Satyam Announces Commencement of Process to Select an Investor

March 09 2009 - 8:08AM

PR Newswire (US)

HYDERABAD, India, March 9 /PRNewswire-FirstCall/ -- Satyam Computer

Services Ltd. (NYSE:SAY)(BSE:SATYAM)(NSE:SATYAMCOMP) (the

"Company") announced today that it is commencing a competitive

bidding process which, subject to receipt of all approvals,

contemplates the selection of an investor to acquire a 51 percent

equity interest in the Company. Based on the Securities and

Exchange Board of India's ("SEBI") response to the Company's

application seeking relaxations from certain requirements under

Indian law, the Board proposes to follow the bidding process

outlined below. Transaction Structure: The acquisition is expected

to occur in the following related steps: -- An initial subscription

by the selected investor of newly issued equity shares representing

31 percent of the Company's share capital after giving effect to

the share issuance ("enhanced share capital"); 1 Upon deposit of

the entire subscription amount by the selected investor with the

Company and requisite funds for the public offer in the escrow

account as required under the SEBI Takeover Regulations, the

investor will be required to make a mandatory public offer to

purchase a minimum of 20 percent of the Company's enhanced share

capital. The public offer will be made at the same share price as

the price paid by the investor for the initial subscription; and 2

If upon the closing of the public offer, the investor would have

acquired less than 51 percent of the enhanced share capital of the

Company through the initial subscription and the public offer, the

investor would have the option to subscribe to additional newly

issued equity shares, such that the shares acquired by the investor

through the three related steps, the initial subscription, public

offer and the subsequent subscription (if any) will result in the

investor acquiring not more than 51 percent of the enhanced share

capital of the Company. Ability to subscribe to additional equity

shares in the third related step would be subject to the terms and

conditions specified in the request-for-proposal ("RFP"). The

subsequent subscription, if any, will be required to be completed

within 15 days of the closing of the public offer and will not

result in requiring a further public offer. Process for

Registration of Interest: -- Commencing today, all interested

bidders should register their interest in participating in the

bidding process by accessing

http://www.satyam.com/bidprocess/march09/index.asp and registering

their interest by 5:00 p.m. Indian Standard Time on Thursday, March

12, 2009, subject to their meeting the registration requirements

set forth on such website. Interested bidders may see

http://www.satyam.com/bidprocess/march09/index.asp for more

details. -- The process for selecting a bidder shall be overseen by

a former Chief Justice of India or a former Supreme Court judge

appointed by the Company. Bid Process: -- Each interested bidder

that has validly registered its interest in participating in the

bid process by 5:00 p.m. Indian Standard Time on Thursday, March

12, 2009, will be sent an RFP shortly thereafter, and asked to

submit a detailed Expression of Interest ("EOI") together with the

proof of availability of funds in the amount of at least Rs. 1,500

crores (US$290 million based on exchange rate of Rs. 51.635 to

US$1) by 5:00 p.m. Indian Standard Time on Friday, March 20, 2009.

-- Based on submitted EOIs, eligible bidders will be short-listed

and given access to certain business, financial and legal diligence

materials relating to the Company provided they have executed a

non-disclosure and non-solicitation agreement, a stand-still

agreement and a "no-claims" undertaking. After completion of the

due diligence process and execution of the pre-financial bid

documents, all short-listed bidders will be asked to submit their

financial bids and an executed copy of the share subscription

agreement. -- Based on an evaluation of the bids, the Company will

select the successful bidder, after which the successful bidder

will have four days to deposit with the Company the entire

subscription amount, and the requisite funds for the public offer

in an escrow account. -- As a result of a relaxation from SEBI,

there is no requirement to have a minimum floor price that is

otherwise required under Indian law in connection with the initial

subscription. -- Upon selection of the successful bidder, the

Company will be required to approach the Company Law Board and SEBI

for approval and, upon receipt thereof, the successful bidder would

be allowed to consummate the subscription. Further details of the

bidding process and other terms and conditions would be set forth

in the RFP. This press release is not an offer of securities for

sale in the United States. Securities may not be offered or sold in

the United States absent registration or an exemption from

registration under the U.S. Securities Act of 1933, as amended. Any

public offering of securities to be made in the United States will

be made by means of a prospectus that may be obtained from the

Company and that will contain detailed information about the

Company and its management, as well as financial statements. The

Company does not intend to register any securities in the United

States or to conduct a public offering of securities in the United

States. As previously disclosed, the Company Law Board Principal

Bench New Delhi authorized the Company's Board of Directors to

select an investor, subject to certain conditions. The commencement

of the bidding process by the Company is not an assurance that any

qualified investor will bid to acquire any interest in the Company

at an appropriate price or at all. This press release contains

forward-looking statements within the meaning of section 27A of

Securities Act of 1933, as amended, and section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements contained herein, including statements regarding the

global competitive bidding process, are subject to various risks

and uncertainties and there can be no assurance that the Company

will be able to find a qualified investor. About Satyam Satyam

(NYSE:SAY), a leading global business and information technology

services company, delivers consulting, systems integration, and

outsourcing solutions to clients in numerous industries across the

globe. Satyam leverages deep industry and functional expertise,

leading technology practices, and an advanced, global delivery

model to help clients transform their highest-value business

processes and improve their business performance. The company's

professionals excel in engineering and product development, supply

chain management, client relationship management, business process

quality, business intelligence, enterprise integration, and

infrastructure management, among other key capabilities. Satyam

development and delivery centers in the US, Canada, Brazil, the UK,

Hungary, Egypt, UAE, India, China, Malaysia, Singapore, and

Australia serve numerous clients, including many Fortune 500

organizations. For more information, visit: http://www.satyam.com/.

Satyam Contacts: For clarifications, write to us at Or contact our

global Satyam PR representatives at: US Jim Swords +1-703-877-2225

Europe Sandeep Thawani +44-783-010-3838 Asia-Pacific Dan Bleakman

+61-439-408-484 Reshma Wad Jan +65-98-140-507 DATASOURCE: Satyam

Computer Services Ltd. CONTACT: US: Jim Swords, +1-703-877-2225, ;

or Europe: Sandeep Thawani, +44-783-010-3838, ; or Asia-Pacific:

Dan Bleakman, +61-439-408-484, , or Reshma Wad Jan, +65-98-140-507,

, all of Satyam Computer Services Ltd. Web Site:

http://www.satyam.com/

Copyright

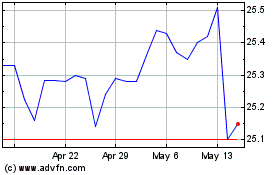

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

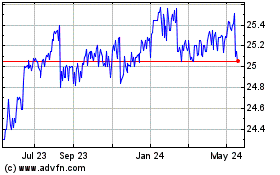

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Jul 2023 to Jul 2024