Additional Proxy Soliciting Materials (definitive) (defa14a)

June 13 2022 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: |

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

|

[X]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Sec. 240.14a-12

|

Templeton Global Income Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

| |

|

[X]

|

No fee required.

|

| |

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

|

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

|

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

|

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction:

|

| |

|

|

| |

|

|

| |

(5) |

Total fee paid:

|

| |

|

|

| |

|

|

|

[ ]

|

Fee paid previously with preliminary proxy materials.

|

| |

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its filing.

|

(1) Amount Previously Paid:

____________________________________________________________

(2) Form, Schedule or Registration Statement No.:

____________________________________________________________

(3) Filing Party:

____________________________________________________________

(4) Date Filed:

____________________________________________________________

|

|

TEMPLETON GLOBAL INCOME FUND

300 S.E. 2nd Street

Fort Lauderdale, FL 33301

|

FOR IMMEDIATE RELEASE:

For more information, please contact Franklin Templeton at 1-800-342-5236.

TEMPLETON GLOBAL INCOME FUND ANNOUNCES

LEGAL ACTION TO PREVENT CERTIFICATION OF THE RESULTS OF THE

FUND’S ANNUAL MEETING OF SHAREHOLDERS

FORT LAUDERDALE, Fla. – June 13, 2022 – Templeton Global Income Fund [NYSE: GIM] (the “Fund”), today announced that the Fund and a Fund shareholder have filed a complaint

and temporary restraining order request in United States District Court in the Southern District of New York seeking to prevent the certification of the results of the Fund’s Annual Meeting of Shareholders held on June 6, 2022 (the “Annual

Meeting”).

The complaint alleges that, over the weekend prior to the Fund’s Annual Meeting, Saba Capital Management, L.P. and related individuals and parties (together, “Saba”) struck—but kept secret—a deal to pay at least

one large institutional shareholder a significant premium to the market price of the Fund’s shares, with an additional premium if Saba’s nominees prevailed at the Annual Meeting. The complaint argues that federal securities laws expressly require

that any such arrangements be fully disclosed with sufficient time to be absorbed by shareholders whose votes may be impacted. The complaint alleges that Saba failed to make those required disclosures, keeping its deal secret until after the

Annual Meeting had concluded. The complaint requests that a new vote be held after Fund shareholders have had the benefit of true and complete information about Saba’s conduct and an opportunity to cast informed votes.

For further information on Templeton Global Income Fund, please visit our web site at: www.franklintempleton.com

Franklin Resources, Inc. [NYSE:BEN] is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 155 countries. Franklin Templeton’s mission is to

help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers boutique specialization on a global scale, bringing extensive

capabilities in equity, fixed income, multi-asset solutions and alternatives. With offices in more than 30 countries and approximately 1,300 investment professionals, the California-based company has 75 years of investment experience and

approximately $1.45 trillion in assets under management as of May 31, 2022. For more information, please visit franklintempleton.com.

Media Contact

Prosek Partners

Brian Schaffer

bschaffer@prosek.com

# # #

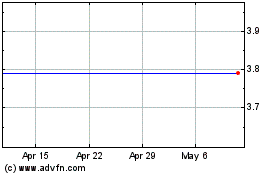

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Jun 2024 to Jul 2024

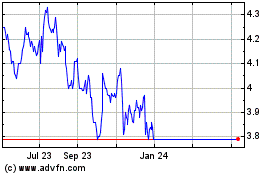

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Jul 2023 to Jul 2024