false

0001846975

0001846975

2024-02-20

2024-02-20

0001846975

sedau:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2024-02-20

2024-02-20

0001846975

sedau:ClassOrdinarySharesParValue0.0001PerShareMember

2024-02-20

2024-02-20

0001846975

sedau:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-02-20

2024-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 20, 2024

SDCL EDGE Acquisition Corporation

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

|

001-40980 |

|

98-1583135 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

60 East 42nd Street, Suite 1100,

New York, NY |

|

10165 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(212)

488-5509

(Registrant’s telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

SEDA.U |

|

New York Stock Exchange LLC |

| Class

A ordinary shares, par value $0.0001 per share |

|

SEDA |

|

New York Stock Exchange LLC |

| Redeemable

warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

SEDA.WS |

|

New York Stock Exchange LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Business

Combination Agreement

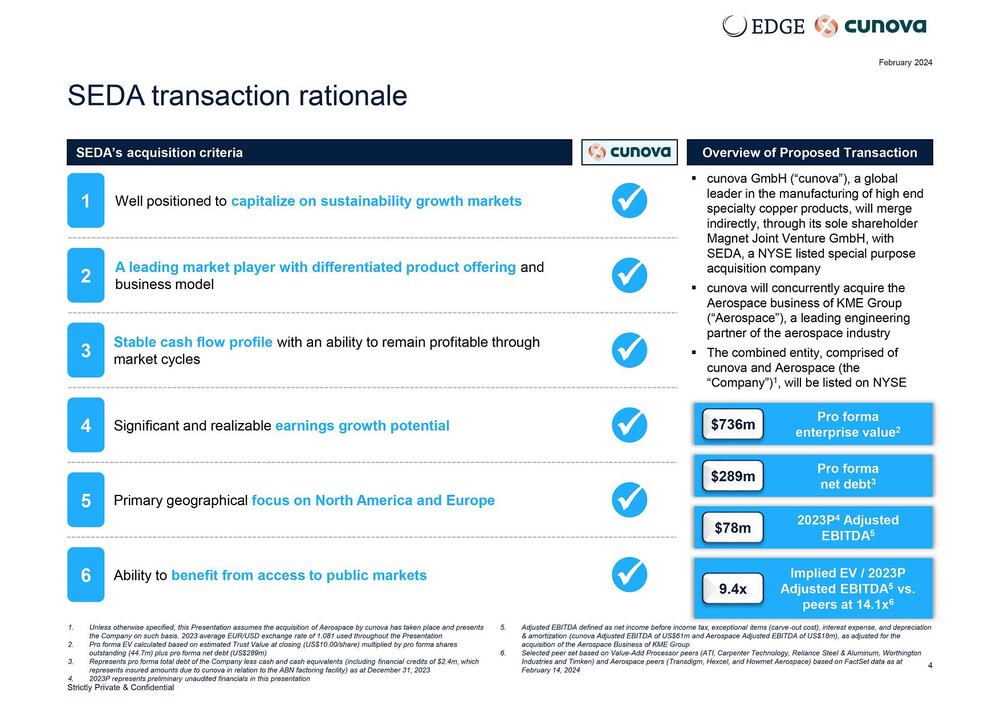

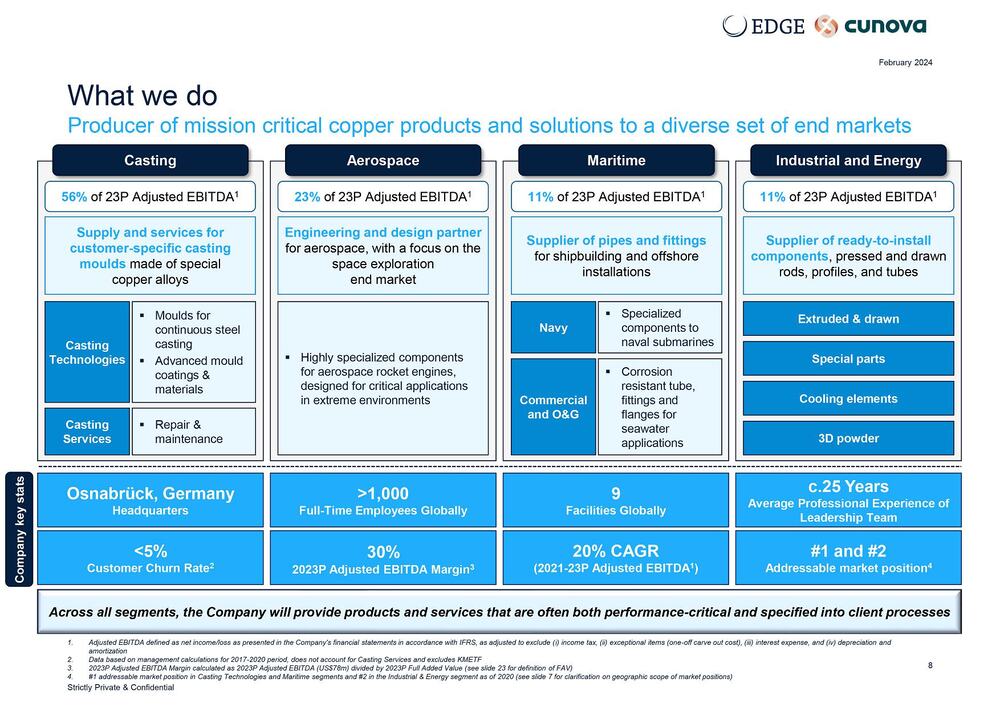

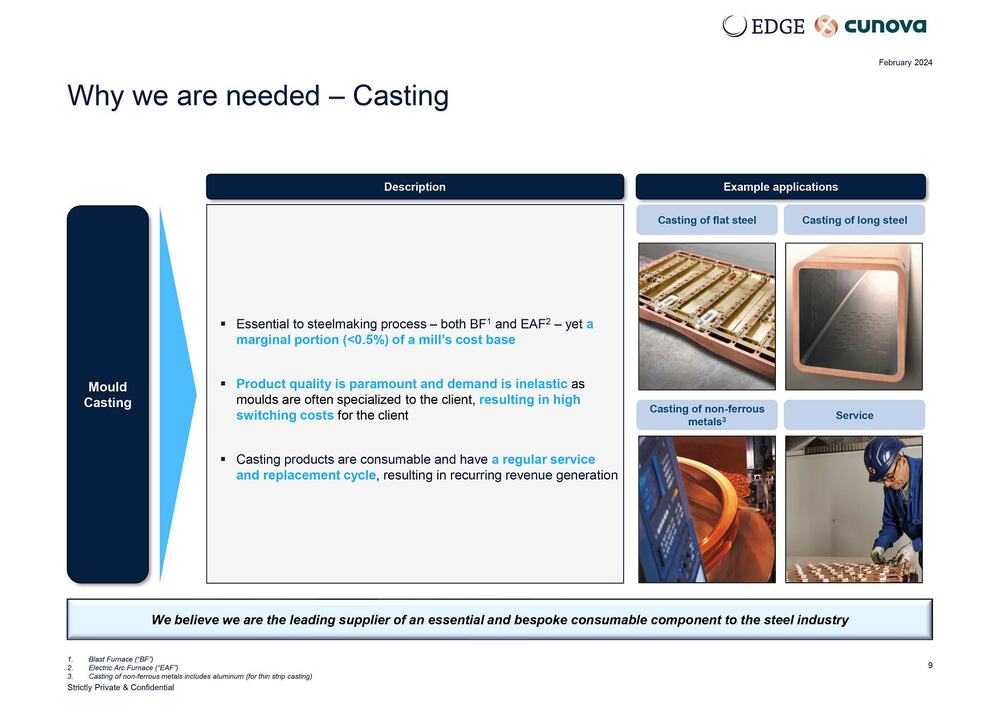

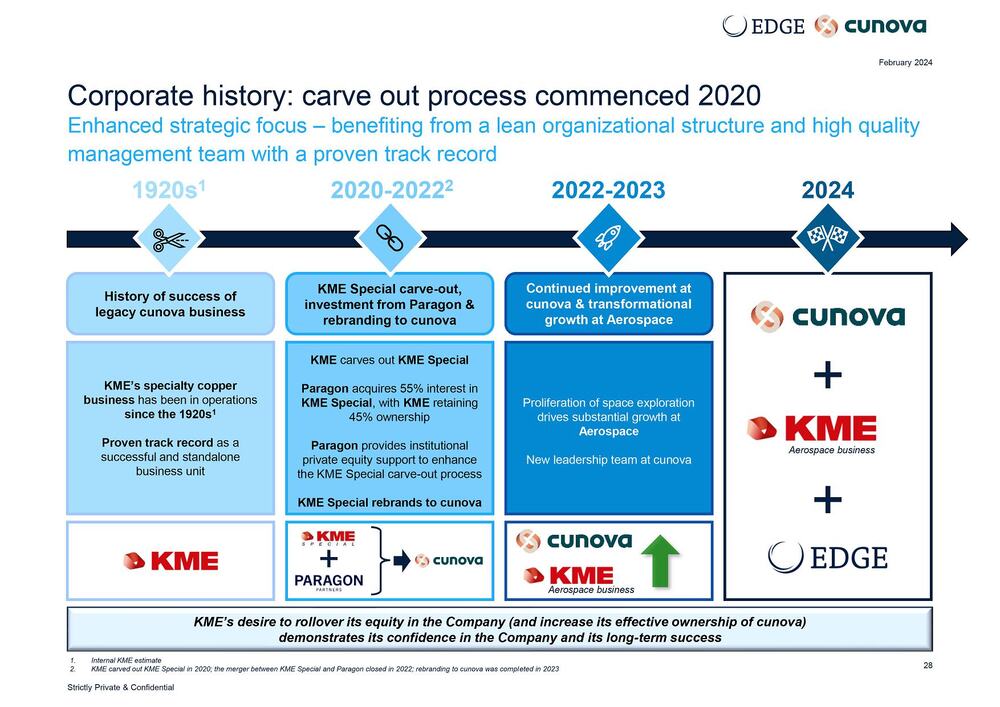

SDCL EDGE Acquisition Corporation (“SEDA”) is a blank check

company incorporated as a Cayman Islands exempted company on February 16, 2021 for the purpose of effecting a business combination, capital

stock exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On February

20, 2024, SEDA entered into a business combination agreement (the “Business Combination Agreement”) with (i) Specialty Copper

Listco Plc, a public limited company registered in England and Wales with registered number 15395590 (“PubCo”), (ii) SEDA

Magnet LLC, a Delaware limited liability company (“Merger Sub”), (iii) MAGNET Joint Venture GmbH, a limited liability company

organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number

HRB 217397 (“JV GmbH”), (iv) PP S&C Holding GmbH, a limited liability company organized under the laws of Germany, registered

with the commercial register of the local court of Munich under registration number HRB 275474 (“PP Holding”), (v) cunova

GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück

under registration number HRB 216155 (“Cunova”), (vi) KME SE, a stock corporation organized under the laws of Germany,

registered with the commercial register of the local court of Osnabrück under registration number HRB 213357 (“KME”),

(vii) Creature Kingdom Limited, a private limited company registered in England and Wales with registered number 06799429 (“Creature

Kingdom”), and (viii) The Paragon Fund III GmbH & Co. geschlossene Investment KG, a limited partnership organized under the

laws of Germany, registered with the commercial register of the local court of Munich under registration number HRA 110100 (“Paragon”)

and (ix) Mr. Edward Wilson Davis, solely in the capacity as the representative for the shareholders of SEDA (the “SEDA Representative”

and together with SEDA, PubCo, Merger Sub, JV GmbH, PP Holding, Cunova, KME, Creature Kingdom and Paragon, the “Parties”).

Pursuant

to the Business Combination Agreement, and upon the terms and subject to the conditions set forth therein:

| ● | SEDA

will merge with and into Merger Sub (the “Merger”), with Merger Sub being the

surviving entity in the merger (the time at which the Merger becomes effective, the “Merger

Effective Time”); |

| ● | in connection with the Merger, (a) each outstanding SEDA Class B ordinary share, par value $0.0001 per share (the “SEDA Class

B Shares”) will be converted into 0.893 SEDA Class A ordinary shares, par value $0.0001 per share, unless otherwise agreed in writing

(the “SEDA Class A Shares”, and together with the SEDA Class B Shares, the “SEDA Shares”), (b) each outstanding

SEDA Class A Share will be automatically cancelled and will be converted into PubCo ordinary shares at an exchange ratio of 1.119375,

each such PubCo ordinary share having a par value of £1 per share (the “PubCo Shares”), and (c) each outstanding warrant

of SEDA will be automatically adjusted to entitle the holder to purchase one whole PubCo Share at a price of $11.50 per PubCo Share (the

“SEDA Adjusted Warrants”); |

| ● | on the Exchange Date (as defined below) (and, if applicable, immediately after the closing contemplated of any Financing (as defined

below)), PubCo will (a) redeem the redeemable preference share in PubCo held by Creature Kingdom, and (b) purchase from Creature

Kingdom the ordinary share in PubCo held by Creature Kingdom in exchange for the release of the undertaking to pay the subscription price

of such redeemable share; and |

| ● | on the Exchange Date (as defined below), (a) Paragon will transfer its shares in PP Holding and a certain shareholder loan to PubCo

in exchange for cash and a vendor loan agreement by and between Paragon and PubCo, (b) Cunova will redeem the preference share of Cunova

with the number 25,001 (the “Cunova Preference Share”) in consideration for the transfer of the preference share of KME AssetCo

GmbH (“KME AssetCo”) with the number 25,001 (the “KME AssetCo Preference Share”) by Cunova to KME Special Products

GmbH & Co. KG (“KME Special”), and (c) KME will cause KME Germany GmbH (“KME Germany”), KME Mansfeld GmbH

(“KME Mansfeld”) and KME America Inc. (“KME America” and, together with KME Germany and KME Mansfeld, the “Aerospace

Business Sellers”) to transfer to Cunova the KME specialty aerospace business (the “Aerospace Business”, together with

Cunova, the “Target”) in exchange for a vendor loan debt instrument issued by Cunova (the “Aerospace VLN”) and

which the Aerospace Business Sellers will transfer to KME Special and KME Special, in turn, will contribute the Aerospace VLN to PubCo

in exchange for PubCo Shares; and KME Special will transfer its shares in JV GmbH and a certain shareholder loan between KME Special and

JV GmbH to PubCo in exchange for PubCo Shares and cash ((a)-(c) the “Exchange” and the date on which the Exchange occurs,

the “Exchange Date”) (together with the other transactions contemplated by the Business Combination Agreement and the ancillary

documents thereto, the “Business Combination”). |

Upon

the closing of the Business Combination (collectively, the “Closing”), PubCo expects to trade on the New York Stock Exchange

(the “NYSE”). As of the date of this Current Report on Form 8-K, a NYSE ticker symbol has not been reserved.

The Business Combination Agreement and the Business Combination were

unanimously approved by (i) the boards of directors of each of SEDA, PubCo, Merger Sub and KME, (ii) the shareholders of JV GmbH and Cunova

and (iii) the managing directors of Paragon and PP Holding.

In connection with the Business Combination, holders of SEDA Class

A Shares will have the right to redeem their SEDA Class A Shares other than those holders of SEDA Class A Shares who have agreed not to

redeem their shares pursuant to the letter agreement, dated October 28, 2021, among SEDA, the Sponsor and the other parties thereto. Holders

of SEDA Class A Shares that do not elect to redeem their SEDA Class A Shares in connection with the Business Combination will receive,

at the Merger Date, 1.119375 PubCo Shares (and such exchange ratio, the “Exchange Ratio”) in exchange for each non-redeemed

SEDA Class A Share held by such holder.

Additionally,

in connection with the Merger, the warrant adjustment provision under SEDA’s warrant agreement, dated October 28, 2021 (the “Warrant

Agreement”), between SEDA and Continental Stock Transfer & Trust Company, as warrant agent, is expected to be triggered, and

the Parties have agreed to take certain actions, as described in the Business Combination Agreement, with respect to the applicability

of such provision to the Business Combination.

Conditions

to Obligations of Parties

Each

Party’s obligation to consummate the Business Combination is conditioned upon the satisfaction or waiver of certain conditions,

including, among others:

| ● | approval

of the Business Combination and certain other items by the shareholders of SEDA; |

| ● | approvals

and consents from the necessary government agencies and regulators; |

| ● | execution and delivery of an amendment to the Warrant Agreement (the “Warrant Assignment and Assumption”), to give effect

to the assignment and assumption of the SEDA Adjusted Warrants; |

| ● | the

absence of any legal restraint enjoining or prohibiting the Closing; |

| ● | the registration statement to be filed on Form F-4 (the “Registration Statement”) by PubCo with the SEC in connection

with the Business Combination having been declared effective by the SEC in accordance with the provisions of the Securities Act, no stop

order having been issued by the SEC that remains in effect with respect to the Registration Statement, and no proceeding seeking such

a stop order having been threatened or initiated by the SEC that remains pending; |

| ● | approval

for listing on the New York Stock Exchange (“NYSE”) of the PubCo Shares and SEDA

Adjusted Warrants having been obtained in connection with the Business Combination; and |

| ● | the

refinancing of certain debt incurred under the existing JV GmbH facilities agreement (the

“Existing Financing”) by JV GmbH for an amount equal to the amount outstanding

under the Existing Financing (after deducting any applicable fees) or the obtaining of all

necessary waivers, consents, amendments, confirmations and/or approvals for the continuation

of the Existing Financing following Closing (the “Debt Refinancing”). |

SEDA’s

obligation to consummate the Business Combination is also subject to the satisfaction or waiver of certain conditions, including, among

others:

| ● | accuracy

of the representations and warranties of JV GmbH, KME and Paragon in all material respects

(subject to customary bring-down standards); |

| ● | performance

of covenants by JV GmbH, PP Holding, Paragon and KME in all material respects as of or prior

to the Closing; |

| ● | absence

of a material adverse effect on the Aerospace Business, PP Holding or JV GmbH and its subsidiaries,

taken as a whole, since the date of the Business Combination Agreement; |

| ● | delivery

of certain documentation and certificates by JV GmbH, KME and Paragon and their respective

officers to SEDA pursuant to the Business Combination Agreement at Closing; and |

| ● | consummation of the transfer of the Aerospace Business to Cunova pursuant to the Aerospace Business Transfer Agreement scheduled to

the Business Combination Agreement. |

JV

GmbH’s, PP Holding’s, Paragon’s and KME’s obligation to consummate the Business Combination is also subject to

the satisfaction or waiver of certain conditions, including, among others:

| ● | accuracy

of the representations and warranties of SEDA, PubCo and Merger Sub (subject to customary bring-down standards); |

| ● | performance

of covenants by SEDA, SEDA Representative, PubCo and Merger Sub in all material respects, except with respect to the payment obligation

by PubCo associated with the transfer of Paragon’s shares in PP Holding, which must have been

complied with in all respects, as of or prior to the Closing; |

| ● | absence

of a material adverse effect on SEDA, since the date of the Business Combination Agreement; |

| ● | PubCo

and SEDA having an aggregate amount of cash from (i) any proceeds from any PIPE Investment

(as defined below) and any other equity or debt financing (other than the Debt Refinancing)

(each, a “Financing”) which are permitted to be paid out as cash consideration

due at Closing, plus (ii) cash available in SEDA’s trust account as of the Closing

after taking into account all shareholder redemptions (together with any Financing, the “Available

Cash”), in an amount of at least $140,000,000; and |

| ● | delivery by SEDA at Closing to JV GmbH, Paragon and KME of a certificate signed by an officer of SEDA, certifying that to the knowledge

and belief of such officer, the conditions pertaining to SEDA have been fulfilled. |

Governance

Subject

to the terms of the governing documents of PubCo, the Parties will take all necessary action so that effective as of the Closing: PubCo’s

board of directors (the “Post-Closing PubCo Board”) will consist of seven (7) persons. Two members of the Post-Closing PubCo

Board will be identified by SEDA and five (5) members of the Post-Closing PubCo Board will be identified by KME.

Covenants

The

Business Combination Agreement includes customary covenants of the Parties with respect to business operations prior to consummation

of the Business Combination and efforts to satisfy conditions to consummation of the Business Combination.

The Business

Combination Agreement contains certain additional covenants of the Parties, including, among others, covenants providing that: (a)

JV GmbH, PP Holding, PubCo, Merger Sub, Paragon, KME and SEDA to (i) use reasonable best efforts to obtain all material

third party consents and (ii) take such other actions as may reasonably be necessary or as another party may reasonably request to

satisfy the conditions of the Closing or otherwise to comply with the Business Combination Agreement and to consummate the Business

Combination as soon as practicable; (b) each of the Parties to use reasonable best efforts to obtain necessary governmental and

regulatory consents and approvals; (c) PubCo, Merger Sub, JV GmbH and SEDA to use reasonable best efforts to cooperate with respect

to the Registration Statement to be filed with the SEC and the related proxy statement to be sent to SEDA shareholders in connection

with the Business Combination; (d) JV GmbH, Paragon and KME not to initiate any negotiations or enter into any agreements for

certain alternative transactions; (e) to the extent PubCo and SEDA enter into any subscription agreements (the “Subscription

Agreements”) with third-party investors (the “PIPE Investors”, and any such investment, the “PIPE

Investment”) prior to the Closing, PubCo and SEDA to use reasonable best efforts to satisfy the conditions of any PIPE

Investors’ closing obligations contained in any such Subscription Agreements, and consummate the transactions contemplated

thereby; (f) KME to provide additional funding (up to $35,000,000) if Available Cash is less than $175,000,000, and KME can set off

its cash consideration against such additional funding; (g) JV GmbH to use reasonable best efforts to procure the Debt Refinancing;

(h) JV GmbH, PP Holding, Cunova and the Shareholders to provide such cooperation and information in connection with any Financing or

the Debt Refinancing as may be reasonably requested by SEDA; (i) Paragon and KME to use reasonable best efforts to implement the

sale of existing Cunova joint ventures in Russia and China prior to the Closing; (j) SEDA to use commercially reasonable efforts to

ensure that Available Cash is not less than $175,000,000 as of the Closing; (k) SEDA to use its best efforts to ensure that

Available Cash is not less than $140,000,000 as of the Closing; (l) JV GmbH to use its reasonable best efforts to procure the Debt

Refinancing; (m) KME and the Aerospace Business Sellers to take certain actions to prepare to transfer the Aerospace Business; and

(n) SEDA, KME and Paragon (as applicable) to agree and enter into certain documentation prior to Closing, such as (i) new articles

of association of PubCo, (ii) a merger plan with respect to the Merger, (iii) a registration rights agreement pursuant to which

PubCo will agree to file a shelf registration within 45 days of closing and such shareholders will have the right to demand a

certain number of underwritten takedowns form the shelf, as well as to piggyback on certain other registration statements filed by

PubCo, and (iv) a lock-up agreement pursuant to which SDCL EDGE Sponsor LLC (the “Sponsor”), until one year after the

Closing Date, and KME Special and certain directors and officers of PubCo, until one hundred eighty (180) days after the Closing

Date, will agree to certain transfer restrictions in respect of their shares in PubCo subject to customary exemptions.

Representations

and Warranties

The

Business Combination Agreement contains customary representations and warranties by JV GmbH, KME, Paragon, PubCo, Merger Sub and SEDA.

The representations and warranties of the respective parties to the Business Combination Agreement generally will not survive the Closing.

Termination

The

Business Combination Agreement may be terminated under certain customary and limited circumstances at any time prior to the Closing,

including, without limitation, (a) by mutual written consent of SEDA, Paragon and KME; (b) by any of the Parties, if SEDA’s shareholder

meeting to vote on the Business Combination Agreement has concluded (including any adjournment or postponement thereof) and the approval

of the Business Combination by the requisite vote of SEDA’s shareholders was not obtained; (c) by SEDA, if (i) JV GmbH, Paragon

or KME has breached any of its representations, warranties, agreements or covenants contained in the Business Combination Agreement and

such failure or breach would render certain conditions precedent to the Closing incapable of being satisfied, subject to certain cure

rights; (ii) if an applicable governmental entity has taken a final and non-appealable action permanently enjoining or prohibiting the

Business Combination; and (iii) if the Committee on Foreign Investment in the United States (“CFIUS”) will recommend the

transaction be prohibited; and (d) by Paragon and KME, if (i) SEDA, PubCo or Merger Sub has breached any of its representations, warranties,

agreements or covenants contained in the Business Combination Agreement and such failure or breach would render certain conditions precedent

to the Closing incapable of being satisfied, subject to certain cure rights, (ii) if an applicable governmental entity has taken a final

and non-appealable action permanently enjoining or prohibiting the Business Combination; and (iii) if CFIUS will recommend the transaction

be prohibited.

A

copy of the Business Combination Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein

by reference, and the foregoing description of the Business Combination Agreement and the Merger does not purport to be complete and

is qualified in its entirety by reference thereto.

The

Business Combination Agreement contains representations, warranties and covenants that the respective Parties made to each other as of

the date of the Business Combination Agreement or other specific dates. The assertions embodied in those representations, warranties

and covenants were made for purposes of the contract among the respective Parties and are subject to important qualifications and limitations

agreed to by the Parties in connection with negotiating the Business Combination Agreement. The Business Combination Agreement is being

filed to provide investors with information regarding its terms. It is not intended to provide any other factual information about the

Parties to the Business Combination Agreement. In particular, the representations, warranties, covenants and agreements contained in

the Business Combination Agreement, which were made only for purposes of the Business Combination Agreement and as of specific dates,

were solely for the benefit of the parties to the Business Combination Agreement, may be subject to limitations agreed upon by the contracting

parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties

to the Business Combination Agreement instead of establishing these matters as facts) and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to investors, security holders and reports and documents filed

with the SEC. Investors and security holders are not third-party beneficiaries under the Business Combination Agreement and should not

rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state

of facts or condition of any party to the Business Combination Agreement. In addition, the representations, warranties, covenants and

agreements and other terms of the Business Combination Agreement may be subject to subsequent waiver or modification.

Certain

Related Agreements

In

connection with the execution of the Business Combination Agreement, SEDA entered into certain other agreements, including, among others:

Support

Agreements

Sponsor

Support Agreement

On

February 20, 2024, in connection with the execution of the Business Combination Agreement, SEDA entered into a sponsor support agreement

(the “Sponsor Support Agreement”) with PubCo and Sponsor as a holder of private warrants of SEDA(“SEDA Private Warrants”)

(purchased in a private placement contemporaneously with the initial public offering of SEDA) and a holder of SEDA Class B Shares. Pursuant

to the Sponsor Support Agreement, upon the terms and subject to the conditions set forth therein, until the earlier of the Merger Effective

Time and the date and time, if any, that the Business Combination Agreement is terminated, the Sponsor agreed to (a) inter alia,

vote any SEDA Shares that it owns in favor of the proposals regarding the Business Combination; (b) not redeem or effect any sale or

distribution of any SEDA Shares or SEDA Warrants that it owns; (c) convert its 2,639,375 SEDA Class B Shares into 1,593,941 SEDA Class

A Shares; and (d) at Closing, enter into a registration rights agreement based on the term sheet scheduled to the Business Combination

Agreement.

A

copy of the Sponsor Support Agreement is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by

reference, and the foregoing description of the Sponsor Support Agreement and the transactions contemplated thereby does not purport

to be complete and is qualified in its entirety by reference thereto.

Anchor

Support Agreements

On

February 20, 2024, in connection with the execution of the Business Combination Agreement, SEDA entered into an anchor support agreement

(the “Anchor Support Agreement”) with PubCo and each of Sustainable Investors Fund, LP (“Capricorn”) and Seaside

Holdings (Nominee) Limited (“Seaside” and, together with Capricorn, the “A Anchor Investors”)) as holders of

public warrants of SEDA (“SEDA Public Warrants” and, together with the SEDA Private Warrants, the “SEDA Warrants”))

(purchased in the initial public offering of SEDA) and SEDA Private Warrants (purchased in a private placement contemporaneously with

the initial public offering of SEDA) and holders of SEDA Class A Shares and SEDA Class B Shares. Pursuant to the Anchor Support Agreement,

upon the terms and subject to the conditions set forth therein, until the earlier of the Merger Effective Time and the date and time,

if any, that the Business Combination Agreement is terminated, each A Anchor Investor agreed to (a) inter alia, vote any SEDA

Shares that it owns in favor of the proposals regarding the Business Combination; (b) not redeem or effect any sale or distribution of

any SEDA Shares or SEDA Warrants that it owns; (c) convert its 499,881 SEDA Class B Shares into 283,291 SEDA Class A Shares; and (d)

at Closing, enter into a registration rights agreement based on the term sheet scheduled to the Business Combination Agreement.

A copy of the

form of Anchor Support Agreement is filed with this Current Report on Form 8-K as Exhibit 10.2 and is incorporated herein by

reference, and the foregoing description of the Sponsor Support Agreement and the transactions contemplated thereby does not purport

to be complete and is qualified in its entirety by reference thereto.

Item

3.02 Unregistered Sales of Equity Securities

To the extent required, the disclosure set forth above in Item 1.01

of this Current Report on Form 8-K is incorporated by reference herein. The SEDA Class A Shares to be issued pursuant to the Sponsor Support

Agreement have not been registered under the Securities Act in reliance upon the exemption provided in Section 4(a)(2) and/or Regulation

D, as applicable.

Item

7.01 Regulation FD Disclosure

On February 20, 2024, SEDA issued a press release

(the “SEDA Press Release”) announcing that it has entered into the Business Combination Agreement. The SEDA Press Release

is attached to this Current Report on Form 8-K as Exhibit 99.1.

On February 20, 2024, KME Group S.p.A. issued a press release (the

“KME Press Release”) announcing that it has entered into the Business Combination Agreement. The KME Press Release is attached

to this Current Report on Form 8-K as Exhibit 99.2.

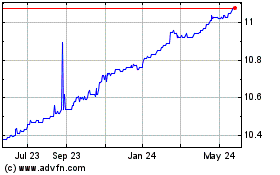

In

addition, furnished as Exhibit 99.3 hereto is the investor presentation dated February 2024, that will be used by SEDA in connection

with the Business Combination.

The information in this Current Report on Form

8-K furnished pursuant to Item 7.01, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed to be “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under

that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information

pursuant to Item 7.01, SEDA makes no admission as to the materiality of any information in this Current Report on Form 8-K, including

Exhibits 99.1, 99.2 and 99.3, that is required to be disclosed solely by Regulation FD.

Important

Information and Where to Find It

In

connection with the Business Combination, PubCo will file with the SEC a preliminary proxy statement/prospectus (a “Proxy Statement/Prospectus”).

A definitive Proxy Statement/Prospectus will be mailed to holders of SEDA’s ordinary shares as of a record date to be established

for voting on the Business Combination and other matters as described in the Proxy Statement/Prospectus. The Proxy Statement/Prospectus

will include information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to SEDA’s

shareholders in connection with the Business Combination. SEDA may also file other documents regarding the Business Combination with

the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SEDA ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS,

THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH

THE MERGER, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION.

Investors

and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and all other relevant documents filed or that

will be filed with the SEC by SEDA through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by SEDA

may be obtained free of charge from SEDA’s website at www.sdcledge.com or by written request to SEDA at SDCL EDGE Acquisition Corporation,

60 East 42nd Street, Suite 1100, New York, NY 10165, Attn: Francesca Lorenzini.

Participants

in the Solicitation

SEDA,

and certain of their respective directors and officers may be deemed to be participants in the solicitation of proxies from SEDA’s

shareholders in connection with the Business Combination. Information about SEDA’s directors and executive officers and their ownership

of SEDA’s securities is set forth in SEDA’s filings with the SEC, including SEDA’s Annual Report on Form 10-K for the

year ended December 31, 2022, which was filed with the SEC on March 30, 2023. Additional information regarding the interests of those

persons and other persons who may be deemed participants in the Business Combination may be obtained by reading the Proxy Statement/Prospectus

regarding the Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding

paragraph.

No

Offer or Solicitation

This

current report on Form 8-K and the information contained herein do not constitute an offer to sell or the solicitation of an offer to

buy any security, commodity or instrument or related derivative, nor shall there be any sale of securities in any jurisdiction in which

the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

No offer of securities in the United States or to or for the account or benefit of U.S. persons (as defined in Regulation S under the

Securities Act) shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption

therefrom. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption

under the Securities Act.

Forward

Looking Statements

This

current report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect

to the Business Combination between SEDA and the Target, including but are not limited to, statements regarding the benefits of the transaction,

the anticipated timing of the transaction, the products offered by the Target and the markets in which it operates, the Target’s

projected future results (including EBITDA and cash flow). These forward-looking statements generally are identified by the words “project,”

“expect,” “anticipate,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” and similar expressions. Forward-looking statements are predictions, projections

and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including but not limited to: (a) the outcome of any legal proceedings that may be instituted in connection with the Business Combination;

(b) delays in obtaining, adverse contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews

required to complete the Business Combination; (c) the risk that the Business Combination disrupts Cunova’s or the Aerospace Business’s

current plans and operations; (d) the inability of Cunova to recognize the anticipated benefits of the Business Combination, including

its acquisition of the Aerospace Business, which may be affected by, among other things, competition, the ability of the combined company

to grow and manage growth profitably with customers and suppliers and retain key employees; (e) the risk that Cunova’s or the Aerospace

Business’s projected pipeline of projects and production capacity do not meet Cunova’s or the Aerospace Business’s

proposed timeline or that such pipeline fails to be met at all; (f) costs related to the Business Combination; (g) the risk that the

Business Combination does not close in the second quarter of 2024 or does not close at all; (h) changes in the applicable laws or regulations;

(i) the possibility that Cunova, the Aerospace Business, or the combined company may be adversely affected by other economic, business,

and/or competitive factors; (j) economic uncertainty caused by the impacts of geopolitical conflicts, including Russia’s invasion

of Ukraine and the ongoing conflicts in the Middle East; (k) economic uncertainty due to rising levels of inflation and interest rates;

(l) the risk that the approval of the shareholders of SEDA for the Business Combination is not obtained; (m) the risk that any current

or future equity or debt transactions are not completed prior to the closing of the Business Combination; (n) the risk that even if any

current or future equity or debt transactions are completed, they will not be sufficient to satisfy the minimum cash condition set forth

in the definitive documentation in connection with the Business Combination and/or fund the combined company’s execution on its

near-term project pipeline allowing the combined company to scale its operations; (o) the amount of redemption requests made by SEDA’s

shareholders and the amount of funds remaining in SEDA’s trust account after satisfaction of such requests prior to the closing

of the Business Combination; (p) SEDA’s, Cunova’s, the Aerospace Business and the other parties to the definitive documentation

in connection with the Business Combination ability to satisfy the conditions to closing the Business Combination; and (q) the ability

to maintain listing of SEDA’s securities on the NYSE. The foregoing list of factors is not exhaustive. You should carefully consider

the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of SEDA’s forthcoming

registration statement on Form F-4, the proxy statement /prospectus contained therein, SEDA’s Annual Report on Form 10-K, SEDA’s

Quarterly Reports on Form 10-Q and other documents filed by the Target or SEDA from time to time with the U.S. Securities and Exchange

Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could

cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Target

and SEDA assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information,

future events, or otherwise. Neither the Target nor SEDA gives any assurance that either the Target or SEDA will achieve its expectations.

The inclusion of any statement in this communication does not constitute an admission by the Target or SEDA or any other person that

the events or circumstances described in such statement are material.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| * | Furnished herewith. |

| ** | Certain schedules and exhibits to this agreement have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. Copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request.

Certain personal information has been redacted from this exhibit pursuant to Item 601(a)(6) of Regulation S-K. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 20, 2024 |

SDCL

EDGE Acquisition Corporation |

| |

|

|

| |

By: |

/s/ Ned Davis |

| |

Name: |

Ned

Davis |

| |

Title: |

Chief

Financial Officer |

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

dated as of

February 20, 2024

by and among

SDCL EDGE ACQUISITION CORPORATION,

EDWARD WILSON DAVIS,

(in the capacity as the SEDA Representative)

SPECIALTY COPPER LISTCO PLC,

SEDA MAGNET LLC,

KME SE,

CUNOVA GMBH,

THE PARAGON FUND III GMBH & CO. GESCHLOSSENE INVESTMENT KG,

PP S&C HOLDING GMBH,

CREATURE KINGDOM LIMITED

and

MAGNET JOINT VENTURE GMBH

TABLE OF CONTENTS

| |

|

Page |

ARTICLE I

CERTAIN DEFINITIONS |

| |

|

|

|

|

| 1.01 |

|

Definitions |

|

3 |

| 1.02 |

|

Construction |

|

25 |

| 1.03 |

|

Knowledge |

|

26 |

| 1.04 |

|

Equitable Adjustments |

|

27 |

| |

|

|

|

|

ARTICLE II

THE MERGER; EXCHANGE |

| |

|

|

| 2.01 |

|

Merger |

|

27 |

| 2.02 |

|

PubCo Redemption and Purchase |

|

30 |

| 2.03 |

|

Exchange of PP Holding Shares |

|

30 |

| 2.04 |

|

Transfer of Aerospace Business and Exchange of JV GmbH Shares |

|

31 |

| 2.05 |

|

PubCo Share Capital Increase |

|

32 |

| 2.06 |

|

Redemption of the Cunova Preference Share and Transfer of KME AssetCo Preference Share |

|

32 |

| 2.07 |

|

Exchange Procedures |

|

32 |

| 2.08 |

|

Meeting of the JV GmbH Shareholders |

|

34 |

| 2.09 |

|

Meeting of the PP Holding Shareholders |

|

34 |

| 2.10 |

|

Meeting of the Cunova Shareholders |

|

35 |

| 2.11 |

|

Meeting of the KME AssetCo Shareholders |

|

35 |

| 2.12 |

|

Termination of Certain Agreements |

|

35 |

| 2.13 |

|

Withholding Rights |

|

36 |

| |

|

|

ARTICLE III

CLOSING |

| |

|

|

| 3.01 |

|

Closing |

|

36 |

| |

|

|

|

|

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF JV GMBH |

| |

|

|

| 4.01 |

|

Corporate Organization of JV GmbH |

|

37 |

| 4.02 |

|

Subsidiaries |

|

37 |

| 4.03 |

|

Due Authorization; Board Approval; Vote Required |

|

38 |

| 4.04 |

|

No Conflict |

|

38 |

| 4.05 |

|

Governmental Authorities; Consents |

|

39 |

| 4.06 |

|

Capitalization |

|

39 |

| 4.07 |

|

Financial Statements |

|

41 |

| 4.08 |

|

Undisclosed Liabilities |

|

41 |

| 4.09 |

|

Litigation and Proceedings |

|

42 |

| 4.10 |

|

Compliance with Laws |

|

42 |

| 4.11 |

|

Intellectual Property |

|

43 |

| 4.12 |

|

Data Protection, Cybersecurity and Information Technology |

|

44 |

| 4.13 |

|

Contracts; No Defaults |

|

46 |

| 4.14 |

|

Benefit Plans |

|

48 |

| 4.15 |

|

Labor Matters |

|

50 |

| 4.16 |

|

Tax Matters |

|

51 |

| 4.17 |

|

Brokers’ Fees |

|

53 |

| 4.18 |

|

Insurance |

|

53 |

| 4.19 |

|

Real Property; Assets |

|

54 |

| 4.20 |

|

Environmental Matters |

|

55 |

| 4.21 |

|

Absence of Changes |

|

56 |

| 4.22 |

|

Affiliate Agreements |

|

56 |

| 4.23 |

|

Internal Controls |

|

56 |

| 4.24 |

|

Certain Business Practices |

|

57 |

| 4.25 |

|

Sanctions; Anti-Corruption Laws |

|

58 |

| 4.26 |

|

Permits |

|

58 |

| 4.27 |

|

Customers and Suppliers; Inventory |

|

59 |

| 4.28 |

|

Proxy Statement/Prospectus |

|

59 |

| 4.29 |

|

No Additional Representations and Warranties |

|

60 |

| |

|

|

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF KME |

| |

|

|

| 5.01 |

|

Corporate Organization |

|

60 |

| 5.02 |

|

Due Authorization |

|

60 |

| 5.03 |

|

Ownership |

|

61 |

| 5.04 |

|

Sufficiency of Assets |

|

62 |

| 5.05 |

|

No Conflict |

|

62 |

| 5.06 |

|

Governmental Authorities; Consents |

|

62 |

| 5.07 |

|

Financial Statements |

|

62 |

| 5.08 |

|

Litigation and Proceedings |

|

63 |

| 5.09 |

|

Compliance with Laws |

|

63 |

| 5.10 |

|

Intellectual Property |

|

63 |

| 5.11 |

|

Data Protection and Cybersecurity |

|

64 |

| 5.12 |

|

Aerospace Business Assets; No Defaults |

|

65 |

| 5.13 |

|

Benefit Plans |

|

66 |

| 5.14 |

|

Labor Matters |

|

67 |

| 5.15 |

|

Brokers’ Fees |

|

68 |

| 5.16 |

|

Absence of Changes |

|

68 |

| 5.17 |

|

Affiliate Agreements |

|

68 |

| 5.18 |

|

Certain Business Practices |

|

69 |

| 5.19 |

|

Sanctions; Anti-Corruption Laws |

|

69 |

| 5.20 |

|

Permits |

|

70 |

| 5.21 |

|

Proxy Statement/Prospectus |

|

70 |

| 5.22 |

|

Independent Investigation |

|

70 |

| 5.23 |

|

No Additional Representations and Warranties |

|

70 |

| 5.24 |

|

Tax Matters |

|

70 |

| |

|

|

ARTICLE VI

REPRESENTATIONS AND WARRANTIES OF PARAGON |

| |

|

|

| 6.01 |

|

Corporate Organization of PP Holding |

|

71 |

| 6.02 |

|

Due Authorization; Shareholder Approval; Vote Required |

|

71 |

| 6.03 |

|

Ownership |

|

72 |

| 6.04 |

|

No Conflict |

|

73 |

| 6.05 |

|

Governmental Authorities; Consents |

|

73 |

| 6.06 |

|

Capitalization |

|

73 |

| 6.07 |

|

Financial Statements |

|

74 |

| 6.08 |

|

Undisclosed Liabilities |

|

74 |

| 6.09 |

|

Litigation and Proceedings |

|

74 |

| 6.10 |

|

Holding Company |

|

75 |

| 6.11 |

|

Compliance with Laws |

|

75 |

| 6.12 |

|

Absence of Changes |

|

75 |

| 6.13 |

|

Proxy Statement/Prospectus |

|

76 |

| 6.14 |

|

Independent Investigation |

|

76 |

| 6.15 |

|

Brokers’ Fees |

|

76 |

| 6.16 |

|

No Additional Representations and Warranties |

|

76 |

| 6.17 |

|

Tax Matters |

|

76 |

| |

|

|

ARTICLE VII

REPRESENTATIONS AND WARRANTIES OF SEDA |

| |

|

|

| 7.01 |

|

Corporate Organization |

|

79 |

| 7.02 |

|

Due Authorization |

|

79 |

| 7.03 |

|

No Conflict |

|

79 |

| 7.04 |

|

Litigation and Proceedings |

|

80 |

| 7.05 |

|

Governmental Authorities; Consents |

|

80 |

| 7.06 |

|

Financial Ability; Trust Account |

|

80 |

| 7.07 |

|

Brokers’ Fees |

|

81 |

| 7.08 |

|

SEC Reports; Financial Statements |

|

81 |

| 7.09 |

|

Business Activities; Absence of Changes |

|

82 |

| 7.10 |

|

Form F-4 and Proxy Statement/Prospectus |

|

83 |

| 7.11 |

|

Independent Investigation |

|

84 |

| 7.12 |

|

No Additional Representations and Warranties |

|

84 |

| 7.13 |

|

Tax Matters |

|

84 |

| 7.14 |

|

Capitalization |

|

86 |

| 7.15 |

|

NYSE Stock Market Quotation |

|

86 |

| |

|

|

ARTICLE VIII

REPRESENTATIONS AND WARRANTIES OF PUBCO AND MERGER SUB |

| |

|

|

| 8.01 |

|

Corporate Organization |

|

87 |

| 8.02 |

|

Due Authorization |

|

87 |

| 8.03 |

|

No Conflict |

|

88 |

| 8.04 |

|

Governmental Authorities; Consents |

|

88 |

| 8.05 |

|

Brokers’ Fees |

|

88 |

| 8.06 |

|

Business Activities; Absence of Changes |

|

89 |

| 8.07 |

|

Capitalization |

|

89 |

| 8.08 |

|

Investment Company Act |

|

90 |

| 8.09 |

|

Proxy Statement/Prospectus |

|

90 |

| 8.10 |

|

Independent Investigation |

|

90 |

| |

|

|

ARTICLE

IX

COVENANTS OF PP HOLDING, JV GMBH, KME, Pubco and merger sub |

| |

|

|

| 9.01 |

|

Conduct of PP Holding, KME and JV GmbH |

|

90 |

| 9.02 |

|

Conduct of PubCo and Merger Sub During the Interim Period |

|

94 |

| 9.03 |

|

Inspection |

|

95 |

| 9.04 |

|

No SEDA Transactions |

|

96 |

| 9.05 |

|

Use of Proceeds |

|

96 |

| 9.06 |

|

No Claim Against the Trust Account |

|

96 |

| 9.07 |

|

Proxy Solicitation; Other Actions |

|

97 |

| 9.08 |

|

Additional Funding |

|

98 |

| 9.09 |

|

Expense Side Letter |

|

98 |

| 9.10 |

|

PIPE Investment |

|

99 |

| 9.11 |

|

Directors’ Resignations |

|

99 |

| 9.12 |

|

Notifications, Waivers, Consents, Licenses and Trademarks |

|

99 |

| 9.13 |

|

Support Agreements |

|

99 |

| 9.14 |

|

PubCo Tax Residence |

|

99 |

| 9.15 |

|

Existing Facility |

|

99 |

| 9.16 |

|

Financing Cooperation |

|

99 |

| 9.17 |

|

Amendment and Replacement of Aerospace Business Contracts |

|

100 |

| 9.18 |

|

Notification and Consent of Counterparties to Aerospace Business Contracts |

|

100 |

| 9.19 |

|

Notification of Aerospace Business Employees |

|

101 |

| 9.20 |

|

Operations of Aerospace Business during Interim Period |

|

102 |

| 9.21 |

|

Retention of Key Employees |

|

103 |

| 9.22 |

|

Incentive Equity Plan |

|

103 |

| 9.23 |

|

Amendments to Organizational Documents |

|

103 |

| 9.24 |

|

Russia and China |

|

103 |

ARTICLE X

COVENANTS OF SEDA |

| |

|

|

| 10.01 |

|

Conduct of SEDA During the Interim Period |

|

104 |

| 10.02 |

|

SEDA Financing Efforts |

|

105 |

| |

|

|

ARTICLE XI

JOINT COVENANTS |

| |

|

|

| 11.01 |

|

Support of Transaction |

|

105 |

| 11.02 |

|

Regulatory Approvals |

|

106 |

| 11.03 |

|

Preparation of Form F-4 & Proxy Statement/Prospectus; SEDA Meeting |

|

108 |

| 11.04 |

|

Exclusivity |

|

110 |

| 11.05 |

|

Tax Matters |

|

111 |

| 11.06 |

|

Confidentiality; Publicity |

|

112 |

| 11.07 |

|

Indemnification and Insurance |

|

114 |

| 11.08 |

|

DTC Cooperation |

|

115 |

| 11.09 |

|

Post-Closing Cooperation; Further Assurances |

|

116 |

| 11.10 |

|

Delisting and Deregistration |

|

116 |

| 11.11 |

|

Registration Rights Agreement |

|

116 |

| 11.12 |

|

Interim Period Agreements |

|

116 |

| 11.13 |

|

Subscription Agreements |

|

116 |

| 11.14 |

|

Trust Account and Other Closing Payments |

|

117 |

| 11.15 |

|

Post-Closing Board of Directors |

|

117 |

| 11.16 |

|

Stock Exchange Listing |

|

117 |

| 11.17 |

|

Assignment and Assumption of Warrant Agreement |

|

117 |

| 11.18 |

|

Requisite SEDA Warrantholder Approval |

|

118 |

| |

|

|

ARTICLE XII

CONDITIONS TO OBLIGATIONS |

| |

|

|

| 12.01 |

|

Conditions to Obligations of All Parties |

|

118 |

| 12.02 |

|

Conditions to Obligations of SEDA |

|

118 |

| 12.03 |

|

Conditions to the Obligations of JV GmbH, PP Holding and the Shareholders |

|

120 |

| 12.04 |

|

Frustration of Closing Conditions |

|

122 |

| |

|

|

ARTICLE XIII

TERMINATION/EFFECTIVENESS |

| |

|

|

| 13.01 |

|

Termination |

|

122 |

| 13.02 |

|

Automatic Termination |

|

123 |

| 13.03 |

|

Effect of Termination |

|

123 |

ARTICLE XIV

MISCELLANEOUS |

| |

|

|

| 14.01 |

|

Waiver |

|

123 |

| 14.02 |

|

Notices |

|

123 |

| 14.03 |

|

Assignment |

|

126 |

| 14.04 |

|

Rights of Third Parties |

|

126 |

| 14.05 |

|

No Fiduciary Duty |

|

126 |

| 14.06 |

|

Investment Banking Services |

|

126 |

| 14.07 |

|

Expenses |

|

126 |

| 14.08 |

|

Governing Law |

|

127 |

| 14.09 |

|

Headings; Counterparts |

|

127 |

| 14.10 |

|

Schedules and Exhibits |

|

127 |

| 14.11 |

|

Entire Agreement |

|

127 |

| 14.12 |

|

Amendments |

|

127 |

| 14.13 |

|

Severability |

|

128 |

| 14.14 |

|

Jurisdiction; WAIVER OF TRIAL BY JURY |

|

128 |

| 14.15 |

|

Enforcement |

|

128 |

| 14.16 |

|

Non-Recourse |

|

129 |

| 14.17 |

|

Nonsurvival of Representations, Warranties and Covenants |

|

129 |

| 14.18 |

|

SEDA Representative |

|

130 |

| EXHIBITS |

|

|

| |

|

|

| Exhibit A |

– |

Sponsor Support Agreement |

|

|

| Exhibit B |

– |

Registration Rights Agreement Term Sheet |

|

|

| Exhibit C |

– |

Aerospace Business Transfer Agreement |

|

|

| Exhibit D |

– |

Form of Paragon Vendor Loan |

|

|

| Exhibit E |

– |

Incentive Equity Plan Term Sheet |

|

|

| Exhibit F |

– |

Lock-Up Agreement |

|

|

| Exhibit G |

– |

APA Vendor Loan |

|

|

| Exhibit H |

– |

U.S. Sales Agency Agreement |

|

|

BUSINESS COMBINATION AGREEMENT

This Business Combination Agreement (this “Agreement”), dated as of February 20, 2024, is entered into by and among (i) SDCL EDGE Acquisition Corporation, a Cayman Islands exempted company (together with its successors, “SEDA”), (ii) Mr. Edward Wilson Davis, solely in the capacity as the representative for the shareholders of SEDA, in accordance with the terms and conditions of this Agreement (the “SEDA Representative”), (iii) Specialty Copper Listco Plc, a public limited company registered in England and Wales with registered number 15395590 (“PubCo”), (iv) SEDA Magnet LLC, a Delaware limited liability company (“Merger Sub”), (v) MAGNET Joint Venture GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 217397 (“JV GmbH”), (vi) PP S&C Holding GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRB 275474 (“PP Holding”), (vii) cunova GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 216155 (“Cunova”), (viii) KME SE, a stock corporation organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 213357 (“KME”), (ix) Creature Kingdom Limited, a private limited company registered in England and Wales with registered number 06799429 (“Creature Kingdom”), and (x) The Paragon Fund III GmbH & Co. geschlossene Investment KG, a limited partnership organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRA 110100 (“Paragon” and together with KME, the “Shareholders”). Except as otherwise indicated, capitalized terms used but not defined herein shall have the meanings set forth in Article I of this Agreement.

RECITALS

WHEREAS, SEDA is a special purpose acquisition company incorporated to acquire one or more operating businesses through a Business Combination;

WHEREAS, SEDA obtained from its shareholders on October 30, 2023 an extension of the deadline by which SEDA must complete its Business Combination, by four months, from November 2, 2023 to March 2, 2024, with the option for the SEDA Board to implement up to four additional one-month extensions (the “Extension”);

WHEREAS, PubCo is a newly formed public limited company, wholly-owned by Creature Kingdom as of the date hereof, and was formed for the purpose of making acquisitions and investments, with the objective of acting as the publicly traded holding company for its investee entities;

WHEREAS, Merger Sub is a newly formed Delaware limited liability company, wholly owned by PubCo, and was formed for the purpose of effectuating investments including by way of merger with other investment entities;

WHEREAS, the parties hereto desire and intend to effect a business combination transaction whereby on the Merger Date (a) SEDA will merge with and into Merger Sub, with Merger Sub being the surviving entity (the “Merger”) in exchange for, among other things, shares in PubCo being issued to the shareholders of SEDA (excluding the holders of any Dissenting SEDA Shares); and (b) on the day following the Merger Date, to the extent legally permitted, PubCo will (i) redeem the redeemable preference share in PubCo held by Creature Kingdom; and (ii) purchase from Creature Kingdom the ordinary share in PubCo held by Creature Kingdom, in each case as further set out in this Agreement, and PubCo will thereafter cancel such shares;

WHEREAS, after the execution and delivery of this Agreement, in connection with the Transactions, PubCo and SEDA may enter into certain subscription agreements with certain third-party investors (the “PIPE Investors”) (the “PIPE Investment”), pursuant to which any such PIPE Investors may commit, on the terms and subject to the conditions of such subscription agreements, to subscribe for and purchase a number of PubCo Shares for consideration as provided in such subscription agreements on the date of and immediately prior to the Exchange (as defined below);

WHEREAS, (a) the ordinary shares in Cunova are wholly owned by JV GmbH, and the Cunova Preference Share is wholly owned by KME Special; (b) the JV GmbH Ordinary Shares are owned by PP Holding and KME Special; (c) the JV GmbH Preference Share is owned by PP Holding; and (d) PP Holding is wholly owned by Paragon;

WHEREAS, on the Exchange Date (as defined below), and immediately after the closing of any PIPE Investment, (a) Paragon will transfer, and PubCo will acquire, the Paragon Exchanged Shares and the Paragon PP Holding SHL (as defined below) as consideration and in exchange for the Paragon Cash Consideration and the Paragon Vendor Loan (as defined below); (b) Cunova will redeem the Cunova Preference Share in consideration for the transfer of the KME AssetCo Preference Share by Cunova to KME Special; (c) KME will cause (i) KME Germany, KME Mansfeld and KME America to transfer to Cunova, and Cunova shall accept the transfer of, the Aerospace Business Assets pursuant to the Aerospace Business Transfer Agreement (the “Aerospace Business Transfer”), as consideration and in exchange for the issuance of a promissory note substantially the form of Exhibit G attached hereto (the “APA Vendor Loan”) by Cunova to KME Germany, KME Mansfeld and KME America; (ii) KME Germany, KME Mansfeld and KME America to transfer the APA Vendor Loan to KME Special; (iii) KME Special will contribute the APA Vendor Loan to PubCo in exchange for the issuance of PubCo Shares by PubCo to KME Special; (d) Cunova will assume PubCo’s liability under the Paragon Vendor Loan in partial satisfaction of its obligations under the APA Vendor Loan; and (e) KME will cause KME Special to contribute all right, title and interest in and attaching to its shares of JV GmbH Ordinary Shares and the KME JV GmbH SHL (as defined below) to PubCo in exchange for the PubCo Exchanged Shares and the KME Cash Consideration (the foregoing clauses (a)-(e), “Exchange”);

WHEREAS, the respective boards of directors of each of SEDA, PubCo, Merger Sub, PP Holding, JV GmbH, KME and Paragon have each approved and declared advisable and in the best interests of such entity the Transactions upon the terms and subject to the conditions of this Agreement and in accordance with applicable Law (as defined below);

WHEREAS, contemporaneously with the execution and delivery of this Agreement, SEDA, the officers and directors of SEDA and certain other SEDA Affiliates who are SEDA Shareholders are entering into a sponsor support agreement, in substantially the form of Exhibit A attached hereto (the “Sponsor Support Agreement”), pursuant to which Sponsor has agreed to, among other things, vote in favor of the Transactions put to the SEDA Shareholders for approval, prior to the Merger Effective Time, and exchange its SEDA Class B Shares for SEDA Class A Shares on the terms and subject to the conditions set forth in the Sponsor Support Agreement (the “Sponsor Recapitalization”);

WHEREAS, concurrently with the Closing, in connection with the Transactions, (i) SEDA, PubCo, KME Special and certain persons who will be shareholders of PubCo upon Closing shall enter into a registration rights agreement, dated as of the Closing Date, on the terms substantially as the ones attached hereto under Exhibit B (the “Registration Rights Agreement Term Sheet”) and (ii) Sponsor, PubCo, KME Special and certain persons who will be shareholders of PubCo upon Closing shall enter into a lock-up agreement, dated as of the Closing Date, on the terms substantially as the ones attached hereto under Exhibit F (the “Lock-Up Agreement”);

WHEREAS, the parties hereto intend that, for U.S. federal income tax purposes, the Merger will qualify as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code and the U.S. Treasury Regulations promulgated thereunder (the “Intended Tax Treatment”), as further described in Section 11.05(e); and

WHEREAS, the parties hereto intend that, for the purposes of UK taxation on chargeable gains, the disposal of SEDA Shares by UK resident SEDA Shareholders on the Merger shall be treated as a reorganization pursuant to and for the purposes of sections 136 and 127 to 131 Taxation of Chargeable Gains Act 1992.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound hereby, the parties hereto agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

1.01 Definitions. As used herein, the following terms shall have the following meanings:

“A&R LLCA of Merger Sub” has the meaning specified in Section 2.01(c).

“Acquisition Transaction” has the meaning specified in Section 11.04(a).

“Action” means any claim, action, suit, assessment, arbitration, proceeding or investigation, in each case, that is by or before any Governmental Authority or arbitrator.

“Additional Funding” has the meaning specified in Section 9.08(a).

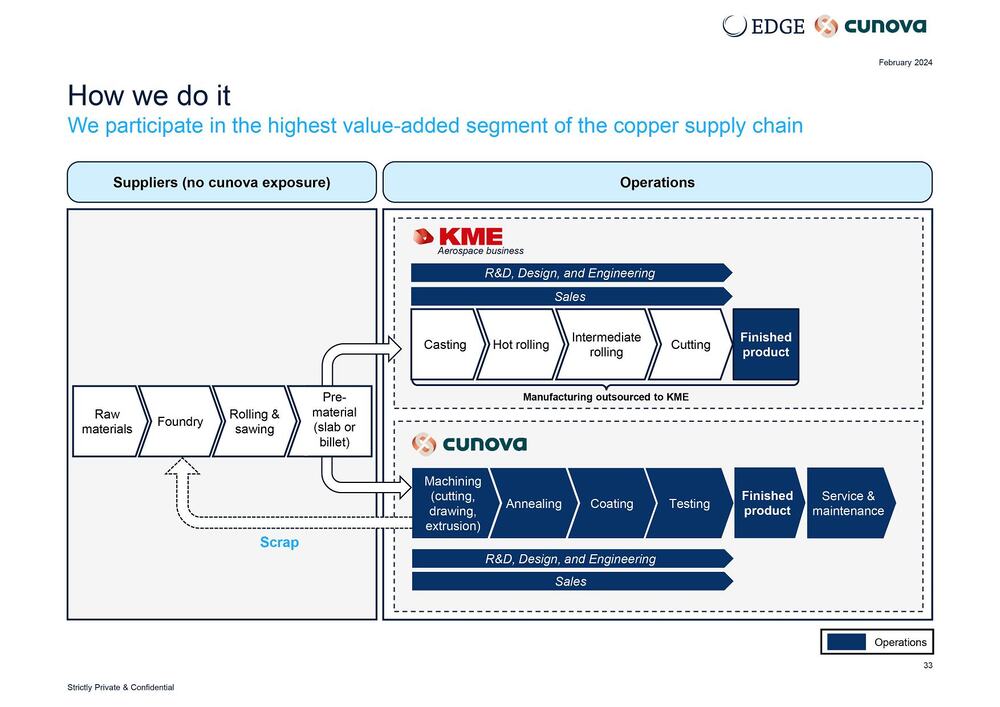

“Aerospace Business” means the engineering and designing of highly specialized components for aerospace rocket engines designed for critical applications business operated by KME Germany, KME Mansfeld and KME America.

“Aerospace Business Assets” has the meaning specified in Section 5.03(b).

“Aerospace Business Benefit Plan” has the meaning specified in Section 5.13(a).

“Aerospace Business Contract” means each and all of the contracts relating to the Aerospace Business forming part of the Aerospace Business Assets being transferred pursuant to the Aerospace Business Transfer and listed in Schedule 5.03(b) of the KME Disclosure Schedules.

“Aerospace Business Employee” means any person employed by KME Germany who is wholly or mainly assigned to work in the Aerospace Business and listed in Schedule 5.03(b) of the KME Disclosure Schedules.

“Aerospace Business Know-How” means all Know-How exclusively or primarily relating to the Aerospace Business that is used or held by KME or its Subsidiaries.

“Aerospace Business Pro Forma Management Accounts” has the meaning specified in Section 5.07(a).

“Aerospace Business Transfer” has the meaning specified in the recitals.

“Aerospace Business Transfer Agreement” means the Aerospace Business Transfer Agreement to be entered into on the Exchange Date between Cunova (as purchaser) and KME Germany, KME Mansfeld and KME America (as sellers) substantially in the form attached hereto as Exhibit C, including all schedules and exhibits thereto.

“Aerospace Business Transfer Information Letter” has the meaning specified in Section 9.19(a)(i).

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by or is under common control with such specified Person, through one or more intermediaries or otherwise. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning specified in the preamble.

“Anti-Corruption

Laws” means any applicable Laws relating to anti-bribery or anti-corruption (governmental or commercial), including the

U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act 2010, and the corresponding laws and regulations applicable to the

Aerospace Business or in the jurisdictions in which the JV GmbH, any of its Subsidiaries, or any of their respective employees, agents, representatives, sales intermediaries or other third parties acting on their behalf operate.

“Antitrust Laws” means any applicable antitrust Laws and all other applicable Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through merger or acquisition.

“APA Vendor Loan” has the meaning specified in the recitals.

“Approved Stock Exchange” means the NYSE or such other national securities exchange that may be agreed upon in writing by SEDA and the Shareholders.

“Assignment and Assumption Agreement” has the meaning specified in Section 11.17.

“Available Cash” means (i) the aggregate amount of cash available in the Trust Account as of the Closing Date after taking into account all shareholder redemptions, plus (ii) any proceeds from any Financing which are permitted to be paid out as cash consideration due at Closing; provided, that, for the avoidance of doubt, Available Cash shall not take into account any Additional Funding.

“Benefit Plan” means any plan, program, policy, or arrangement that is (a) a welfare plan within the meaning of Section 3(1) of ERISA (whether or not subject to ERISA), (b) a pension benefit plan within the meaning of Section 3(2) of ERISA (whether or not subject to ERISA), (c) a security bonus, security purchase, security option, restricted security, security appreciation right or similar equity-based plan or (d) any other deferred compensation, compensation, incentive compensation, performance award, phantom equity, equity purchase or other equity-based compensation plan, employment or consulting, severance, retirement, death, disability or termination pay, holiday, vacation or other bonus plan or practice, hospitalization or other medical, life or other insurance, fringe benefit, supplemental unemployment benefits, profit sharing, pension, gratuity or retirement plan, reimbursement, employee loan, provident fund, program, agreement, commitment or arrangement, and each other employee benefit plan, program, agreement or arrangement, maintained or contributed to or required to be contributed to by a Person for the benefit of any employee or terminated employee of such Person, or with respect to which such Person has any liability, whether direct or indirect, actual or contingent, whether formal or informal, and whether legally binding or not.

“Business Combination” has the meaning ascribed to such term in SEDA’s Organizational Documents.

“Business Combination Proposal” has the meaning specified in Section 11.04(b).

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in London (United Kingdom), New York (New York), Cayman Islands, Frankfurt (Germany) and Milan (Italy) are authorized or required by Law to close.

“Business IPR” means the Intellectual Property (i) owned by JV GmbH or any of its Subsidiaries and (ii) used by, or held for, the purposes of JV GmbH or any of its Subsidiaries’ businesses.

“CA 2006” means the U.K.’s Companies Act 2006, as amended.

“Capricorn” means Sustainable Investors Fund, LP, a Delaware limited partnership.

“Capricorn Extension Funding Promissory Note” means the funding undertaking and promissory note dated November 2, 2023, entered into by and between SEDA (as maker) and Capricorn (as payee).

“Capricorn Working Capital Promissory Note” means the promissory note dated October 10, 2023, entered into by and between SEDA (as maker) and Capricorn (as payee).

“Carve-Out JVs” means the Russia JV and the China JVs collectively, and each of them a “Carve-Out JV”.

“Cayman Companies Act” means the Companies Act (As Revised), as amended, of the Cayman Islands.

“CFIUS” means the Committee on Foreign Investment in the United States and each member agency thereof, acting in such capacity.

“CFIUS Approval” means (i) the receipt by the CFIUS Filing Parties of written notification (including by email) from CFIUS that (A) CFIUS has determined that the transactions contemplated by this Agreement do not constitute a “covered transaction” under the DPA; or (B) CFIUS has concluded its review (or, if applicable, investigation) under the DPA in response to the CFIUS Notice and CFIUS determined that there are no unresolved national security concerns with respect to the transactions contemplated by this Agreement, and advised that all action under the DPA has concluded with respect to the transactions contemplated by this Agreement; or (ii) CFIUS has sent a report to the President of the United States (the “President”) requesting the President’s decision and (A) the President has announced a decision not to take any action to suspend or prohibit the transactions contemplated by this Agreement or (B) the period under the DPA during which the President may announce a decision to take action on the transactions contemplated by this Agreement shall have expired without the President having taken or announced such a decision.

“CFIUS Denial” means that CFIUS has notified the parties to the CFIUS Notice that it (i) intends to recommend to the President that the transactions contemplated by this Agreement be prohibited and (ii) has been unable to identify conditions mitigating the risk of the transactions contemplated by this Agreement sufficient to alter its recommendation.

“CFIUS Filing Parties” means the parties that submit the CFIUS Notice.

“CFIUS Notice” means a joint voluntary notice prepared by the CFIUS Filing Parties with respect to the Transactions and submitted to CFIUS pursuant to 31 C.F.R. Part 800 Subpart E.

“Change in Recommendation” has the meaning specified in Section 11.03(d).

“China JV 1” means Dalian ETDZ Dashan Surface Machinery Co., Ltd.

“China JV 2” means Dalian Dashan Heavy Industry Machinery Co., Ltd.

“China JV 3” means Dalian Dashan Crystallizer Co., Ltd.

“China JVs” means, collectively, China JV 1, China JV 2 and China JV 3.

“Closing” has the meaning specified in Section 3.01.

“Closing Date” has the meaning specified in Section 3.01.

“Code” means the Internal Revenue Code of 1986, as amended, and any successor thereto, as amended.

“Communications Plan” has the meaning specified in Section 11.06(b).

“Confidential Information” means all confidential or proprietary documents and information concerning any party hereto or any of its Affiliates or Representatives; provided, however, that Confidential Information shall not include any information which, (i) at the time of disclosure by any other party hereto or any of their respective Representatives, is generally available publicly and was not disclosed in breach of this Agreement, (ii) at the time of the disclosure by the party to which the information relates or its Representatives to any other party hereto or any of their respective Representatives, was previously known by such receiving party without violation of Law or any confidentiality obligation by the Person receiving or disclosing such Confidential Information or (iii) is independently developed by a party or its Affiliates or Representatives without reference to the Confidential Information.

“Confidentiality Agreement” means, in each case, as amended from time to time, (i) the confidentiality agreement dated March 27, 2023, by and between SEDA and KME Group S.p.A. and (ii) the confidentiality agreement dated April 13, 2023, by and between SEDA and Paragon Partners GmbH.

“Consent” means any consent, approval, notice of no objection, expiration of applicable waiting period, waiver, authorization or Permit of, or notice to or declaration or filing with any Governmental Authority or any other Person.

“Contracts” means any legally binding contracts, agreements, subcontracts, leases and purchase orders.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester or similar Law, or directive, by any Governmental Authority in connection with or in response to the 2019 novel coronavirus, including any new strains or variants thereto or any other coronavirus or respiratory illness.

“Creature Kingdom” has the meaning specified in the preamble.

“Cunova” has the meaning specified in the preamble.

“Cunova Preference Share” means the preference share with the number 25,001 of Cunova.

“Cunova Shareholders” means JV GmbH and KME Special.

“Data Protection Laws” means all applicable Laws in any jurisdiction relating to privacy or the processing or protection of personal data, including (without limitation) the General Data Protection Regulation (2016/679) (the “GDPR”) and any national law supplementing the GDPR.

“DDTC” means the U.S. Department of State, Directorate of Defense Trade Controls.

“Debt Financing” means any debt financing obtained on or prior to the Closing Date in connection with the Transaction other than the Debt Refinancing and the Paragon Vendor Loan.

“Debt Refinancing” means the refinancing of the Existing Financing for an amount equal to the amount outstanding under the Existing Financing (after deducting any applicable fees) or the obtaining of all necessary waivers, consents, amendments, confirmations and/or approvals for the continuation of the Existing Financing following Closing, in each case with changes to permit the incurrence of indebtedness under, and (p)repayment of, the Paragon Vendor Loan.

“Disclosed Instruments” has the meaning specified in Section 9.24.

“Dissenting SEDA Shareholders” has the meaning specified in Section 2.01(g)(i).

“Dissenting SEDA Shares” has the meaning specified in Section 2.01(g)(i).

“Domain Names” means the domain names used by JV GmbH or any of its Subsidiaries.

“DPA” means the Defense Production Act of 1950, as amended (50 U.S.C.§ 4565), and all implementing regulations thereof.

“DTC” means the Depository Trust Company.

“Employment Laws” has the meaning specified in Section 4.15(b).

“Enforceability Exceptions” has the meaning specified in Section 4.03(a).