Sonida Senior Living, Inc. (the “Company,” “we,” “our,” or “us”)

(NYSE: SNDA) announced results for the third quarter ended

September 30, 2023.

“We continue to see growth in both year-over-year occupancy and

revenue that is surpassing industry trends. This strong financial

performance combined with our improved debt structure has Sonida

firmly positioned for strategic expansion within the marketplace,”

said Brandon Ribar, President and CEO. “As we close out the year

and prepare for 2024, we look forward to bringing our signature

programs and services to more seniors and to pursuing new avenues

of growth and shareholder value creation.”

Third Quarter Highlights

- Weighted average occupancy for the Company’s consolidated

portfolio increased 150 basis points to 84.9% year-over-year.

- Resident revenue increased $6.6 million, or 12.6%

year-over-year.

- Net loss for the third quarter was $18.4 million.

- Adjusted EBITDA, a non-GAAP measure, was $9.3 million for Q3

2023, an increase of $4.8 million year-over-year.

- Net cash provided by operating activities was $10.6 million

year-to-date as compared to $2.9 million for the same period in

2022.

- Results for the Company’s consolidated portfolio of

communities:

- Q3 2023 vs. Q3 2022:

- Revenue Per Available Unit (“RevPAR”) increased 13.7% to

$3,446.

- Revenue Per Occupied Unit (“RevPOR”) increased 11.7% to

$4,061.

- Community Net Operating Income, a non-GAAP measure, increased

$4.7 million. Adjusted Community Net Operating Income, a non-GAAP

measure, which excludes $0.5 million of state grant revenue

received in Q3 2023 (none recognized in Q3 2022) was $14.2 million

and $10.0 million for Q3 2023 and Q3 2022, respectively.

- Community Net Operating Income Margin and Adjusted Community

Net Operating Income Margin (non-GAAP measures with the latter

adjusted for non-recurring state grant revenue) were 24.8% and

24.2%, for Q3 2023, respectively, and 19.0% and 19.0% for Q3 2022,

respectively.

- Q3 2023 vs. Q2 2023:

- RevPAR increased 4.4% to $3,446.

- RevPOR increased 3.3% to $4,061.

- Community Net Operating Income increased $1.1 million. Adjusted

Community Net Operating Income, excluding $0.5 million and $0.4

million of state grant revenue received in Q3 2023 and Q2 2023,

respectively, was $14.2 million and $13.1 million for Q3 2023 and

Q2 2023, respectively.

- Community Net Operating Income Margin and Adjusted Community

Net Operating Income Margin (adjusted for non-recurring state grant

revenue) were 24.8% and 24.2% for Q3 2023, respectively, and 23.8%

and 23.2% for Q2 2023, respectively.

SONIDA SENIOR LIVING,

INC.

SUMMARY OF CONSOLIDATED

FINANCIAL RESULTS

THREE MONTHS ENDED SEPTEMBER

30, 2023

(in thousands)

Three Months Ended September

30,

Three Months Ended June

30,

2023

2022

2023

Consolidated results

Resident revenue (1)

$

59,117

$

52,485

$

56,960

Management fees

569

608

531

Operating expenses

44,486

43,123

44,662

General and administrative expenses

8,615

5,851

6,574

Long-lived asset impairment

5,965

—

—

Loss before provision for income taxes

(1)

(18,328

)

(13,739

)

(12,159

)

Net loss (1)

(18,411

)

(13,739

)

(12,212

)

Adjusted EBITDA (1) (2)

9,270

4,446

7,538

Community net operating income (NOI)

(2)

14,690

9,995

13,549

Community net operating income margin

(2)

24.8

%

19.0

%

23.8

%

Weighted average occupancy

84.9

%

83.4

%

83.9

%

(1) Includes $0.5 million, $0.0 million,

and $0.4 million of state grant revenue received in Q3 2023, Q3

2022, and Q2 2023, respectively.

(2) Adjusted EBITDA, Community Net

Operating Income, and Community Net Operating Income Margin are

financial measures that are not calculated in accordance with U.S.

Generally Accepted Accounting Principles (“GAAP”). See

“Reconciliation of Non-GAAP Financial Measures” for the Company's

definition of such measures, reconciliations to the most comparable

GAAP financial measures, and other information regarding the use of

the Company's non-GAAP financial measures.

Results of Operations

Three months ended September 30, 2023 as compared to three

months ended September 30, 2022

Revenues

Resident revenue for the three months ended September 30, 2023

was $59.1 million as compared to $52.5 million for the three months

ended September 30, 2022, an increase of $6.6 million, or 12.6%.

The increase in revenue was primarily due to increased occupancy

and increased average rent rates.

Expenses

Operating expenses for the three months ended September 30, 2023

were $44.5 million as compared to $43.1 million for the three

months ended September 30, 2022, an increase of $1.4 million, or

3.2%. The increase is primarily due to a $2.2 million increase in

labor and employee-related expenses and a $0.3 million increase in

computer software/ internet costs, partially offset by a reduction

in real estate taxes of $0.4 million and $0.7 million in other

expenses.

General and administrative expenses for the three months ended

September 30, 2023 were $8.6 million as compared to $5.9 million

for the three months ended September 30, 2022, representing an

increase of $2.7 million. This increase is primarily due to a $1.4

million increase in transaction costs due to our loan modification

and a $1.2 million increase in stock-based compensation expense

from prior quarter due to forfeiture credits in connection with

executive personnel changes.

The Company reported a net loss of $18.4 million for the three

months ended September 30, 2023, compared to a net loss of $13.7

million for the three months ended September 30, 2022. A major

factor impacting the comparison of net loss for the three months

ended September 30, 2023 and September 30, 2022 relates to a

non-cash impairment charge of $6.0 million related to one owned

community.

Adjusted EBITDA for the three months ended September 30, 2023

was $9.3 million compared to $4.4 million for the three months

ended September 30, 2022. See “Reconciliation of Non-GAAP Financial

Measures” below.

Nine months ended September 30, 2023 as compared to nine

months ended September 30, 2022

Revenues

Resident revenue for the nine months ended September 30, 2023

was $172.7 million as compared to $155.3 million for the nine

months ended September 30, 2022, an increase of $17.4 million, or

11.2%. The increase in revenue was primarily due to increased

occupancy and increased average rent rates.

Expenses

Operating expenses for the nine months ended September 30, 2023

were $133.0 million as compared to $126.6 million for the nine

months ended September 30, 2022, an increase of $6.4 million, or

5.1%. The increase is primarily due to a $5.8 million increase in

labor and employee-related expenses, a $0.4 million increase in

service contracts, a $0.8 million increase in computer software/

internet costs, partially offset by a $0.6 million decrease in food

costs and a $0.2 million decrease in real estate taxes.

General and administrative expenses for the nine months ended

September 30, 2023 were $22.3 million as compared to $23.6 million

for the nine months ended September 30, 2022, representing a

decrease of $1.3 million. This decrease is primarily due to a $1.9

million decrease in recurring general and administrative expenses

and a $1.3 million decrease in stock-based compensation expense as

a result of prior year forfeiture credits in connection with

executive personnel changes. Partially offsetting the decrease in

general and administrative expense is an increase of $1.9 million

related to transaction costs associated with our 2023 loan

modifications.

The Company reported a net loss of $6.5 million for the nine

months ended September 30, 2023 compared to a net loss of $37.8

million for the nine months ended September 30, 2022, primarily due

to a $36.3 million gain on extinguishment of debt, partially offset

by a non-cash impairment charge of $6.0 million during the nine

months ended September 30, 2023.

Significant Transactions

Fannie Mae Loan Modification

On June 29, 2023, the Company entered into a binding forbearance

agreement (“Fannie Forbearance”) with the Federal National Mortgage

Association (“Fannie Mae”) for all 37 of its encumbered

communities, effective as of June 1, 2023 (“Fannie Forbearance

Effective Date”). Under the Fannie Forbearance, Fannie Mae agreed

to forbear on its remedies otherwise available under the community

mortgages and Master Credit Facility (“MCF”) in connection with

reduced debt service payments made by the Company during the

forbearance period. In connection with the Fannie Forbearance, the

Company made a $5.0 million principal payment in July 2023. The

Fannie Forbearance was the first of a two-step process to modify

all existing mortgage agreements with Fannie Mae by October 1, 2023

under proposed loan modification agreements, as defined in the

Fannie Forbearance (“Loan Modification Agreements”). Terms outlined

in an agreed upon term sheet accompanying the Fannie Forbearance

were included in the Loan Modification Agreements as the final step

to modify the various 37 Fannie Mae community mortgages and MCF

prior to the expiration of the Fannie Forbearance, which was

subsequently extended to October 6, 2023. The Company entered into

Loan Modification Agreements with Fannie Mae on October 2, 2023.

The forbearance and subsequent loan modification provide the

Company with additional financial flexibility and increases its

liquidity position.

Under the terms of the Loan Modification Agreements, the

mortgage principal payments on 18 community mortgages, ranging from

July 2024 to December 2026, will be extended to December 2026. The

remaining 19 communities under the MCF have existing maturities in

December 2028. The Company will not be required to make scheduled

principal payments due under the 18 community mortgages and 19

communities under the MCF through (the revised maturity date)

December 2026 and June 1, 2026, respectively. The monthly interest

rate was reduced by a 1.5% weighted average on all 37 communities

for 12 months, resulting in a projected cash savings of $6.1

million over the period of June 1, 2023 through June 1, 2024.

Ally Loan Amendment

On June 29, 2023 and concurrent with the Fannie Forbearance, the

Company executed a second amendment (“Ally Amendment”) to its

refinance facility (“Ally Term Loan”) and amended limited payment

guaranty with Ally Bank (“Second Amended and Restated Limited

Payment Guaranty”) with terms that include a waiver of its current

$13.0 million liquid assets requirement through June 30, 2024.

During the waiver period (June 30, 2023 through July 1, 2024 under

the Ally Amendment, the “Waiver Period”), a new and temporary

liquid assets minimum threshold will be established at $6.0 million

and measured weekly. Beginning on July 1, 2024, a new liquid assets

requirement of $7.0 million will be effective, with such threshold

increasing $1.0 million per month rising to $13.0 million by the

earlier of the release of the Waiver Period or December 31, 2024.

In addition, the Company must replace its interest rate cap (“IRC”)

on the $88.1 million notional value and a 2.25% SOFR strike rate

when the current IRC expires on November 30, 2023. In July 2023,

the Company funded a $2.3 million interest rate cap reserve to Ally

Bank with an additional $0.1 million added during the remainder of

Q3.

Conversant Equity Commitment

In connection with the Fannie Forbearance and Ally Amendment

signed on June 29, 2023, the Company entered into a $13.5 million

equity commitment agreement (“Equity Commitment”) with Conversant

Dallas Parkway (A) LP and Conversant Dallas Parkway (B) LP,

(together “Conversant”) for a term of 18 months. The Equity

Commitment had a commitment fee of $675,000 payable through the

issuance of 67,500 shares of common stock of the Company. Sonida

shall have the right, but not the obligation, to utilize

Conversant’s equity commitment and may draw on the commitment in

whole or in part. The Company made a $6.0 million equity draw in

July 2023 in exchange for 600,000 shares of common stock of the

Company. Subsequent to September 30, 2023, the Company elected to

draw down an additional $4.0 million of the Conversant Equity

Commitment in October which was received on November 1, 2023. The

Company issued 400,000 shares of common stock to Conversant on

November 1, 2023.

The foregoing description of the Fannie Forbearance, the Ally

Amendment, Second Amended & Restated Limited Payment Guaranty,

Loan Modification Agreements, and Equity Commitment and related

transactions contemplated do not purport to be complete and are

subject to, and qualified in their entirety by, the full text of

the Fannie Forbearance, the Ally Amendment, Second Amended and

Restated Limited Payment Guaranty, and Equity Commitment which are

filed as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively, to the

Company’s Form 8-K filed on July 5, 2023, incorporated herein by

reference. In addition, the full text of the Loan Modification

Agreements are filed as Exhibits 10.2 and 10.3 to the Company’s

Form 8-K filed on October 6, 2023, incorporated herein by

reference.

Liquidity and Capital

Resources

Cash flows

The table below presents a summary of the Company’s net cash

provided by (used in) operating, investing, and financing

activities (in thousands):

Nine months ended September

30,

2023

2022

Net cash provided by operating

activities

$

10,643

$

2,903

Net cash used in investing activities

(12,792

)

(30,659

)

Net cash used in financing activities

(7,441

)

(24,304

)

Decrease in cash and cash equivalents

$

(9,590

)

$

(52,060

)

In addition to $3.6 million of unrestricted cash on hand as of

September 30, 2023, our future liquidity will depend in part upon

our operating performance, which will be affected by prevailing

economic conditions, including those related to the COVID-19

pandemic, and financial, business and other factors, some of which

are beyond our control. Principal sources of liquidity are expected

to be cash flows from operations, proceeds from debt refinancings

or loan modifications, proceeds from the issuance of common or

preferred stock, COVID-19 or related relief grants from various

state agencies, and/or proceeds from the sale of owned assets. In

June 2023, the Company entered into the Fannie Forbearance, the

Ally Amendment, Second Amended and Restated Limited Payment

Guaranty, and the Equity Commitment, as disclosed above. The

Company entered into Loan Modification Agreements with Fannie Mae

on October 2, 2023. These transactions are expected to provide

additional financial flexibility to the Company and increase its

liquidity position. In March 2022, the Company completed the

refinancing of certain existing mortgage debt, which was further

amended in December 2022 and June 2023.

The Company has implemented plans, which include strategic and

cash-preservation initiatives, designed to provide the Company with

adequate liquidity to meet its obligations for at least the

12-month period following the date its third quarter 2023 financial

statements are issued. While the Company’s plans are designed to

provide it with adequate liquidity to meet its obligations for at

least the 12-month period following the date its financial

statements are issued, the remediation plan is dependent on

conditions and matters that may be outside of the Company’s

control, and no assurance can be given that certain options will be

available on terms acceptable to the Company, or at all. If the

Company is unable to successfully execute all of the planned

initiatives or if the plan does not fully mitigate the Company’s

liquidity challenges, the Company’s operating plans and resulting

cash flows along with its cash and cash equivalents and other

sources of liquidity may not be sufficient to fund operations for

the 12-month period following the date the financial statements are

issued.

The Company, from time to time, considers and evaluates

financial and capital raising transactions related to its

portfolio, including debt refinancings and modifications, purchases

and sales of assets and other transactions. There can be no

assurance that the Company will continue to generate cash flows at

or above current levels, or that the Company will be able to obtain

the capital necessary to meet the Company’s short and long-term

capital requirements.

Recent changes in the current economic environment, and other

future changes, could result in decreases in the fair value of

assets, slowing of transactions, and the tightening of liquidity

and credit markets. These impacts could make securing debt or

refinancings for the Company or buyers of the Company’s properties

more difficult or on terms not acceptable to the Company. The

Company’s actual liquidity and capital funding requirements depend

on numerous factors, including its operating results, its capital

expenditures for community investment, and general economic

conditions, as well as other factors described in “Item 1A. Risk

Factors” of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, filed with the SEC on March 30, 2023.

Conference Call

Information

The Company will host a conference call with senior management

to discuss the Company’s financial results for the three months

ended September 30, 2023, on Tuesday November 14, 2023, at 4:00

p.m. Eastern Time. To participate, dial 877-407-0989 (no passcode

required). A link to the simultaneous webcast of the teleconference

will be available at:

https://www.webcast-eqs.com/register/sonidaseniorliving_q32023_en/en.

For the convenience of the Company’s shareholders and the

public, the conference call will be recorded and available for

replay starting November 15, 2023 through November 29, 2023. To

access the conference call replay, call 877-660-6853, passcode

13742296. A transcript of the call will be posted in the Investor

Relations section of the Company’s website.

About the Company

Dallas-based Sonida Senior Living, Inc. is a leading

owner-operator of independent living, assisted living and memory

care communities and services for senior adults. As of September

30, 2023, the Company operated 71 communities, with capacity for

approximately 8,000 residents across 18 states, which provide

comfortable, safe, affordable environment where residents can form

friendships, enjoy new experiences and receive personalized care

from dedicated team members who treat them like family. For more

information, visit www.sonidaseniorliving.com or connect with the

Company on Facebook, Twitter or LinkedIn.

Definitions of RevPAR and

RevPOR

RevPAR, or average monthly revenue per available unit, is

defined by the Company as resident revenue for the period, divided

by the weighted average number of available units in the

corresponding portfolio for the period, divided by the number of

months in the period.

RevPOR, or average monthly revenue per occupied unit, is defined

by the Company as resident revenue for the period, divided by the

weighted average number of occupied units in the corresponding

portfolio for the period, divided by the number of months in the

period.

Safe Harbor

This release contains forward-looking statements which are

subject to certain risks and uncertainties that could cause our

actual results and financial condition of Sonida Senior Living,

Inc. (the “Company,” “we,” “our” or “us”) to differ materially from

those indicated in the forward-looking statements, including, among

others, the risks, uncertainties and factors set forth under “Item.

1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, filed with the Securities and

Exchange Commission (the “SEC”) on March 30, 2023, and also include

the following: the impact of COVID-19, including the actions taken

to prevent or contain the spread of COVID-19, the transmission of

its highly contagious variants and sub-lineages and the development

and availability of vaccinations and other related treatments, or

another epidemic, pandemic or other health crisis; the Company’s

ability to generate sufficient cash flows from operations,

additional proceeds from debt financings or refinancings, and

proceeds from the sale of assets to satisfy its short- and

long-term debt obligations and to make capital improvements to the

Company’s communities; increases in market interest rates that

increase the cost of certain of our debt obligations; increased

competition for, or a shortage of, skilled workers, including due

to the COVID-19 pandemic or general labor market conditions, along

with wage pressures resulting from such increased competition, low

unemployment levels, use of contract labor, minimum wage increases

and/or changes in overtime laws; the Company’s ability to obtain

additional capital on terms acceptable to it; the Company’s ability

to extend or refinance its existing debt as such debt matures,

including the Company’s ability to complete the modifications to

its loan agreements; the Company’s compliance with its debt

agreements, including certain financial covenants and the risk of

cross-default in the event such non-compliance occurs; the

Company’s ability to complete acquisitions and dispositions upon

favorable terms or at all; the risk of oversupply and increased

competition in the markets which the Company operates; the

Company’s ability to improve and maintain controls over financial

reporting and remediate the identified material weakness discussed

in its recent Quarterly and Annual Reports filed with the SEC; the

departure of the Company’s key officers and personnel; the cost and

difficulty of complying with applicable licensure, legislative

oversight, or regulatory changes; risks associated with current

global economic conditions and general economic factors such as

inflation, the consumer price index, commodity costs, fuel and

other energy costs, competition in the labor market, costs of

salaries, wages, benefits, and insurance, interest rates, and tax

rates; and changes in accounting principles and

interpretations.

For information about Sonida Senior Living, visit

www.sonidaseniorliving.com

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Revenues:

Resident revenue

$

59,117

$

52,485

$

172,683

$

155,315

Management fees

569

608

1,605

1,836

Managed community reimbursement

revenue

4,989

7,694

15,314

21,757

Total revenues

64,675

60,787

189,602

178,908

Expenses:

Operating expense

44,486

43,123

132,956

126,562

General and administrative expense

8,615

5,851

22,252

23,563

Depreciation and amortization expense

9,943

9,691

29,751

28,940

Long-lived asset impairment

5,965

—

5,965

—

Managed community reimbursement

expense

4,989

7,694

15,314

21,757

Total expenses

73,998

66,359

206,238

200,822

Other income (expense):

Interest income

139

44

521

47

Interest expense

(9,020

)

(8,205

)

(26,445

)

(23,728

)

Gain (loss) on extinguishment of debt,

net

—

—

36,339

(641

)

Gain (loss) on sale of assets, net

(34

)

—

217

—

Other income (expense), net

(90

)

(6

)

(269

)

8,663

Loss before provision for income

taxes

(18,328

)

(13,739

)

(6,273

)

(37,573

)

Provision for income taxes

(83

)

—

(205

)

(254

)

Net loss

(18,411

)

(13,739

)

(6,478

)

(37,827

)

Dividends on Series A convertible

preferred stock

—

—

—

(2,267

)

Undeclared dividends on Series A

convertible preferred stock

(1,265

)

(1,134

)

(3,693

)

(1,134

)

Undistributed net income allocated to

participating securities

—

—

—

—

Net loss attributable to common

stockholders

$

(19,676

)

$

(14,873

)

$

(10,171

)

$

(41,228

)

Weighted average common shares outstanding

— basic

7,050

6,364

6,602

6,357

Weighted average common shares outstanding

— diluted

7,050

6,364

6,602

6,357

Basic net loss per common share

$

(2.79

)

$

(2.34

)

$

(1.54

)

$

(6.49

)

Diluted net loss per common share

$

(2.79

)

$

(2.34

)

$

(1.54

)

$

(6.49

)

Sonida Senior Living,

Inc.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands, except per

share amounts)

September 30,

2023

December 31,

2022

Assets

Current assets:

Cash and cash equivalents

$

3,562

$

16,913

Restricted cash

17,590

13,829

Accounts receivable, net

8,124

6,114

Prepaid expenses and other assets

3,540

4,099

Derivative assets

745

2,611

Total current assets

33,561

43,566

Property and equipment, net

594,116

615,754

Other assets, net

1,412

1,948

Total assets

$

629,089

$

661,268

Liabilities and Equity

Current liabilities:

Accounts payable

$

10,067

$

7,272

Accrued expenses

41,532

36,944

Current portion of notes payable, net of

deferred loan costs

64,309

46,029

Deferred income

3,790

3,419

Federal and state income taxes payable

158

—

Other current liabilities

548

653

Total current liabilities

120,404

94,317

Notes payable, net of deferred loan costs

and current portion

565,149

625,002

Other liabilities

61

113

Total liabilities

685,614

719,432

Commitments and contingencies

Redeemable preferred stock:

Series A convertible preferred stock,

$0.01 par value; 41 shares authorized, 41 shares issued and

outstanding as of September 30, 2023 and December 31, 2022

47,243

43,550

Shareholders’ deficit:

Authorized shares - 15,000 as of September

30, 2023 and December 31, 2022; none issued or outstanding, except

Series A convertible preferred stock as noted above

—

—

Authorized shares - 15,000 as of September

30, 2023 and December 31, 2022; 7,778 and 6,670 shares issued and

outstanding as of September 30, 2023 and December 31, 2022,

respectively

78

67

Additional paid-in capital

299,690

295,277

Retained deficit

(403,536

)

(397,058

)

Total shareholders’ deficit

(103,768

)

(101,714

)

Total liabilities, redeemable preferred

stock and shareholders’ deficit

$

629,089

$

661,268

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Nine Months Ended September

30,

2023

2022

Cash flows from operating

activities:

Net loss

$

(6,478

)

$

(37,827

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

29,751

28,940

Amortization of deferred loan costs

1,130

946

Gain on sale of assets, net

(217

)

—

Long-lived asset impairment

5,965

—

Write-off of other assets

—

535

Unrealized (gain) loss on interest rate

cap, net

1,958

(206

)

(Gain) loss on extinguishment of debt

(36,339

)

641

Provision for bad debt

582

908

Non-cash stock-based compensation

expense

2,144

3,479

Other non-cash items

(7

)

7

Changes in operating assets and

liabilities:

Accounts receivable, net

(2,592

)

(1,760

)

Prepaid expenses and other assets

2,997

6,755

Other assets, net

(45

)

(115

)

Accounts payable and accrued expense

11,276

566

Federal and state income taxes payable

158

(423

)

Deferred income

371

414

Other current liabilities

(11

)

43

Net cash provided by operating

activities

10,643

2,903

Cash flows from investing

activities:

Acquisition of new communities

—

(12,342

)

Capital expenditures

(14,168

)

(18,317

)

Proceeds from sale of assets

1,376

—

Net cash used in investing

activities

(12,792

)

(30,659

)

Cash flows from financing

activities:

Proceeds from notes payable

—

80,000

Repayments of notes payable

(12,508

)

(98,535

)

Proceeds from issuance of common stock

6,000

(263

)

Dividends paid on Series A convertible

preferred stock

—

(2,987

)

Purchase of interest rate cap

—

(258

)

Deferred loan costs paid

(825

)

(2,180

)

Other financing costs

(108

)

(81

)

Net cash used in financing

activities

(7,441

)

(24,304

)

Decrease in cash and cash equivalents and

restricted cash

(9,590

)

(52,060

)

Cash, cash equivalents, and restricted

cash at beginning of period

30,742

92,876

Cash, cash equivalents, and restricted

cash at end of period

$

21,152

$

40,816

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

This earnings release contains the financial measures (1)

Community Net Operating Income and Adjusted Community Net Operating

Income, (2) Community Net Operating Income Margin and Adjusted

Community Net Operating Income Margin, (3) Adjusted EBITDA, (4)

Revenue per Occupied Unit (RevPOR) and (5) Revenue per Available

Unit (RevPAR), all of which are not calculated in accordance with

U.S. GAAP. Presentations of these non-GAAP financial measures are

intended to aid investors in better understanding the factors and

trends affecting the Company’s performance and liquidity. However,

investors should not consider these non-GAAP financial measures as

a substitute for financial measures determined in accordance with

GAAP, including net income (loss), income (loss) from operations,

net cash provided by (used in) operating activities, or revenue.

Investors are cautioned that amounts presented in accordance with

the Company’s definitions of these non-GAAP financial measures may

not be comparable to similar measures disclosed by other companies

because not all companies calculate non-GAAP measures in the same

manner. Investors are urged to review the following reconciliations

of these non-GAAP financial measures from the most comparable

financial measures determined in accordance with GAAP.

Community Net Operating Income and Consolidated Community Net

Operating Income Margin are non-GAAP performance measures for the

Company’s consolidated owned portfolio of communities that the

Company defines as net income (loss) excluding: general and

administrative expenses (inclusive of stock-based compensation

expense), interest income, interest expense, other income/expense,

provision for income taxes, settlement fees and expenses, revenue

and operating expenses from the Company’s disposed properties; and

further adjusted to exclude income/expense associated with

non-cash, non-operational, transactional, or organizational

restructuring items that management does not consider as part of

the Company’s underlying core operating performance and impacts the

comparability of performance between periods. For the periods

presented herein, such other items include depreciation and

amortization expense, gain(loss) on extinguishment of debt,

gain(loss) on disposition of assets, long-lived asset impairment,

and loss on non-recurring settlements with third parties. The

Community Net Operating Income Margin is calculated by dividing

Community Net Operating Income by community resident revenue.

Adjusted Community Net Operating Income and Adjusted Community Net

Operating Income Margin are further adjusted to exclude the impact

from non-recurring state grant funds received.

The Company believes that presentation of Community Net

Operating Income, Community Net Operating Income Margin, Adjusted

Community Net Operating Income, and Adjusted Community Net

Operating Income Margin as performance measures are useful to

investors because (i) they are one of the metrics used by the

Company’s management to evaluate the performance of our core

consolidated owed portfolio of communities, to review the Company’s

comparable historic and prospective core operating performance of

the consolidated owned communities, and to make day-to-day

operating decisions; (ii) they provide an assessment of operational

factors that management can impact in the short-term, namely

revenues and the controllable cost structure of the organization,

by eliminating items related to the Company’s financing and capital

structure and other items that management does not consider as part

of the Company’s underlying core operating performance, and impacts

the comparability of performance between periods.

Community Net Operating Income, Net Community Operating Income

Margin, Adjusted Community Net Operating Income, and Adjusted

Community Net Operating Income Margin have material limitations as

a performance measure, including: (i) excluded general and

administrative expenses are necessary to operate the Company and

oversee its communities; (ii) excluded interest is necessary to

operate the Company’s business under its current financing and

capital structure; (iii) excluded depreciation, amortization, and

impairment charges may represent the wear and tear and/or reduction

in value of the Company’s communities, and other assets and may be

indicative of future needs for capital expenditures; and (iv) the

Company may incur income/expense similar to those for which

adjustments are made, such as gain (loss) on debt extinguishment,

gain(loss) on disposition of assets, loss on settlements, non-cash

stock-based compensation expense, and transaction and other costs,

and such income/expense may significantly affect the Company’s

operating results.

(in thousands)

Three Months Ended

September 30,

Three Months Ended June

30,

2023

2022

2023

Consolidated Community Net Operating

Income

Net loss

$

(18,411

)

$

(13,739

)

$

(12,212

)

General and administrative expense

8,615

5,851

6,574

Depreciation and amortization expense

9,943

9,691

9,927

Long-lived asset impairment

5,965

—

—

Interest income

(139

)

(44

)

(188

)

Interest expense

9,020

8,205

8,558

Loss on sale of assets, net

34

—

—

Other expense

90

6

117

Provision for income taxes

83

—

53

Settlement (income) fees and expense, net

(1)

(510

)

25

559

Other taxes

—

—

161

Consolidated community net operating

income

14,690

9,995

13,549

Resident revenue

$

59,117

$

52,485

$

56,960

Consolidated community net operating

income margin

24.8

%

19.0

%

23.8

%

COVID-19 state relief grants (2)

478

—

411

Adjusted resident revenue

58,639

52,485

56,549

Adjusted community net operating

income

$

14,212

$

9,995

$

13,138

Adjusted community net operating income

margin

24.2

%

19.0

%

23.2

%

(1) Settlement fees and expenses relate to

non-recurring settlements with third parties for contract

terminations, insurance claims, and related fees.

(2) COVID-19 relief revenue are grants and

other funding received from third parties to aid in the COVID-19

response and includes state relief funds received.

ADJUSTED EBITDA (UNAUDITED)

Adjusted EBITDA is a non-GAAP performance measures that the

Company defines as net income (loss) excluding: depreciation and

amortization expense, interest income, interest expense, other

expense/income, provision for income taxes; and further adjusted to

exclude income/expense associated with non-cash, non-operational,

transactional, or organizational restructuring items that

management does not consider as part of the Company’s underlying

core operating performance and impacts the comparability of

performance between periods. For the periods presented herein, such

other items include stock-based compensation expense, provision for

bad debts, gain (loss) on extinguishment of debt, gain on sale of

assets, long-lived asset impairment, casualty losses, and

transaction and conversion costs.

The Company believes that presentation of Adjusted EBITDA’s

impact as a performance measure is useful to investors because it

provides an assessment of operational factors that management can

impact in the short-term, namely revenues and the controllable cost

structure of the organization, by eliminating items related to the

Company’s financing and capital structure and other items that

management does not consider as part of the Company’s underlying

core operating performance and that management believes impact the

comparability of performance between periods.

Adjusted EBITDA has material limitations as a performance

measure, including: (i) excluded interest is necessary to operate

the Company’s business under its current financing and capital

structure; (ii) excluded depreciation, amortization and impairment

charges may represent the wear and tear and/or reduction in value

of the Company’s communities and other assets and may be indicative

of future needs for capital expenditures; and (iii) the Company may

incur income/expense similar to those for which adjustments are

made, such as bad debts, gain(loss) on sale of assets, or

gain(loss) on debt extinguishment, non-cash stock-based

compensation expense and transaction and other costs, and such

income/expense may significantly affect the Company’s operating

results.

(In thousands)

Three Months Ended

September 30,

Three Months Ended June

30,

2023

2022

2023

Adjusted EBITDA

Net loss

$

(18,411

)

$

(13,739

)

$

(12,212

)

Depreciation and amortization expense

9,943

9,691

9,927

Stock-based compensation expense, net

641

(588

)

601

Provision for bad debt

249

386

96

Interest income

(139

)

(44

)

(188

)

Interest expense

9,020

8,205

8,558

Long-lived asset impairment

5,965

—

—

Loss on sale of assets, net

34

—

—

Other expense, net

90

6

117

Provision for income taxes

83

—

53

Casualty losses (1)

204

372

456

Transaction and conversion costs (2)

1,591

157

130

Adjusted EBITDA

$

9,270

$

4,446

$

7,538

(1) Casualty losses relate to

non-recurring insured claims for unexpected events.

(2) Transaction and conversion costs

relate to legal and professional fees incurred for transactions,

restructure projects, or related projects.

SUPPLEMENTAL INFORMATION

Third Quarter

(Dollars in thousands)

2023

2022

Increase

(decrease)

Second Quarter 2023

Sequential increase

(decrease)

Selected Operating Results

I. Consolidated community

portfolio

Number of communities

61

62

(1)

62

(1)

Unit capacity

5,718

5,771

(53)

5,753

(35)

Weighted average occupancy (1)

84.9%

83.4%

1.5%

83.9%

1.0%

RevPAR

$3,446

$3,032

$414

$3,300

$146

RevPOR

$4,061

$3,636

$425

$3,932

$129

Consolidated community net operating

income

$14,690

$9,995

$4,695

$13,549

$1,141

Consolidated community net operating

income margin (3)

24.8%

19.0%

5.8%

23.8%

1.0%

Consolidated community net operating

income, net of general and administrative expenses (2)

$6,716

$3,556

$3,160

$7,576

$(860)

Consolidated community net operating

income margin, net of general and administrative expenses (2)

11.4%

6.8%

4.6%

13.3%

(1.9)%

II. Consolidated Debt

Information

(Excludes insurance premium

financing)

Total variable rate mortgage debt (4)

$137,320

$129,727

N/A

$137,253

N/A

Total fixed rate debt

$493,436

$538,128

N/A

$499,078

N/A

(1) Weighted average occupancy represents

actual days occupied divided by total number of available days

during the quarter.

(2) General and administrative expenses

exclude stock-based compensation expense in order to remove the

fluctuation in fair value due to market volatility.

(3) Includes $0.5 million, $0.0 million,

and $0.4 million of state grant revenue received in Q3 2023, Q3

2022, and Q2 2023, respectively. Excluding the grant revenue, Q3

2023 consolidated community NOI margin was 24.2%.

(4) As of September 30, 2023, the entire

balance of our outstanding variable-rate debt obligations were

covered by interest rate cap agreements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114372746/en/

Investor Contact: Kevin J. Detz, Chief Financial Officer, at

972-308-8343 Press Contact: media@sonidaliving.com

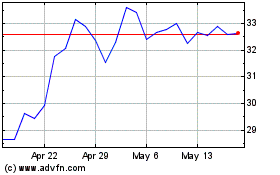

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Jan 2024 to Jan 2025