Delivers significant value for stockholders

while positioning Vector Group for long-term success

Vector Group Ltd. (NYSE: VGR) today announced that it has

entered into a definitive agreement to be acquired by JT Group, a

global company headquartered in Tokyo, Japan, operating in tobacco,

pharmaceuticals and processed food. JT Group’s global tobacco

business, headquartered in Geneva, Switzerland, manufactures and

sells some of the world’s best-known brands in over 130 markets

worldwide – including Winston and Camel (outside the U.S.), as well

as MEVIUS and LD.

Under the terms of the agreement, JT Group will offer to acquire

all outstanding shares of Vector Group common stock for $15.00 per

share in cash, which represents a premium of 29.9% over the 60-day

volume-weighted average share price, or approximately $2.4 billion

of total equity value (in addition to redemption or repayment of

debt), through a tender offer and second-step merger. The Boards of

Directors of both companies have unanimously approved the merger

agreement. Details regarding the process will be available in

Vector Group’s Recommendation Statement for the tender offer, which

Vector Group will file shortly with the Securities and Exchange

Commission (“SEC”). After closing, Vector Group will become a

wholly owned subsidiary of JT Group.

“Vector Group and JT Group share a commitment to quality and

excellence and providing consumers an outstanding value proposition

in the U.S. cigarette market,” said Howard M. Lorber, President and

Chief Executive Officer of Vector Group Ltd. “This transaction

delivers significant value to Vector Group stockholders and creates

opportunities for our employees, who will become part of a leading

global organization. Vector Group has an incredibly talented team

who have been completely dedicated to building a strong business.

JT Group has deep respect for Liggett Vector Brands’ legacy of

value-focused, quality products and looks forward to continuing to

meet customers’ evolving needs.”

The transaction is subject to customary closing conditions,

including the tender of a majority of the outstanding shares of

Vector Group and the receipt of applicable regulatory approvals.

The transaction is expected to close in the fourth quarter of

2024.

Jefferies LLC served as exclusive financial advisor and Sullivan

& Cromwell LLP served as legal advisor to Vector Group. J.P.

Morgan Securities LLC and J.P. Morgan Securities plc are serving as

exclusive financial advisor to JT Group, Ernst & Young Tax Co.

is acting as its financial and tax advisor and Freshfields

Bruckhaus Deringer US LLP is acting as its legal advisor.

About Vector Group

Vector Group is a holding company for Liggett Group LLC, Vector

Tobacco LLC and New Valley LLC. Additional information concerning

the company is available on the Company's website,

www.VectorGroupLtd.com.

Investors and others should note that we may post information

about the Company or its subsidiaries on our website at

www.VectorGroupLtd.com and/or at the websites of those subsidiaries

or, if applicable, on their accounts on LinkedIn, Twitter or other

social media platforms. It is possible that the postings or

releases could include information deemed to be material

information. Therefore, we encourage investors, the media and

others interested in the Company to review the information we post

on our website at www.VectorGroupLtd.com, on the websites of our

subsidiaries and on their social media accounts.

Additional Information and Where to Find it

The tender offer described in this communication has not yet

commenced. This communication is neither an offer to purchase nor a

solicitation of an offer to sell shares of Vector Group. At the

time the offer is commenced, JTI (US) Holding Inc. and its merger

subsidiary, Vapor Merger Sub Inc., will file a Tender Offer

Statement on Schedule TO with the U.S. Securities and Exchange

Commission, and Vector Group will file a

Solicitation/Recommendation Statement on Schedule 14D-9 with

respect to the offer. Vector Group stockholders and other

investors are urged to read the tender offer materials (including

an Offer to Purchase, a related Letter of Transmittal and certain

other offer documents) and the Solicitation/Recommendation

Statement, as they may be amended from time to time, when they

become available because they will contain important information

that should be read carefully before any decision is made with

respect to the tender offer. These materials will be sent free

of charge to all stockholders of Vector Group. In addition, all of

these materials (and all other materials filed by Vector Group with

the SEC) will be available at no charge from the SEC through its

website at www.sec.gov. Investors and security holders may also

obtain free copies of the documents filed with the SEC by Vector

Group at www.VectorGroupLtd.com.

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical fact, may

be forward-looking statements. These forward-looking statements may

be accompanied by such words as “anticipate,” “believe,”

“estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“potential,” “project,” “target,” “should,” “likely,” “will” and

other words and terms of similar meaning. Forward-looking

statements include, among other things, statements regarding the

potential benefits of the proposed transaction; the prospective

performance, future plans, events, expectations, performance,

objectives and opportunities and the outlook for Vector Group’s

business; filings and approvals relating to the transaction; the

expected timing of the completion of the transaction; the ability

to complete the transaction considering the various closing

conditions; and any assumptions underlying any of the foregoing.

Investors are cautioned that any such forward-looking statements

are not guarantees of future performance and involve risks and

uncertainties and are cautioned not to place undue reliance on

these forward-looking statements. Actual results may differ

materially from those currently anticipated due to a number of

risks and uncertainties.

Risks and uncertainties that could cause the actual results to

differ from expectations contemplated by forward-looking statements

include: uncertainties as to the timing of the tender offer and

merger; the risk that the proposed transaction may not be completed

in a timely manner or at all; uncertainties as to how many of

Vector Group’s stockholders will tender their stock in the offer;

the possibility that various closing conditions for the transaction

may not be satisfied or waived, including that a governmental

entity may prohibit, delay or refuse to grant approval for the

consummation of the transaction; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the merger agreement; the effect of this

announcement or pendency of the proposed transaction on Vector

Group’s ability to retain and hire key personnel, its ability to

maintain relationships with its customers, suppliers and others

with whom it does business, its business generally or its stock

price; risks related to diverting management’s attention from

Vector Group’s ongoing business operations; the risk that

stockholder litigation in connection with the proposed transaction

may result in significant costs of defense, indemnification and

liability; other business effects, including the effects of

industry, economic or political conditions outside of Vector

Group’s control; transaction costs; and other risks and

uncertainties detailed from time to time in documents filed with

the Securities and Exchange Commission (“SEC”) by Vector Group,

including Vector Group’s current annual report on Form 10-K on file

with the SEC, as well as the Schedule 14D-9 to be filed by Vector

Group and the tender offer documents to be filed by JTI (US)

Holding Inc. and Vapor Merger Sub Inc.

Vector Group is providing the information in this filing as of

this date and assumes no obligation to update any forward-looking

statements as a result of new information, future developments or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240820090283/en/

Investor Relations J. Bryant Kirkland III, Vector Group

Ltd. 305-579-8000

Media FGS Global 212-687-8080 (U.S.)

VectorGroup@fgsglobal.com

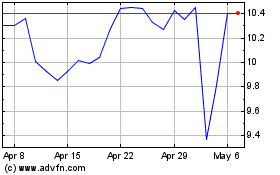

Vector (NYSE:VGR)

Historical Stock Chart

From Feb 2025 to Mar 2025

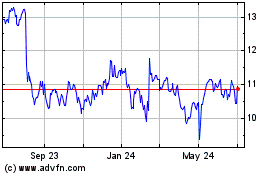

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Mar 2025