SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER

SECTION 14(D)(1) OR 13(E)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 3)

VECTOR GROUP LTD.

(Name of Subject Company (Issuer))

VAPOR MERGER SUB INC.

a wholly owned subsidiary of

JTI (US) HOLDING INC.

an indirect wholly owned subsidiary

of

JT INTERNATIONAL HOLDING B.V.

(Names of Filing Persons —

Offerors)

Common Stock, par value $0.10

per share

(Title of Class of Securities)

92240M108

(CUSIP Number of Class of

Securities)

Christopher Hill

c/o JTI (US) Holding Inc.

501 Brickell Key Dr., Suite 402

Miami, Florida 33131

United States

Telephone: +1 201 871 1210

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

Sebastian L. Fain, Esq.

Paul K. Humphreys, Esq.

Freshfields Bruckhaus Deringer US LLP

3 World Trade Center

175 Greenwich Street

New York, NY 10007

Telephone: +1 212 277 4000

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| Check the appropriate boxes below to designate any transactions to which the statement relates: |

| |

x |

Third-party tender offer subject to Rule 14d-1. |

| |

¨ |

Issuer tender offer subject to Rule 13e-4. |

| |

¨ |

Going-private transaction subject to Rule 13e-3. |

| |

¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment

reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

|

|

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment

No. 3 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed with the Securities

and Exchange Commission (the “SEC”) on September 4, 2024, as amended by Amendment No. 1 to the Tender Offer Statement

on Schedule TO filed with the SEC on September 18, 2024 and Amendment No 2. To the Tender Offer Statement on Schedule TO filed with the

SEC on October 4, 2024 (together with any amendments and supplements hereto, the “Schedule TO”) by Vapor Merger Sub

Inc., a Delaware corporation (“Merger Sub”) and wholly owned subsidiary of JTI (US) Holding Inc., a Delaware corporation

(“Parent”), Parent and JT International Holding B.V., a private company with limited liability (besloten vennootschap

met beperkte aansprakelijkheid) (“JTI”) organized and existing under the law of the Netherlands and an Affiliate

of Parent. The Schedule TO relates to the tender offer by Merger Sub to purchase all of the outstanding shares of common stock, par value

$0.10 per share (the “Shares”), of Vector Group Ltd., a Delaware corporation (the “Company”), in

exchange for $15.00 per Share in cash, subject to applicable withholding taxes and without interest (the “Offer Price”),

on the terms and subject to the conditions set forth in this Offer to Purchase (as it may be amended, supplemented or otherwise modified

from time to time, the “Offer to Purchase”) and in the related Letter of Transmittal (as it may be amended, supplemented

or otherwise modified from time to time, the “Letter of Transmittal”) and the related Notice of Guaranteed Delivery

(as it may be amended, supplemented or otherwise modified from time to time, the “Notice of Guaranteed Delivery”),

copies of which are attached to the Schedule TO as Exhibits (a)(1)(A), (a)(1)(B) and (a)(1)(C), respectively, and which, together with

other related materials, collectively constitute the “Offer”, including the Minimum Condition

All information

regarding the Offer as set forth in the Schedule TO, including all exhibits thereto that were previously filed with the Schedule TO, is

hereby expressly incorporated by reference into this Amendment, except that such information is hereby amended and supplemented to the

extent specifically provided for herein. Capitalized terms used but not defined in this Amendment have the meanings ascribed to them in

the Schedule TO.

Items 1 through 9 and Item 11.

The Offer

to Purchase and Items 1 through 9 and Item 11 of the Schedule TO, to the extent such Items incorporate by reference the information contained

in the Offer to Purchase, are hereby amended and supplemented as follows:

“The

Offer and related withdrawal rights expired as scheduled at one minute after 11:59 p.m., New York City time, on October 4, 2024 (such

date and time, the “Expiration Time”), and the Offer was not extended. Merger Sub was advised by the Depository, that,

as of the Expiration Time, a total of 108,097,425 Shares had been validly tendered and not validly withdrawn pursuant to the Offer, representing

approximately 68.67% of the outstanding Shares as of the Expiration Time. As of the Expiration Time, the number of Shares validly

tendered and not validly withdrawn pursuant to the Offer satisfied the Minimum Condition, and all other Offer Conditions were satisfied.

Promptly after the expiration of the Offer, Merger Sub accepted all Shares validly tendered and not validly withdrawn pursuant to the

Offer and will promptly pay for all Shares accepted pursuant to the Offer.

Parent completed

the acquisition of the Company on October 7, 2024, by consummating the Merger pursuant to the Merger Agreement without a vote of the Company

stockholders in accordance with Section 251(h) of the DGCL. At the Effective Time, Merger Sub was merged with and into the Company, the

separate existence of Merger Sub ceased and the Company continued as the Surviving Corporation and a wholly owned subsidiary of Parent.

Each Share issued and outstanding immediately prior to the Effective Time (excluding (a) any Shares owned by Parent, Merger Sub or the

Company (or held in the Company’s treasury), or by any direct or indirect wholly owned subsidiary of Parent, Merger Sub, or the

Company, in each case, immediately prior to the Effective Time, (b) any Shares irrevocably accepted for payment pursuant to the Offer,

(c) any Shares held by stockholders who are entitled to demand, and who shall have properly and validly demanded their statutory rights

of appraisal in respect of such Shares in compliance with Section 262 of the DGCL and (d) any Shares subject to Company Restricted Share

Awards), was canceled and extinguished and automatically converted into the right to receive the Merger Consideration, without interest

thereon and less any applicable withholding taxes.

Following

the consummation of the Merger, all Shares ceased trading prior to the open of trading on the New York Stock Exchange (“NYSE”)

on October 7, 2024 and the Shares will be delisted from NYSE. Parent and Merger Sub intend to take steps to cause the termination of the

registration of the Shares under the Exchange Act and suspend all of the Company’s reporting obligations under the Exchange Act

as promptly as practicable.

On October 7, 2024, JTI issued

a press release announcing the expiration and results of the Offer and the completion of the acquisition of the Company. The full text

of the press release is attached as Exhibit (a)(5)(F) hereto and is incorporated herein by reference.”

ITEM 12. EXHIBITS.

Item 12 of the Schedule TO is hereby amended and supplemented by adding

the following Exhibit to the list of Exhibits:

SIGNATURES

After due

inquiry and to the best knowledge and belief of the undersigned, each of the undersigned certifies that the information set forth in this

statement is true, complete and correct.

| Date: October 7, 2024 |

| |

|

JT INTERNATIONAL

HOLDING B.V. |

| |

|

| |

By: |

/s/ Biljana Ivosevic |

| |

|

Name: Biljana Ivosevic |

| |

|

Title: Authorized Person |

| |

|

| |

|

| |

By: |

/s/ John Gerard Colton |

| |

|

Name: John Gerard Colton |

| |

|

Title: Authorized Person |

| |

|

| |

|

| |

JTI (US) HOLDING INC. |

| |

|

| |

By: |

/s/ Idil Yasa |

| |

|

Name: Idil Yasa |

| |

|

Title: Authorized Person |

| |

|

| |

|

| |

By: |

/s/ Lindsay Shain |

| |

|

Name: Lindsay Shain |

| |

|

Title: Authorized Person |

| |

|

| |

|

| |

VAPOR MERGER SUB INC. |

| |

|

| |

By: |

/s/ Idil Yasa |

| |

|

Name: Idil Yasa |

| |

|

Title: Authorized Person |

| |

|

| |

|

| |

By: |

/s/ Lindsay Shain |

| |

|

Name: Lindsay Shain |

| |

|

Title: Authorized Person |

Exhibit

(a)(5)(F)

FOR IMMEDIATE RELEASE

Tokyo, October 7,

2024

JT Group Completes

Acquisition of Vector Group Ltd.

Japan Tobacco Inc. (JT) (TSE: 2914)

announces that the JT Group completed the acquisition of Vector Group Ltd. (VGR) on October 7, 2024, following a tender offer, initially

announced on August 21, 2024 (JT Group to Acquire Vector Group Ltd.).

The tender offer period, initiated on

September 4, 2024, expired at one minute after 11:59 P.M., Eastern Daylight Time (EDT), on October 4, 2024. The conditions

of the tender offer having been satisfied, the JT Group has accepted all such tendered shares, and, following a statutory merger on October 7,

2024, VGR became a wholly owned subsidiary of the JT Group and was delisted from the New York Stock Exchange on October 7, 2024.

In line with JT Group’s tobacco

business strategy, this acquisition is expected to improve the Company’s Return-On-Investment in combustibles by significantly

increasing the Group’s presence and distribution network in the US, the second largest tobacco market in net sales and one of the

most profitable.

1. Results of Tender Offer

(1) Overview of Tender

Offer

| ①Tender

offeror |

Vapor

Merger Sub Inc. |

| ②Target

Company |

Vector

Group Ltd. |

| ③Class of

shares to be acquired |

Common

stock (on a fully diluted basis) |

| ④Tender

offer price |

US$

15.00 per share |

| ⑤Period

of tender offer |

September 4,

2024 to one minute after 11:59 P.M, EDT October 4, 2024 |

| ⑥Conditions

of tender offer |

The

tender offer was subject to approval under U.S. and Serbian antitrust laws, the tender of more than 50% of VGR’s outstanding

common stock, and satisfaction of other customary closing conditions. Any remaining shares of common stock of VGR that were not tendered

in the tender offer were, upon the completion of the transaction, cancelled and converted into the right to receive the same consideration

payable in the tender offer. |

(2) Results

of Tender Offer

① Status

of application (as of at one minute after 11:59 P.M. EDT, on October 4, 2024)

Number

of shares tendered: 108,097,425 shares (approximately 68.7%)

② Results

of the Tender Offer

The

Offer was validly completed because the number of shares of VGR common stock validly tendered met and exceeded the minimum conditions

set forth in 1.(1).⑥ above.

(3) Merger

Procedures after the Tender Offer

On October 7,

2024 EDT, VGR and the Offeror merged and VGR is the surviving entity. After the merger VGR became a wholly owned subsidiary of the JT

Group. As a result, effective from October 7, 2024, the shares of VGR stock not tendered in the offer were cancelled and converted

into the right to receive payment of $15.00 per share in cash, the same as the purchase price in the tender offer.

2. Change of

Subsidiary

(1) Reason

for change

As a

result of the Tender Offer, VGR became a consolidated subsidiary of the JT Group as of October 7, 2024 EDT.

(2) Overview

of Subsidiary to be Transferred

| ① Name |

Vector Group Ltd. |

| ② Address |

Miami, FL 33137 USA |

| ③ Representative |

Howard M. Lorber (President and CEO) |

| ④ Business description |

Manufacturing and sales of cigarettes, etc. |

| ⑤ Capitalization |

USD 15,598 Thousand (As of December 31, 2023) |

| ⑥ Year of foundation |

1873 |

| ⑦ Major shareholder and holding ratio (As of June 27, 2024) |

BlackRock, Inc. (13.61%)

The Vanguard Group, Inc. (11.35%)

Dr. Phillip Frost (9.38%) |

| ⑧ Relationship with JT |

Capital |

None |

| Personnel |

None |

| Business |

None |

| ⑨ Financial results audited (Note1) |

| Accounting period (Dollars in Thousands) |

Fiscal year ended December 31, 2021 |

Fiscal year ended December 31, 2022 |

Fiscal year ended December 31, 2023 |

| Net assets |

(841,553) |

(807,877) |

(741,814) |

| Total assets |

871,087 |

908,591 |

934,095 |

| Net assets per share (Dollar) (Note2) |

(5.47) |

(5.22) |

(4.76) |

| Net sales |

1,220,700 |

1,441,009 |

1,424,268 |

| Operating profit |

320,439 |

339,010 |

328,035 |

| Net income |

219,463 |

158,701 |

183,526 |

| Net income per share (Dollar) (Note3) |

1.16 |

1.01 |

1.40 |

| Dividend per share (Dollar) |

0.80 |

0.80 |

0.80 |

| |

|

|

|

|

| Note1: | The

results of operations and financial condition of the company are taken from the Form 10-K filed by VGR with the U.S. Securities

and Exchange Commission (SEC). |

Note2:

Net assets per share is calculated by dividing net assets by the number of common shares outstanding at the end of each period.

Note3:

Diluted EPS is shown.

3. Status of

the number of shares and consideration for acquisition

① Number

of shares held by

JT

Group (before acquisition) |

None |

② Number

of shares to be

acquired |

157,420,597

shares |

| ③ Acquisition

price |

The outstanding

shares: USD 2.4billion

(approximately

378 billion yen) |

④ Number

of shares to be held

by

JT Group (after acquisition) |

157,420,597 shares

(Ratio of voting rights: 100%) |

Note

1: The acquisition price is converted at the rate of 158.229 yen per U.S. dollar (TTM rate mean in July, 2024).

4. Date of change

of subsidiary

October 7,

2024 EDT

5. Impact on Financial Performance

The

transaction is not expected to have any material impact on the Group’s consolidated performance for the fiscal year ending December 31,

2024.

6. Notes

Forward-Looking

Statements

This announcement

may include statements that are not statements of historical fact, or “forward-looking statements,” including with respect

to the JT Group’s acquisition of VGR. Such forward-looking statements include, but are not limited to, the JT Group’s beliefs

and expectations and statements about the benefits sought to be achieved in the JT Group’s acquisition of VGR and the potential

effects of the acquisition on both the JT Group and VGR. These statements are based upon the current beliefs and expectations of the

JT Group’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks

or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties

include, but are not limited to, general industry conditions and competition; general economic factors, including interest rate and currency

exchange rate fluctuations; the impact of COVID-19; the impact of tobacco industry regulation and tobacco legislation in the United States

and internationally; competition from other products; and challenges inherent in new product development, including obtaining regulatory

approval.

JT Group undertakes

any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise,

except to the extent required by law. Additional factors that could cause results to differ materially from those described in the forward-looking

statements can be found in Japan Tobacco Inc.’s integrated report for the year ended December 31, 2023, VGR’s Annual

Report on Form 10-K for the year ended December 31, 2023 and VGR’s Quarterly Reports on Form 10-Q for the three

months ended March 31, 2024 and June 30, 2024, in each case as amended by any subsequent filings made with the SEC. These and

other filings made by VGR with the SEC are available at www.sec.gov.

###

Japan Tobacco Inc. (JT) is a global

company headquartered in Tokyo, Japan. It is listed on the primary section of the Tokyo Stock Exchange (ticker: 2914.T). JT Group

has approximately 53,000 employees and 62 factories worldwide, operating in three business segments: tobacco, pharmaceutical, and

processed food. Within the tobacco business, the largest segment, products are sold in over 130 markets and its flagship brands

include Winston, Camel, MEVIUS, and LD. The Group is committed to investing in Reduced-Risk Products and markets its heated tobacco products

under its Ploom brand.

Consumers, shareholders, employees,

and society are the four stakeholder groups (4S) at the heart of all of JT Group's activities. Inspired by its “Fulfilling

Moment, Enriching Life” purpose, the Group aims to ensure sustainable and valuable contributions to its stakeholders over the long

term. In addition to our three business segments, this goal is also supported by D-LAB, the JT Group’s corporate R&D initiative,

set up to search and create added-value business opportunities. For more information, visit https://www.jt.com/.

| Contact: |

Investor

and Media Relations Division |

| |

Japan

Tobacco Inc. |

| |

|

| |

For

Investors Jerome Jaffeux, Head of IR: jt.ir@jt.com |

| |

For

Media Yunosuke Miyata, Director: jt.media.relations@jt.com |

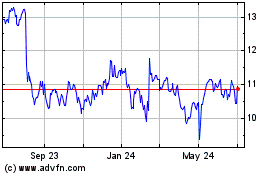

Vector (NYSE:VGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

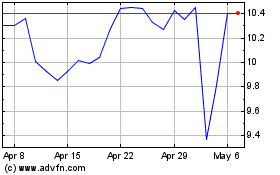

Vector (NYSE:VGR)

Historical Stock Chart

From Dec 2023 to Dec 2024