UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of March 2023

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

SENDAS DISTRIBUIDORA S.A.

Companhia de Capital Aberto Autorizado

CNPJ nº 06.057.223/0001-71

NIRE 3330027290-9

MINUTES TO THE MEETING OF THE BOARD OF DIRECTORS

HELD ON MARCH 28th, 2023.

1. Date, Time and Place: On March

28th, 2023, at 03:00 p.m, at the headquarters of Sendas Distribuidora SA (“Company”), located in the City of Rio

de Janeiro, State of Rio de Janeiro, at Avenida Ayrton Senna, nº 6.000, Lote 2, Pal 48959, Annex A, Jacarepaguá, CEP 22775-005.

2. Call and Attendance: Call was

waived in accordance with the regalement and the meeting had the presence of all the members of the Company's Board of Directors.

3. Conduction of the Meeting: Chairman:

Jean-Charles Henri Naouri; Secretary: Aline Pacheco Pelucio.

4. Agenda: (i) Analysis

and deliberation on the proposal (a) for the allocation of the results for the year ended December 31, 2022, according to the Company's

Financial Statements for the year ended December 31, 2022; (b) the investment plan; and (c) the capital budget; (ii)

Analysis and deliberation on the items of the Reference Form adjusted based on the Management Proposal; (iii) Analysis and deliberation

on the proposal for the global amount of compensation to be paid to the Company's management in the year 2023, including members of the

Fiscal Council, if installed; and (iv) Analysis and deliberation on the proposal of issuance of shares under the terms of the Stock

Option Plan and Stock Option Compensation Plan of the Company and the respective capital increase.

5. Resolutions: The members of

the Board of Directors, by unanimous vote and without restrictions, decided the following:

5.1 Analysis and deliberation on the

proposal (a) for the allocation of the results for the year ended December 31, 2022, according to the Company's Financial Statements

for the year ended December 31, 2022 (b) the investment plan; and (c) the capital budget: based on the favorable recommendation

of the Financial Committee, and aware of the fact that there will be no capital budget approval, the Members of the Board of Directors,

resolved, by unanimous vote and without any reservations, for the approval of the management´s proposal, to be resolved at the Company's

Annual and Extraordinary Shareholders' Meeting;

5.2 Analysis and deliberation on the

items of the Reference Form adjusted based on the Management Proposal: based on the favorable recommendation of the Financial Committee

and the People and Culture Committee, the Members of the Board of Directors decided, unanimously and without reservations, for the approval

the items of the Reference Form adjusted based on the Management Proposal;

5.3 Analysis

and deliberation on the proposal for the global amount of compensation to be paid to the Company's management in the year 2023, including

members of the Fiscal Council, if installed: the members of the Company's Board of Directors, by unanimous vote and without any reservations,

and based on the favorable recommendation of the People and Culture Committee and Corporate Governance Committee, resolved on the management's

proposal for the global amount of compensation for the year 2023 to be paid to the Company's Statutory Executive Board, Board of Directors

and Fiscal Council, if installed, to be submitted to the General Shareholders' Meeting of the Company, subdivided into: (a) the Board

of Directors and advisory committees, (b) the Executive Board, and (c) the Fiscal Council, if installed; and

5.4 Analysis

and deliberation on the proposal of issuance of shares under the terms of the Stock Option Plan and Stock Option Compensation Plan of

the Company and the respective capital increase: Messrs. members of the Board of Directors discussed (i) the Company’s Stock

Option Compensation Plan approved in the Special Shareholders’ Meeting held on December 31st, 2020 (“Compensation Plan”)

and (ii) the Company’s Stock Option Plan approved in the Special Shareholders’ Meeting held on December 31st, 2020 (“Stock Option Plan”

and, together with the Compensation Plan, the “Plans”) and resolved:

As a consequence of the exercise of options pertaining

to Series B7 and B9 of the Compensation Plan, and to Series C7 and C9 of the Stock Option Plan, to approve, in accordance with

Article 6 of the Bylaws and the limit of the authorized capital of the Company, the increase of the corporate capital of the Company in

the amount of R$1,154,499.05 (one million, one hundred fifty-four thousand, four hundred and ninety-nine reais and five cents), by means

of the issuance of 1,031,232 (one million, thirty-one thousand, two hundred and thirty-two) common shares, as follows:

(i) 705,337 (seven hundred five thousand, three

hundred and thirty-seven) common shares, at the issuance price of R$0.01 (one cent) per share, fixed in accordance with the Compensation

Plan, in the total amount of R$7,053.37 (seven thousand, fifty-three reais and thirty-seven cents), due to the exercise of options from

Serie B7; (ii) 87,875 (eighty-seven thousand, eight hundred seventy-five) common shares, at the issuance price of R$7.72 (seven reais

and seventy-two cents) per share, fixed in accordance with the Stock Option Plan, in the total amount of R$678,395.00 (six hundred seventy-eight

thousand, three hundred and ninety-five reais), due to the exercise of options from Serie C7; (iii) 200,746 (two hundred thousand, seven

hundred and forty-six) common shares, at the issuance price of R$0.01 (one cent) per share, fixed in accordance with the Compensation

Plan, in the total amount of R$2,007.46 (two thousand, seven reais and forty-six), due to the exercise of options from Serie B9; (iv)

37,274 (thirty-seven thousand, two hundred and seventy-four) common shares, at the issuance price of R$12.53(twelve reais and fifty-three

cents) per share, fixed in accordance with the Stock Option Plan, in the total amount of R$467.043.22 (four hundred sixty-seven thousand,

forty-three reais and twenty-two cents), due to the exercise of options from Serie C9;

According to the Company’s By-laws, such

common shares hereby issued have the same characteristics and conditions and enjoy the same rights, benefits and advantages of other existing

common shares issued by the Company, including dividends and other capital’s remuneration that may be declared by the Company.

In view of the above, the Company’s capital

stock is amended from the current R$1,263,855,996.33 (one billion, two hundred and sixty-three million, eight hundred and fifty-five thousand,

nine hundred and ninety-six reais and thirty-three cents) to R$1,265,010,495.38 (one billion, two hundred and sixty-five million, ten

thousand, four hundred and ninety-five reais and thirty-eight cents), fully subscribed and paid for, divided into 1,350,256,496 (one billion,

three hundred and fifty million, two hundred and fifty-six thousand, four hundred and ninety-six) common shares with no par value.

6. Approval

and signature of these minutes: As there were no further matters to be addressed, the meeting was adjourned so that these minutes

were drawn up. Then the meeting was resumed and these minutes were read and agreed to, having been undersigned by all attending persons.

Rio de Janeiro, March 28th, 2023. Chairman: Mr. Jean-Charles Henri Naouri; Secretary: Mrs. Aline Pacheco Pelucio.

Members of the Board of Directors who were present: Messrs. Jean-Charles Henri Naouri, Belmiro de Figueiredo Gomes, Luiz Nelson

Guedes de Carvalho, Christophe José Hidalgo, Philippe Alarcon, David Julien Emeric Lubek, Josseline Marie-José Bernadette

De Clausade, José Flavio Ferreira Ramos and Geraldo Luciano Mattos Júnior.

Rio de Janeiro, March 28th, 2023.

I hereby certify, for due purposes,

that this is a certificate of the minutes registered in the relevant corporate book, in accordance with Article 130, paragraph 3, of Law

No. 6.404/76 as amended.

|

__________________________________

Aline Pacheco Pelucio

Secretary |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 2, 2023

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

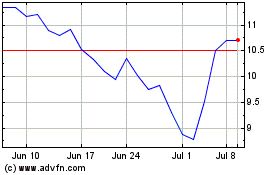

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Apr 2024 to May 2024

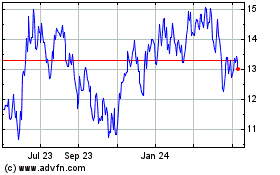

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From May 2023 to May 2024