Sonida Continues Executing on its Accretive Growth and Capital Allocation Strategy with $48 Million of Investments

November 05 2024 - 8:15AM

Business Wire

Completes previously disclosed purchase of two

senior living communities in Atlanta market for $29.0 million

Brings total year-to-date acquired properties

to 19 and total operating portfolio to 93 communities

Completes previously disclosed discounted

payoff of two mortgage loans representing $28.7 million of

outstanding principal for $18.5 million, a 36% discount

Sonida Senior Living, Inc. (“Sonida” or the “Company”) (NYSE:

SNDA), a leading owner, operator and investor in senior living

communities, announced today the closing of its latest acquisition,

as the Company continues to execute on its capital allocation and

inorganic, accretive growth strategy, which aims to further expand

and upgrade its portfolio to fully leverage operating scale and

efficiencies.

“Sonida’s latest portfolio purchase brings total year-to-date

property acquisitions to 19, as the Company continues to deploy its

fully integrated operating and investment platform to strategically

and aggressively invest in high-quality, recently constructed

communities at attractive valuations, amidst a bevy of historically

favorable senior housing trends,” said Brandon Ribar, President and

Chief Executive Officer.

Capital Allocation – Acquired Two-Asset

Senior Housing Portfolio in the Southeast

On November 1, 2024, the Company finalized the previously

announced acquisition of two senior living communities located in

the Atlanta, Georgia market. The two communities, in Lawrenceville

and Peachtree Corners, are strategically located in high-growth

submarkets of Atlanta with favorable demographic growth and

supply/demand prospects.

Consistent with the Company’s focus on regional densification,

the acquisition brings Sonida’s Atlanta portfolio total to three

assets and further grows its exposure to highly attractive

Southeast markets. The two-asset portfolio has an average asset age

of five years, which will further modernize Sonida’s portfolio, and

compares favorably to an average asset age of 10+ years for

comparable inventory within a five-mile radius.

Sonida’s purchase price of $29.0 million, or approximately

$163,000 per unit, reflects a significant discount to the Company’s

estimate of replacement cost and expands Sonida’s accretive

acquisitions year-to-date, as the Company capitalizes on

historically favorable senior housing trends. The portfolio’s

in-place occupancy is approximately 86% with an average RevPOR of

more than $5,700 and is comprised of 178 units with Assisted Living

(“AL”) and Memory Care (“MC”) offerings (approximately 60% AL and

40% MC). Sonida funded the transaction with cash on its balance

sheet and proceeds from its senior secured revolving credit

facility.

Capital Allocation – Completes

Discounted Payoff of Two Loans at 36% Discount to

Par

As previously announced in August 2024, the Company entered into

loan modification agreements (“Texas Loan Modification”) with one

of its lenders on two owned communities in Texas. The original loan

terms included maturities of April 2025 and October 2031, as well

as cross-default provisions with each other. The Texas Loan

Modification revised the loan maturities to December 2025 on both

communities and provided the Company with an option to make a

discounted payoff (“Texas DPO”) of the outstanding loan principal,

which the Company executed and closed on November 1, 2024. The

Texas DPO amount of $18.5 million represents a discount of 36% on

the total principal outstanding of $28.7 million on these two loans

(as of July 31, 2024).

Safe Harbor

The forward-looking statements in this press release, including,

but not limited to, statements relating to the Company’s

acquisitions, are subject to certain risks and uncertainties that

could cause the Company’s actual results and financial condition to

differ materially, including, but not limited to the Company’s

ability to recognize the anticipated benefits of such acquisitions;

the impact of such acquisitions on the Company’s business,

including our ability to successfully implement integration

strategies or achieve expected synergies and operating

efficiencies; any legal proceedings that may be brought related to

such acquisitions; our projections related to said acquisitions may

not materialize as expected; and other risks and factors identified

from time to time in the Company’s reports filed with the SEC,

including the Company’s ability to generate sufficient cash flows

from operations, proceeds from equity issuances and debt

financings, and proceeds from the sale of assets to satisfy its

short- and long-term debt obligations and to fund the Company’s

acquisitions and capital improvement projects to expand, redevelop,

and/or reposition its senior living communities; increases in

market interest rates that increase the cost of certain of our debt

obligations; increased competition for, or a shortage of, skilled

workers, including due to general labor market conditions, along

with wage pressures resulting from such increased competition, low

unemployment levels, use of contract labor, minimum wage increases

and/or changes in overtime laws; the Company’s ability to obtain

additional capital on terms acceptable to it; the Company’s ability

to extend or refinance its existing debt as such debt matures; the

Company’s compliance with its debt agreements, including certain

financial covenants, and the risk of cross-default in the event

such non-compliance occurs; the Company’s ability to complete

acquisitions and dispositions upon favorable terms or at all,

including the possibility that the expected benefits and our

projections related to such acquisitions may not materialize as

expected; the risk of oversupply and increased competition in the

markets which the Company operates; the Company’s ability to

improve and maintain controls over financial reporting and

remediate the identified material weakness discussed in its recent

Quarterly and Annual Reports filed with the SEC; the cost and

difficulty of complying with applicable licensure, legislative

oversight, or regulatory changes; risks associated with current

global economic conditions and general economic factors such as

inflation, the consumer price index, commodity costs, fuel and

other energy costs, competition in the labor market, costs of

salaries, wages, benefits, and insurance, interest rates, and tax

rates; the impact from or the potential emergence and effects of a

future epidemic, pandemic, outbreak of infectious disease or other

health crisis; and changes in accounting principles and

interpretations.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading owner,

operator and investor in independent living, assisted living and

memory care communities and services for senior adults. The Company

provides compassionate, resident-centric services and care as well

as engaging programming operating 93 senior housing communities in

20 states with an aggregate capacity of approximately 9,966

residents, including 80 communities which the Company owns

(including eight communities in which the Company owns varying

interests through two separate joint ventures), and 13 communities

that the Company manages on behalf of a third-party.

For more information, visit www.sonidaseniorliving.com or

connect with the Company on Facebook, X or LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105908174/en/

Investor Relations Jason Finkelstein IGNITION IR

ir@sonidaliving.com

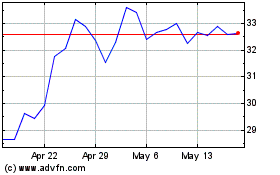

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2023 to Dec 2024