure of some of these securities may be complex and there may be less available information than other

types of debt securities. Some of the underlying funds invest in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities (such as the Government National Mortgage Association (Ginnie Mae), the Federal National

Mortgage Association (Fannie Mae) or the Federal Home Loan Mortgage Corporation (Freddie Mac)). Securities, such as those issued or guaranteed by Ginnie Mae or the U.S. Treasury, that are backed by the full faith and credit of the United States are

guaranteed only as to the timely payment of interest and principal when held to maturity. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of

principal and interest. Securities issued by U.S. government-related organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. government and no assurance can be given that the U.S. government will

provide financial support.

4

High Yield Securities Risk.

Some of the underlying funds invest in securities and instruments that are

issued by companies that are highly leveraged, less creditworthy or financially distressed. These investments (known as junk bonds) are considered to be speculative and are subject to greater risk of loss, greater sensitivity to economic changes,

valuation difficulties, and potential illiquidity.

Real Estate Securities Risk.

The Fund may be exposed through its direct investments or

investments in underlying funds to real estate securities, including real estate investment trusts (REITs). These securities are subject to the same risks as direct investments in real estate and mortgages, which include, but are not limited to,

sensitivity to changes in real estate values and property taxes, interest rate risk, tax and regulatory risk, fluctuations in rent schedules and operating expenses, adverse changes in local, regional or general economic conditions, deterioration of

the real estate market and the financial circumstances of tenants and sellers, unfavorable changes in zoning, building, environmental and other laws, the need for unanticipated renovations, unexpected increases in the cost of energy and

environmental factors. In addition, investments in REITS are subject to risks associated with management skill and creditworthiness of the issuer and underlying funds will indirectly bear their proportionate share of expenses, including management

fees, paid by each REIT in which they invest in addition to the expenses of the underlying funds. Certain underlying funds are highly concentrated in real estate securities, including REITs.

Smaller Companies Risk.

Some of the underlying funds invest in securities of smaller companies which may be riskier, more volatile and vulnerable to economic, market and industry changes than

securities of larger, more established companies.

Derivatives Risk.

The underlying funds and the Fund may use derivatives, including

futures contracts and exchange traded futures. Derivatives may be riskier than other investments because they may be more sensitive to changes in economic and market conditions and could result in losses that significantly exceed the original

investment. Many derivatives create leverage thereby causing the Fund or underlying fund to be more volatile than it would be if it had not used derivatives. Derivatives also expose the Fund and underlying funds to counterparty risk (the risk that

the derivative counterparty will not fulfill its contractual obligation), including credit risk of the derivative counterparty. Certain derivatives are synthetic instruments that attempt to replicate the performance of certain reference assets. With

regard to such derivatives, the Fund or the underlying fund do not have a claim on the reference assets and are subject to enhanced counterparty risk.

Commodity Risk.

Exposure to commodities, commodity-related securities and derivatives may subject the

Fund to greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked investments may be affected by changes in overall market movements, commodity index volatility,

changes in interest rates, or factors affecting a particular industry or commodity. In addition, to the extent that an underlying fund gains exposure to an asset through synthetic replication by investing in commodity-linked investments rather than

directly in the asset, it may not have a claim on the applicable underlying asset and will be subject to enhanced counterparty risk.

Natural

Resources Risk.

Some of the underlying funds may invest in natural resources companies. Equity and equity-like securities of natural resources companies and associated businesses may be negatively impacted by variations, often rapid, in the

commodities markets, the supply of and demand for specific products and services, the supply of and demand for oil and gas, the price of oil and gas, exploration and production spending, government regulation, economic conditions, events relating to

international political developments, environmental incidents, energy conservation and the success of exploration projects. Therefore, the securities of companies in the natural resources sector may experience more price volatility than securities

of companies in other industries.

Direct Investment Risk.

The Fund’s direct investments in securities and financial instruments are

subject to additional risks specific to their structure, sector or market (e.g., futures and swaps on foreign securities are subject to foreign investment, emerging market and derivative risks; debt securities are subject to credit risk).

Redemption Risk.

The Fund could experience a loss when selling securities to meet redemption requests by shareholders. The risk of loss

increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are

not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

You could lose money investing in the Fund.

The Fund’s Past Performance

The Fund

commenced operations on July 2, 2012 and, therefore, has limited performance history. Once the Fund has operated for at least one calendar year, a bar chart and performance table will be included in the prospectus to show

5

the performance of the Fund. Although past performance of a Fund is no guarantee of how it will perform in the future, historical performance may give you some indication of the risks of

investing in the Fund.

Management

J.P. Morgan Investment Management Inc.

|

|

|

|

|

|

|

Portfolio

Manager

|

|

Managed

Fund

Since

|

|

Primary Title with

Investment Adviser

|

|

Jeffrey A. Geller

|

|

2012

|

|

Managing Director

|

|

Anne Lester

|

|

2012

|

|

Managing Director

|

|

Daniel Oldroyd

|

|

2012

|

|

Managing Director

|

|

Michael Schoenhaut

|

|

2012

|

|

Managing Director

|

Purchase and Sale of Fund Shares

There are no minimum or maximum purchase requirements with respect to Class R5 Shares.

|

|

|

|

|

|

|

For Class R6 Shares

|

|

|

|

|

|

To establish an account

|

|

|

|

|

|

$15,000,000 for Direct Investors

|

|

|

$5,000,000 for Discretionary Accounts

|

|

|

To add to an account

|

|

|

No minimum levels

|

|

There is no minimum investment for other eligible Class R6 investors.

In general, you may purchase or redeem shares on any business day:

|

Ÿ

|

|

Through your Financial Intermediary or the eligible retirement plan or college saving plan through which you invest in the Fund

|

|

Ÿ

|

|

By writing to J.P. Morgan Funds Services, P.O. Box 8528, Boston, MA 02266-8528

|

|

Ÿ

|

|

After you open an account, by calling J.P. Morgan Funds Services at 1-800-480-4111

|

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income or capital gains because your investment is in a

401(k) plan or other tax-advantaged investment plan, in which case you may be

subject to federal income tax upon withdrawal from the tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its

related companies may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or financial intermediary and your salesperson to recommend the

Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

SPRO-SRB2030-R5R6-1113

6

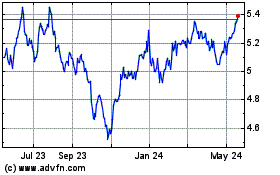

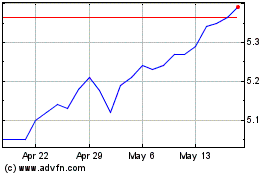

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Jul 2023 to Jul 2024