UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

| SMITH & NEPHEW PLC |

| (Exact name of the registrant as specified in its charter) |

| England and Wales |

1-14978 |

(State or other jurisdiction of

Incorporation or organization) |

(Commission

File Number) |

|

Building 5, Croxley Park, Hatters Lane

Watford, England, WD18 8YE |

N/A |

| (Address of principal executive offices) |

(Zip code) |

| Helen Barraclough |

+44-01903-477317 |

(Name and telephone number, including area code, of the

person to contact in connection with this report.) |

| Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: |

| X |

|

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| |

|

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the reporting period from January 1 to December 31, 2023. |

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure

and Report; Item 1.02 Exhibit

Conflict Minerals Disclosure

A copy of Smith & Nephew plc’s Conflict Minerals Report for

the year ended December 31, 2023 is provided as Exhibit 1.01 hereto and is publicly available at https://www.smith-nephew.com/en/who-we-are/sustainability/conflict-minerals#reports

Section 2 – Resource Extraction Issuer Disclosure and Report

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 – Exhibits

Item 3.01 Exhibits

Exhibit 1.01 – Conflict Minerals Report as required by Items

1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| Date: May 21, 2024 |

SMITH & NEPHEW PLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Helen Barraclough |

| |

Name: |

Helen Barraclough |

| |

Title: |

Company Secretary |

Exhibit 1.01

CONFLICT MINERALS REPORT for the year ending

31 December 2023

Introduction

Smith & Nephew plc, also referred to as “Smith

& Nephew”, the “company”, “we”, “our”, and “us” is a global medical technology

business. We have products in the following fields: Orthopaedic Reconstruction, Advanced Wound Management, Sports Medicine and Trauma

& Extremities.

This Conflict Minerals Report (CMR) for the year

ended December 31, 2023, is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the Rule) and Form SD. The

Rule imposes certain reporting obligations on U.S. Securities and Exchange Commission (SEC) issuers whose manufactured products contain

certain minerals which are “necessary to the functionality or production” of their products. These minerals are cassiterite,

columbite-tantalite (coltan), gold, wolframite, and their derivatives, which are limited to tin, tantalum and tungsten (collectively,

3TG or Conflict Minerals). The Rule focuses on 3TG emanating from the Democratic Republic of the Congo (DRC) region and nine adjoining

countries (collectively the Covered Countries). If an issuer has reason to believe that any of the Conflict Minerals in their supply chain

may have originated in the Covered Countries, or if they are unable to determine the country of origin of those Conflict Minerals, then

the issuer must exercise due diligence on the Conflict Minerals’ source and chain of custody and submit a CMR to the SEC that includes

a description of those due diligence measures.

This CMR relates to the process undertaken for

Smith & Nephew products that were manufactured, or contracted to be manufactured, during calendar year 2023 and that contain Conflict

Minerals. Third party products that Smith & Nephew sells but does not manufacture or contract to manufacture are outside the scope

of this CMR.

Executive Summary

Whilst Smith & Nephew’s products may

contain components or materials that utilize 3TG, Smith & Nephew does not purchase 3TG directly from mines, smelters, or refiners.

The majority of Smith & Nephew’s suppliers and their upstream suppliers are not directly subject to the Rule issued pursuant

to Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Smith & Nephew is reliant on the provision of information

by its suppliers to determine whether any 3TG in its products originated in the Covered Countries.

Smith & Nephew performed a Reasonable Country

of Origin Inquiry (RCOI) on suppliers believed to provide Smith & Nephew with materials or components containing 3TGs necessary to

the functionality or production of Smith & Nephew’s products. Smith & Nephew’s suppliers identified 330 valid smelters

and refineries (smelters) in their supply chains. Of these 330 smelters, Smith & Nephew identified 43 as sourcing (or there was a

reason to believe they may be sourcing) from the Covered Countries. Smith & Nephew’s due diligence review indicated that 36

of these smelters have been audited and recognized as conflict free by the Responsible Minerals Assurance Process (RMAP). Risk mitigation

was conducted on the remaining 7 smelters.

Company Management Systems

Smith & Nephew established robust management

systems according to Step 1 of the OECD Due Diligence Guidance. Smith & Nephew’s systems included:

| • | Step 1A - Adopt, and clearly communicate to suppliers and the public, a company policy for the supply

chain of minerals originating from conflict-affected and high-risk areas. |

| • | Implemented a conflict minerals policy |

| • | Policy made publicly available |

| • | https://www.smith-nephew.com/en/who-we-are/sustainability/conflict-minerals |

| • | Policy communicated directly to suppliers as part of RCOI process |

| • | Step 1B - Structure internal management to support supply chain due diligence |

| • | Maintained an internal cross functional team to support supply chain due diligence |

| • | Appointed a member of the senior staff with the necessary competence, knowledge, and experience to oversee

supply chain due diligence |

| • | Applied the resources necessary to support the operation and monitoring of these processes including internal

resources and external consulting support. |

| • | Step 1C - Establish a system of transparency, information collection and control over the supply chain |

| • | Implemented a process to collect required supplier and smelter RCOI and due diligence data. Full details

on the supply chain data gathering are included in the RCOI and due diligence sections of this CMR. |

| • | Step 1D - Strengthen company engagement with suppliers |

| • | Directly engaged suppliers during RCOI process. |

| • | Reviewed supplier responses as part of RCOI process. |

| • | Added conflict minerals compliance to new supplier contracts and Smith & Nephew’s supplier code

of conduct. |

| • | Implemented a plan to improve the quantity and quality of supplier and smelter responses year over year. |

| • | Step 1E - Establish a company and/or mine level grievance mechanism. |

| • | Recognized the RMAP’s three audit protocols for gold, tin/tantalum, and tungsten as valid sources

of smelter or mine level grievances. |

| • | Smith & Nephew’s ethics violations reporting system allows employees to voice confidentially

without any fear of retribution, any concerns with the violations of the Smith & Nephew’s conflict minerals policy |

RCOI

Smith & Nephew designed its RCOI process in

accordance with Step 2A and 2B of the OECD Due Diligence Guidance. Smith & Nephew’s RCOI process involved two stages:

| • | Stage 1 - Supplier RCOI (Step 2A of the OECD Due Diligence Guidance) |

| • | Stage 2 - Smelter RCOI (Step 2B of the OECD Due Diligence Guidance) |

Supplier RCOI

Smith & Nephew designed its supplier RCOI process

to identify, to the best of Smith & Nephew’s efforts, the smelters in Smith & Nephew’s supply chain in accordance

with Step 2A of the OECD Due Diligence Guidance. Smith & Nephew’s supplier RCOI process for the 2023 reporting period included

the following -

| • | Developing a list of suppliers providing 3TG containing components to Smith & Nephew. |

| • | Contacting each supplier and requesting the industry standard Conflict Minerals Reporting Template (“CMRT”)

including smelter information. |

| • | Reviewing supplier responses for accuracy and completeness. |

| • | Amalgamating supplier provided smelters into a single unique list of smelters meeting the definition of

a smelter under one of three industry recognized audit protocols. |

| • | Reviewing the final smelter list (and compared it to industry peers) to determine if Smith & Nephew

identified reasonably all of the smelters in its supplier’s supply chain. |

For the 2023 reporting period, Smith & Nephew’s

RCOI process was executed by Claigan Environmental Inc., a third-party contractor.

Smith & Nephew’s suppliers identified

330 smelters in their supply chain. The specific list of smelters is included in the “Smelter and Refineries” section at the

end of this CMR.

Smelter RCOI

Due to the overlap between smelter RCOI and smelter

due diligence, the smelter RCOI process is summarized in the due diligence section of this CMR.

Due Diligence

Smith & Nephew’s Due Diligence Process

was designed in accordance with the applicable sections of Steps 2, 3, and 4 of the OECD Due Diligence Guidance.

Smelter RCOI and Due Diligence

Smith & Nephew’s smelter RCOI and due

diligence process were designed to:

| • | Identify the scope of the risk assessment of the mineral supply chain (OECD Step 2B). |

| • | Assess whether the smelters/refiners have carried out all elements of due diligence for responsible supply

chains of minerals from conflict-affected and high-risk areas (OECD Step 2C). |

| • | Where necessary, carry out, including through participation in industry-driven programs, joint spot checks

at the mineral smelter/refiner’s own facilities (OECD Step 2D). |

Smith & Nephew’s smelter RCOI and Due

Diligence Process included the following -

| • | For each smelter identified by its suppliers: |

| • | Smith & Nephew attempted direct engagement with suppliers to determine whether or not the smelters

identified source from the Covered Countries. |

| • | For smelters that declared directly (e.g. email correspondence, publicly available conflict minerals policy,

or information available on their website) or through their relevant industry association that they did not source from the Covered Countries,

and were not recognized as conflict free by the RMAP, Smith & Nephew reviewed publicly available information to determine if there

was any contrary evidence to the smelter’s declaration. |

The sources reviewed included:

| • | Public internet search (e.g., Google) of the facility in combination with each of the Covered Countries |

| • | Review of specific NGO publications. NGO publications reviewed included: |

| • | Le Conge N’est Pas a Vendre |

| • | The Business and Human Rights Resource Centre (BHRRC) |

| • | The most recent UN Group of Experts report on the DRC |

| • | For smelters whose status could not be confirmed by direct engagement with suppliers, Smith & Nephew

reviewed publicly available sources to determine if there was any reason to believe that the smelter may have sourced from the Covered

Countries during the reporting period. |

| • | Smith & Nephew reviewed the same sources as those used to compare against smelter sourcing declarations. |

| • | For high-risk smelters (smelters that are sourcing from or there is reason to believe they may be sourcing

from the Covered Countries), Smith & Nephew sought to identify whether such smelters have been audited and recognized as conflict

free by the RMAP. |

| • | For high-risk smelters that have not been audited and recognized as conflict free by the RMAP, Smith &

Nephew communicates the risk to a designated member of senior management (OECD Step 3A) and conducts risk mitigation on the smelter according

to OECD Step 3B. |

Smith & Nephew’s suppliers identified

330 smelters in their supply chain. Smith & Nephew identified 43 smelters that source, or there is a reason to believe they may source,

from the Covered Countries. Smith & Nephew determined that 36 of these smelters have been audited and recognized as conflict free

by the RMAP. Risk mitigation was conducted on the remaining 7 smelters.

Risk Mitigation

Smith & Nephew conducted risk mitigation on

7 smelters that were not recognized as conformant to the RMAP. Smith & Nephew’s risk mitigation was designed in accordance with

Step 3B of the OECD Due Diligence Guidance and was reported to Smith+Nephew’s Manager, Product Stewardship, in accordance with Step

3A of the OECD Due Diligence Guidance.

As part of Smith & Nephew’s risk mitigation

process, additional due diligence was performed to determine if there was any reason to believe the relevant smelters directly or indirectly

financed or benefited armed groups in the DRC or adjoining countries. Notifications were issued to relevant suppliers regarding engaging

smelters, either directly or through any necessary upstream suppliers, to promote participation in the RMAP. Suppliers were requested

to consider removal of non RMAP conformant smelters from their supply chains, if smelters are unwilling or unable to participate in the

RMAP.

Smith+Nephew will continue to engage with its suppliers

on an ongoing basis with regards to these efforts and to ensure appropriate risk mitigation.

Improvement Plan

Smith & Nephew has a global, multi-tier, significantly

complex and highly regulated supply chain. Supply chain changes carry long lead times and the necessity for extensive quality and safety

related due diligence checks, as well as in certain instances, the obtaining of approvals from regulators. Smith & Nephew therefore

works collaboratively with suppliers to educate and manage change on an ongoing basis and to ensure conformance with Smith & Nephew’s

Conflict Minerals Policy.

Smith & Nephew is taking and will continue

to take the following steps to improve the due diligence conducted to further mitigate risk that the necessary conflict minerals in Smith

& Nephew’s products could directly or indirectly benefit or finance armed groups in the Covered Countries:

| a. | Including a conflict minerals clause in all new and renewing supplier contracts. |

| b. | Continuing to drive its suppliers to obtain current, accurate, and complete information about the smelters

in their supply chain. |

| c. | Engaging with suppliers regarding smelters sourcing from the Covered Countries to be audited and certified

to a protocol recognized by the RMAP. |

| d. | Follow up in 2024 on smelters requiring risk mitigation and implement corrective and preventative actions

where risks cannot be appropriately mitigated. |

Smelters and Refineries

Below are the smelters reported to Smith &

Nephew as likely in Smith & Nephew’s supply chain in the 2023 reporting period.

| Metal |

Smelter |

| Gold |

8853 S.p.A. |

| Gold |

ABC Refinery Pty Ltd. |

| Gold |

Abington Reldan Metals, LLC |

| Gold |

Advanced Chemical Company |

| Gold |

Agosi AG |

| Gold |

Aida Chemical Industries Co., Ltd. |

| Gold |

Al Etihad Gold Refinery DMCC |

| Gold |

Albino Mountinho Lda. |

| Gold |

Alexy Metals |

| Gold |

Almalyk Mining and Metallurgical Complex (AMMC) |

| Gold |

AngloGold Ashanti Córrego do Sítio Mineração |

| Gold |

Argor-Heraeus S.A. |

| Gold |

Asahi Pretec Corp. |

| Gold |

Asahi Refining Canada Ltd. |

| Gold |

Asahi Refining USA Inc. |

| Gold |

Asaka Riken Co., Ltd. |

| Gold |

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

| Gold |

AU Traders and Refiners |

| Gold |

Augmont Enterprises Private Limited |

| Gold |

Aurubis AG |

| Gold |

Bangalore Refinery |

| Gold |

Bangko Sentral ng Pilipinas (Central Bank of the Philippines) |

| Gold |

Boliden AB |

| Gold |

C. Hafner GmbH + Co. KG |

| Gold |

Caridad |

| Gold |

CCR Refinery - Glencore Canada Corporation |

| Gold |

Cendres + Métaux S.A. |

| Gold |

CGR Metalloys Pvt Ltd. |

| Gold |

Chimet S.p.A. |

| Gold |

Chugai Mining |

| Gold |

Daye Non-Ferrous Metals Mining Ltd. |

| Gold |

Degussa Sonne / Mond Goldhandel GmbH |

| Gold |

Dijllah Gold Refinery FZC |

| Gold |

Dongwu Gold Group |

| Gold |

Dowa |

| Gold |

DSC (Do Sung Corporation) |

| Gold |

Eco-System Recycling Co., Ltd. East Plant |

| Gold |

Eco-System Recycling Co., Ltd. North Plant |

| Gold |

Eco-System Recycling Co., Ltd. West Plant |

| Gold |

Emerald Jewel Industry India Limited (Unit 1) |

| Gold |

Emerald Jewel Industry India Limited (Unit 2) |

| Gold |

Emerald Jewel Industry India Limited (Unit 3) |

| Gold |

Emerald Jewel Industry India Limited (Unit 4) |

| Gold |

Emirates Gold DMCC |

| Gold |

Fujairah Gold FZC |

| Gold |

GGC Gujrat Gold Centre Pvt. Ltd. |

| Gold |

Gold by Gold Colombia |

| Gold |

Gold Coast Refinery |

| Gold |

Gold Refinery of Zijin Mining Group Co., Ltd. |

| Gold |

Great Wall Precious Metals Co., Ltd. of CBPM |

| Gold |

Guangdong Jinding Gold Limited |

| Gold |

Guoda Safina High-Tech Environmental Refinery Co., Ltd. |

| Gold |

Hangzhou Fuchunjiang Smelting Co., Ltd. |

| Gold |

Heimerle + Meule GmbH |

| Gold |

Heraeus Germany GmbH Co. KG |

| Gold |

Heraeus Metals Hong Kong Ltd. |

| Gold |

Hunan Chenzhou Mining Co., Ltd. |

| Gold |

Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. |

| Gold |

HwaSeong CJ Co., Ltd. |

| Gold |

Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. |

| Gold |

International Precious Metal Refiners |

| Gold |

Ishifuku Metal Industry Co., Ltd. |

| Gold |

Istanbul Gold Refinery |

| Gold |

Italpreziosi |

| Gold |

JALAN & Company |

| Gold |

Japan Mint |

| Gold |

Jiangxi Copper Co., Ltd. |

| Gold |

JSC Novosibirsk Refinery |

| Gold |

JSC Uralelectromed |

| Gold |

JX Nippon Mining & Metals Co., Ltd. |

| Gold |

K.A. Rasmussen |

| Gold |

Kazakhmys Smelting LLC |

| Gold |

Kazzinc |

| Gold |

Kennecott Utah Copper LLC |

| Gold |

KGHM Polska Miedź Spółka Akcyjna |

| Gold |

Kojima Chemicals Co., Ltd. |

| Gold |

Korea Zinc Co., Ltd. |

| Gold |

Kundan Care Products Ltd. |

| Gold |

Kyrgyzaltyn JSC |

| Gold |

L'azurde Company For Jewelry |

| Gold |

L'Orfebre S.A. |

| Gold |

Lingbao Gold Co., Ltd. |

| Gold |

Lingbao Jinyuan Tonghui Refinery Co., Ltd. |

| Gold |

LS MnM Inc. |

| Gold |

LT Metal Ltd. |

| Gold |

Luoyang Zijin Yinhui Gold Refinery Co., Ltd. |

| Gold |

Marsam Metals |

| Gold |

Materion |

| Gold |

Matsuda Sangyo Co., Ltd. |

| Gold |

MD Overseas |

| Gold |

Metal Concentrators SA (Pty) Ltd. |

| Gold |

Metallix Refining Inc. |

| Gold |

Metalor Technologies (Hong Kong) Ltd. |

| Gold |

Metalor Technologies (Singapore) Pte., Ltd. |

| Gold |

Metalor Technologies (Suzhou) Ltd. |

| Gold |

Metalor Technologies S.A. |

| Gold |

Metalor USA Refining Corporation |

| Gold |

Metalúrgica Met-Mex Peñoles S.A. De C.V. |

| Gold |

Mitsubishi Materials Corporation |

| Gold |

Mitsui Mining and Smelting Co., Ltd. |

| Gold |

MKS PAMP SA |

| Gold |

MMTC-PAMP India Pvt., Ltd. |

| Gold |

Modeltech Sdn Bhd |

| Gold |

Morris and Watson |

| Gold |

Moscow Special Alloys Processing Plant |

| Gold |

Nadir Metal Rafineri San. Ve Tic. A.Ş. |

| Gold |

Navoi Mining and Metallurgical Combinat |

| Gold |

NH Recytech Company |

| Gold |

Nihon Material Co., Ltd. |

| Gold |

Ögussa Österreichische Gold- und Silber-Scheideanstalt GmbH |

| Gold |

Ohura Precious Metal Industry Co., Ltd. |

| Gold |

OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) |

| Gold |

Pease & Curren |

| Gold |

Penglai Penggang Gold Industry Co., Ltd. |

| Gold |

Planta Recuperadora de Metales SpA |

| Gold |

Prioksky Plant of Non-Ferrous Metals |

| Gold |

PT Aneka Tambang (Persero) Tbk |

| Gold |

PX Précinox S.A. |

| Gold |

QG Refining, LLC |

| Gold |

Rand Refinery (Pty) Ltd. |

| Gold |

Refinery of Seemine Gold Co., Ltd. |

| Gold |

REMONDIS PMR B.V. |

| Gold |

Royal Canadian Mint |

| Gold |

SAAMP |

| Gold |

Sabin Metal Corp. |

| Gold |

Safimet S.p.A |

| Gold |

SAFINA A.S. |

| Gold |

Sai Refinery |

| Gold |

Samduck Precious Metals |

| Gold |

SAMWON Metals Corp. |

| Gold |

SEMPSA Joyería Platería S.A. |

| Gold |

Shandong Gold Smelting Co., Ltd. |

| Gold |

Shandong Humon Smelting Co., Ltd. |

| Gold |

Shandong Tiancheng Biological Gold Industrial Co., Ltd. |

| Gold |

Shandong Zhaojin Gold & Silver Refinery Co., Ltd. |

| Gold |

Shenzhen CuiLu Gold Co., Ltd. |

| Gold |

Shenzhen Zhonghenglong Real Industry Co., Ltd. |

| Gold |

Shirpur Gold Refinery Ltd. |

| Gold |

Sichuan Tianze Precious Metals Co., Ltd. |

| Gold |

Singway Technology Co., Ltd. |

| Gold |

SOE Shyolkovsky Factory of Secondary Precious Metals |

| Gold |

Solar Applied Materials Technology Corp. |

| Gold |

Sovereign Metals |

| Gold |

State Research Institute Center for Physical Sciences and Technology |

| Gold |

Sumitomo Metal Mining Co., Ltd. |

| Gold |

SungEel HiMetal Co., Ltd. |

| Gold |

Super Dragon Technology Co., Ltd. |

| Gold |

T.C.A S.p.A |

| Gold |

Tanaka Kikinzoku Kogyo K.K. |

| Gold |

Tokuriki Honten Co., Ltd. |

| Gold |

Tongling Nonferrous Metals Group Co., Ltd. |

| Gold |

TOO Tau-Ken-Altyn |

| Gold |

Torecom |

| Gold |

Umicore Precious Metals Thailand |

| Gold |

Umicore S.A. Business Unit Precious Metals Refining |

| Gold |

United Precious Metal Refining, Inc. |

| Gold |

Valcambi S.A. |

| Gold |

WEEEREFINING |

| Gold |

Western Australian Mint (T/a The Perth Mint) |

| Gold |

WIELAND Edelmetalle GmbH |

| Gold |

Yamakin Co., Ltd. |

| Gold |

Yokohama Metal Co., Ltd. |

| Gold |

Yunnan Copper Industry Co., Ltd. |

| Gold |

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

| Tantalum |

5D Production OU |

| Tantalum |

AMG Brasil |

| Tantalum |

D Block Metals, LLC |

| Tantalum |

F&X Electro-Materials Ltd. |

| Tantalum |

FIR Metals & Resource Ltd. |

| Tantalum |

Global Advanced Metals Aizu |

| Tantalum |

Global Advanced Metals Boyertown |

| Tantalum |

Hengyang King Xing Lifeng New Materials Co., Ltd. |

| Tantalum |

Jiangxi Dinghai Tantalum & Niobium Co., Ltd. |

| Tantalum |

Jiangxi Tuohong New Raw Material |

| Tantalum |

JiuJiang JinXin Nonferrous Metals Co., Ltd. |

| Tantalum |

Jiujiang Tanbre Co., Ltd. |

| Tantalum |

Jiujiang Zhongao Tantalum & Niobium Co., Ltd. |

| Tantalum |

KEMET de Mexico |

| Tantalum |

Materion Newton Inc. |

| Tantalum |

Metallurgical Products India Pvt., Ltd. |

| Tantalum |

Mineração Taboca S.A. |

| Tantalum |

Mitsui Mining and Smelting Co., Ltd. |

| Tantalum |

Ningxia Orient Tantalum Industry Co., Ltd. |

| Tantalum |

NPM Silmet AS |

| Tantalum |

QuantumClean |

| Tantalum |

Resind Indústria e Comércio Ltda. |

| Tantalum |

RFH Yancheng Jinye New Material Technology Co., Ltd. |

| Tantalum |

Solikamsk Magnesium Works OAO |

| Tantalum |

Taki Chemical Co., Ltd. |

| Tantalum |

TANIOBIS Co., Ltd. |

| Tantalum |

TANIOBIS GmbH |

| Tantalum |

TANIOBIS Japan Co., Ltd. |

| Tantalum |

TANIOBIS Smelting GmbH & Co. KG |

| Tantalum |

Telex Metals |

| Tantalum |

Ulba Metallurgical Plant JSC |

| Tantalum |

XIMEI RESOURCES (GUANGDONG) LIMITED |

| Tantalum |

Yanling Jincheng Tantalum & Niobium Co., Ltd. |

| Tin |

Alpha |

| Tin |

An Vinh Joint Stock Mineral Processing Company |

| Tin |

Aurubis Beerse |

| Tin |

Aurubis Berango |

| Tin |

Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. |

| Tin |

Chifeng Dajingzi Tin Industry Co., Ltd. |

| Tin |

China Tin Group Co., Ltd. |

| Tin |

CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda |

| Tin |

CRM Synergies |

| Tin |

CV Ayi Jaya |

| Tin |

CV Venus Inti Perkasa |

| Tin |

Dongguan CiEXPO Environmental Engineering Co., Ltd. |

| Tin |

Dowa |

| Tin |

DS Myanmar |

| Tin |

Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company |

| Tin |

EM Vinto |

| Tin |

Estanho de Rondônia S.A. |

| Tin |

Fabrica Auricchio Industria e Comercio Ltda. |

| Tin |

Fenix Metals |

| Tin |

Gejiu City Fuxiang Industry and Trade Co., Ltd. |

| Tin |

Gejiu Kai Meng Industry and Trade LLC |

| Tin |

Gejiu Non-Ferrous Metal Processing Co., Ltd. |

| Tin |

Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. |

| Tin |

Gejiu Zili Mining And Metallurgy Co., Ltd. |

| Tin |

Guangdong Hanhe Non-Ferrous Metal Co., Ltd. |

| Tin |

HuiChang Hill Tin Industry Co., Ltd. |

| Tin |

Jiangxi New Nanshan Technology Ltd. |

| Tin |

Luna Smelter, Ltd. |

| Tin |

Ma'anshan Weitai Tin Co., Ltd. |

| Tin |

Magnu's Minerais Metais e Ligas Ltda. |

| Tin |

Malaysia Smelting Corporation (MSC) |

| Tin |

Melt Metais e Ligas S.A. |

| Tin |

Metallic Resources, Inc. |

| Tin |

Mineração Taboca S.A. |

| Tin |

Mining Minerals Resources SARL |

| Tin |

Minsur |

| Tin |

Mitsubishi Materials Corporation |

| Tin |

Modeltech Sdn Bhd |

| Tin |

Nghe Tinh Non-Ferrous Metals Joint Stock Company |

| Tin |

Novosibirsk Tin Combine |

| Tin |

O.M. Manufacturing (Thailand) Co., Ltd. |

| Tin |

O.M. Manufacturing Philippines, Inc. |

| Tin |

Operaciones Metalúrgicas S.A. |

| Tin |

Pongpipat Company Limited |

| Tin |

Precious Minerals and Smelting Limited |

| Tin |

PT Aries Kencana Sejahtera |

| Tin |

PT Artha Cipta Langgeng |

| Tin |

PT ATD Makmur Mandiri Jaya |

| Tin |

PT Babel Inti Perkasa |

| Tin |

PT Babel Surya Alam Lestari |

| Tin |

PT Bangka Prima Tin |

| Tin |

PT Bangka Serumpun |

| Tin |

PT Bangka Tin Industry |

| Tin |

PT Belitung Industri Sejahtera |

| Tin |

PT Bukit Timah |

| Tin |

PT Cipta Persada Mulia |

| Tin |

PT Menara Cipta Mulia |

| Tin |

PT Mitra Stania Prima |

| Tin |

PT Mitra Sukses Globalindo |

| Tin |

PT Panca Mega Persada |

| Tin |

PT Premium Tin Indonesia |

| Tin |

PT Prima Timah Utama |

| Tin |

PT Putera Sarana Shakti (PT PSS) |

| Tin |

PT Rajawali Rimba Perkasa |

| Tin |

PT Rajehan Ariq |

| Tin |

PT Refined Bangka Tin |

| Tin |

PT Sariwiguna Binasentosa |

| Tin |

PT Stanindo Inti Perkasa |

| Tin |

PT Sukses Inti Makmur |

| Tin |

PT Timah Nusantara |

| Tin |

PT Timah Tbk Kundur |

| Tin |

PT Timah Tbk Mentok |

| Tin |

PT Tinindo Inter Nusa |

| Tin |

PT Tirus Putra Mandiri |

| Tin |

PT Tommy Utama |

| Tin |

Resind Indústria e Comércio Ltda. |

| Tin |

Rui Da Hung |

| Tin |

Super Ligas |

| Tin |

Thaisarco |

| Tin |

Tin Smelting Branch of Yunnan Tin Co., Ltd. |

| Tin |

Tin Technology & Refining |

| Tin |

Tuyen Quang Non-Ferrous Metals Joint Stock Company |

| Tin |

VQB Mineral and Trading Group JSC |

| Tin |

White Solder Metalurgia e Mineração Ltda. |

| Tin |

Yunnan Chengfeng Non-ferrous Metals Co., Ltd. |

| Tin |

Yunnan Yunfan Non-ferrous Metals Co., Ltd. |

| Tungsten |

A.L.M.T. Corp. |

| Tungsten |

ACL Metais Eireli |

| Tungsten |

Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. |

| Tungsten |

Artek LLC |

| Tungsten |

Asia Tungsten Products Vietnam Ltd. |

| Tungsten |

China Molybdenum Tungsten Co., Ltd. |

| Tungsten |

Chongyi Zhangyuan Tungsten Co., Ltd. |

| Tungsten |

CNMC (Guangxi) PGMA Co., Ltd. |

| Tungsten |

Cronimet Brasil Ltda |

| Tungsten |

Fujian Xinlu Tungsten Co., Ltd. |

| Tungsten |

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

| Tungsten |

Ganzhou Seadragon W & Mo Co., Ltd. |

| Tungsten |

Global Tungsten & Powders LLC. |

| Tungsten |

Guangdong Xianglu Tungsten Co., Ltd. |

| Tungsten |

H.C. Starck Tungsten GmbH |

| Tungsten |

HANNAE FOR T Co., Ltd. |

| Tungsten |

Hubei Green Tungsten Co., Ltd. |

| Tungsten |

Hunan Chenzhou Mining Co., Ltd. |

| Tungsten |

Hunan Jintai New Material Co., Ltd. |

| Tungsten |

Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch |

| Tungsten |

Hydrometallurg, JSC |

| Tungsten |

Japan New Metals Co., Ltd. |

| Tungsten |

Jiangwu H.C. Starck Tungsten Products Co., Ltd. |

| Tungsten |

Jiangxi Gan Bei Tungsten Co., Ltd. |

| Tungsten |

Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. |

| Tungsten |

Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

| Tungsten |

Jiangxi Xinsheng Tungsten Industry Co., Ltd. |

| Tungsten |

Jiangxi Yaosheng Tungsten Co., Ltd. |

| Tungsten |

JSC "Kirovgrad Hard Alloys Plant" |

| Tungsten |

Kennametal Fallon |

| Tungsten |

Kennametal Huntsville |

| Tungsten |

Lianyou Metals Co., Ltd. |

| Tungsten |

LLC Vostok |

| Tungsten |

Malipo Haiyu Tungsten Co., Ltd. |

| Tungsten |

Masan High-Tech Materials |

| Tungsten |

Moliren Ltd. |

| Tungsten |

Niagara Refining LLC |

| Tungsten |

NPP Tyazhmetprom LLC |

| Tungsten |

OOO “Technolom” 1 |

| Tungsten |

OOO “Technolom” 2 |

| Tungsten |

Philippine Chuangxin Industrial Co., Inc. |

| Tungsten |

TANIOBIS Smelting GmbH & Co. KG |

| Tungsten |

Unecha Refractory Metals Plant |

| Tungsten |

Wolfram Bergbau und Hütten AG |

| Tungsten |

Xiamen Tungsten (H.C.) Co., Ltd. |

| Tungsten |

Xiamen Tungsten Co., Ltd. |

| Tungsten |

YUDU ANSHENG TUNGSTEN CO., LTD. |

Forty-three of the smelters above declared to be

sourcing, or there was reason to believe are sourcing, from the Covered Countries. Under the SEC Final Rule, the requirement is to identify

whether or not a smelter is sourcing from the Covered Countries; there is no requirement to identify the specific covered country by the

smelter. Given the limitation on the specificity of the smelters’ disclosures, the identified Covered Countries are the Democratic

Republic of the Congo, Rwanda, Burundi, Uganda and Tanzania.

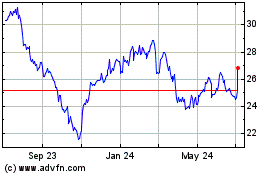

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From May 2024 to Jun 2024

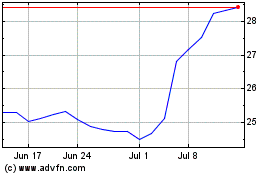

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Jun 2023 to Jun 2024