0001559432FALSE00015594322025-03-042025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 4, 2025

TXO Partners, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware (State or other jurisdiction

of incorporation) | 001-41605 (Commission File Number) | 32-0368858 (IRS Employer Identification No.) |

400 West 7th Street, Fort Worth, Texas (Address of principal executive offices) |

76102

(Zip Code) |

(817) 334-7800

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange

on which registered |

| Common Units representing limited partner interests | TXO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 4, 2025, TXO Partners, L.P. issued a press release announcing the declaration of its quarterly distribution for the fourth quarter of 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Information in this Item 7.01 and Exhibit 99.1 of Item 9.01 below shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as otherwise expressly stated in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit Number | Description |

| |

| 99.1 | |

| |

| 104.0 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | TXO Partners, L.P. | |

| | | | |

| | By: | TXO Partners GP, LLC | |

| | | its general partner | |

| | | | |

| |

| | | |

| Dated: March 4, 2025 | By: | /s/ Brent W. Clum | |

| | | Name: | Brent W. Clum | |

| | | Title: | President of Business Operations and Chief Financial Officer | |

PRESS RELEASE

PRESS RELEASE

Contact Information:

TXO Partners

Brent W. Clum

President, Business Operations & CFO

817.334.7800

ir@txopartners.com

Release Date:

March 4, 2025

TXO PARTNERS DECLARES A FOURTH QUARTER 2024 DISTRIBUTION OF $0.61 ON COMMON UNITS; PROVIDES 2025 DISTRIBUTION OUTLOOK AND FILES ANNUAL REPORT ON FORM 10-K

[Fort Worth, TX, March 2025]—TXO Partners, L.P. (NYSE: TXO) announced today that the Board of Directors of its general partner declared a distribution of $0.61 per common unit for the quarter ended December 31, 2024. The quarterly distribution will be paid on March

21, 2025, to eligible unitholders of record as of the close of trading on March 14, 2025.

“As a unique production and distribution business, TXO focuses on delivering returns to our holders through both cash distribution and value creation per unit. We strive to grow our distributions every year, and since going public in January 2023, TXO has delivered $4.49 per unit to holders,” stated Bob R. Simpson, Chairman and CEO. “Given our outlook, we are targeting a full-year distribution in excess of $2.45 per unit for the year ahead. ”

“Financial stewardship is the key component of the TXO strategy,” further commented President of Business Operations and CFO, Brent Clum. “Our intentional capital allocation generates cash flow through efficient operations which in turn drive distributions and value creation per unit for our holders. As well, we are always on the lookout for accretive opportunities to grow within our operating footprint. We

view the business of TXO through the lens of life-long owners, focusing on steady long-term success.”

Gary D. Simpson, President of Development and Production, continues, “With our long-lived assets, our technical teams have identified a rich inventory of development opportunities across the Permian, San Juan and Williston Basins. As we plan future capital programs, we are evaluating resource in excess of 50 million barrels of oil, along with the additional 3 Tcfe of natural gas potential in our Mancos Shale position. We believe this captured potential in aggregate represents multiples of our current booked reserve base. Specifically, the scope of development activities includes CO2 expansion, waterflood enhancements and drilling programs in all our producing basins. Ultimately, our goal is outstanding returns driven by confident investment with ongoing production and reserve stability.”

Annual Report on Form 10-K

TXO's financial statements and related footnotes will be available in the Annual Report on Form 10-K for the year ended December 31, 2024, which TXO will file with the Securities and Exchange Commission (SEC) today. The 10-K will be available on TXO's Investor Relations website at www.txopartners.com/investors or on the SEC's website at www.sec.gov. TXO unitholders may request a printed copy free of charge of the Annual Report on Form 10-K by emailing IR@txopartners.com or by writing to Investor Relations, 400 West 7th Street, Fort Worth, Texas 76102.

Non-U.S. Withholding Information

This press release is intended to be a qualified notice under Treasury Regulations Section 1.1446-4(b). Brokers and nominees should treat one hundred percent (100%) of TXO’s distribution to foreign unitholders as being attributable to income that is effectively connected with a United States trade or business. Accordingly, TXO’s

distributions to foreign unitholders are subject to federal income tax withholding at the highest applicable effective tax rate. For purposes of Treasury Regulations Section 1.1446(f)-4(c)(2)(iii), brokers and nominees should treat one hundred percent (100%) of the distributions as being in excess of cumulative net income for purposes of determining the amount to withhold. Nominees, and not TXO, are treated as withholding agents responsible for any necessary withholding on amounts received by them on behalf of foreign unitholders.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on the acquisition, development, optimization and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America. TXO’s current acreage positions are concentrated in the Permian Basin of West Texas and New Mexico, the San Juan Basin of

New Mexico and Colorado and the Williston Basin of Montana and North Dakota.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include the words such as “may,” “assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget” and similar expressions, although not all forward-looking statements contain such identifying words. These forward-looking statements include our 2025 distribution outlook, the resource potential of our Mancos Shale position in the San Juan Basin and other future development opportunities, the future production and potential economic value of our Mancos Shale position, the impacts of our Mancos Shale position on our reserves and production, our ability to maintain or increase oil production and reserves, our

ability to execute our strategy, the timing, amount and area of focus of future investments in our assets and the impacts of future commodity price changes. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events at the time such statement was made, and it is possible that the results described in this press release will not be achieved. Our assumptions and future performance are subject to a wide range of business risks, uncertainties and factors, including, without limitation, the following: our ability to meet distribution expectations and projections; the volatility of oil, natural gas and NGL prices; our ability to safely and efficiently operate TXO’s assets; uncertainties about our estimated oil, natural gas and NGL reserves, including the impact of commodity price declines on the economic producibility of such reserves, and in projecting future rates of production; and the risks and other factors disclosed in TXO’s filings with the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, TXO does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for TXO to predict all such factors.

Cautionary Note to Investors

The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. TXO may use certain broader terms such as “resource potential,” “natural gas potential” and “captured potential” in its communications to investors that the SEC’s guidelines strictly prohibit TXO from including in filings with the SEC. These types of estimates do not represent, and are not intended to represent, any category of reserves based on SEC definitions, are by their nature

more speculative than estimates of proved, probably and possible reserves and do not constitute “reserves” within the meaning of the SEC’s rules. These estimates are subject to greater uncertainties, and accordingly, are subject to a substantially greater risk of actually being realized. Investors are urged to consider closely the disclosures and risk factors in the reports TXO files with the SEC.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

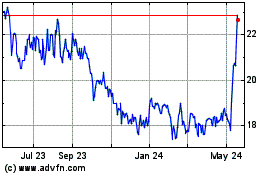

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Feb 2025 to Mar 2025

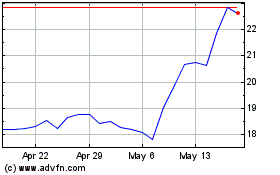

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Mar 2024 to Mar 2025