Triple Flag Precious Metals Corp. (with its subsidiaries,

“Triple Flag” or the “Company”) (TSX: TFPM, NYSE: TFPM) announced

its results for the third quarter of 2023 and declared a dividend

of US$0.0525 per common share to be paid on December 15, 2023. All

amounts are expressed in US dollars unless otherwise indicated.

“Our business continued its strong performance in the third

quarter of 2023, and we are on track to deliver our full-year GEOs

sales guidance of 100,000 to 115,000 ounces,” commented Shaun

Usmar, CEO. “Triple Flag maintained a solid pace of accretive

acquisitions during the quarter, with an incremental 2.65% royalty

acquired at the producing Stawell gold mine in Australia, which

follows the acquisition of the Agbaou royalty during the second

quarter and the Maverix transaction completed earlier this year.

This brings the total value of transactions closed during this year

to nearly $700 million. Sustainability is also core to our identity

and subsequent to quarter-end, we achieved a year-over-year

improvement in our Sustainalytics’ ESG Risk Rating, and now rank

3rd out of 117 companies in the global precious metals sector.”

Q3 2023 Financial Highlights

Q3

2023

Q3

2022

Revenue

$49.4 million

$33.8 million

Gold Equivalent Ounces

(“GEOs”)1

25,629

19,523

Operating Cash Flow3

$36.8 million

$25.4 million

Net (Loss) Earnings

-$6.0 million (-$0.03/share)

$12.8 million ($0.08/share)

Adjusted Net Earnings2

$17.3 million ($0.09/share)

$13.3 million ($0.09/share)

Adjusted EBITDA4

$38.8 million

$26.1 million

Asset Margin5

90%

90%

GEOs Sold by Commodity, Revenue by Commodity, and Financial

Highlights Summary Table

Three Months Ended September 30

($

thousands except GEOs, Asset Margin and per share

numbers)

2023

2022

GEOs1

Gold

15,115

11,918

Silver

9,500

6,134

Other

1,014

1,471

Total

25,629

19,523

Revenue

Gold

29,149

20,605

Silver

18,321

10,605

Other

1,955

2,544

Total

49,425

33,754

Net (Loss) Earnings

(6,041)

12,815

Net (Loss) Earnings per Share

(0.03)

0.08

Adjusted Net Earnings2

17,337

13,258

Adjusted Net Earnings per

Share2

0.09

0.09

Operating Cash Flow3

36,750

25,356

Operating Cash Flow per Share

0.18

0.16

Adjusted EBITDA4

38,804

26,054

Asset Margin5

90%

90%

Corporate Updates

- Guidance and Outlook Maintained: Triple Flag remains on

track to achieve its sales guidance for 2023 of 100,000 to 115,000

GEOs, notwithstanding the Renard diamond mine entering care and

maintenance in the fourth quarter of 2023 as described further

below. Triple Flag’s average annual sales outlook from 2024 to 2028

of over 140,000 GEOs also remains unchanged.

- Quarterly Dividend Maintained: Triple Flag’s Board of

Directors declared a quarterly dividend of US$0.0525 per common

share that will be paid on December 15, 2023, to the shareholders

of record at the close of business on November 30, 2023.

- Sustainalytics ESG Risk Rating Improvement: Subsequent

to quarter-end, Triple Flag was recognized by Morningstar

Sustainalytics as an ‘ESG Industry Top Rated’ and ‘ESG Regional Top

Rated’ company. Improving on the rating from last year, Triple

Flag’s new ESG Risk Rating of 8.9 is a testament to the commitment

of our fantastic team and our mining partners to ESG excellence as

a necessary requirement for maximizing long-term shareholder

returns, while limiting business disruption and maintaining our

privilege to operate in the regions we choose to invest. Triple

Flag is now ranked 3rd out of 117 companies in the global precious

metals sector.

- Additional Royalty Interest Acquired on the Stawell

Mine: On September 25, 2023, Triple Flag acquired an additional

2.65% net smelter return (“NSR”) royalty on the Stawell mine from

Stawell Gold Mine Pty Ltd (“SGM”), the owner and operator, for

$16.6 million in cash. This is in addition to the pre-existing 1.0%

NSR royalty on gold that Triple Flag already held. Both royalties

cover future production at the Stawell gold mine. Stawell has a

long history of reserve replacement and has been in operation since

1981, with a mill refurbishment completed in 2019. Stawell is

expected to have at least a 10-year mine life, with annual gold

production forecasted to ramp up to approximately 70,000 ounces in

the long term (from approximately 50,000 ounces currently). A

surface and underground exploration program focused on resource

expansion and definition is ongoing. Stawell is located in the

state of Victoria in Australia.

Q3 2023 Portfolio Updates

Australia:

- Northparkes (54% gold stream and 80% silver stream):

Sales from Northparkes in Q3 2023 were 3,919 GEOs. E31 and E31N are

higher gold grade open pit deposits at Northparkes, which are

expected to contribute to significant near-term production growth

at this operation. Development continues to advance, with the first

blast successfully completed at E31N during August 2023. Mining of

transitional ore commenced at both open pits during the month, with

sulfide ore mined from E31 in September. Ore from E31 and E31N is

expected to contribute to mill feed blend starting in the fourth

quarter of 2023, which should drive GEOs sales growth starting in

2024.

- Fosterville (2.0% NSR gold royalty): Royalties from

Fosterville in Q3 2023 equated to 1,612 GEOs. Agnico Eagle Mines

Limited now expects full year 2023 gold production at Fosterville

of approximately 285,000 ounces, compared to prior guidance of

295,000 to 315,000 ounces. This is mainly driven by a focus on

underground development to advance upgrades to the primary

ventilation system. Ongoing exploration work continued through Q3

2023, including a highlight intercept of 10.8 g/t gold over 10.0

meters in the Cardinal splay, approximately 190 meters down-plunge

of current mineral reserves. The result is the deepest visible-gold

intercept in the Cardinal splay achieved to date, which is a key

target of the Lower Phoenix zone.

- Beta Hunt (3.25% gross revenue (“GR”) gold royalty and

1.5% NSR gold royalty): Royalties from Beta Hunt in Q3 2023

equated to 1,207 GEOs. During the quarter, Karora Resources Inc.

reported strong drill results at Beta Hunt that have the potential

to expand the strike and depth of the mine, most notably at the

Mason zone.

Latin America:

- Cerro Lindo (65% silver stream): Sales from Cerro

Lindo in Q3 2023 were 5,477 GEOs, an improvement from Q2 2023 GEOs

of 4,054 as expected following its recovery from Cyclone Yaku.

During the quarter, the exploration program at Cerro Lindo focused

on extensions of known orebodies to the southeast. Drilling also

began at the Patahuasi Millay expansion target, which is within

Triple Flag’s stream area and is located 500 meters to the

northwest of Cerro Lindo.

- Camino Rojo (2.0% NSR gold royalty): Royalties from

Camino Rojo in Q3 2023 equated to 560 GEOs. In October 2023, Orla

Mining increased its full-year 2023 gold production guidance to

110,000 to 120,000 ounces due to stronger than expected performance

from Camino Rojo (from 100,000 to 110,000 ounces previously).

- Buriticá (100% silver stream, fixed ratio to gold):

Sales from Buriticá in Q3 2023 were 1,570 GEOs. Through the third

quarter of 2023, Buriticá was able to maintain steady operations.

The mine site continues to engage closely with the surrounding

community on illegal mining and is supported by the National Army

and National Police. Ongoing exploration success targeting minelife

extensions recently drove growth in gold mineral resources by

approximately 700 koz in the measured and indicated category and by

approximately 570 koz in the inferred category, after mining

depletion.

North America:

- Young-Davidson (1.5% NSR gold royalty): Royalties

from Young-Davidson in Q3 2023 equated to 684 GEOs. In October

2023, Alamos Gold reiterated that Young-Davidson is on track to

meet its 2023 production guidance of 185,000 – 200,000 ounces.

- Pumpkin Hollow (97.5% gold and silver stream):

Subsequent to quarter-end, Nevada Copper Corp. announced the

resumption of ore processing operations at Pumpkin Hollow. The mill

is being recommissioned on lower grade ore stockpiles and is

expected to transition to a combination of mined stope ore and

stockpiled ore. Triple Flag has not assumed any contributions from

Pumpkin Hollow to GEOs sales in the fourth quarter of 2023.

- Hope Bay (1.0% NSR gold royalty): Exploration at the

Hope Bay project continued during Q3 2023 with seven drill rigs in

operation targeting the Doris and Madrid-area deposits and regional

areas for a total of 31,074 meters completed, as well as 119,771

meters completed during the first nine months of 2023. The

objective of the exploration program remains to grow the mineral

resources at Doris and Madrid to support future project studies and

potential resumption of mining at Hope Bay. In the meantime,

technical studies continue to progress while larger production

scenarios for Hope Bay are being evaluated by Agnico Eagle.

- Tamarack (1.85% NSR royalty on Talon Metals Corp.’s

interest in the project): On September 12, 2023, Talon Metals Corp.

(“Talon”) entered into a definitive agreement with the United

States Department of Defense’s Office of Manufacturing Capability

Expansion and Investment Prioritization to accelerate and expand

Talon’s efforts to discover and secure additional domestic supply

of nickel for the growing US battery manufacturing base and defense

related supply chains. As part of the agreement, the Department of

Defense will contribute $20.6 million over a period of 39 months to

advance the project. Separately on November 2, 2023, Talon

announced that a definitive agreement has now been signed with the

US Department of Energy setting the terms, conditions and

performance milestones for the previously announced $114.8 million

in grant funding created by the Bipartisan Infrastructure Law.

- DeLamar (2.5% NSR royalty, partial coverage): In

September 2023, Integra Resources Corp. announced an updated

resource estimate for the DeLamar gold and silver project in Idaho,

USA following a successful stockpile drill program. The new

resource estimate increased heap leachable ounces in the measured

and indicated category by approximately 25%, and in the inferred

category by approximately 31%. Optimization work is ongoing for

inclusion in a feasibility study expected to be completed in late

2024 or early 2025.

- Moss (100% silver stream): Sales from Moss in Q3

2023 were 1,214 GEOs under the stream and related agreements. The

3A Phase 2 leach pad expansion at Moss continues to progress on

budget and is expected to be completed in the fourth quarter of

2023.

- Renard (4% diamond stream): Sales from Renard in

Q3 2023 were 887 GEOs. Throughout 2023, global demand for rough

diamonds was soft, with trade bodies in India recently urging its

members to halt imports for two months to manage supplies. These

market conditions pressured the financial position of Stornoway. On

October 27, 2023, Triple Flag was advised by Stornoway that it has

filed for protection under the Companies’ Creditors Arrangement Act

(Canada). An impairment charge of $20.2 million related to Renard

has been recorded in Triple Flag’s Q3 2023 financial

statements.

Rest of World:

- RBPlat (70% gold stream): Sales from RBPlat in Q3

2023 were 1,632 GEOs. The acquisition of Royal Bafokeng Platinum by

Implats was completed during the quarter, combining two contiguous

operations on the Western Limb of the Bushveld Igneous Complex into

the hands of one of the world’s premier PGM producers.

- ATO (25% gold stream and 50% silver stream):

Sales from the ATO stream and related interests in Q3 2023 were

2,142 GEOs. In October 2023, Steppe Gold Ltd. (“Steppe Gold”)

announced an initial drawdown of $9.6 million from the previously

announced $150 million financing package for the construction of

the Phase 2 mine and mill expansion at ATO. This includes a $50

million term loan from the Trade and Development Bank of Mongolia.

First concentrate production under Phase 2 is expected in late 2025

or early 2026 by Steppe Gold, which is designed to produce over

100,000 gold equivalent ounces per annum over 12 years according to

the operator.

- Koné (2.0% NSR gold royalty): In September 2023, Montage

Gold Corp. (“Montage”) released an updated resource estimate for

the Gbongogo Main deposit of the Koné open pit gold project in Côte

d’Ivoire. Indicated resources at the Koné gold project now stand at

4.83 million ounces with an additional 0.32 million ounces in the

inferred category. Montage expects to complete an updated

feasibility study by the end of 2023, with a development decision

in early 2024.

Conference Call Details

Triple Flag has scheduled an investor conference call at 10:00

a.m. ET (7:00 a.m. PT) on Wednesday, November 8, 2023, to discuss

the results reported in today’s earnings announcement. The live

webcast can be accessed by visiting the Events and Presentations

page on the Company’s website at: www.tripleflagpm.com. An archived

version of the webcast will be available on the website for two

weeks following the webcast.

Live Webcast:

https://events.q4inc.com/attendee/155059712

Dial-In Details:

Toll-Free (U.S. & Canada): +1 (888)

330-2384

International: +1 (647) 800-3739

Conference ID: 4548984

Replay (Until November 22):

Toll-Free (U.S. & Canada): +1 (800)

770-2030

International: +1 (647) 362-9199

Conference ID: 4548984

About Triple Flag

Triple Flag is a pure play, precious-metals‐focused streaming

and royalty company. We offer bespoke financing solutions to the

metals and mining industry with exposure primarily to gold and

silver in the Americas and Australia, with a total of 234 assets,

including 15 streams and 219 royalties. These investments are tied

to mining assets at various stages of the mine life cycle,

including 32 producing mines and 202 development and exploration

stage projects, and other assets. Triple Flag is listed on the

Toronto Stock Exchange and New York Stock Exchange, under the

ticker “TFPM”.

Qualified Person

James Dendle, Senior Vice President, Corporate Development for

Triple Flag and a “qualified person” under NI 43-101 has reviewed

and approved the written scientific and technical disclosures

contained in this press release.

Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities laws and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995,

respectively (collectively referred to herein as “forward-looking

information”). Forward-looking information may be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“outlook”, “forecasts”, “projection”, “prospects”, “strategy”,

“intends”, “anticipates”, “believes”, or variations of such words

and phrases or terminology which states that certain actions,

events or results “may”, “could”, “would”, “might”, “will”, “will

be taken”, “occur” or “be achieved”. Forward-looking information in

this news release include, but are not limited to, statements with

respect to the Company’s preliminary sales and revenue information

for the third quarter of 2023, the release of its financial results

for the third quarter of 2023, the conduct of the conference call

to discuss said results, identified synergies from the integration

of Maverix Metals Inc., the payment of a dividend, developments in

respect of the Company’s portfolio of royalties and streams and

those developments at certain of the mines, projects or properties

that underlie the Company’s interests. In addition, any statements

that refer to expectations, intentions, projections or other

characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

possible future events or circumstances.

The forward-looking information included in this news release is

based on our opinions, estimates and assumptions considering our

experience and perception of historical trends, current conditions

and expected future developments, our assumptions regarding the

acquisition of Maverix Metals Inc. (including our ability to derive

the anticipated benefits therefrom), as well as other factors that

we currently believe are appropriate and reasonable in the

circumstances. The forward-looking information contained in this

news release is also based upon a number of assumptions, including

the ongoing operation of the properties in which we hold a stream

or royalty interest by the owners or operators of such properties

in a manner consistent with past practice; the accuracy of public

statements and disclosures made by the owners or operators of such

underlying properties; and the accuracy of publicly disclosed

expectations for the development of underlying properties that are

not yet in production. These assumptions include, but are not

limited to, the following: assumptions in respect of current and

future market conditions and the execution of our business

strategies, that operations, or ramp-up where applicable, at

properties in which we hold a royalty, stream or other interest,

continue without further interruption through the period, and the

absence of any other factors that could cause actions, events or

results to differ from those anticipated, estimated, intended or

implied. Despite a careful process to prepare and review the

forward-looking information, there can be no assurance that the

underlying opinions, estimates and assumptions will prove to be

correct. Forward-looking information is also subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance, or achievements to

be materially different from those expressed or implied by such

forward-looking information. Such risks, uncertainties and other

factors include, but are not limited to, those set forth under the

caption “Risk Factors” in our most recently filed annual

information form which is available on SEDAR+ at www.sedarplus.ca

and on EDGAR at www.sec.gov. For clarity, mineral resources that

are not mineral reserves do not have demonstrated economic

viability and inferred resources are considered too geologically

speculative for the application of economic considerations.

Although we have attempted to identify important risk factors

that could cause actual results or future events to differ

materially from those contained in forward-looking information,

there may be other risk factors not presently known to us or that

we presently believe are not material that could also cause actual

results or future events to differ materially from those expressed

in such forward-looking information. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information, which speaks only as of

the date made. The forward-looking information contained in this

news release represents our expectations as of the date of this

news release and is subject to change after such date. We disclaim

any intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws. All the forward-looking information contained in

this news release is expressly qualified by the foregoing

cautionary statements.

Cautionary Statement to U.S. Investors

Information contained or referenced in this press release or in

the documents referenced herein concerning the properties,

technical information and operations of Triple Flag has been

prepared in accordance with requirements and standards under

Canadian securities laws, which differ from the requirements of the

U.S. Securities and Exchange Commission (“SEC”) under subpart 1300

of Regulation S-K (“S-K 1300”). Because the Company is eligible for

the Multijurisdictional Disclosure System adopted by the SEC and

Canadian Securities Administrators, Triple Flag is not required to

present disclosure regarding its mineral properties in compliance

with S-K 1300. Accordingly, certain information contained in this

press release may not be comparable to similar information made

public by US companies subject to reporting and disclosure

requirements of the SEC.

Technical and Third-Party Information:

Triple Flag does not own, develop or mine the underlying

properties on which it holds stream or royalty interests. As a

royalty or stream holder, Triple Flag has limited, if any, access

to properties included in its asset portfolio. As a result, Triple

Flag is dependent on the owners or operators of the properties and

their qualified persons to provide information to Triple Flag and

on publicly available information to prepare disclosure pertaining

to properties and operations on the properties on which Triple Flag

holds stream, royalty, or other similar interests. Triple Flag

generally has limited or no ability to independently verify such

information. Although Triple Flag does not believe that such

information is inaccurate or incomplete in any material respect,

there can be no assurance that such third-party information is

complete or accurate.

Endnotes

Endnote 1: Gold Equivalent Ounces (“GEOs”)

GEOs are a non-IFRS measure that is based on stream and royalty

interests and calculated on a quarterly basis by dividing all

revenue from such interests for the quarter by the average gold

price during such quarter. The gold price is determined based on

the LBMA PM fix. For periods longer than one quarter, GEOs are

summed for each quarter in the period. Management uses this measure

internally to evaluate our underlying operating performance across

our stream and royalty portfolio for the reporting periods

presented and to assist with the planning and forecasting of future

operating results. GEOs are intended to provide additional

information only and do not have any standardized definition under

IFRS and should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with IFRS. The

measures are not necessarily indicative of gross profit or

operating cash flow as determined under IFRS. Other companies may

calculate these measures differently. The following table

reconciles GEOs to revenue, the most directly comparable IFRS

measure:

2023

($ thousands, except average gold

price and GEOs information)

Three months ended September

30

Three months ended June

30

Three months ended March

31

Nine months ended September

30

Revenue

49,425

52,591

50,269

Average gold price per ounce

1,928

1,976

1,890

GEOs

25,629

26,616

26,599

78,844

2022

($ thousands, except average gold

price and GEOs information)

Three months ended September

30

Three months ended June

30

Three months ended March

31

Nine months ended September

30

Revenue

33,754

36,490

37,755

Average gold price per ounce

1,729

1,871

1,877

GEOs

19,523

19,507

20,113

59,143

Endnote 2: Adjusted Net Earnings and Adjusted Net Earnings

per Share

Adjusted net earnings (loss) is a non‑IFRS financial measure,

which excludes the following from net earnings (loss):

- impairment charges and write-downs, including expected credit

losses;

- gain/loss on sale or disposition of assets/mineral

interests;

- foreign currency translation gains/losses;

- increase/decrease in fair value of financial assets;

- non‑recurring charges; and

- impact of income taxes on these items.

Management uses this measure internally to evaluate our

underlying operating performance for the reporting periods

presented and to assist with the planning and forecasting of future

operating results. Management believes that adjusted net earnings

is a useful measure of our performance because impairment charges

and write-downs, including expected credit losses, gain/loss on

sale or disposition of assets/mineral interests, foreign currency

translation gains/losses, increase/decrease in fair value of

financial assets and non-recurring charges do not reflect the

underlying operating performance of our core business and are not

necessarily indicative of future operating results. The tax effect

is also excluded to reconcile the amounts on a post-tax basis,

consistent with net earnings. Management’s internal budgets and

forecasts and public guidance do not reflect the types of items we

adjust for. Consequently, the presentation of adjusted net earnings

enables users to better understand the underlying operating

performance of our core business through the eyes of management.

Management periodically evaluates the components of adjusted net

earnings based on an internal assessment of performance measures

that are useful for evaluating the operating performance of our

business and a review of the non-IFRS measures used by industry

analysts and other streaming and royalty companies. Adjusted net

earnings is intended to provide additional information only and

does not have any standardized definition under IFRS and should not

be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. The measures are not

necessarily indicative of gross profit or operating cash flow as

determined under IFRS. Other companies may calculate these measures

differently. The following table reconciles adjusted net earnings

to net (loss) earnings, the most directly comparable IFRS

measure.

Reconciliation of Net (Loss) Earnings to Adjusted Net

Earnings

Three months ended

September 30

Nine months ended

September 30

($ thousands, except share and per share

information)

2023

2022

2023

2022

Net (loss) earnings

$ (6,041)

$ 12,815

$ 26,527

$ 39,626

Impairment charges

27,107

-

27,107

-

Expected credit losses

974

-

974

-

Loss (gain) on disposition of mineral

interests

-

-

1,000

(2,099)

Foreign currency translation losses

327

136

275

289

Decrease (increase) in fair value of

financial assets

798

307

(1,901)

4,799

Income tax effect

(5,828)

-

(5,470)

968

Adjusted net earnings

$17,337

$13,258

$48,512

$43,583

Weighted average shares outstanding –

basic

201,839,092

155,970,318

198,589,730

156,003,665

Net (loss) earnings per share

$ (0.03)

$ 0.08

$ 0.13

$ 0.25

Adjusted net earnings per share

$ 0.09

$ 0.09

$ 0.24

$ 0.28

Endnote 3: Free Cash Flow

Free cash flow is a non-IFRS measure that deducts acquisition of

other assets (excluding acquisition of financial assets or mineral

interests) from operating cash flow. Management believes this to be

a useful indicator of our ability to operate without reliance on

additional borrowing or usage of existing cash. Free cash flow is

intended to provide additional information only and does not have

any standardized definition under IFRS and should not be considered

in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. The measure is not necessarily

indicative of operating profit or operating cash flow as determined

under IFRS. Other companies may calculate this measure differently.

The following table reconciles free cash flow to operating cash

flow, the most directly comparable IFRS measure:

Three months ended

September 30

Nine months ended

September 30

($ thousands)

2023

2022

2023

2022

Operating cash flow

$36,750

$25,356

$116,494

$81,655

Acquisition of other assets

-

-

-

-

Free cash flow

$36,750

$25,356

$116,494

$81,655

Endnote 4: Adjusted EBITDA

Adjusted EBITDA is a non‑IFRS financial measure, which excludes

the following from net earnings:

- income tax expense;

- finance costs, net;

- depletion and amortization;

- impairment charges and write-downs, including expected credit

losses;

- gain/loss on sale or disposition of assets/mineral

interests;

- foreign currency translation gains/losses;

- increase/decrease in fair value of assets/investments;

- non-cash cost of sales related to prepaid gold interests;

and

- non‑recurring charges.

Management believes that adjusted EBITDA is a valuable indicator

of our ability to generate liquidity by producing operating cash

flow to fund working capital needs, service debt obligations and

fund acquisitions. Management uses adjusted EBITDA for this

purpose. Adjusted EBITDA is also frequently used by investors and

analysts for valuation purposes whereby adjusted EBITDA is

multiplied by a factor or ‘‘multiple’’ that is based on an observed

or inferred relationship between adjusted EBITDA and market values

to determine the approximate total enterprise value of a

company.

In addition to excluding income tax expense, finance costs, net

and depletion and amortization, adjusted EBITDA also removes the

effect of impairment charges and write-downs, including expected

credit losses, gain/loss on sale or disposition of assets/mineral

interests, foreign currency translation gains/losses,

increase/decrease in fair value of financial assets, non-cash cost

of sales related to prepaid gold interests and non-recurring

charges. We believe these items provide a greater level of

consistency with the adjusting items included in our adjusted net

earnings reconciliation, with the exception that these amounts are

adjusted to remove any impact of income tax expense as they do not

affect adjusted EBITDA. We believe this additional information will

assist analysts, investors and our shareholders to better

understand our ability to generate liquidity from operating cash

flow, by excluding these amounts from the calculation as they are

not indicative of the performance of our core business and not

necessarily reflective of the underlying operating results for the

periods presented.

Adjusted EBITDA is intended to provide additional information to

investors and analysts and does not have any standardized

definition under IFRS and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. Adjusted EBITDA is not necessarily indicative of

operating profit or operating cash flow as determined under IFRS.

Other companies may calculate adjusted EBITDA differently. The

following table reconciles adjusted EBITDA to net earnings, the

most directly comparable IFRS measure.

Reconciliation of Net (Loss) Earnings to Adjusted

EBITDA

Three months ended September

30

Nine months ended September

30

($ thousands)

2023

2022

2023

2022

Net (loss) earnings

$(6,041)

$12,815

$26,527

39,626

Finance costs, net

539

262

3,117

1,241

Income tax expense (recovery)

(3,532)

1,624

(540)

5,036

Depletion and amortization

16,904

10,910

48,756

35,763

Impairment charges

27,107

-

27,107

-

Expected credit losses

974

-

974

-

Loss (gain) on disposition of mineral

interests

-

-

1,000

(2,099)

Foreign currency translation loss

327

136

275

289

Decrease (increase) in fair value of

financial assets

798

307

(1,901)

4,799

Non-cash cost of sales related to prepaid

gold interests

1,728

-

12,209

-

Adjusted EBITDA

$38,804

$26,054

$117,524

$84,655

Endnote 5: Gross Profit Margin and Asset Margin

Gross profit margin is a supplementary financial measure which

we define as gross profit divided by revenue. Asset margin is a

non-IFRS financial measure which we define by taking gross profit

and adding back depletion and non-cash cost of sales related to

prepaid gold interests and dividing by revenue. We use gross profit

margin to assess profitability of our metal sales and use asset

margin to evaluate our performance in increasing revenue and

containing costs and providing a useful comparison to our peers.

Asset margin is intended to provide additional information only and

does not have any standardized definition under IFRS and should not

be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. The following table

reconciles asset margin to gross profit margin, the most directly

comparable IFRS measure:

Three months ended September

30

Nine months ended

September 30

($ thousands except Gross profit

margin and Asset margin)

2023

2022

2023

2022

Revenue

$49,425

$33,754

$152,285

$107,999

Cost of sales

23,616

14,034

76,656

45,453

Gross profit

25,809

19,720

75,629

62,546

Gross profit margin

52%

58%

50%

58%

Gross profit

$25,809

$19,720

$75,629

$62,546

Add: Depletion

16,811

10,817

48,479

35,481

Add: Non-cash cost of sales related to

prepaid gold interests

1,728

-

12,209

-

44,348

30,537

136,317

98,027

Revenue

49,425

33,754

152,285

107,999

Asset margin

90%

90%

90%

91%

Endnote 6: Information Sources

In all cases, mineral resources that are not mineral reserves do

not have demonstrated economic viability.

DeLamar: Please refer to integraresources.com and the

news release of Integra Resources dated September 26, 2023. Integra

Resources has disclosed that an updated technical report will be

filed on SEDAR+ within 45 days of the recent news release.

Koné: Please refer to montagegoldcorp.com and the news

release dated September 7, 2023. Montage Gold reported the combined

mineral resources at the Kone Gold Project using cut-off grades of

0.2 Au g/t for the Kone deposit and 0.5 Au g/t for the Gbongogo

Main deposit and as well the combined Indicated Mineral Resource of

237 million tonnes grading 0.63 Au g/t for 4.83 million ounces of

gold, and a combined Inferred Mineral Resource of 22 million

tonnes, grading 0.45 Au g/t for 0.32 million ounces of gold.

Buritica: Information extracted from a technical report

provided entitled, “Internal Technical Report on the Buritica

Gold-Silver Project, Antioquia, Colombia” dated February 2023 and

prepared for Zijin-Continental Gold Limited Seccursal Colombia.

Mineral Resources are inclusive of Mineral Reserves.

Mineral Resource Statement for HVM Buritica Project ZCGL

Colombia as of December 31, 2022

Category

Volume

(km3)

Tonnage

(Mt)

Au

(g/t)

Ag

(g/t)

Au

(t)

Au

(Moz)

Ag

(t)

Ag

(Moz)

Measured

2,736

8.21

10.18

33.94

83.5

2.69

278.6

8.96

Indicated

5,244

15.73

7.55

27.86

118.8

3.82

438.3

14.09

Measured + Indicated

7,890

23.94

8.45

29.95

202.3

6.50

716.9

23.05

Inferred

6,597

19.79

6.34

23.22

125.5

4.04

459.5

14.77

Notes:

1.

Mineral resources are reported for 1m

minimum thickness (1m MHW), a cut-off grade of EqAu 2.50 g/t

considering an underground extraction. Cut-off grades are based on

an Au metal price of US$1,700/oz and US$21/oz Ag.

2.

LPM domains are not included in the

grade-tonnage tabulation.

Mineral Resource Statement for LPM Buritica Project ZCGL

Colombia as of December 31, 2022

Category

Volume

(km3)

Tonnage

(Mt)

Au

(g/t)

Ag

(g/t)

Au

(t)

Au

(Moz)

Ag

(t)

Ag

(Moz)

Measured

2,773

8.18

3.35

9.26

27.4

0.88

75.8

2.44

Indicated

168

0.49

2.84

7.96

1.4

0.05

3.9

0.13

Measured + Indicated

2,941

8.68

3.32

9.19

28.8

0.93

79.7

2.56

Inferred

313

0.92

3.03

8.11

2.8

0.09

7.5

0.24

Notes:

1.

Mineral resources are reported at a

cut-off grade of EqAu 1.90 g/t considering an underground

extraction. Cut-off grades are based on an Au metal price of

US$1,700/oz and US$21/oz Ag.

2.

1m-Diluted HVM domains are subtracted of

LPM models before Grade-Tonnage tabulations of the LPMs

domains.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107175367/en/

Investor Relations: David Lee Vice President, Investor

Relations Tel: +1 (416) 304-9770 Email: ir@tripleflagpm.com

Media: Gordon Poole, Camarco Tel: +44 (0) 7730 567 938

Email: tripleflag@camarco.co.uk

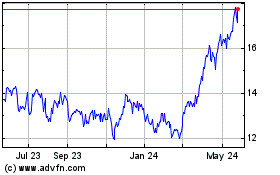

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Nov 2024 to Dec 2024

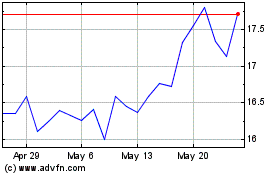

Triple Flag Precious Met... (NYSE:TFPM)

Historical Stock Chart

From Dec 2023 to Dec 2024