UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

|

[X]

|

Preliminary Proxy Statement.

|

|

|

[ ]

|

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

|

|

|

[ ]

|

Definitive Proxy Statement.

|

|

|

[ ]

|

Definitive Additional Materials.

|

|

|

[ ]

|

Soliciting Material Pursuant to § 240.14a-12.

|

RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND,

INC.

RiverNorth

Specialty Finance Corporation

RiverNorth

Opportunistic Municipal Income Fund, Inc.

Rivernorth

managed duration municipal income fund, inc.

Rivernorth

Flexible municipal income fund, inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

[X]

|

No fee required.

|

|

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

[ ]

|

Fee paid previously with preliminary materials:

|

|

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND,

INC.

RIVERNORTH SPECIALTY FINANCE CORPORATION

RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME FUND,

INC.

RIVERNORTH MANAGED DURATION MUNICIPAL INCOME FUND,

INC.

RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND, INC.

444 W Lake Street

Suite 1700

Chicago, Illinois 60606

NOTICE OF Annual

MEETING OF stockholders

To be held August [27], 2021

RiverNorth/DoubleLine Strategic Opportunity Fund,

Inc. (“OPP”), RiverNorth Specialty Finance Corporation (“RSF”), RiverNorth Opportunistic Municipal Income Fund,

Inc. (“RMI”), RiverNorth Managed Duration Municipal Income Fund, Inc. (“RMM”), RiverNorth Flexible Municipal Income

Fund, Inc. (“RFM” and, together with OPP, RSF, RMI and RMM, the “Funds”) each a Maryland corporation, will host

a combined Annual Meeting of Stockholders on August [27], 2021 at the offices of RiverNorth Capital Management, LLC, 444 W Lake Street,

Suite 1700, Chicago, Illinois 60606, at [10:00 a.m. Central Time] (the “Annual Meeting” or “Meeting”). The Annual

Meeting is being held so that stockholders can consider the following proposals:

|

|

1.

|

To elect Directors to the Board of Directors (each a “Board”) of each Fund as outlined below:

|

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

|

|

c.

|

For RMI, to elect two (2) Class I Directors.

|

|

|

d.

|

For RMM, to elect two (2) Class I Directors.

|

|

|

e.

|

For RFM, to elect two (2) Class I Directors.

|

|

|

2.

|

With respect to OPP, a proposal made pursuant to its Articles of Amendment and Restatement (the “Charter”)

to convert the Fund from a closed-end investment company to an open-end investment company.

|

|

|

3.

|

To transact such other business as may properly come before the Annual Meeting or any adjournments or

postponements thereof.

|

THE BOARD

of directors of each fund UNANIMOUSLY RECOMMEND THAT YOU VOTE FOR PROPOSAL 1, to elect the nominated directors of each fund.

THE board

of directors of Opp unanimously recommends that you vote AGainst proposal 2, to convert the Fund from a closed-end investment

company to an open-end investment company.

Stockholders of record of each Fund at the close of

business on June [30], 2021 are entitled to notice of and to vote at the Annual Meeting and any adjournment(s) thereof. The Notice of the

Annual Meeting of Stockholders, proxy statement and proxy card is being mailed on or about July [ ], 2021 to such stockholders of record.

|

By Order of the Boards of Directors,

|

|

|

|

|

|

|

|

|

Marc L. Collings

|

|

|

Secretary and Chief Compliance Officer of each Fund

|

|

[ ], 2021

YOUR VOTE IS IMPORTANT

You can vote easily and quickly over the Internet,

by toll-free telephone call, or by mail. Just follow the simple instructions that appear on your proxy card. Please help the Funds reduce

the need to conduct telephone solicitation and/or follow-up mailings by voting today.

RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND,

INC.

RIVERNORTH SPECIALTY FINANCE CORPORATION

RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME FUND,

INC.

RIVERNORTH MANAGED DURATION MUNICIPAL INCOME FUND,

INC.

RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND, INC.

[ ], 2021

To the Stockholders of the Above Funds,

Thank you for your investment in the Funds. You

are invited to attend a joint annual meeting of stockholders (the “Annual Meeting” or “Meeting”) of

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (“OPP”), RiverNorth Specialty Finance Corporation

(“RSF”), RiverNorth Opportunistic Municipal Income Fund, Inc. (“RMI”), RiverNorth Managed Duration Municipal

Income Fund, Inc. (“RMM”), RiverNorth Flexible Municipal Income Fund, Inc. (“RFM” and, together with OPP,

RSF, RMI and RMM, the “Funds,”). The Meeting will occur on August [27], 2021 at the offices of the Funds’

investment adviser, RiverNorth Capital Management, LLC, 444 W Lake Street, Suite 1700, Chicago, Illinois 60606

(“RiverNorth” or the “Adviser”). The Annual Meeting will be held at [10:00 a.m. (Central Time)]. Formal

notice of the Meeting and the Joint Proxy Statement for the Meeting follows this letter.

At the Meeting, you are being asked to vote on the

following matters and to transact such other business, if any, as may properly come before the meeting:

|

|

1.

|

The election of Directors to the Board of Directors (each a “Board”) of each Fund as outlined

below:

|

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

|

|

c.

|

For RMI, to elect two (2) Class I Directors.

|

|

|

d.

|

For RMM, to elect two (2) Class I Directors.

|

|

|

e.

|

For RFM, to elect two (2) Class I Directors.

|

|

|

2.

|

With respect to OPP, a proposal made pursuant to its Articles of Amendment and Restatement (the “Charter”)

to convert the Fund from a closed-end investment company to an open-end investment company.

|

The Board recommends that you vote FOR Proposal

1, electing each Fund’s nominated Directors; and AGAINST Proposal 2, rejecting the conversion of OPP to an open-end investment

company.

I encourage you to exercise your rights in governing

the Funds by voting on the proposals. Your vote is important.

Whether or not you expect to attend the Meeting, it

is important that your shares be represented. Your immediate response will help reduce the need for the Fund to conduct additional proxy

solicitations. Please review the proxy statement and then vote by Internet, telephone or mail as soon as possible. If you vote by mail,

please sign and return all of the proxy cards included in this package. If you have any questions regarding the proposals or the voting

process, please call [ ] toll-free at [ ].

In light of the COVID-19 pandemic, the Funds are urging

all stockholders to take advantage of voting by mail, by telephone or through the Internet. Additionally, while the Meeting is anticipated

to occur as-planned, there is a possibility that, due to the COVID-19 pandemic, the Meeting may be postponed or the location or approach

may need to be changed, including the possibility of holding the Meeting via remote communications for the health and safety of all Meeting

participants. Should this occur, the Funds will publicly announce the decision to do so in advance and will provide details on how stockholders

may participate in the alternative meeting. Any announcement will also be posted to the Funds' website, www.rivernorth.com, following

release. If you plan to attend the Meeting in person, please note that the Meeting will be held in accordance with any recommended and

required social distancing and safety guidelines, as applicable.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

Marcus L. Collins

|

|

|

|

Secretary and Chief Compliance Officer of each Fund

|

|

SUMMARY OF IMPORTANT INFORMATION CONTAINED

IN THIS PROXY STATEMENT

|

|

Q.

|

Why am I receiving this proxy statement?

|

|

|

A.

|

You are being asked to vote on two important matters affecting the Funds, as follows:

|

(1) The election of Directors to the

Board of each Fund as outlined below:

For OPP:

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

For RSF:

|

|

‒

|

to elect one (1) Class I Director by all stockholders, voting together.

|

|

|

‒

|

to elect one (1) Class I Director by Preferred Shares only.

|

For RMI, to elect two (2) Class I Directors.

For RMM, to elect two (2) Class I Directors.

For RFM, to elect two (2) Class I Directors.

(2) With respect to OPP, a proposal made

pursuant to its Charter to convert the Fund from a closed-end investment company to an open-end investment company.

Proposal 1: Election

of the Board of Directors of each Fund

|

|

Q.

|

Why am I being asked to vote?

|

|

|

A.

|

Each Fund is required to hold an annual meeting of stockholders for the election of members of the Board.

Each Fund’s Board is divided into three classes, each class having a term of three years. Each year, the term of office for one

class will expire. For each Fund, the Class I Directors’ terms are up for election. John K. Carter and John S. Oakes have been designated

as nominees for re-election as Class I Directors of each Fund. More information about the Directors is available in the Joint Proxy Statement.

|

|

|

Q.

|

Who can vote on this proposal?

|

|

|

A.

|

Stockholders of record at the close of business on June [30], 2021 of each Fund are able to vote on Proposal

1.

|

For RSF and OPP only, Class I Director,

John K. Carter, is to be elected by record holders of both common shares and preferred shares, voting together as a single class. However,

Class I Director, John S. Oakes, is to be elected by holders of RSF’s and OPP’s preferred shares only.

|

|

Q.

|

How many of the proposed individuals will be Independent Directors if re-elected?

|

|

|

A.

|

Class I Directors John K. Carter and John S. Oakes are currently Independent Directors and will remain

Independent Directors if re-elected by stockholders.

|

|

|

Q.

|

When will the proposed individuals take office?

|

|

|

A.

|

Class I Directors John K. Carter and John S. Oakes are currently Directors and are expected to continue

serving on each Fund’s Board following relection at the Annual Meeting.

|

|

|

|

|

Q.

|

What stockholder vote is required for the election of Directors to the Board of each Fund?

|

|

|

|

|

A.

|

For each Fund, the affirmative vote of a plurality of the votes cast at the Annual Meeting will be required to elect the specified nominees as Directors of that Fund, provided a quorum is present. Abstentions and broker non-votes will have no effect on the approval of the proposal to elect Directors.

|

|

|

Q.

|

How does the Board recommend that I vote?

|

|

|

A.

|

The Board recommends that you vote FOR the proposal for the election of the Directors to the Board

of each Fund as outlined in the Joint Proxy Statement.

|

Proposal 2: With respect to OPP, a proposal

made pursuant to its Charter to convert the Fund from a closed-end investment company to an open-end investment company.

|

|

Q.

|

What is this proposal?

|

|

|

A.

|

OPP’s stockholders are being asked to consider whether to convert the Fund from a closed-end fund

to an open-end investment company.

|

|

|

Q.

|

Why is this proposal being submitted to stockholders?

|

|

|

A.

|

The Fund has operated as a closed-end management investment company (commonly referred to as a “closed-end

fund”) since its inception in 2016. The Fund’s Charter requires that in the calendar year 2021, the Board call a meeting of

stockholders for the purposes of voting to determine whether the Fund should be converted to an open-end fund.

|

|

|

Q.

|

How does the Board recommend that I vote?

|

|

|

A.

|

The Directors of OPP believe the continued operation of the Fund as a closed-end fund is in the best interest

of the Fund’s stockholders. The Board recommends that you vote AGAINST the proposal to convert the Fund from a closed-end

investment company to an open-end investment company.

|

|

|

Q.

|

Why

does the Board recommend that I vote against the proposal?

|

|

|

A.

|

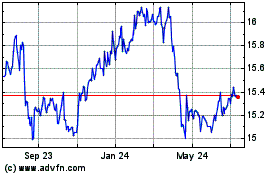

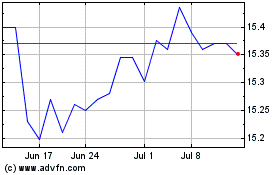

The Board believes that the Fund has been successful in its current closed-end fund structure and that

any benefits that stockholders might receive from changing the structure would be significantly outweighed by the negatives of operating

as and converting to an open-end fund. At a meeting held on May 12, 2021, the Board considered information concerning a number of factors

relevant to Proposal 2, including the anticipated effects on OPP of a conversion to an open-end fund, the legal, operational and practical

differences between closed-end and open-end investment companies, OPP’s performance as a closed-end fund and the historical relationship

between the market price of the Fund’s shares and its net asset value per share. More information about the Board’s considerations

is available in the Joint Proxy Statement.

|

|

|

Q.

|

What effect would approval of this proposal have on OPP?

|

|

|

A.

|

If the Fund converts to an open-end fund, the Fund’s shares would become redeemable directly by

the Fund at NAV and would not trade on any exchange. In addition, there would be significant effects on the Fund’s operations and

portfolio management, which are discussed in detail in the Joint Proxy Statement.

|

|

|

Q.

|

What other approvals or actions would be authorized by this proposal?

|

|

|

A.

|

In order to address the organizational changes necessitated by converting from a closed-end fund to an

open-end fund, approval of this proposal would also authorize the Directors to make such amendments to OPP’s Charter and such other

changes as they may deem necessary or appropriate, which may require additional stockholder approval.

|

|

|

Q.

|

Who can vote on this proposal?

|

|

|

A.

|

Common and preferred stockholders of OPP of record on June [30], 2021 of the Fund are able to vote on Proposal

2.

|

|

|

Q.

|

What

stockholder vote is required to approve the Proposal 2?

|

|

|

A.

|

Approval

of the proposal to convert the Fund from a closed-end investment company to an open-end investment company will require the affirmative

vote of the holders of record of the majority of the outstanding shares entitled to vote at the Meeting.

|

General

|

|

Q.

|

I have only a few shares — does my vote matter?

|

|

|

A.

|

Your vote is important. If many stockholders choose not to vote, the Funds might not receive enough votes to reach a quorum to hold the Meeting. If it appears that there will not be a quorum, the Funds would have to send additional mailings or otherwise solicit stockholders to try to obtain more votes.

|

|

|

Q.

|

What is the deadline for submitting my vote?

|

|

|

A.

|

We encourage you to vote as soon as possible to make sure that the Funds receive enough votes to act on the proposals. Unless you attend the Meeting to vote in person, your vote (cast by Internet, telephone or paper proxy cards as described below) must be received by the Funds for the Annual Meeting by [10:00 a.m. Central Time].

|

|

|

Q.

|

Who is eligible to vote?

|

|

|

A.

|

Stockholders of record at the close of business on

June [30], 2021 of each Fund are able to vote on Proposal 1. For RSF and OPP only, Class I Director, John K. Carter, is to be elected by

record holders of both common shares and preferred shares, voting together as a single class. However, Class I Director, John S. Oakes,

is to be elected by holders of RSF’s and OPP’s preferred shares only.

Common and preferred stockholders of OPP of record

on June [30], 2021 of the Fund are able to vote on Proposal 2.

|

|

|

A.

|

You may vote in any of four ways:

|

|

|

o

|

Through the Internet. Please follow the instructions on your proxy cards.

|

|

|

o

|

By telephone, with a toll-free call to the phone number indicated on the proxy cards.

|

|

|

o

|

By mailing in your proxy cards.

|

|

|

o

|

In person at the Meeting at the offices of the RiverNorth Capital Management, LLC on August [27], 2021.

|

We encourage you to vote via the Internet

or telephone using the control number on your proxy cards and following the simple instructions because these methods result in the most

efficient means of transmitting your vote and reduce the need for the Funds to conduct telephone solicitations and/or follow up mailings.

If you would like to change your previous vote, you may vote again using any of the methods described above.

|

|

Q.

|

Who should I call if I have questions?

|

|

|

A.

|

If you have any questions regarding the proposals or the voting process, please call [ ] toll-free at [ ].

|

|

|

Q.

|

How should I sign the proxy cards?

|

|

|

A.

|

You should sign your name exactly as it appears on the proxy cards. Unless you have instructed us otherwise, either owner of a joint account may sign the cards, but again, the owner must sign the name exactly as it appears on the cards. The proxy cards for accounts of which the signer is not the owner should be signed in a way that indicates the signer’s authority—for example, “Mary Smith, Custodian.”

|

|

|

Q.

|

Will the Funds pay for the proxy solicitation and related legal costs?

|

|

|

A.

|

The expenses incurred in connection with preparing the Joint Proxy Statement and its enclosures will be paid by the Funds.

|

RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND,

INC.

RIVERNORTH SPECIALTY FINANCE CORPORATION

RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME FUND,

INC.

RIVERNORTH MANAGED DURATION MUNICIPAL INCOME FUND,

INC.

RIVERNORTH FLEXIBLE MUNICIPAL INCOME FUND, INC.

444 W. Lake Street,

Suite 1700

Chicago, Illinois 60606

JOINT

PROXY STATEMENT

ANNUAL MEETING

OF Stockholders

to held on August [27], 2021 at [10:00 a.m. Central

Time]

Introduction

This Joint Proxy Statement is furnished in

connection with the solicitation of proxies by the Boards of Directors (each a “Board” and collectively, the

“Boards”) of RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (“OPP”), RiverNorth Specialty Finance

Corporation (“RSF”), RiverNorth Opportunistic Municipal Income Fund, Inc. (“RMI”), RiverNorth Managed

Duration Municipal Income Fund, Inc. (“RMM”) and RiverNorth Flexible Municipal Income Fund, Inc. (“RFM”)

(each a “Fund” and collectively, the “Funds”), each a Maryland corporation, for use at the Annual Meeting of

Stockholders of each Fund (the “Annual Meeting” or “Meeting”) to be held on August [27], 2021, at [10:00

a.m. Central Time], at the offices of RiverNorth Capital Management, LLC, each Fund’s investment adviser

(“RiverNorth” or the “Adviser”), 444 W Lake Street, Suite 1700, Chicago, Illinois 60606, and at any

adjournments or postponements thereof. The following table identifies the proposals set forth in this proxy statement.

|

Proposal Number

|

Proposal Description

|

|

1

|

To elect Directors to the Board of Directors (each

a “Board”) of each Fund as outlined below:

a. For

OPP:

a. to

elect one (1) Class I Director by all stockholders, voting together.

b. to

elect one (1) Class I Director by Preferred Shares only.

b. For

RSF:

a. to

elect one (1) Class I Director by all stockholders, voting together.

b. to

elect one (1) Class I Director by Preferred Shares only.

c. For

RMI, to elect two (2) Class I Directors.

d. For

RMM, to elect two (2) Class I Directors.

e. For

RFM, to elect two (2) Class I Directors.

|

|

2

|

With respect to OPP, a proposal made pursuant to its Articles of Amendment and Restatement (the “Charter”) to convert the Fund from a closed-end investment company to an open-end investment company.

|

|

3

|

To consider and vote upon such other matters, including adjournments, as may properly come before the Meeting or any adjournments thereof.

|

The Board recommends that you vote FOR PROPOSAL

1, electing each Fund’s nominated Directors; and AGAINST PROPOSAL 2, rejecting the conversion of OPP to an open-end investment

company.

You will find this proxy statement divided into four

parts:

|

|

Part 1

|

Provides details on the proposal to elect Directors to the Board

of each Fund (see page 3).

|

|

|

Part 2

|

Provides details on the proposal to amend OPP’s Charter

to convert the Fund from a closed-end investment company to an open-end investment company (see page 16).

|

|

|

Part 3

|

Provides information about ownership of shares of the Funds

(see page 23).

|

|

|

Part 4

|

Provides other information on the Funds, voting, and the Meeting

(see page 24).

|

A Notice of the Annual Meeting of Stockholders and

a proxy card accompany this Joint Proxy Statement, which is expected to be first be mailed to stockholders on or about July [ ], 2021.

The Boards have determined that the use of this Joint Proxy Statement is in the best interests of each Fund in light of the similar matters

being considered and voted on by the stockholders.

The close of business on June [30], 2021 has been fixed

as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual

Meeting. RMI, RMM and RFM each have one class of stock: common shares with a par value of $0.0001 per share. OPP and RSF have two

classes of stock: common shares with a par value of $0.0001 per share and preferred shares with a par value of $0.0001 per share.

Throughout this Joint Proxy Statement, common shares of each Fund will be referred to as “Common Shares,” preferred shares

of OPP and RSF will be referred to as “Preferred Shares,” and, unless the context otherwise requires, Common Shares and Preferred

Shares will generally be referred to as “Shares.” Stockholders of record on the Record Date are entitled to one vote for each

Share the stockholder owns and a pro rata fractional vote for any fractional Share the stockholder owns.

Please read the Joint Proxy Statement before voting

on the proposals. If you have any questions regarding the proposals or the voting process, please call [ ] toll-free at [ ].

Important Notice Regarding the Availability of Materials

for the Meeting to be Held on August [27], 2021

The Joint Proxy Statement for the Meeting is available

at [ ]

Annual and Semi-Annual Reports. The Funds’

most recent annual and semi-annual reports to stockholders are available, upon request, at no cost. You may view these reports at the

Funds’ website at rivernorth.com. You may also request a report by calling toll-free at [(844) 569-4750].

PART 1

|

PROPOSAL 1

Election of

Directors

|

_

The proposal relates to the election of certain of the Directors of each

Fund, as shown in the table below.

|

Matter

|

Common

Shares

|

Preferred

Shares

|

|

For OPP, election of one (1) Class I Director by all stockholders.

|

X

|

X

|

|

For OPP, election of one (1) Class I Director by Preferred Shares only

|

-

|

X

|

|

For RSF, election of one (1) Class I Director by all stockholders.

|

X

|

X

|

|

For RSF, election of one (1) Class I Director by Preferred Shares only

|

-

|

X

|

|

For RMI, election of two (2) Class I Directors.

|

X

|

N/A

|

|

For RMM, election of two (2) Class I Directors.

|

X

|

N/A

|

|

For RFM, election of two (2) Class I Directors.

|

X

|

N/A

|

The Board has, by resolution adopted on October 2,

2020 and October 16, 2020, reclassified from unissued Common Shares and authorized the issuance of Preferred Shares. Stockholders of outstanding

Preferred Shares are entitled to vote as a separate class on a one-vote-per-share basis to elect two Directors of OPP at all times. Stockholders

of outstanding shares of Common Shares and Preferred Shares, voting together as a single class, shall elect the balance of OPP’s

Directors. Under the organizational documents of OPP, its Board is divided into three classes of directors serving staggered three-year

terms. The initial terms of the first, second and third classes of Directors will expire at the first, second and third annual meetings

of stockholders, respectively, and, in each case, until their successors are duly elected and qualify, or until a Director sooner dies,

retires, resigns or is removed as provided in the governing documents of the Fund. Upon expiration of their initial terms, Directors of

each class will be elected to serve for three-year terms and until their successors are duly elected and qualify, and at each annual meeting,

one class of Directors will be elected by the stockholders.

For OPP, at the Annual Meeting, Class I Director,

John K. Carter, is to be elected by holders of Common Shares and Preferred Shares, voting together as a single class, and Class I Director,

John S. Oakes, is to be elected by holders of Preferred Shares only, voting as a single class. Class I Directors John K. Carter and John

S. Oakes have been designated as nominees for election as Class I Directors for a term expiring at the annual meeting of stockholders

in 2024 or until their successors have been duly elected and qualify. Class III Directors Patrick W. Galley and Jerry R. Raio are current

and continuing Class III Directors that are each elected by holders of Common Shares and Preferred Shares, voting together as a single

class. J. Wayne Hutchens is the current and continuing Class II Director that is elected by holders of Common Shares and Preferred Shares,

voting together as a single class. David M. Swanson is the current and continuing Class II Director that is elected by holders of Preferred

Shares only.

On August 20, 2019, the RSF Board amended (the “Amendment”)

the organizational documents of RSF to divide its Board into three classes of Directors serving staggered three year terms. The initial

terms of the first, second and third classes of Directors will expire at the annual meeting of stockholders in 2021, 2022 and 2020, respectively,

and, in each case until their successors are duly elected and qualify, or until a Director sooner dies, retires, resigns or is removed

as provided in the governing documents of the Fund. Upon expiration of their initial terms, Directors of each class will be elected to

serve for three-year terms and until their successors are duly elected and qualify, and at each annual meeting, one class of Directors

will be elected by the stockholders. Prior to the Amendment, each Director served an annual term and at each annual meeting, Directors

were elected to serve until the next annual meeting or until their successors were duly elected and qualified.

For RSF, at the Annual Meeting, Class I Director,

John K. Carter, is to be elected by holders of Common Shares and Preferred Shares, voting together as a single class, and Class I Director,

John S. Oakes, is to be elected by holders of Preferred Shares only, voting as a single class. Class I Directors John K. Carter and John

S. Oakes have been designated as nominees for election as Class I Directors for a term expiring at the annual meeting of stockholders

in 2024 or until their successors have been duly elected and qualify. Class III Directors Patrick W. Galley and Jerry R. Raio are current

and continuing Class III Directors that are each elected by holders of Common Shares and Preferred Shares, voting together as a single

class. J. Wayne Hutchens is the current and continuing Class II Director that is elected by holders of Common Shares and Preferred Shares,

voting together as a single class. David M. Swanson is the current and continuing Class II Director that is elected by holders of Preferred

Shares only.

(c) RMI

Under the organizational documents of RMI, its Board

is divided into three classes of directors serving staggered three-year terms. The initial terms of the first, second and third classes

of Directors will expire at the third, first and second annual meetings of stockholders, respectively, and, in each case, until their

successors are duly elected and qualify, or until a Director sooner dies, retires, resigns or is removed as provided in the governing

documents of the Fund. Upon expiration of their initial terms, Directors of each class will be elected to serve for three-year terms and

until their successors are duly elected and qualify, and at each annual meeting, one class of Directors will be elected by the stockholders.

For RMI, at the Annual Meeting, two Class I Directors

are to be elected by all stockholders. Class I Directors John K. Carter and John S. Oakes have been designated as nominees for election

as Class I Directors for a term expiring at the annual meeting of stockholders in 2024 or until their successors have been duly elected

and qualify. Directors J. Wayne Hutchens and David M. Swanson (the Class II Directors) and Patrick W. Galley and Jerry R. Raio (the Class

III Directors) are current and continuing Directors.

(d) RMM

Under the organizational documents of RMM, its Board

is divided into three classes of directors serving staggered three-year terms. The initial terms of the first, second and third classes

of Directors will expire at the second, third and first annual meetings of stockholders, respectively, and, in each case, until their

successors are duly elected and qualify, or until a Director sooner dies, retires, resigns or is removed as provided in the governing

documents of the Fund. Upon expiration of their initial terms, Directors of each class will be elected to serve for three-year terms and

until their successors are duly elected and qualify, and at each annual meeting, one class of Directors will be elected by the stockholders.

For RMM, at the Annual Meeting, two Class I Directors

are to be elected by all stockholders. Class I Directors John K. Carter and John S. Oakes have been designated as nominees for election

as Class I Directors for a term expiring at the annual meeting of stockholders in 2024 or until their successors have been duly elected

and qualify. Directors J. Wayne Hutchens and David M. Swanson (the Class II Directors) and Patrick W. Galley and Jerry R. Raio (the Class

III Directors) are current and continuing Directors.

(e) RFM

Under the organizational documents of RFM, its Board

is divided into three classes of directors serving staggered three-year terms. The initial terms of the first, second and third classes

of Directors will expire at the second, third and first annual meetings of stockholders, respectively, and, in each case, until their

successors are duly elected and qualify, or until a Director sooner dies, retires, resigns or is removed as provided in the governing

documents of the Fund. Upon expiration of their initial terms, Directors of each class will be elected to serve for three-year terms and

until their successors are duly elected and qualify, and at each annual meeting, one class of Directors will be elected by the stockholders.

For RFM, at the Annual Meeting, two Class I Directors

are to be elected by all stockholders. Class I Directors John K. Carter and John S. Oakes have been designated as nominees for election

as Class I Directors for a term expiring at the annual meeting of stockholders in 2024 or until their successors have been duly elected

and qualify. Directors J. Wayne Hutchens and David M. Swanson (the Class II Directors) and Patrick W. Galley and Jerry R. Raio (the Class

III Directors) are current and continuing Directors.

MANAGEMENT

Management of the Funds

The management of each Fund, including general supervision

of the duties performed for each Fund under the investment management agreement between each Fund and the Adviser, is the responsibility

of its Boards. There are six Directors of each Fund, two of whom are “interested persons” (as defined in the Investment Company

Act of 1940, as amended (the “1940 Act”)) of each Fund (such Directors, the “Interested Directors”) and four of

whom are not “interested persons” (as defined in the 1940 Act) of each Fund (such Directors, the “Independent Directors”).

The Directors of a Fund set broad policies for that Fund, choose the Fund’s officers and hire the Fund’s investment adviser

and sub-adviser (if applicable). The officers of a Fund manage the day-to-day operations and are responsible to each Fund’s Board.

The following is a list of Directors and officers

of each Fund and a statement of their present positions, principal occupations during the past five years, the number of portfolios

each Director oversees and the other directorships held by the Directors during the past five years, if applicable. There are no

familial relationships among the officers and Directors. Except as otherwise noted, the address for all Directors and officers is 325

North LaSalle Street, Suite 645, Chicago, Illinois 60654.

INDEPENDENT AND INTERESTED DIRECTORS

|

Name, Address, and Year of Birth

|

Position(s)

Held with

Funds

|

Term of Office

and Length

of Time Served

|

Principal

Occupation(s)

During Past

Five Years

|

Number of

Portfolios

in Fund

Complex(1)

Overseen

by

Director

|

Other

Directorships

Held by

Director

during past

Five Years

|

|

John K. Carter

(1961)

|

Independent Director

|

Term: Class I Expires in 2021.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since 2016

(OPP); since 2015 (RSF).

|

Managing Partner, Law Office of John K. Carter, P.A. (a general practice and corporate law firm) (2015 to present); Managing Partner, Global Recruiters of St. Petersburg (a financial services consulting and recruiting firm) (2012 to present).

|

10

|

Carillon Mutual Funds (12 funds) (2016 to present); RiverNorth Funds (3 funds) (2013 to present); RiverNorth Opportunities Fund, Inc. (1 fund) (2013 to present); RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

J. Wayne Hutchens

(1944)

|

Independent Director

|

Term: Class II Expires in 2022.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since 2019

(OPP); since 2019 (RSF).

|

Currently retired; Trustee of the Denver Museum of Nature and Science (2000

to present); Director of AMG National Trust Bank (June 2012 to present); Trustee of Children’s Hospital Colorado (May 2012 to present).

|

7

|

ALPS Series Trust (9 funds) (2012 to present); RiverNorth Opportunities Fund, Inc. (1 fund) (2013 to present); RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

John S. Oakes

(1943)

|

Independent Director

|

Term: Class I Expires in 2021.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since 2016

(OPP); since 2015 (RSF).

|

Currently retired; Principal, Financial Search and Consulting (a recruiting and consulting firm) (2013 to 2017).

|

10

|

RiverNorth Funds (3 funds) (2010 to present); RiverNorth Opportunities Fund, Inc. (1 fund) (2013 to present); RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

David M. Swanson

(1957)

|

Independent Director

|

Term: Class II Expires in 2022.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since 2019

(OPP); since 2018 (RSF).

|

Founder & Managing Partner, SwanDog Strategic Marketing (2006 to present).

|

10

|

RiverNorth Funds (3 funds) (2018 to present); RiverNorth Opportunities Fund, Inc. (2013 to present); Managed Portfolio Series (33 funds) (2011 to present); ALPS Variable Investment Trust (7 funds) (2006 to present); RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

Patrick W. Galley(2)

(1975)

|

Interested Director, Chairman, and President

|

Term: Class III Expires in 2023.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since

2016 (OPP); since 2015 (RSF).

|

Chief Executive Officer, RiverNorth Capital Management, (since 2020); Chief

Investment Officer, RiverNorth Capital Management, LLC (2004 to present).

|

10

|

RiverNorth Funds (3 funds) (2006 to present); RiverNorth Opportunities

Fund, Inc. (1 fund) (2013 to present); RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

Jerry R. Raio(3)

(1964)

|

Interested Director

|

Term: Class III Expires in 2023.

Service: since 2020 (RFM); since 2019 (RMM); since 2018 (RMI); since 2018

(OPP); since 2018 (RSF).

|

President, Arbor Lane Advisors, Inc. (Since 2018); Board Member of each of FLX Distribution, (2020 to present); Qudos Technologies (2019 to present); and Quantify Crypto (2021 to present); Head of Capital Markets, ClickIPO (2018-2019); Managing Director, Head of Retail Origination, Wells Fargo Securities, LLC (2005 to 2018).

|

7

|

RiverNorth Opportunities Fund, Inc. (1 fund)(2019 to present);

RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) (2021 to present).

|

|

|

(1)

|

The Fund Complex consists of the Funds, the RiverNorth Funds (3 Funds), the RiverNorth Opportunities Fund, Inc. and the RiverNorth

Flexible Municipal Income Fund II, Inc. for all Directors, except for Mr. Raio and Mr. Hutchens. For Mr. Raio and Mr. Hutchens, the Fund

Complex consists of the Funds, the RiverNorth Opportunities Fund, Inc. and the RiverNorth Flexible Municipal Income Fund II, Inc.

|

|

|

(2)

|

Mr. Galley is deemed an “interested person” of each Fund due to his position as Chief Executive Officer and Chief

Investment Officer of RiverNorth Capital Management, LLC, the investment adviser to each Fund.

|

|

|

(3)

|

Mr. Raio is deemed an “interested person” of each Fund because of his current position as a director of FLX Distribution,

which the Adviser is an investor in and Mr. Galley is a Director of; and because of his prior position as Managing Director – Head

of Retail Origination at Wells Fargo, which had previously served as a broker and principal underwriter for certain funds advised by the

Adviser.

|

|

Officers

|

|

Name, Address, and Year of Birth

|

Position Held with Funds

|

Term of Office and

Length of Time

Served(3)

|

Principal Occupation(s)

During Past Five Years

|

|

Jonathan M.

Mohrhardt

(1974)

|

Chief Financial Officer, Treasurer

|

RFM: Indefinite/Has served since 2020.

RMM: Indefinite/Has served since 2019.

RMI: Indefinite/Has served since 2018.

OPP: Indefinite/Has served since 2016.

RSF: Indefinite/Has served since 2015.

|

President, RiverNorth Capital Management, LLC (since 2020); Chief Operating

Officer, RiverNorth Capital Management, LLC (2011 to present).

|

|

Marcus L. Collins

(1968)

|

Chief Compliance Officer and Secretary

|

RFM: Indefinite/Has served since 2020.

RMM: Indefinite/Has served since 2019.

RMI: Indefinite/Has served since 2018.

OPP: Indefinite/Has served since 2016.

RSF: Indefinite/Has served since 2015.

|

General Counsel, RiverNorth Capital Management, LLC (2012 to present), Chief Compliance Officer, RiverNorth Capital Management, LLC (2012 to present).

|

Board Leadership Structure. The

Board of Directors, which has overall responsibility for the oversight of each Fund’s investment programs and business affairs,

believes that it has structured itself in a manner that allows it to effectively perform its oversight obligations. Mr. Patrick W. Galley,

the Chairman of the Board (“Chairman”), is not an Independent Director.

The Board believes that the use of an interested director

as Chairman is the appropriate leadership structure for each Fund given (i) Mr. Patrick Galley’s role in the day to day operations

of the Adviser, (ii) the extent to which the work of the Board of Directors is conducted through the Audit Committee of the Board of Directors

(the “Audit Committee”) and the Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating

and Corporate Governance Committee”), each of whose meetings is chaired by an Independent Director, (iii) the frequency that Independent

Directors meet with their independent legal counsel and auditors in the absence of members of the Board of Directors who are interested

directors of each Fund and management, and (iv) the overall sophistication of the Independent Directors, both individually and collectively.

The members of the Board of Directors also complete an annual self-assessment during which the directors review their overall structure

and consider where and how their structure remains appropriate in light of each Fund’s current circumstances. The Chairman’s

role is to preside at all meetings of the Board of Directors and in between meetings of the Board of Directors to generally act as the

liaison between the Board of Directors and each Fund’s officers, attorneys and various other service providers, including but not

limited to the Adviser and other such third parties servicing each Fund. The Board of Directors believes that having an interested person

serve as Chairman of the Board of Directors enables Mr. Galley to more effectively carry out these liaison activities. The Board of Directors

also believes that it benefits during its meetings from having a person intimately familiar with the operation of each Fund to set the

agenda for meetings of the Board of Directors to ensure that important matters are brought to the attention of and considered by the Board

of Directors.

Each Fund has two standing committees, each of which

enhances the leadership structure of the Board of Directors: the Audit Committee and the Nominating and Corporate Governance Committee.

The Audit Committee and Nominating and Corporate Governance Committee are each chaired by, and composed of, members who are Independent

Directors.

For each Fund, the Audit Committee is comprised of

Messrs. Carter, Oakes, Swanson and Hutchens, all of whom are “independent” as defined in the listing standard of the New York

Stock Exchange. Mr. Hutchens is the Chair of the Audit Committee and has been determined to qualify as an “audit committee financial

expert” as such term is defined in Form N-CSR. The role of the Audit Committee is to assist the Board of Directors in its oversight

of (i) the quality and integrity of each Fund’s financial statements, reporting process and the independent registered public accounting

firm (the “independent accountants”) and reviews thereof, (ii) each Fund’s accounting and financial reporting policies

and practices, its internal controls and, as appropriate, the internal controls of certain service providers, (iii) each Fund’s

compliance with certain legal and regulatory requirements, and (iv) the independent accountants’ qualifications, independence and

performance. The Audit Committee is also required to prepare an audit committee report pursuant to the rules of the Securities and Exchange

Commission (“SEC”) for inclusion in each Fund’s annual proxy statement. The Audit Committee operates pursuant to the

Audit Committee Charter that is reviewed and approved annually. As set forth in the Audit Committee Charter, management is responsible

for maintaining appropriate systems for accounting and internal controls, and each Fund’s independent accountants are responsible

for planning and carrying out proper audits and reviews. The independent accountants are ultimately accountable to the Board of Directors

and to the Audit Committee, as representatives of the stockholders. The independent accountants for each Fund reports directly to the

Audit Committee. For RSF, OPP, RMI, RMM and RFM, the Audit Committee met [three] times during the fiscal year ended June 30, 2021.

For each Fund, the Nominating and Corporate Governance

Committee is comprised of Messrs. Carter, Hutchens, and Oakes. Mr. Carter is the Chair of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board of Directors individuals

believed to be qualified to become members of the Board of Directors in the event that a position is vacated or created. The Nominating

and Corporate Governance Committee will consider director candidates recommended by stockholders. In considering candidates submitted

by stockholders, the Nominating and Corporate Governance Committee will take into consideration the needs of the Board of Directors, the

qualifications of the candidate and the interests of stockholders. Stockholders wishing to recommend candidates to the Nominating and

Corporate Governance Committee should submit such recommendations to the Secretary of each Fund, who will forward the recommendations

to the committee for consideration. The submission must include: (i) whether the shareholder proposing such nominee believes the

proposed nominee is, or is not, an “interested person”, (ii) the name and address, as they appear on the Fund’s books,

of the shareholder proposing such business or nomination, (iii) a representation that the shareholder is a holder of record of Shares

entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to present such nomination; (iv) whether the

shareholder plans to deliver or solicit proxies from other stockholders; (v) the class and number of Shares of the capital stock

of the Fund, which are beneficially owned by the shareholder and the proposed nominee to the Board; (vi) any material interest of the

shareholder or nominee in such business; (vii) the extent to which such shareholder (including such shareholder’s principals) or

the proposed nominee to the Board has entered into any hedging transaction or other arrangement with the effect or intent of mitigating

or otherwise managing profit, loss or risk of changes in the value of the Shares or the daily quoted market price of the Fund held by

such shareholder (including the shareholder’s principals) or the proposed nominee, including independently verifiable information

in support of the foregoing; (viii) any substantial interest, direct or indirect, of such shareholder or the proposed nominee in the Fund

other than interest arising from ownership of Common Shares; (ix) to the extent known by such shareholder, the name and address of any

other shareholder supporting the proposed nominee; (x) the nominee holder for, and number of, Common Shares owned beneficially but not

of record by such shareholder; (xi) the investment strategy or objective, if any, of such shareholder who is not an individual and a copy

of the prospectus, offering memorandum, or similar document, if any; and (xii) such other information regarding such nominee proposed

by such shareholder as would be required to be included in a proxy statement filed pursuant to Regulation 14A under the 1934 Act.

Each eligible shareholder or shareholder group may submit no more than one Independent Director nominee each calendar year. The Nominating

and Corporate Governance Committee has not determined any minimum qualifications necessary to serve as a director of each Fund. The Nominating

and Corporate Governance Committee operates pursuant to the Nominating and Corporate Governance Committee Charter that is reviewed and

approved annually. For RSF, OPP, RMI, RMM and RFM, the Nominating and Governance Committee met [one] time during the fiscal year ended

June 30, 2021.

During the fiscal year ended June 30, 2021, the

Board of RSF, RMI, RMM and RFM met [four] times, while the Board of OPP met [six] times. Each Director then serving in such capacity attended

at least 75% of the meetings of Directors and of any Committee of which he is a member.

The Funds do not require the Directors to attend annual

meetings of stockholders.

Director Qualifications.

Interested Directors

Mr. Patrick Galley is the Chief Executive Officer

and Chief Investment Officer for each Fund’s investment adviser. He is also the President and a portfolio manager of each Fund.

His knowledge regarding the investment strategy of each Fund, more specifically the closed-end mutual fund industry, makes him uniquely

qualified to serve as each Fund’s President.

Mr. Raio has many years of experience in the securities

industry, including management roles in the banking and investment management industries. He has more than 15 years of experience in equity

capital markets, having worked on the retail syndicate desks at both Citigroup and Morgan Stanley. Since 2018, he has served as President

and CEO of Arbor Lane Advisors, Inc. He served as the Managing Director and Head of Retail Origination for Wells Fargo Securities, LLC

from 2005 to 2018. Prior to working at Wells Fargo, he served as Director and Head of Closed-End Funds for Citigroup Asset Management.

He also serves on the Board of each of FLX Distribution; Qudos Technologies; and Quantify Crypto. He was selected to serve as a Director

of the Fund based on his business, financial services and investment management experience.

Independent Directors

Mr. John K. Carter possesses extensive mutual fund

industry experience. Mr. Carter served as a Business Unit Head at Transamerica Asset Management, a subsidiary of Aegon, N.V. Mr. Carter

oversaw the mutual fund servicing, operations and advisory services for Transamerica’s approximately 120 mutual funds. He also served

as a compliance officer. Mr. Carter brings experience managing a large mutual fund complex, including experience overseeing multiple sub-advisers.

Mr. Carter is currently an attorney in private practice and was previously an investment management attorney with experience as in-house

counsel, serving with the SEC and in private practice with a large law firm. The Board feels Mr. Carter’s industry-specific experience,

including as a chairman of another fund complex, as a compliance officer and as an experienced investment management attorney will be

valuable to the Board, particularly when dealing with legally complex issues.

Mr. John S. Oakes has many years of experience in

the securities industry. His background includes extensive management and leadership roles in both the brokerage and banking businesses.

Additionally, he had served on the Board of Directors of another registered investment company, including serving as its Chairman. The

Board feels Mr. Oakes’ industry and board experience adds an operational perspective to the Board and his experience in marketing

can assist the Fund in its efforts to expand into different distribution channels.

Mr. Hutchens was President and CEO of the University

of Colorado (CU) Foundation from April 2006 to December 2012 and Executive Director for the CU Real Estate Foundation from April 2009

to December 2012. Prior to these positions, Mr. Hutchens spent over 30 years in the banking industry, retiring as Chairman of Chase Bank

Colorado. Mr. Hutchens is a graduate of the University of Colorado Boulder’s School of Business and has done graduate study at Syracuse

University and the University of Colorado. He was selected to serve as a Director of the Fund based on his business and financial services

experience.

Mr. Swanson founded SwanDog Marketing, a marketing

consulting firm to asset managers, in 2006. He currently serves as SwanDog’s Managing Partner. He has over 30 years of senior management

and marketing experience, with approximately 20 years in financial services. Before joining SwanDog, Mr. Swanson most recently served

as Executive Vice President and Head of Distribution for Calamos Investments, an investment management firm. He previously held positions

as Chief Operating Officer of Van Kampen Investments, President of CEO of Scudder, Stevens & Clark, Canada, Ltd. And Managing Director

and Head of Global Investment Products at Morgan Stanley. Mr. Swanson holds a Master of Management from the Kellogg Graduate School of

Management at Northwestern University and a Bachelors in Journalism from Southern Illinois University. He was selected to serve as a Director

of the Fund based on his business, financial services and investment management experience.

Risk Oversight. Each Fund

is confronted with a multitude of risks, such as investment risk, counterparty risk, valuation risk, political risk, risk of operational

failures, business continuity risk, regulatory risk, legal risk and other risks not listed here. The Board of Directors recognizes that

not all risks that may affect each Fund can be known, eliminated or even mitigated. In addition, there are some risks that may not be

cost effective or an efficient use of each Fund’s limited resources to moderate. As a result of these realities, the Board of Directors,

through its oversight and leadership, has and will continue to deem it necessary for stockholders to bear certain and undeniable risks,

such as investment risk, in order for each Fund to operate in accordance with each Fund’s applicable Prospectus, Statement of Additional

Information (“SAI”) and other related documents.

However, the Board of Directors has adopted on each

Fund’s behalf a vigorous risk program that mandates each Fund’s various service providers, including the Adviser and Sub-adviser,

to adopt a variety of processes, procedures and controls to identify various risks, mitigate the likelihood of adverse events from occurring

and/or attempt to limit the effects of such adverse events on each Fund. The Board of Directors fulfills its leadership role by receiving

a variety of quarterly written reports prepared by each Fund’s Chief Compliance Officer (“CCO”) that (i) evaluate the

operation, policies and procedures of each Fund’s service providers, (ii) make known any material changes to the policies and procedures

adopted by each Fund or its service providers since the CCO’s last report, and (iii) disclose any material compliance matters that

occurred since the date of the last CCO report. In addition, the Independent Directors meet quarterly in executive sessions without the

presence of any interested directors, the Adviser or Sub-adviser, or any of their affiliates. This configuration permits the Independent

Directors to effectively receive the information and have private discussions necessary to perform their risk oversight role, exercise

independent judgment and allocate areas of responsibility between the full Board of Directors, its committees and certain officers of

each Fund. Furthermore, the Independent Directors have engaged independent legal counsel and auditors to assist the Independent Directors

in performing their oversight responsibilities. As discussed above and in consideration of other factors not referenced herein, the Board

of Directors has determined its leadership role concerning risk management as one of oversight and not active management of each Fund’s

day-to-day risk management operations.

Compensation. The Funds pay

no salaries or compensation to their officers or to any interested Director affiliated with the Adviser, and each Fund has no employees.

In addition, with respect to RMM and RFM only, the Adviser (not the Fund) is responsible for paying the Director compensation out of its

unified management fee. For their services, the Directors of each Fund who are not affiliated with the Adviser receive an annual retainer

in the amount of $16,500, and an additional $1,500 for attending each quarterly meeting of the Board. In addition, the lead Independent

Director receives $250 annually, the Chair of the Audit Committee receives $500 annually and the Chair of the Nominating and Corporate

Governance Committee receives $250 annually. The Directors not affiliated with the Adviser are also reimbursed for all reasonable out-of-pocket

expenses relating to attendance at meetings of the Board. The following tables show compensation with respect to the Funds and the Fund

Complex for the fiscal year ended [June 30, 2021]. Patrick W. Galley is an interested person of the Funds and employed by the Adviser

and does not receive any compensation from the Funds.

|

Name of Director

|

Aggregate

Compensation

from OPP

|

Aggregate

Compensation

from RSF

|

Aggregate

Compensation

from RMI

|

Aggregate

Compensation

from RMM(2)

|

Aggregate

Compensation

from RFM(2)

|

Aggregate Total

Compensation

from the

Funds and

Fund Complex(1)(3)

|

|

Independent Directors:

|

|

|

|

|

|

John K. Carter

|

|

|

|

|

|

|

|

John S. Oakes

|

|

|

|

|

|

|

|

J. Wayne Hutchens

|

|

|

|

|

|

|

|

David M. Swanson

|

|

|

|

|

|

|

Interested Directors:

|

|

|

|

|

|

|

Jerry R. Raio

|

|

|

|

|

|

|

|

|

(1)

|

For Messrs. Carter, Oakes, and Swanson, the Fund Complex consists of the Funds (5 funds), RiverNorth Opportunities

Fund, Inc. (1 fund), RiverNorth Flexible Municipal Income Fund II, Inc. (1 fund) and the RiverNorth Funds (3 funds). For Mr. Raio and

Mr. Hutchens, the Fund Complex consists of the Funds (5 funds), RiverNorth Opportunities Fund, Inc. (1 fund) and RiverNorth Flexible Municipal

Income Fund II, Inc. (1 fund). This information is as of June 30, 2021.

|

|

|

(2)

|

With respect to RMM and RFM, the Adviser, not the Fund, paid all compensation to the Directors described

above out of its unified management fee.

|

|

|

(3)

|

The Adviser, not the Fund, paid all Director compensation out of its unified management fee related to

RMM, RFM, and RiverNorth Flexible Municipal Income Fund II, funds within the Fund Complex described in footnote 1.

|

Director Ownership in the Funds

The following table shows the dollar

range of equity securities beneficially owned by each Director in each Fund and Family of Investment Companies as of December 31,

2020.

|

|

Dollar Range of Beneficial Ownership

|

|

|

|

Name of Director

|

in OPP

|

in RSF

|

in RMI

|

in RMM

|

in RFM

|

Aggregate Dollar Range

of Ownership in all

Funds Overseen by

Director in the Family of

Investment Companies

|

|

|

Independent Directors:

|

|

|

|

|

John K. Carter

|

None

|

None

|

None

|

None

|

None

|

$50,001 - $100,000

|

|

John S. Oakes

|

$10,001 - $50,000

|

None

|

None

|

$10,001 - $50,000

|

$10,001 - $50,000

|

Over $100,000

|

|

J. Wayne Hutchens

|

None

|

None

|

None

|

$10,001 - $50,000

|

$10,001 - $50,000

|

Over $100,000

|

|

David M. Swanson

|

None

|

None

|

None

|

$10,001 - $50,000

|

$10,001 - $50,000

|

$10,001 - $50,000

|

|

|

Interested Directors:

|

|

|

|

|

Patrick W. Galley

|

Over $100,000

|

Over $100,000

|

Over $100,000

|

Over $100,000

|

Over $100,000

|

Over $100,000

|

|

Jerry R. Raio

|

None

|

None

|

$10,001 - $50,000

|

None

|

None

|

$10,001 - $50,000

|

|

|

|

|

|

|

|

|

|

As of June [30], 2021, the Independent Directors

of each Fund and immediate family members do not own beneficially or of record any class of securities of the investment adviser or principal

underwriter of each Fund or any person directly or indirectly controlling, controlled by, or under common control with an investment

adviser or principal underwriter of each Fund.

Audit Committee Report

In performing its oversight function, during the 2021

fiscal year, the Audit Committee will review and discussed with management and the independent accountant (Cohen & Company, Ltd in

the case of OPP, RMI, RMM and RFM, and KPMG LLP in the case of RSF) for each Fund, the audited financial statements of each respective

Fund as of and for the fiscal period ended June 30, 2021, and will discuss the audit of such financial statements with each Fund’s

independent accountants.

In addition, the Audit Committee will discuss with

each Fund’s independent registered public accounting firm the accounting principles applied by each Fund and such other matters

brought to the attention of the Audit Committee by the independent registered public accounting firm required by Auditing Standard 1301,

Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee

will also receive from each Fund’s independent registered public accounting firm the written disclosures and letters required by

PCAOB Rule 3526, Communication with Audit Committees Concerning Independence, and discuss the relationship between the independent

registered public accounting firm and each Fund and the impact that any such relationships might have on the objectivity and independence

of the independent registered public accounting firm.

As set forth above, and as more fully set forth in

the Audit Committee Charter, the Audit Committee has significant duties and powers in its oversight role with respect to each Fund’s

financial reporting procedures, internal control systems and the independent audit process.

The members of the Audit Committee are not, and do

not represent themselves to be, professionally engaged in the practice of auditing or accounting and are not employed by each Fund for

accounting, financial management or internal control purposes. Moreover, the Audit Committee relies on and makes no independent verification

of the facts presented to it or representations made by management or the respective Fund’s independent registered public accounting

firm. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained

appropriate accounting and/or financial reporting principles and policies, or internal controls and procedures designed to assure compliance

with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions

referred to above do not provide assurance that the audits of each Fund’s financial statements have been carried out in accordance

with generally accepted accounting standards or that the financial statements are presented in accordance with generally accepted accounting

principles.

The Audit Committee’s review and discussions

of the audited financial statements of the Funds for the fiscal year ended June 30, 2021 with management and each Fund’s independent

registered public accounting firm are set to occur prior to the issuance of each independent registered public accounting firm’s

opinion on the financial statements and also at the Funds’ next scheduled Audit Committee meeting on August 10-11, 2021. At this

meeting, the Audit Committee will be asked to ratify its recommendation to the Board with regards to the inclusion of the audited financial

statements of the Funds for the fiscal year ended June 30, 2021 in the Annual Reports of the Funds. For the fiscal year ended June 30,

2021, the Audit Committee will discuss with Cohen and KPMG the matters required to be discussed by the applicable requirements of the

PCAOB and will receive written affirmation of their independence pursuant to PCAOB Rule 3526.

Submitted by the Audit Committee of the

Board of Directors

J. Wayne Hutchens

John K. Carter

John S. Oakes

David M. Swanson

Independent Registered Public Accounting Firms’

Fees

At the Funds’ next Audit Committee meeting on

August 10-11, 2021, Cohen & Company, Ltd. will be approved to serve as the independent registered public accounting firm for OPP,

RMI, RMM and RFM for its current fiscal year, and acted as the independent registered public accounting firm for each Fund during its

most recently completed fiscal year. KPMG LLP will be approved to serve as the independent registered public accounting firm for RSF for

its current fiscal year, and acted as the independent registered public accounting firm for such Fund during its most recently completed

fiscal year. Each independent registered public accounting firm has advised the applicable Fund that, to the best of its knowledge and

belief, its professionals did not have any direct or material indirect ownership interest in the independent registered public accounting

firm inconsistent with independent professional standards pertaining to independent registered public accounting firms. It is not expected

that representatives of each Fund’s independent registered public accounting firm will be present at the Annual Meeting; however,

representatives of each Fund’s independent registered public accounting firm are expected to be available by telephone to answer

any questions that may arise and will have the opportunity to make a statement if they desire to do so. In reliance on Rule 32a-4

under the 1940 Act, each Fund is not seeking stockholder ratification of the selection of their independent registered public accounting

firm.

Audit Fees, Audit-Related Fees, Tax Fees and All

Other Fees

The aggregate fees billed by the

applicable independent registered public accounting firm for the following services during each of the last two fiscal years for each

Fund are disclosed below:

|

|

Audit Fees*(1)

|

Audit-Related

Fees(2)

|

Tax Fees(3)

|

All Other

Fees(4)

|

|

Fees Billed To

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

|

OPP

|

$[ ]

|

$27,500

|

$[ ]

|

$3,143

|

$[ ]

|

$5,000

|

$[ ]

|

$0

|

|

RSF

|

$[ ]

|

$150,000

|

$[ ]

|

$0

|

$[ ]

|

$8,300

|

$[ ]

|

$0

|

|

RMI

|

$[ ]

|

$25,000

|

$[ ]

|

$1,043

|

$[ ]

|

$6,000

|

$[ ]

|

$0

|

|

RMM

|

$[ ]

|

$22,000

|

$[ ]

|

$8,000

|

$[ ]

|

$6,000

|

$[ ]

|

$0

|

|

RFM

|

$[ ]

|

$22,000

|

$[ ]

|

$8,000

|

$[ ]

|

$6,000

|

$[ ]

|

$0

|

|

|

*

|

Information related to fees for the 2021 fiscal year includes

amounts estimated to be billed for services rendered for the annual audit of the Fund's financial statements for the fiscal year ended

June 30, 2021.

|

|

|

(1)

|

“Audit Fees” are fees for professional services for the audit of each Fund’s annual

financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

|

|

|

(2)

|

“Audit-Related Fees” are for assurance and related services that are reasonably related to

the performance of the audit of each Fund’s financial statements and are not reported under “Audit Fees.”

This includes assurance and diligence work related to offerings of preferred and common shares and reviews of semi-annual financial statements.

|

|

|

(3)

|

“Tax Fees” are for professional services for tax compliance, tax advice and tax planning.

|

|

|

(4)

|

“All Other Fees” are for products and services other than those services reported under “Audit

Fees,” “Audit-Related Fees” and “Tax Fees.”

|

Pre-Approval

Each Fund’s Audit Committee Charter requires

that the Audit Committee pre-approve all audit and non-audit services to be provided by the applicable independent registered public accounting

firm. [There were no non-audit fees billed by Cohen & Company, Ltd. or KPMG LLP for services rendered to the Adviser or any entity

controlling, controlled by or under common control with the Adviser that provided ongoing services to the Funds in 2021 or 2020.]

VOTING

For each Fund, the affirmative vote of a plurality

of the votes cast at the Annual Meeting will be required to elect the specified nominees as Directors of that Fund provided a quorum is

present. Abstentions and broker non-votes will have no effect on the approval of the proposal to elect Directors.

If the enclosed proxy card is properly executed and

returned in time to be voted at each Fund’s Annual Meeting, each Fund’s Shares represented thereby will be voted in accordance

with the instructions marked thereon or, if no instructions are marked thereon, will be voted in the discretion of the persons named on

the proxy card. Accordingly, unless instructions to the contrary are marked thereon, a properly executed and returned proxy will be

voted FOR the election of the nominees as Directors and, at the discretion of the named proxies, on any other matters that may properly

come before each Fund’s Annual Meeting, as deemed appropriate. Any stockholder who has given a proxy has the right to revoke