Current Report Filing (8-k)

November 04 2019 - 4:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

November 1, 2019

|

Vishay Precision Group, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

1-34679

|

27-0986328

|

|

(State or Other Jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer Identification

|

|

Incorporation or Organization)

|

|

Number)

|

|

|

|

|

|

|

3 Great Valley Parkway, Suite 150

|

|

|

Malvern, PA

|

19355

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(484) 321-5300

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.10 par value

|

VPG

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

Emerging growth company ¨

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2019, Vishay Precision Group, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Purchase Agreement”) with DSI Holdings DE Inc. (“DSI”), the sellers identified in the Purchase Agreement (the “Sellers”) and HCI Equity Partners III, L.P., as representative of the Sellers. Pursuant to the Purchase Agreement, and subject to the conditions thereof, the Company acquired all of the outstanding capital stock of DSI for a purchase price of $41.0 million, subject to customary adjustments, plus up to an additional $3.0 million payable to the Sellers as an earn out in the event that DSI achieves certain EBITDA thresholds (collectively, the “DSI Acquisition”). The Company used cash on hand and borrowings under its revolving credit facility to fund the purchase price under the Purchase Agreement.

The Company purchased a buy-side representations and warranties insurance policy, which comprises the material portion of the Company’s remedy for breaches of representations and warranties, absent fraud or beaches of certain fundamental representations and warranties identified in the Purchase Agreement. The representations and warranties insurance policy is subject to certain policy limits, exclusions, deductibles and other terms and conditions. In connection with the DSI Acquisition, DSI entered into restrictive covenant agreements with each of the Sellers containing post-closing covenants restricting the Sellers from competing with DSI or soliciting certain of its business relations. The duration and nature of the covenants varies according to the identity of the Seller. The Purchase Agreement also contains customary indemnification obligations of each party with respect to breaches of their respective covenants and certain other specified matters.

The foregoing summary description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is filed as Exhibit 2.1 hereto and incorporated herein by reference.

Item 8.01 Other Events.

On November 4, 2019, the Company issued a press release announcing the closing of the DSI Acquisition. A copy of the press release is attached hereto as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

2.1*

|

|

|

|

99.1

|

|

|

__

* Pursuant to Item 601(b)(2) of Regulation S-K schedules and exhibits have been omitted and will be furnished supplementally to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Vishay Precision Group, Inc.

|

|

|

|

|

|

Date: November 4, 2019

|

By:

|

/s/ William M. Clancy

|

|

|

|

Name: William M. Clancy

|

|

|

|

Title: Executive Vice President and Chief

|

|

|

|

Financial Officer

|

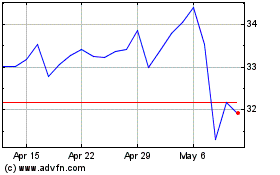

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Jul 2024 to Aug 2024

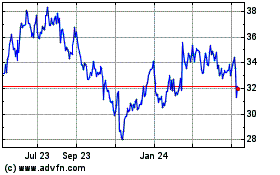

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Aug 2023 to Aug 2024