Several RiverNorth closed-end funds (the “Funds”) have announced

the declaration of monthly distributions for October, November and

December 2021 in accordance with each Fund’s level distribution

policy, as detailed below.

Ex Date

Record Date

Payable Date

October 14, 2021

October 15, 2021

October 29, 2021

November 10, 2021

November 12, 2021

November 30, 2021

December 15, 2021

December 16, 2021

December 31, 2021

Tax-Exempt Distributions1

Fund Name

Ticker

Distribution Per Share

Change From Prior

Distribution

Net Asset Value (NAV) as of

9/30/2021

Annualized Current

Distribution Rate at NAV

Market Price as of

9/30/2021

Annualized Current

Distribution Rate at Market

RiverNorth Opportunistic Municipal

Income Fund, Inc.1,2

RMI

$0.0917

‒

$23.74

4.64%

$23.12

4.76%

RiverNorth Managed Duration Municipal

Income Fund, Inc.1,3

RMM

$0.0917

‒

$20.07

5.48%

$19.85

5.54%

RiverNorth Flexible Municipal Income

Fund, Inc.1,4

RFM

$0.1042

‒

$24.10

5.19%

$23.41

5.34%

RiverNorth Flexible Municipal Income

Fund II, Inc.1,5

RFMZ

$0.1000

‒

$20.11

5.97%

$20.26

5.92%

Taxable Distributions

Fund Name

Ticker

Distribution Per Share

Change From Prior

Distribution

Net Asset Value (NAV) as of

9/30/2021

Annualized Current

Distribution Rate at NAV

Market Price as of

9/30/2021

Annualized Current

Distribution Rate at Market

RiverNorth/DoubleLine Strategic

Opportunity Fund, Inc.6

OPP

$0.1586

‒

$14.81

12.85%

$14.57

13.06%

RiverNorth Specialty Finance

Corporation7

RSF

$0.1523

‒

$20.09

9.10%

$19.20

9.52%

RMI, RMM, RFM, RFMZ, OPP, and RSF are closed-end funds.

1

Monthly distributions from RMI,

RMM, RFM and RFMZ are expected to be generally exempt from regular

U.S. federal income taxes, however, portions of these Funds’

distributions may (i) be subject to U.S. federal income tax, (ii)

be includable in taxable income for purposes of the federal

alternative minimum tax, or (iii) constitute a return of capital.

Such distributions will also generally be subject to state and

local taxes. RiverNorth does not provide tax advice; consult a

professional tax advisor regarding your specific tax situation.

2

In accordance with its level

distribution policy, RMI’s annual distribution rate has been set

equal to 5.50% of the Fund’s initial public offering price of

$20.00 per share.

3

In accordance with its level

distribution policy, RMM’s annual distribution rate has been set

equal to 5.50% of the Fund’s initial public offering price of

$20.00 per share.

4

In accordance with its level

distribution policy, RFM’s annual distribution rate has been set

equal to 6.25% of the Fund’s initial public offering price of

$20.00 per share.

5

In accordance with its level

distribution policy, RFMZ’s annual distribution rate has been set

equal to 6.00% of the Fund’s initial public offering price of

$20.00 per share.

6

In accordance with its level

distribution policy, OPP’s annual distribution rate has been set to

12.50% of the average of the Fund’s NAV per common share reported

the final five trading days of the preceding calendar year.

7

In accordance with its level

distribution policy, RSF’s annual distribution rate has been set to

10.00% of the average of the Fund’s NAV per common share reported

the final five trading days of the preceding calendar year.

With each distribution that does not consist solely of net

investment income, the respective Fund will issue a notice to

shareholders and an accompanying press release that will provide

detailed information regarding the amount and composition of the

distribution and other related information. The amounts and sources

of distributions reported in the notice to shareholders are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon the Fund’s investment experience during

its full fiscal year and may be subject to changes based on tax

regulations. Each Fund will send shareholders a Form 1099-DIV for

the calendar year that will tell them how to report these

distributions for federal income tax purposes.

Each Fund may at times distribute more than its net investment

income and net realized capital gains; therefore, a portion of the

distribution may result in a return of capital. A return of capital

occurs when some or all of the money that shareholders invested in

the Fund is paid back to them. A return of capital does not

necessarily reflect the Fund’s investment performance and should

not be confused with ‘yield’ or ‘income.’ Any such returns of

capital will decrease the Fund’s total assets and, therefore, could

have the effect of increasing the Fund’s expense ratio. In

addition, in order to make the level of distributions called for

under its plan, the Fund may have to sell its portfolio securities

at a less than opportune time.

About RiverNorth

RiverNorth Capital Management, LLC is an investment management

firm founded in 2000. With $5.5 billion8 in assets under management

as of August 31, 2021, RiverNorth specializes in opportunistic

investment strategies in niche markets where the potential to

exploit inefficiencies is greatest. RiverNorth is an institutional

investment manager to registered funds, private funds and

separately managed accounts.

8

Firm AUM reflects Managed Assets

which includes the effects of leverage and investments in

affiliated funds.

An investment in the Funds involves risk, including loss of

principal.

Chris Lakumb is a registered representative of ALPS

Distributors, Inc. RiverNorth Capital Management, LLC is not

affiliated with DoubleLine Capital LP, or ALPS Distributors,

Inc.

Investors should consider a Fund's investment objective,

risks, charges and expenses carefully before investing. Each Fund’s

prospectus and most recent periodic reports contain this and other

important information about the respective Fund and may be obtained

by visiting rivernorth.com/literature or by calling your financial

professional or RiverNorth at 844.569.4750.

Not FDIC Insured | May Lose Value | No Bank Guarantee ALPS

Distributors, Inc. is the FINRA Member Firm. RiverNorth® is a

registered trademark of RiverNorth Capital Management, LLC.

DoubleLine® is a registered trademark of DoubleLine Capital LP.

©2000-2021 RiverNorth Capital Management, LLC. All rights reserved.

RMI000214

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211001005700/en/

Investor Contact Chris Lakumb, CFA, CAIA 312.445.2336

clakumb@rivernorth.com

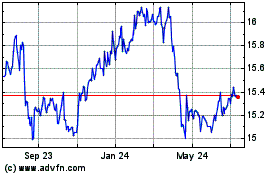

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Oct 2024 to Nov 2024

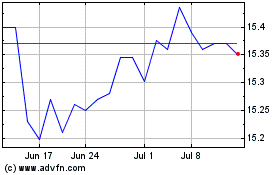

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Nov 2023 to Nov 2024