Vishay Intertechnology, Inc. (NYSE: VSH), one of the world's

largest manufacturers of discrete semiconductors and passive

components, today announced its results for the fiscal quarter and

nine fiscal months ended October 2, 2021.

Revenues for the fiscal quarter ended October 2, 2021 were

$813.7 million, compared to $819.1 million for the fiscal quarter

ended July 3, 2021, and $640.2 million for the fiscal quarter ended

October 3, 2020. Net earnings attributable to Vishay

stockholders for the fiscal quarter ended October 2, 2021 were

$96.8 million, or $0.67 per diluted share, compared to $93.2

million, or $0.64 per diluted share for the fiscal quarter ended

July 3, 2021, and $33.5 million, or $0.23 per diluted share for the

fiscal quarter ended October 3, 2020.

As summarized on the attached reconciliation schedule, all

periods presented include items affecting comparability.

Adjusted earnings per diluted share, which exclude certain items

net of tax and the unusual tax items, were $0.63, $0.61, and $0.25

for the fiscal quarters ended October 2, 2021, July 3, 2021, and

October 3, 2020, respectively.

Commenting on results for the third quarter 2021, Dr. Gerald

Paul, President and Chief Executive Officer stated, “In the third

quarter of 2021, we continued to operate under excellent economic

conditions, resulting in a further increase of our record backlogs.

During the quarter we experienced localized shortages of labor

impacting the manufacturing output. The automotive sector is

expected to increase over the next quarters as the current supply

chain problems are getting resolved step by step. We also continued

to strategically increase prices to offset the increased

inflationary costs for metals, materials and transportation.”

Dr. Paul continued, “We anticipate higher growth rates than in

the past for our key end markets and we intend to further invest in

the expansion of our manufacturing capacities to be well positioned

to take advantage of these growth opportunities. In this context,

we announced that we will build a 12” fab for MOSFETs adjacent to

our existing fab in Itzehoe, Germany. Despite increased capital

expenditures, we expect to continue to generate strong annual free

cash flow.”

Commenting on the outlook Dr. Paul stated, “For the fourth

quarter 2021 we guide for revenues in the range of $805 to $845

million at a gross margin of 27.7% plus/minus 50 basis points at

the exchange rates of Q3 2021.”

A conference call to discuss Vishay’s third quarter financial

results is scheduled for Wednesday, November 3, 2021 at 9:00 a.m.

ET. The dial-in number for the conference call is 877 589-6174 (+1

706-643-1406, if calling from outside the United States) and the

access code is 9760937.

A live audio webcast of the conference call and a PDF copy of

the press release and the quarterly presentation will be accessible

directly from the Investor Relations section of the Vishay website

at http://ir.vishay.com.

There will be a replay of the conference call from 12:00 p.m. ET

on Wednesday, November 3, 2021 through 11:59 p.m. ET on Thursday,

November 18. The telephone number for the replay is +1 855-859-2056

(+1 404-537-3406, if calling from outside the United States or

Canada) and the access code is 9760937.

About VishayVishay manufactures one of the

world’s largest portfolios of discrete semiconductors and passive

electronic components that are essential to innovative designs in

the automotive, industrial, computing, consumer,

telecommunications, military, aerospace, and medical markets.

Serving customers worldwide, Vishay is The DNA of

tech.™ Vishay Intertechnology, Inc. is a Fortune 1,000

Company listed on the NYSE (VSH). More on Vishay at

www.Vishay.com.

This press release includes certain financial measures which are

not recognized in accordance with U.S. generally accepted

accounting principles ("GAAP"), including adjusted net earnings;

adjusted earnings per share; adjusted gross margin; adjusted

operating margin; free cash; earnings before interest, taxes,

depreciation and amortization ("EBITDA"); adjusted EBITDA; and

adjusted EBITDA margin; which are considered "non-GAAP financial

measures" under the U.S. Securities and Exchange Commission rules.

These non-GAAP measures supplement our GAAP measures of performance

or liquidity and should not be viewed as an alternative to GAAP

measures of performance or liquidity. Non-GAAP measures such as

adjusted net earnings, adjusted earnings per share, adjusted gross

margin, adjusted operating margin, free cash, EBITDA, adjusted

EBITDA, and adjusted EBITDA margin do not have uniform definitions.

These measures, as calculated by Vishay, may not be comparable to

similarly titled measures used by other companies. Management

believes that such measures are meaningful to investors because

they provide insight with respect to intrinsic operating results of

the Company. Although the terms "free cash" and "EBITDA" are not

defined in GAAP, the measures are derived using various line items

measured in accordance with GAAP. Reconciling items to arrive at

adjusted net earnings represent significant charges or credits that

are important to understanding the Company's intrinsic operations.

Reconciling items to calculate adjusted gross margin, adjusted

operating margin and adjusted EBITDA represent those same items

used in computing adjusted net earnings, as relevant. Furthermore,

the presented calculation of adjusted EBITDA is substantially

similar to, but not identical to, a measure used in the calculation

of financial ratios required for covenant compliance under Vishay's

revolving credit facility. These reconciling items are indicated on

the accompanying reconciliation schedules and are more fully

described in the Company's financial statements presented in its

annual report on Form10-K and its quarterly reports presented on

Forms 10-Q.

Statements contained herein that relate to the Company's future

performance, including statements with respect to forecasted

revenues, margins, inventories, product demand, anticipated areas

of growth, market segment performance, and the performance of the

economy in general, are forward-looking statements within the safe

harbor provisions of Private Securities Litigation Reform Act of

1995. Words such as "believe," "estimate," "will be," "will,"

"would," "expect," "anticipate," "plan," "project," "intend,"

"could," "should," or other similar words or expressions often

identify forward-looking statements. Such statements are based on

current expectations only, and are subject to certain risks,

uncertainties and assumptions, many of which are beyond our

control. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results, performance, or achievements may vary materially

from those anticipated, estimated or projected. Among the factors

that could cause actual results to materially differ include:

general business and economic conditions; manufacturing or supply

chain interruptions or changes in customer demand because of

COVID-19 or otherwise; delays or difficulties in implementing our

cost reduction strategies; delays or difficulties in expanding our

manufacturing capacities; an inability to attract and retain highly

qualified personnel; changes in foreign currency exchange rates;

uncertainty related to the effects of changes in foreign currency

exchange rates; competition and technological changes in our

industries; difficulties in new product development; difficulties

in identifying suitable acquisition candidates, consummating a

transaction on terms which we consider acceptable, and integration

and performance of acquired businesses; changes in U.S. and foreign

trade regulations and tariffs, and uncertainty regarding the same;

changes in applicable domestic and foreign tax regulations, and

uncertainty regarding the same; changes in applicable accounting

standards and other factors affecting our operations that are set

forth in our filings with the Securities and Exchange Commission,

including our annual reports on Form 10-K and our quarterly reports

on Form 10-Q. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

The DNA of tech™ is a trademark of Vishay

Intertechnology.

Contact:

Vishay Intertechnology, Inc. Peter HenriciSenior Vice President,

Corporate Communications

+1-610-644-1300

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

|

|

| Summary of

Operations |

|

|

|

|

|

| (Unaudited -

In thousands, except per share amounts) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Fiscal quarters

ended |

| |

October 2, 2021 |

|

July 3, 2021 |

|

October 3, 2020 |

| |

|

|

|

|

|

|

Net revenues |

$ |

813,663 |

|

|

$ |

819,120 |

|

|

$ |

640,160 |

|

| Costs of

products sold* |

|

587,927 |

|

|

|

589,848 |

|

|

|

488,451 |

|

| Gross

profit |

|

225,736 |

|

|

|

229,272 |

|

|

|

151,709 |

|

|

Gross margin |

|

27.7 |

% |

|

|

28.0 |

% |

|

|

23.7 |

% |

| |

|

|

|

|

|

| Selling,

general, and administrative expenses* |

|

102,215 |

|

|

|

103,900 |

|

|

|

90,219 |

|

| Operating

income |

|

123,521 |

|

|

|

125,372 |

|

|

|

61,490 |

|

|

Operating margin |

|

15.2 |

% |

|

|

15.3 |

% |

|

|

9.6 |

% |

| |

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

Interest expense |

|

(4,427 |

) |

|

|

(4,443 |

) |

|

|

(7,414 |

) |

|

Loss on early extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

(3,454 |

) |

|

Other |

|

(2,679 |

) |

|

|

(3,749 |

) |

|

|

(4,898 |

) |

|

Total other income (expense) - net |

|

(7,106 |

) |

|

|

(8,192 |

) |

|

|

(15,766 |

) |

| |

|

|

|

|

|

| Income

before taxes |

|

116,415 |

|

|

|

117,180 |

|

|

|

45,724 |

|

| |

|

|

|

|

|

| Income tax

expense |

|

19,333 |

|

|

|

23,799 |

|

|

|

12,063 |

|

| |

|

|

|

|

|

| Net

earnings |

|

97,082 |

|

|

|

93,381 |

|

|

|

33,661 |

|

| |

|

|

|

|

|

| Less: net

earnings attributable to noncontrolling interests |

|

262 |

|

|

|

189 |

|

|

|

177 |

|

| |

|

|

|

|

|

| Net earnings

attributable to Vishay stockholders |

$ |

96,820 |

|

|

$ |

93,192 |

|

|

$ |

33,484 |

|

| |

|

|

|

|

|

| Basic

earnings per share attributable to Vishay stockholders |

$ |

0.67 |

|

|

$ |

0.64 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

| Diluted

earnings per share attributable to Vishay stockholders |

$ |

0.67 |

|

|

$ |

0.64 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

| Weighted

average shares outstanding - basic |

|

145,017 |

|

|

|

145,017 |

|

|

|

144,854 |

|

| |

|

|

|

|

|

| Weighted

average shares outstanding - diluted |

|

145,458 |

|

|

|

145,445 |

|

|

|

145,197 |

|

| |

|

|

|

|

|

| Cash

dividends per share |

$ |

0.095 |

|

|

$ |

0.095 |

|

|

$ |

0.095 |

|

| |

|

|

|

|

|

| * The fiscal

quarter ended October 3, 2020 includes incremental costs of

products sold and selling, general, and administrative expenses

(benefits) separable from normal operations directly attributable

to the COVID-19 pandemic of $242 and $(441), respectively. |

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

| Summary of

Operations |

|

|

|

| (Unaudited -

In thousands, except per share amounts) |

|

|

|

| |

|

|

|

| |

Nine fiscal months

ended |

| |

October 2, 2021 |

|

October 3, 2020 |

| |

|

|

|

|

Net revenues |

$ |

2,397,415 |

|

|

$ |

1,834,718 |

|

| Costs of

products sold* |

|

1,739,458 |

|

|

|

1,405,099 |

|

| Gross

profit |

|

657,957 |

|

|

|

429,619 |

|

|

Gross margin |

|

27.4 |

% |

|

|

23.4 |

% |

| |

|

|

|

| Selling,

general, and administrative expenses* |

|

311,800 |

|

|

|

279,178 |

|

|

Restructuring and severance costs |

|

- |

|

|

|

743 |

|

| Operating

income |

|

346,157 |

|

|

|

149,698 |

|

|

Operating margin |

|

14.4 |

% |

|

|

8.2 |

% |

| |

|

|

|

| Other income

(expense): |

|

|

|

|

Interest expense |

|

(13,246 |

) |

|

|

(24,396 |

) |

|

Loss on early extinguishment of debt |

|

- |

|

|

|

(7,520 |

) |

|

Other |

|

(12,159 |

) |

|

|

(6,184 |

) |

|

Total other income (expense) - net |

|

(25,405 |

) |

|

|

(38,100 |

) |

| |

|

|

|

| Income

before taxes |

|

320,752 |

|

|

|

111,598 |

|

| |

|

|

|

| Income tax

expense |

|

58,646 |

|

|

|

25,658 |

|

| |

|

|

|

| Net

earnings |

|

262,106 |

|

|

|

85,940 |

|

| |

|

|

|

| Less: net

earnings attributable to noncontrolling interests |

|

659 |

|

|

|

584 |

|

| |

|

|

|

| Net earnings

attributable to Vishay stockholders |

$ |

261,447 |

|

|

$ |

85,356 |

|

| |

|

|

|

| Basic

earnings per share attributable to Vishay stockholders |

$ |

1.80 |

|

|

$ |

0.59 |

|

| |

|

|

|

| Diluted

earnings per share attributable to Vishay stockholders |

$ |

1.80 |

|

|

$ |

0.59 |

|

| |

|

|

|

| Weighted

average shares outstanding - basic |

|

145,000 |

|

|

|

144,831 |

|

| |

|

|

|

| Weighted

average shares outstanding - diluted |

|

145,455 |

|

|

|

145,221 |

|

| |

|

|

|

| Cash

dividends per share |

$ |

0.285 |

|

|

$ |

0.285 |

|

| |

|

|

|

| * The nine fiscal

months ended October 3, 2020 includes incremental costs of products

sold and selling, general, and administrative expenses (benefits)

separable from normal operations directly attributable to the

COVID-19 pandemic of $4,295 and $(871), respectively. |

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

| Consolidated

Condensed Balance Sheets |

|

|

|

| (In

thousands) |

|

|

|

| |

|

|

|

| |

October 2, 2021 |

|

December 31, 2020 |

| |

(Unaudited) |

|

|

| Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

831,760 |

|

|

$ |

619,874 |

|

|

Short-term investments |

|

84,177 |

|

|

|

158,476 |

|

|

Accounts receivable, net |

|

378,523 |

|

|

|

338,632 |

|

|

Inventories: |

|

|

|

|

Finished goods |

|

152,769 |

|

|

|

120,792 |

|

|

Work in process |

|

223,355 |

|

|

|

201,259 |

|

|

Raw materials |

|

156,544 |

|

|

|

126,200 |

|

|

Total inventories |

|

532,668 |

|

|

|

448,251 |

|

| |

|

|

|

|

Prepaid expenses and other current assets |

|

146,870 |

|

|

|

132,103 |

|

| Total

current assets |

|

1,973,998 |

|

|

|

1,697,336 |

|

| |

|

|

|

| Property and

equipment, at cost: |

|

|

|

|

Land |

|

75,063 |

|

|

|

76,231 |

|

|

Buildings and improvements |

|

632,219 |

|

|

|

641,041 |

|

|

Machinery and equipment |

|

2,746,511 |

|

|

|

2,732,771 |

|

|

Construction in progress |

|

112,157 |

|

|

|

86,520 |

|

|

Allowance for depreciation |

|

(2,640,993 |

) |

|

|

(2,593,398 |

) |

| |

|

924,957 |

|

|

|

943,165 |

|

| |

|

|

|

| Right of use

assets |

|

110,083 |

|

|

|

102,440 |

|

| |

|

|

|

|

Goodwill |

|

157,683 |

|

|

|

158,183 |

|

| |

|

|

|

| Other

intangible assets, net |

|

59,583 |

|

|

|

66,795 |

|

| |

|

|

|

| Other

assets |

|

197,974 |

|

|

|

186,554 |

|

|

Total assets |

$ |

3,424,278 |

|

|

$ |

3,154,473 |

|

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

|

|

Consolidated Condensed Balance Sheets (continued) |

|

|

|

| (In

thousands) |

|

|

|

|

| |

|

|

|

|

| |

October 2, 2021 |

|

December 31, 2020 |

|

| |

(Unaudited) |

|

|

|

| |

|

|

|

|

| Liabilities

and equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Trade accounts payable |

$ |

221,666 |

|

|

$ |

196,203 |

|

|

Payroll and related expenses |

|

155,792 |

|

|

|

141,034 |

|

|

Lease liabilities |

|

21,583 |

|

|

|

22,074 |

|

|

Other accrued expenses |

|

206,045 |

|

|

|

182,642 |

|

|

Income taxes |

|

40,648 |

|

|

|

20,470 |

|

| Total

current liabilities |

|

645,734 |

|

|

|

562,423 |

|

| |

|

|

|

|

| Long-term

debt less current portion |

|

454,848 |

|

|

|

394,886 |

|

| U.S.

transition tax payable |

|

110,681 |

|

|

|

125,438 |

|

| Deferred

income taxes |

|

1,843 |

|

|

|

1,852 |

|

| Long-term

lease liabilities |

|

94,064 |

|

|

|

86,220 |

|

| Other

liabilities |

|

105,880 |

|

|

|

104,356 |

|

| Accrued

pension and other postretirement costs |

|

283,049 |

|

|

|

300,113 |

|

| Total

liabilities |

|

1,696,099 |

|

|

|

1,575,288 |

|

| |

|

|

|

|

| Redeemable

convertible debentures |

|

- |

|

|

|

170 |

|

| |

|

|

|

|

| Equity: |

|

|

|

|

| Vishay

stockholders' equity |

|

|

|

|

|

Common stock |

|

13,271 |

|

|

|

13,256 |

|

|

Class B convertible common stock |

|

1,210 |

|

|

|

1,210 |

|

|

Capital in excess of par value |

|

1,346,980 |

|

|

|

1,409,200 |

|

|

Retained earnings |

|

379,672 |

|

|

|

138,990 |

|

|

Accumulated other comprehensive income (loss) |

|

(15,613 |

) |

|

|

13,559 |

|

|

Total Vishay stockholders' equity |

|

1,725,520 |

|

|

|

1,576,215 |

|

|

Noncontrolling interests |

|

2,659 |

|

|

|

2,800 |

|

| Total

equity |

|

1,728,179 |

|

|

|

1,579,015 |

|

| Total

liabilities, temporary equity, and equity |

$ |

3,424,278 |

|

|

$ |

3,154,473 |

|

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

| Consolidated

Condensed Statements of Cash Flows |

|

|

|

| (Unaudited -

In thousands) |

|

| |

Nine fiscal months

ended |

| |

October 2, 2021 |

|

October 3, 2020 |

| |

|

|

|

| Operating

activities |

|

|

|

|

Net earnings |

$ |

262,106 |

|

|

$ |

85,940 |

|

| Adjustments

to reconcile net earnings to |

|

|

|

|

net cash provided by operating activities: |

|

|

|

|

Depreciation and amortization |

|

125,095 |

|

|

|

123,776 |

|

|

(Gain) loss on disposal of property and equipment |

|

(254 |

) |

|

|

257 |

|

|

Accretion of interest on convertible debt instruments |

|

- |

|

|

|

10,232 |

|

|

Inventory write-offs for obsolescence |

|

14,960 |

|

|

|

17,891 |

|

|

Loss on early extinguishment of debt |

|

- |

|

|

|

7,520 |

|

|

Deferred income taxes |

|

(4,208 |

) |

|

|

(1,142 |

) |

|

Other |

|

8,376 |

|

|

|

3,188 |

|

|

Change in U.S. transition tax liability |

|

(14,757 |

) |

|

|

(14,757 |

) |

|

Change in repatriation tax liability |

|

- |

|

|

|

(16,258 |

) |

|

Changes in operating assets and liabilities, net of effects of

business acquired |

|

(80,866 |

) |

|

|

(27,408 |

) |

| Net cash

provided by operating activities |

|

310,452 |

|

|

|

189,239 |

|

| |

|

|

|

| Investing

activities |

|

|

|

| Purchase of

property and equipment |

|

(118,156 |

) |

|

|

(70,801 |

) |

| Proceeds

from sale of property and equipment |

|

1,257 |

|

|

|

293 |

|

| Purchase of

businesses, net of cash acquired |

|

- |

|

|

|

(25,852 |

) |

| Purchase of

short-term investments |

|

(55,491 |

) |

|

|

(157,177 |

) |

| Maturity of

short-term investments |

|

126,171 |

|

|

|

241,016 |

|

| Other

investing activities |

|

347 |

|

|

|

(529 |

) |

| Net cash

used in investing activities |

|

(45,872 |

) |

|

|

(13,050 |

) |

| |

|

|

|

| Financing

activities |

|

|

|

| Repurchase

of convertible debt instruments |

|

(300 |

) |

|

|

(148,177 |

) |

| Net changes

in short-term borrowings |

|

- |

|

|

|

(110 |

) |

| Dividends

paid to common stockholders |

|

(37,823 |

) |

|

|

(37,779 |

) |

| Dividends

paid to Class B common stockholders |

|

(3,448 |

) |

|

|

(3,448 |

) |

|

Distributions to noncontrolling interests |

|

(800 |

) |

|

|

(600 |

) |

| Cash

withholding taxes paid when shares withheld for vested equity

awards |

|

(1,963 |

) |

|

|

(2,016 |

) |

| Net cash

used in financing activities |

|

(44,334 |

) |

|

|

(192,130 |

) |

| Effect of

exchange rate changes on cash and cash equivalents |

|

(8,360 |

) |

|

|

4,230 |

|

| |

|

|

|

| Net increase

(decrease) in cash and cash equivalents |

|

211,886 |

|

|

|

(11,711 |

) |

| |

|

|

|

| Cash and

cash equivalents at beginning of period |

|

619,874 |

|

|

|

694,133 |

|

| Cash and

cash equivalents at end of period |

$ |

831,760 |

|

|

$ |

682,422 |

|

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted Earnings Per Share |

|

|

|

|

|

|

|

|

|

| (Unaudited -

In thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

| |

Fiscal quarters ended |

|

Nine fiscal months ended |

| |

October 2, 2021 |

|

July 3, 2021 |

|

October 3, 2020 |

|

October 2, 2021 |

|

October 3, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

GAAP net earnings attributable to Vishay stockholders |

$ |

96,820 |

|

|

$ |

93,192 |

|

|

$ |

33,484 |

|

|

$ |

261,447 |

|

|

$ |

85,356 |

|

| |

|

|

|

|

|

|

|

|

|

| Reconciling

items affecting gross profit: |

|

|

|

|

|

|

|

|

|

| Impact of

the COVID-19 pandemic |

$ |

- |

|

|

$ |

- |

|

|

$ |

242 |

|

|

$ |

- |

|

|

$ |

4,295 |

|

| |

|

|

|

|

|

|

|

|

|

| Other

reconciling items affecting operating income: |

|

|

|

|

|

|

|

|

|

|

Restructuring and severance costs |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

743 |

|

| Impact of

the COVID-19 pandemic |

$ |

- |

|

|

$ |

- |

|

|

$ |

(441 |

) |

|

|

- |

|

|

|

(871 |

) |

| |

|

|

|

|

|

|

|

|

|

| Reconciling

items affecting other income (expense): |

|

|

|

|

|

|

|

|

|

| Loss on

early extinguishment of debt |

$ |

- |

|

|

$ |

- |

|

|

$ |

3,454 |

|

|

$ |

- |

|

|

$ |

7,520 |

|

| |

|

|

|

|

|

|

|

|

|

| Reconciling

items affecting tax expense (benefit): |

|

|

|

|

|

|

|

|

|

| Changes in

tax regulation |

$ |

- |

|

|

$ |

(3,881 |

) |

|

$ |

- |

|

|

$ |

(8,276 |

) |

|

$ |

- |

|

| Change in

deferred taxes due to early extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,346 |

) |

| Effects of

cash repatriation program |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(190 |

) |

| Effects of

changes in valuation allowances |

|

(5,714 |

) |

|

|

- |

|

|

|

- |

|

|

|

(5,714 |

) |

|

|

- |

|

| Tax effects

of pre-tax items above |

|

- |

|

|

|

- |

|

|

|

(716 |

) |

|

|

- |

|

|

|

(2,787 |

) |

| |

|

|

|

|

|

|

|

|

|

| Adjusted net

earnings |

$ |

91,106 |

|

|

$ |

89,311 |

|

|

$ |

36,023 |

|

|

$ |

247,457 |

|

|

$ |

92,720 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

weighted average diluted shares outstanding |

|

145,458 |

|

|

|

145,445 |

|

|

|

145,197 |

|

|

|

145,455 |

|

|

|

145,221 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

earnings per diluted share |

$ |

0.63 |

|

|

$ |

0.61 |

|

|

$ |

0.25 |

|

|

$ |

1.70 |

|

|

$ |

0.64 |

|

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Free Cash |

|

|

|

|

|

|

|

|

|

| (Unaudited -

In thousands) |

|

|

|

|

|

|

|

|

|

| |

Fiscal quarters ended |

|

Nine fiscal months ended |

| |

October 2, 2021 |

|

July 3, 2021 |

|

October 3, 2020 |

|

October 2, 2021 |

|

October 3, 2020 |

|

Net cash provided by operating activities |

$ |

135,669 |

|

|

$ |

117,461 |

|

|

$ |

64,330 |

|

|

$ |

310,452 |

|

|

$ |

189,239 |

|

| Proceeds

from sale of property and equipment |

|

1,023 |

|

|

|

34 |

|

|

|

63 |

|

|

|

1,257 |

|

|

|

293 |

|

| Less:

Capital expenditures |

|

(57,446 |

) |

|

|

(32,183 |

) |

|

|

(21,969 |

) |

|

|

(118,156 |

) |

|

|

(70,801 |

) |

| Free

cash |

$ |

79,246 |

|

|

$ |

85,312 |

|

|

$ |

42,424 |

|

|

$ |

193,553 |

|

|

$ |

118,731 |

|

| VISHAY

INTERTECHNOLOGY, INC. |

|

|

|

|

|

|

|

|

|

|

Reconciliation of EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

| (Unaudited -

In thousands) |

|

|

|

|

|

|

|

|

|

| |

Fiscal quarters ended |

|

Nine fiscal months ended |

| |

October 2, 2021 |

|

July 3, 2021 |

|

October 3, 2020 |

|

October 2, 2021 |

|

October 3, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

GAAP net earnings attributable to Vishay stockholders |

$ |

96,820 |

|

|

$ |

93,192 |

|

|

$ |

33,484 |

|

|

$ |

261,447 |

|

|

$ |

85,356 |

|

| Net earnings

attributable to noncontrolling interests |

|

262 |

|

|

|

189 |

|

|

|

177 |

|

|

|

659 |

|

|

|

584 |

|

| Net

earnings |

$ |

97,082 |

|

|

$ |

93,381 |

|

|

$ |

33,661 |

|

|

$ |

262,106 |

|

|

$ |

85,940 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest

expense |

$ |

4,427 |

|

|

$ |

4,443 |

|

|

$ |

7,414 |

|

|

$ |

13,246 |

|

|

$ |

24,396 |

|

| Interest

income |

|

(295 |

) |

|

|

(325 |

) |

|

|

(514 |

) |

|

|

(907 |

) |

|

|

(3,324 |

) |

| Income

taxes |

|

19,333 |

|

|

|

23,799 |

|

|

|

12,063 |

|

|

|

58,646 |

|

|

|

25,658 |

|

| Depreciation

and amortization |

|

41,216 |

|

|

|

41,733 |

|

|

|

41,618 |

|

|

|

125,095 |

|

|

|

123,776 |

|

| EBITDA |

$ |

161,763 |

|

|

$ |

163,031 |

|

|

$ |

94,242 |

|

|

$ |

458,186 |

|

|

$ |

256,446 |

|

| |

|

|

|

|

|

|

|

|

|

| Reconciling

items |

|

|

|

|

|

|

|

|

|

| Impact of

the COVID-19 pandemic |

$ |

- |

|

|

$ |

- |

|

|

$ |

(199 |

) |

|

$ |

- |

|

|

$ |

3,424 |

|

|

Restructuring and severance costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

743 |

|

| Loss on

early extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

3,454 |

|

|

|

- |

|

|

|

7,520 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

161,763 |

|

|

$ |

163,031 |

|

|

$ |

97,497 |

|

|

$ |

458,186 |

|

|

$ |

268,133 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA margin** |

|

19.9 |

% |

|

|

19.9 |

% |

|

|

15.2 |

% |

|

|

19.1 |

% |

|

|

14.6 |

% |

| |

|

|

|

|

|

|

|

|

|

| ** Adjusted

EBITDA as a percentage of net revenues |

|

|

|

|

|

|

|

|

|

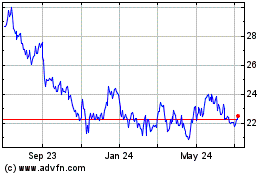

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Nov 2023 to Nov 2024