Triple Flag Precious Metals Corp. (with its subsidiaries,

“Triple Flag” or the “Company”) (TSX: TFPM, NYSE: TFPM) announced

its results for the first quarter of 2024 and declared a dividend

of US$0.0525 per common share to be paid on June 14, 2024. All

amounts are expressed in US dollars, unless otherwise

indicated.

“The business continues to generate significant free cash flow,

with a record start to 2024 putting us firmly in line with annual

GEOs sales guidance of 105 to 115 thousand ounces,” commented Shaun

Usmar, CEO. “Growth from our cornerstone asset, Northparkes, has

delivered meaningful results in the first quarter of 2024, and we

look forward to the impact of our portfolio’s exposure to increased

gold and silver prices on our cash flow. Triple Flag has a highly

driven, invested team, and we have a clear opportunity to

meaningfully advance our development aspirations.”

Q1 2024 Financial Highlights

Q1

2024

Q1

2023

Revenue

$57.5 million

$50.3 million

Gold Equivalent Ounces

(“GEOs”)1

27,794

26,599

Net Earnings (per share)

$17.4 million ($0.09)

$16.5 million ($0.09)

Adjusted Net Earnings2 (per

share)

$23.2 million ($0.12)

$15.3 million ($0.08)

Operating Cash Flow

$38.9 million

$38.9 million

Operating Cash Flow per Share

0.19

0.20

Adjusted EBITDA3

$48.1 million

$39.4 million

Asset Margin4

92%

88%

GEOs Sold by Commodity and Revenue by Commodity

Three Months Ended March 31

($

thousands except GEOs)

2024

2023

GEOs1

Gold

17,646

14,005

Silver

9,485

11,385

Other

663

1,209

Total

27,794

26,599

Revenue

Gold

36,524

26,468

Silver

19,632

21,517

Other

1,372

2,284

Total

57,528

50,269

Corporate Updates

- Guidance and Outlook Maintained: Triple Flag remains on

track to achieve its sales guidance for 2024 of 105,000 to 115,000

GEOs. As previously announced, we expect the GEOs contribution in

2024 from the higher gold grade E31 and E31N open pits at

Northparkes to be slightly higher in the second half of the year

compared to the first half due to the sequencing of mining and

processing activities. Triple Flag’s average annual sales outlook

from 2025 to 2029 of approximately 140,000 GEOs remains

unchanged.

- Quarterly Dividend Maintained: Triple Flag’s Board of

Directors declared a quarterly dividend of US$0.0525 per common

share that will be paid on June 14, 2024, to shareholders of record

at the close of business on May 31, 2024.

- Share Buyback Activity: Under its current normal course

issuer bid (“NCIB”), Triple Flag is authorized to repurchase

10,078,488 common shares from November 15, 2023, to November 14,

2024. Through the end of the first quarter of 2024, Triple Flag

bought back 454,700 shares in the open market for C$7.8 million, of

which, 283,100 shares for C$4.8 million was during the first

quarter of 2024.

- Commencement of Payments on NSR Royalty on the Kensington

Gold Mine: As previously announced, during the first quarter of

2024, wholly owned subsidiaries of Triple Flag and Coeur Mining,

Inc. (“Coeur”) entered into a settlement agreement to resolve

litigation regarding the terms of a royalty held by Triple Flag on

Coeur’s Kensington gold mine. Under the terms of the settlement,

Triple Flag and Coeur agreed to amend the terms of the existing

Kensington royalty to provide that:

- Effective January 1, 2024, the royalty will pay at a rate of

1.25% of net smelter returns through to December 31, 2026.

- The royalty rate will increase to 1.50% of net smelter returns

starting January 1, 2027.

Coeur’s production guidance for 2024 at

Kensington is 92,000 to 106,000 ounces of goldi.

As part of the settlement agreement, Triple

Flag has received 737 thousand shares of Coeur and, in the first

quarter of 2025, will receive further shares of Coeur with a fixed

value of $3.75 million as determined at that time. The Coeur share

consideration is in settlement of royalties in arrears and

litigation expenses incurred. The recognition of royalties in

arrears resulted in approximately 2,600 GEOs in the first quarter

of 2024.

The amended NSR royalty is subject to a cap

of two million ounces of gold, adjusted for consideration received

related to royalties in arrears.

Kensington is an underground gold operation

located in Alaska, currently consisting of the Kensington Main,

Raven and Jualin deposits, as well as other exploration targets.

Commercial production began in 2010, and in 2019, the mine achieved

over one million ounces of gold produced.

As of December 31, 2023, proven and probable

reserves at Kensington totaled 411 koz of gold, with an additional

819 koz of resources (exclusive) in the measured and indicated

category as well as 388 koz in the inferred categoryii. Ongoing

exploration work includes drilling at the Kensington Zone 30 and

Elmira deposits to further build reserves. Recent assays at the

property have shown orebody continuity to the south and

down-dip.

Q1 2024 Portfolio Updates

Triple Flag’s long-term GEOs sales outlook builds on the

sector-leading growth achieved since our inception, with a compound

annual growth rate of more than 20% since 2017.

GEOs sales over the five-year period from 2025 to 2029 are

expected to average 140,000 GEOs per year, a significant increase

over current levels driven by expansions from existing producing

assets as well as development and exploration assets slated to

commence operations in the medium to long term.

Significant year-to-date newsflow and milestones related to

assets within our portfolio are detailed below.

Australia:

- Northparkes (54% gold stream and 80% silver stream):

Sales from Northparkes in Q1 2024 were 6,286 GEOs, compared to

3,339 GEOs in Q4 2023. Consistent with Triple Flag’s guidance for a

stronger 2024 due to the processing of the higher-gold-grade E31

and E31N open pits, GEOs sales from Northparkes increased by nearly

90% quarter-on-quarter. We continue to expect these higher grade

open pits to contribute to mill feed blend through at least 2025. A

feasibility study for the E22 underground orebody is expected by

the end of the second quarter of 2024, which is anticipated to

represent a source of higher grade gold ore at Northparkes in the

medium to long term.

- Beta Hunt (3.25% GR gold royalty and 1.5% NSR gold

royalty): Royalties from Beta Hunt in Q1 2024 equated to

1,214 GEOs. Karora Resources disclosed that first quarter

performance at Beta Hunt was impacted by wet weather and a regional

interruption to grid power that impacted processing operations.

Full primary crushing was restored by the end of March. The

operator is on track to deliver 2024 production guidance of 170,000

to 185,000 ounces of gold. The expansion project to increase mine

capacity at Beta Hunt to 2 million tonnes per annum remains on

track for completion by the end of 2024. To accommodate the

expected increase in mining fleet, orders were placed for the

supply, installation, and commissioning of new, permanent primary

ventilation fans late in the third quarter of 2024. On April 7,

2024, Westgold Resources and Karora Resources announced a friendly

merger pursuant to which, Westgold will acquire 100% of the issued

and outstanding common shares of Karora. Completion of the

transaction is expected to create one of the top 5 largest,

ASX-listed gold producers operating exclusively in Western

Australia. In the transaction announcement, Westgold commented that

“the prize here is Beta Hunt’s gold potential. Rarely do you find a

gold asset of the quality and potential of Beta Hunt hiding in a

nickel belt and drilling is expected to further unlock value at

this mine.” An immediate focus for Westgold is the Fletcher zone,

with initial cuts expected in the second half of 2024. Significant

existing drilling equipment from Westgold will be redeployed to

Beta Hunt, which is currently defined over 7 km with only 4 km

drilled historically.

- Fosterville (2.0% NSR gold royalty): Royalties from

Fosterville in Q1 2024 equated to 1,051 GEOs. Agnico Eagle has

disclosed that first quarter performance was in line with plan, and

reiterated production guidance of 200,000 to 220,000 ounces of gold

in 2024.

Latin America:

- Cerro Lindo (65% silver stream): Sales from Cerro

Lindo in Q1 2024 were 6,585 GEOs. On March 27, 2024, Nexa announced

updated reserves and resources for Cerro Lindoiii, including proven

and probable silver reserves of 41.15 Mt at 22.6 g/t totaling

29,966 koz Ag as of December 31, 2023. Current measured and

indicated silver resources (exclusive) totaled 7.70 Mt at 23.7 g/t

totaling 5,857 koz Ag, and inferred silver resources totaled 9.28

Mt at 32.6 g/t totaling 9,726 koz Ag.

- Camino Rojo (2.0% NSR gold royalty on oxides): Royalties

from Camino Rojo in Q1 2024 equated to 656 GEOs. 2024 production

guidance for the asset remains unchanged at 110,000 to 120,000

ounces of gold.

- Buriticá (100% silver stream, fixed ratio to gold):

Sales from Buriticá in Q1 2024 were 974 GEOs. Throughout the first

quarter of 2024, Buriticá was able to maintain steady operations;

however, due to the ongoing presence of illegal miners, certain

areas of the mine were avoided as a precautionary measure. The mine

site continues to engage closely with the surrounding community on

illegal mining and is supported by the National Army and National

Police of Colombia.

North America:

- Young-Davidson (1.5% NSR gold royalty): Royalties from

Young-Davidson in Q1 2024 equated to 652 GEOs. As of December 31,

2023, Alamos Gold estimates a mine life of approximately 15 years

for Young-Davidson based on current underground mining rates. The

operator has budgeted $12 million for exploration at Young-Davidson

in 2024, focusing on extending mineralization within the syenite,

which hosts the majority of the current reserve and resource base.

Drilling is also expected to test the hanging wall and footwall of

the deposit, where higher grades have been previously

intersected.

- Pumpkin Hollow (97.5% gold and silver stream, fixed

ratio): On April 22, 2024, the operator disclosed that further

near-term funding is required to complete the commissioning and

ramp-up of the Pumpkin Hollow underground mine and that discussions

are ongoing with a third-party regarding a proposal for additional

financing and a potential change of control transaction. Triple

Flag continues to monitor this development closely to maximize

value for our shareholders. Our interests related to the Pumpkin

Hollow gold and silver stream are second secured against all of

Nevada Copper’s assets. Separately, our royalty interest on the

Pumpkin Hollow property has been registered and/or otherwise

recorded in the applicable state and federal registries.

- Florida Canyon (3.0% NSR gold royalty): Royalties from

Florida Canyon in Q1 2024 equated to 448 GEOs. During the quarter,

Argonaut Gold introduced 2024 production guidance of 63,000 to

70,000 gold equivalent ounces. On March 27, 2024, Alamos Gold

announced a friendly acquisition of Argonaut Gold. Upon closing of

the acquisition, Argonaut Gold’s assets in the United States and

Mexico, including the Florida Canyon heap leach mine in Nevada,

will be spun out to a newly created junior gold producer. This new

junior gold producer is expected to receive $10 million from Alamos

in exchange for a 19.9% ownership interest.

- Moss (100% silver stream): In April 2024, Elevation Gold

announced that it is examining all available options to preserve

sufficient liquidity for the continued operation of the Moss mine,

including debt consolidation or restructuring, further debt or

equity financing, or a sale of the operation. Pursuant to this,

Elevation Gold also announced that it has temporarily suspended

royalty/finder fee payments and silver stream delivery obligations.

Together with other stakeholders, Triple Flag is closely monitoring

this development. Our interests related to the Moss mine, including

the silver stream, are first secured against all of Elevation

Gold’s assets. Moss is a gold and silver heap leach operation

located in Arizona, USA.

- Hope Bay (1.0% NSR gold royalty): Exploration drilling

during the first quarter of 2024 returned strong results in the

Patch 7 area of the Madrid deposit, including 20.8 g/t gold over

17.7 meters and 14.1 g/t gold over 16.4 meters in a cluster of

high-grade intersections approximately 200 meters north of Patch 7

mineral resources. With this emerging new mineralized area

returning grades and thicknesses greater than average for the

Madrid deposit, Agnico Eagle expects to intensify drilling in this

area for the rest of 2024 given the potential positive impact on

mining scenarios for potential project redevelopment.

- South Railroad (2.0% NSR gold and silver royalty): In

April 2024, Orla Mining completed the acquisition of Contact Gold,

whose key asset is the 100%-owned Pony Creek property in Nevada.

Pony Creek is located immediately adjacent to Orla’s core growth

asset, the South Railroad heap leach project. Ongoing exploration

success at South Railroad has indicated the potential for resource

and pit growth. Over a 25-kilometer strike length at the property,

Orla is expected to complete a 22,000-meter drill program in 2024.

A record of decision for South Railroad is expected in 2025.

- Tamarack (1.85% NSR nickel and PGM royalty on Talon

Metals Corp.’s interest in the project): In April 2024, Talon

announced that a feasibility study for Tamarack is expected to be

completed in unison with the project’s environmental impact

statement in 2025. Under a $114.8 million grant from the US

Department of Energy, Talon is also in the final stages of securing

an existing brownfields site in North Dakota to receive feedstock

from the Tamarack project.

- Fenn-Gib (1.0% to 1.5% NSR gold royalty): Fenn-Gib is a

100%-owned gold deposit that straddles the Pipestone fault in

Northern Ontario, operated by Mayfair Gold. Conceptually, the

deposit is currently designed to be mined by bulk tonnage, open pit

methods, however, recent drilling indicates the potential for

underground mining. The current pit-constrained resource is 3.4

million ounces Au at 0.93 g/tiv. During the quarter, a

pre-feasibility study for Fenn-Gib was launched.

Rest of World:

- Impala Bafokeng (70% gold stream): Sales from Impala

Bafokeng in Q1 2024 were 1,537 GEOs, versus Q4 2023 sales of 1,674

GEOs. During the quarter, performance at the asset’s value driver,

Styldrift, was constrained by mining fleet and operational

impediments. Impala Platinum, the operator, disclosed that it

remains on track to deliver within group guidance for the fiscal

year ended June 30, 2024.

- ATO (25% gold stream and 50% silver stream): Sales from

the ATO streams in Q1 2024 were 1,376 GEOs. During the quarter,

Steppe Gold reported progress on the ATO Phase 2 Expansion, and

have now drawn the first $50 million of the previously announced

$150 million project financing package. First concentrate

production under Phase 2 is expected by 2026. On April 11, 2024,

Steppe Gold announced that it had entered into a share exchange

agreement to acquire all of the outstanding common shares of Boroo

Gold LLC pursuant to a previously announced binding term sheet. The

completion of this acquisition is expected to establish Steppe Gold

as the largest gold producer in Mongolia, providing further

financial strength, asset diversification and scale. On March 15,

2024, Triple Flag entered into an agreement with Steppe Gold to

acquire a prepaid gold interest. Under the terms of the agreement,

the Company made a cash payment of $5 million to acquire the

prepaid gold interest, which provides for the delivery of 2,650

ounces of gold that will be delivered by Steppe Gold over five

months. Deliveries will commence on August 15, 2024, with five

equal monthly deliveries of 530 ounces of gold.

- Agbaou (2.5% NSR gold royalty): Royalties from Agbaou in

Q1 2024 equated to 328 GEOs. During the quarter, the operator

introduced 2024 production guidance of 85,000 to 95,000 ounces of

gold for Agbaou. The current life-of-mine plan contemplates a

minimum annual production profile of 90,000 ounces until 2026, with

total gold production of over 465,000 ounces through 2028. Further

mine life extensions are targeted from the newly defined Agbalé

deposit, which is included in the 2024 exploration program for

Agbaou with a budget of $6 million.

- Koné (2.0% NSR gold royalty): During the first quarter

of 2024, Montage Gold announced the appointment of Martino De

Ciccio as CEO, as well as the completion of a non-brokered private

placement. The closing of this financing increased the Lundin

family’s ownership interest in Montage Gold to approximately 18%

and raised the cash balance to C$39.5 million. Based on the 2024

feasibility study, Koné is designed to produce an average of

223,000 ounces of gold per year over an initial mine life of 16

years. Final permits and approvals for Koné are expected in Q3

2024, with construction anticipated to commence thereafter.

- Prieska (0.8% GR royalty and 84% gold and silver stream,

fixed ratio): Trial mining at Prieska continued during the first

quarter of 2024, with ore development testing the strike dip

extensions within the +105 Block. Ore sourced from trial mining

will be used for metallurgical testwork and the design of a

sulphide concentrator plant. An updated feasibility study for

Prieska is scheduled to be completed in the second half of

2024.

- Enchi (2.0% NSR gold royalty): In April 2024, Newcore

Gold released an updated preliminary economic assessment for the

100%-owned Enchi gold project in Ghana. Enchi is designed as an

open pit, heap leach operation producing an average of 120,000

ounces of gold per year over a 9-year mine life. All deposits and

targets remain open along strike and at depth, with growth

potential in both shallow oxide and sulphide mineralization.

Conference Call Details

A conference call and live webcast presentation will be held on

May 8, 2024, starting at 9:00 a.m. ET (6:00 a.m. PT) to discuss

these results. The live webcast can be accessed by visiting the

Events and Presentations page on the Company’s website at:

www.tripleflagpm.com. An archived version of the webcast will be

available on the website for one year following the webcast.

Live Webcast:

https://events.q4inc.com/attendee/189620706

Dial-In Details:

Toll-Free (U.S. & Canada): +1 (888)

330-2384

International: +1 (647) 800-3739

Conference ID: 4548984, followed by #

key

Replay (Until May 22):

Toll-Free (U.S. & Canada): +1 (800)

770-2030

International: +1 (647) 362-9199

Conference ID: 4548984, followed by #

key

About Triple Flag

Triple Flag is a pure play, precious-metals‐focused streaming

and royalty company. We offer bespoke financing solutions to the

metals and mining industry with exposure primarily to gold and

silver in the Americas and Australia, with a total of 234 assets,

including 15 streams and 219 royalties. These investments are tied

to mining assets at various stages of the mine life cycle,

including 32 producing mines and 202 development and exploration

stage projects, and other assets. Triple Flag is listed on the

Toronto Stock Exchange and New York Stock Exchange, under the

ticker “TFPM”.

Qualified Person

James Lill, Director, Mining for Triple Flag Precious Metals and

a “qualified person” under NI 43-101 has reviewed and approved the

written scientific and technical disclosures contained in this

press release.

Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities laws and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995,

respectively (collectively referred to herein as “forward-looking

information”). Forward-looking information may be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“outlook”, “forecasts”, “projection”, “prospects”, “strategy”,

“intends”, “anticipates”, “believes” or variations of such words

and phrases or terminology which states that certain actions,

events or results “may”, “could”, “would”, “might”, “will”, “will

be taken”, “occur” or “be achieved”. Forward-looking information in

this news release includes, but is not limited to, statements with

respect to the Company’s annual and five-year guidance, operational

and corporate developments for the Company, developments in respect

of the Company’s portfolio of royalties and streams and related

interests and those developments at certain of the mines, projects

or properties that underlie the Company’s interests, strengths,

characteristics, the payment of a dividend by the Company, the

conduct of the conference call to discuss the financial results for

the first quarter of 2024, and our assessments of, and expectations

for, future periods (including, but not limited to, the long-term

sales outlook for GEOs). In addition, any statements that refer to

expectations, intentions, projections or other characterizations of

future events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding possible future events or

circumstances.

The forward-looking information included in this news release is

based on our opinions, estimates and assumptions in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that we

currently believe are appropriate and reasonable in the

circumstances. The forward-looking information contained in this

news release is also based upon a number of assumptions, including

the ongoing operation of the properties in which we hold a stream

or royalty interest by the owners or operators of such properties

in a manner consistent with past practice; the accuracy of public

statements and disclosures made by the owners or operators of such

underlying properties; and the accuracy of publicly disclosed

expectations for the development of underlying properties that are

not yet in production. These assumptions include, but are not

limited to, the following: assumptions in respect of current and

future market conditions and the execution of our business

strategies; that operations, or ramp-up where applicable, at

properties in which we hold a royalty, stream or other interest

continue without further interruption through the period; and the

absence of any other factors that could cause actions, events or

results to differ from those anticipated, estimated, intended or

implied. Despite a careful process to prepare and review the

forward-looking information, there can be no assurance that the

underlying opinions, estimates and assumptions will prove to be

correct. Forward-looking information is also subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information. Such risks, uncertainties and other

factors include, but are not limited to, those set forth under the

caption “Risk and Risk Management” in our management’s discussion

and analysis in respect of the first quarter of 2024 and the

caption “Risk Factors” in our most recently filed annual

information form, each of which is available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. In addition, we note

that mineral resources that are not mineral reserves do not have

demonstrated economic viability and inferred resources are

considered too geologically speculative for the application of

economic considerations.

Although we have attempted to identify important risk factors

that could cause actual results or future events to differ

materially from those contained in the forward-looking information,

there may be other risk factors not presently known to us or that

we presently believe are not material that could also cause actual

results or future events to differ materially from those expressed

in such forward-looking information. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information, which speaks only as of

the date made. The forward-looking information contained in this

news release represents our expectations as of the date of this

news release and is subject to change after such date. We disclaim

any intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws. All of the forward-looking information contained

in this news release is expressly qualified by the foregoing

cautionary statements.

Cautionary Statement to U.S. Investors

Information contained or referenced in this press release or in

the documents referenced herein concerning the properties,

technical information and operations of Triple Flag has been

prepared in accordance with requirements and standards under

Canadian securities laws, which differ from the requirements of the

U.S. Securities and Exchange Commission (“SEC”) under subpart 1300

of Regulation S-K (“S-K 1300”). Because the Company is eligible for

the Multijurisdictional Disclosure System adopted by the SEC and

Canadian Securities Administrators, Triple Flag is not required to

present disclosure regarding its mineral properties in compliance

with S-K 1300. Accordingly, certain information contained in this

press release may not be comparable to similar information made

public by U.S. companies subject to reporting and disclosure

requirements of the SEC.

Technical and Third-Party Information:

Triple Flag does not own, develop or mine the underlying

properties on which it holds stream or royalty interests. As a

royalty or stream holder, Triple Flag has limited, if any, access

to properties included in its asset portfolio. As a result, Triple

Flag is dependent on the owners or operators of the properties and

their qualified persons to provide information to Triple Flag and

on publicly available information to prepare disclosure pertaining

to properties and operations on the properties on which Triple Flag

holds stream, royalty or other similar interests. Triple Flag

generally has limited or no ability to independently verify such

information. Although Triple Flag does not believe that such

information is inaccurate or incomplete in any material respect,

there can be no assurance that such third-party information is

complete or accurate.

Endnotes

Endnote 1: Gold Equivalent Ounces (“GEOs”)

GEOs are a non-IFRS measure that is based on stream and royalty

interests and calculated on a quarterly basis by dividing all

revenue from such interests for the quarter by the average gold

price during such quarter. The gold price is determined based on

the LBMA PM fix. For periods longer than one quarter, GEOs are

summed for each quarter in the period. Management uses this measure

internally to evaluate our underlying operating performance across

our stream and royalty portfolio for the reporting periods

presented and to assist with the planning and forecasting of future

operating results. GEOs are intended to provide additional

information only and do not have any standardized definition under

IFRS Accounting Standards and should not be considered in isolation

or as a substitute for measures of performance prepared in

accordance with IFRS Accounting Standards. The measures are not

necessarily indicative of gross profit or operating cash flow as

determined under IFRS Accounting Standards Other companies may

calculate these measures differently. The following table

reconciles GEOs to revenue, the most directly comparable IFRS

Accounting Standards measure:

Three months ended

March 31

($ thousands, except average gold price

and GEOs information)

2024

2023

Revenue

57,528

50,269

Average gold price per ounce

2,070

1,890

GEOs

27,794

26,599

Endnote 2: Adjusted Net Earnings and Adjusted Net Earnings

per Share

Adjusted net earnings is a non‑IFRS financial measure, which

excludes the following from net earnings:

- impairment charges, write-downs and reversals, including

expected credit losses;

- gain/loss on sale or disposition of assets/mineral

interests;

- foreign currency translation gains/losses;

- increase/decrease in fair value of investments;

- non-recurring charges; and

- impact of income taxes on these items.

Management uses this measure internally to evaluate our

underlying operating performance for the reporting periods

presented and to assist with the planning and forecasting of future

operating results. Management believes that adjusted net earnings

is a useful measure of our performance because impairment charges,

write-downs and reversals, including expected credit losses,

gain/loss on sale or disposition of assets/mineral interests,

foreign currency translation gains/losses, increase/decrease in

fair value of investments, and non-recurring charges do not reflect

the underlying operating performance of our core business and are

not necessarily indicative of future operating results. The tax

effect is also excluded to reconcile the amounts on a post-tax

basis, consistent with net earnings. Management’s internal budgets

and forecasts and public guidance do not reflect the types of items

we adjust for. Consequently, the presentation of adjusted net

earnings enables users to better understand the underlying

operating performance of our core business through the eyes of

management. Management periodically evaluates the components of

adjusted net earnings based on an internal assessment of

performance measures that are useful for evaluating the operating

performance of our business and a review of the non-IFRS measures

used by industry analysts and other streaming and royalty

companies. Adjusted net earnings is intended to provide additional

information only and does not have any standardized definition

under IFRS Accounting Standards and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS Accounting Standards. The measures are not

necessarily indicative of gross profit or operating cash flow as

determined under IFRS Accounting Standards. Other companies may

calculate these measures differently. The following table

reconciles adjusted net earnings to net earnings, the most directly

comparable IFRS Accounting Standards measure.

Reconciliation of Net Earnings to Adjusted Net Earnings

Three months ended

March 31

($ thousands, except share and per share

information)

2024

2023

Net earnings

$

17,424

$

16,534

Impairment reversal

(589

)

—

Expected credit losses

6,851

—

Foreign currency gain

(40

)

(45

)

Decrease (Increase) in fair value of

investments

427

(1,308

)

Income tax effect

(870

)

103

Adjusted net earnings

$

23,203

$

15,284

Weighted average shares outstanding –

basic

201,140,642

191,778,186

Net earnings per share

$

0.09

$

0.09

Adjusted net earnings per share

$

0.12

$

0.08

Endnote 3: Adjusted EBITDA

Adjusted EBITDA is a non‑IFRS financial measure, which excludes

the following from net earnings:

- income tax expense;

- finance costs, net;

- depletion and amortization;

- impairment charges, write-downs and reversals, including

expected credit losses;

- gain/loss on sale or disposition of assets/mineral

interests;

- foreign currency translation gains/losses;

- increase/decrease in fair value of investments;

- non-cash cost of sales related to prepaid gold interests;

and

- non‑recurring charges

Management believes that adjusted EBITDA is a valuable indicator

of our ability to generate liquidity by producing operating cash

flow to fund working capital needs, service debt obligations and

fund acquisitions. Management uses adjusted EBITDA for this

purpose. Adjusted EBITDA is also frequently used by investors and

analysts for valuation purposes, whereby adjusted EBITDA is

multiplied by a factor or ‘‘multiple’’ that is based on an observed

or inferred relationship between adjusted EBITDA and market values

to determine the approximate total enterprise value of a

company.

In addition to excluding income tax expense, finance costs, net

and depletion and amortization, adjusted EBITDA also removes the

effect of impairment charges, write-downs and reversals, including

expected credit losses, gain/loss on sale or disposition of

assets/mineral interests, foreign currency translation

gains/losses, increase/decrease in fair value of investments,

non-cash cost of sales related to prepaid gold interests and

non-recurring charges. We believe these items provide a greater

level of consistency with the adjusting items included in our

adjusted net earnings reconciliation, with the exception that these

amounts are adjusted to remove any impact of income tax expense as

they do not affect adjusted EBITDA. We believe this additional

information will assist analysts, investors and our shareholders to

better understand our ability to generate liquidity from operating

cash flow, by excluding these amounts from the calculation as they

are not indicative of the performance of our core business and not

necessarily reflective of the underlying operating results for the

periods presented.

Adjusted EBITDA is intended to provide additional information to

investors and analysts and does not have any standardized

definition under IFRS Accounting Standards and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS Accounting Standards.

Adjusted EBITDA is not necessarily indicative of operating profit

or operating cash flow as determined under IFRS Accounting

Standards. Other companies may calculate adjusted EBITDA

differently. The following table reconciles adjusted EBITDA to net

earnings, the most directly comparable IFRS Accounting Standards

measure.

Reconciliation of Net Earnings to Adjusted EBITDA

Three months ended

March 31

($ thousands)

2024

2023

Net earnings

$

17,424

$

16,534

Finance costs, net

1,294

1,308

Income tax expense

2,718

1,366

Depletion and amortization

17,810

16,021

Impairment reversal

(589

)

—

Expected credit losses1

6,851

—

Non-cash cost of sales related to prepaid

gold interests

2,173

5,560

Foreign currency translation gain

(40

)

(45

)

Decrease (Increase) in fair value of

investments

427

(1,308

)

Adjusted EBITDA

$

48,068

$

39,436

1.

Expected credit losses for the three

months ended March 31, 2024 primarily relate to expected credit

loss provision for loan receivables.

Endnote 4: Gross Profit Margin and Asset Margin

Gross profit margin is an IFRS Accounting Standards financial

measure which we define as gross profit divided by revenue. Asset

margin is a non-IFRS financial measure which we define by taking

gross profit and adding back depletion and non-cash cost of sales

related to prepaid gold interests and dividing by revenue. We use

gross profit margin to assess profitability of our metal sales and

asset margin to evaluate our performance in increasing revenue,

containing costs and providing a useful comparison to our peers.

Asset margin is intended to provide additional information only and

does not have any standardized definition under IFRS Accounting

Standards and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS Accounting Standards. The following table reconciles asset

margin to gross profit margin, the most directly comparable IFRS

Accounting Standards measure:

Three months ended

March 31

($ thousands except Gross profit margin

and Asset margin)

2024

2023

Revenue

$

57,528

$

50,269

Less: Cost of sales

24,269

27,395

Gross profit

33,259

22,874

Gross profit margin

58%

46%

Gross profit

$

33,259

$

22,874

Add: Depletion

17,720

15,928

Add: Non-cash cost of sales related to

prepaid gold interests

2,173

5,560

53,152

44,362

Revenue

57,528

50,269

Asset margin

92%

88%

__________________________

i Refer to Coeur’s press release dated

February 21, 2024, “Coeur Reports Fourth Quarter and Full-Year 2023

Results”.

ii Refer to Coeur’s press release dated

February 20, 2024, “Coeur Reports Year-End 2023 Mineral Reserves

and Resources”.

iii Refer to Nexa’s press release dated

March 27, 2024, “Nexa Resources Announces 2023 Year-End Mineral

Reserves and Mineral Resources”.

iv Refer to Mayfair’s NI 43-101 technical

report for the Fenn-Gib Project dated July 26, 2023 with an

effective date of April 6, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507045999/en/

Investor Relations: David Lee Vice President, Investor

Relations +1 (416) 304-9770 ir@tripleflagpm.com

Media: Gordon Poole, Camarco +44 (0) 7730 567 938

tripleflag@camarco.co.uk

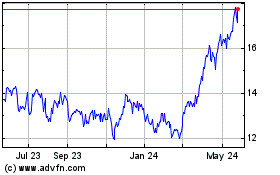

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Nov 2024 to Dec 2024

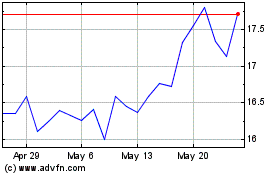

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Dec 2023 to Dec 2024