TXO Partners Declares a Second Quarter 2024 Distribution of $0.57 on Common Units; Files Quarterly Report on Form 10-Q

August 06 2024 - 4:11PM

Business Wire

TXO Partners, L.P. (NYSE: TXO) announced today that the Board of

Directors of its general partner declared a distribution of $0.57

per common unit for the quarter ended June 30, 2024. The quarterly

distribution will be paid on August 27, 2024, to eligible

unitholders of record as of the close of trading on August 20,

2024.

“Our financial focus for the unit holders is stewardship of

capital—in our allocation to producing assets, in our strong

balance sheet, and critically, in our distribution of cash flow,”

stated Bob R. Simpson, Chairman and CEO. “As our investors enjoy

quarterly cash returns, we will focus on accretive value creation.

For the second quarter of 2024, we are proud to announce $.57 per

unit will be delivered to our investors.”

“Our re-entry into the Greater Williston Basin affirms our

successful strategy of allocating capital with our production and

distribution model,” further commented President of Business

Operations and CFO, Brent Clum. “We remain on track to close our

transactions by the end of August and look forward to the fourth

quarter for the full impact on our production and cash flows.”

Quarterly Report on Form 10-Q

TXO's financial statements and related footnotes will be

available in the Quarterly Report on Form 10-Q for the quarter

ended June 30, 2024, which TXO will file with the Securities and

Exchange Commission (SEC) today. The 10-Q will be available on

TXO's Investor Relations website at www.txopartners.com/investors

or on the SEC's website at www.sec.gov.

Non-U.S. Withholding Information

This press release is intended to be a qualified notice under

Treasury Regulations Section 1.1446-4(b). Brokers and nominees

should treat one hundred percent (100%) of TXO’s distribution to

foreign unitholders as being attributable to income that is

effectively connected with a United States trade or business.

Accordingly, TXO’s distributions to foreign unitholders are subject

to federal income tax withholding at the highest applicable

effective tax rate. For purposes of Treasury Regulations Section

1.1446(f)-4(c)(2)(iii), brokers and nominees should treat one

hundred percent (100%) of the distributions as being in excess of

cumulative net income for purposes of determining the amount to

withhold. Nominees, and not TXO, are treated as withholding agents

responsible for any necessary withholding on amounts received by

them on behalf of foreign unitholders.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on

the acquisition, development, optimization and exploitation of

conventional oil, natural gas, and natural gas liquid reserves in

North America. TXO’s current acreage positions are concentrated in

the Permian Basin of West Texas and New Mexico and the San Juan

Basin of New Mexico and Colorado.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include the words such as “may,” “assume,” “forecast,”

“could,” “should,” “will,” “plan,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “budget” and similar

expressions, although not all forward-looking statements contain

such identifying words. These forward-looking statements include

our ability to manage our cashflow, our ability to execute our

strategy, the timing, amount and area of focus of future

investments in our assets, our ability to close the pending asset

acquisition and the impact of such acquisition on our operating and

financial results, and the impacts of future commodity price

changes. These forward-looking statements are based on management’s

current belief, based on currently available information, as to the

outcome and timing of future events at the time such statement was

made, and it is possible that the results described in this press

release will not be achieved. Our assumptions and future

performance are subject to a wide range of business risks,

uncertainties and factors, including, without limitation, the

following: our ability to meet distribution expectations and

projections; the volatility of oil, natural gas and NGL prices; our

ability to safely and efficiently operate TXO’s assets; our ability

to integrate the acquired assets and realize the benefits of the

acquisition; uncertainties about our estimated oil, natural gas and

NGL reserves, including the impact of commodity price declines on

the economic producibility of such reserves, and in projecting

future rates of production; and the risks and other factors

disclosed in TXO’s filings with the SEC, including its Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, TXO does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for TXO to predict all such factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806727118/en/

TXO Partners Brent W. Clum President, Business Operations &

CFO 817.334.7800 ir@txopartners.com

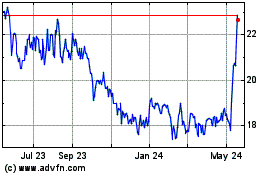

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Oct 2024 to Nov 2024

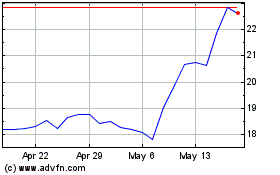

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Nov 2023 to Nov 2024