|

|

|

|

|

Security Ownership of Management

|

The following table shows all shares of our common stock that were beneficially owned, as of March 15, 2021, by: (i) each of our current directors, nominees for director at the Annual Meeting and our NEOs and (ii) all of our current directors and executive officers as a group. In general, a person “beneficially owns” shares if he or she has, or shares with others, the right to vote or dispose of them, or if he or she has the right to acquire them within 60 days of March 15, 2021 (such as by the conversion of stock-settled RSUs or exercising options).

|

|

|

|

|

|

|

|

|

|

|

Name (1)

|

Shares

Beneficially

Owned (#) (2)

|

Percent

of Class

|

|

Herbert Wender

|

568,232

|

|

*

|

|

Brad L. Conner

|

9,962

|

|

*

|

|

Howard B. Culang

|

252,153

|

|

*

|

|

Debra Hess

|

15,730

|

|

*

|

|

Lisa W. Hess

|

119,528

|

|

*

|

|

Lisa Mumford

|

12,657

|

|

*

|

|

Gaetano Muzio

|

95,899

|

|

*

|

|

Gregory V. Serio

|

108,694

|

|

*

|

|

Noel J. Spiegel

|

159,502

|

|

*

|

|

Richard G. Thornberry

|

391,943

|

|

*

|

|

Derek V. Brummer

|

242,713

|

|

*

|

|

J. Franklin Hall

|

132,593

|

|

*

|

|

Edward J. Hoffman

|

212,049

|

|

*

|

|

Eric R. Ray

|

31,635

|

|

*

|

|

All current directors and executive officers as a group (17 persons)

|

2,595,708

|

|

1.36 %

|

*Less than one percent of class. Percentages are calculated in accordance with Rule 13d-3 under the Exchange Act.

(1)The address of each person listed is c/o Radian Group Inc., 1500 Market Street, Philadelphia, Pennsylvania 19102.

(2)Each individual (including each current executive officer) has or is entitled to have within 60 days of March 15, 2021, sole voting or dispositive power with respect to the shares reported as beneficially owned, other than: (i) Mr. Spiegel, whose spouse owns 10,004 of the shares reported as beneficially owned and as to which shares Mr. Spiegel disclaims beneficial ownership and (ii) Mr. Hoffman, who shares voting and dispositive power with his spouse with respect to 19,500 of the shares reported as beneficially owned. In addition to shares owned outright, the amounts reported include:

■Shares of our common stock allocable to our NEOs based on their holdings in the Radian Group Inc. Stock Fund under the Radian Group Inc. Savings Incentive Plan (the “Savings Plan”) as of March 15, 2021.

■Shares that may be acquired within 60 days of March 15, 2021 through the exercise of non-qualified stock options, as follows: Mr. Brummer—48,520 shares; Mr. Hall—20,520 shares; and Mr. Hoffman—73,860 shares; and all current directors and executive officers as a group—237,950 shares.

■Shares that may be acquired within 60 days of March 15, 2021 upon the conversion of stock-settled RSUs awarded to our non-employee directors and executive officers as follows: Mr. Wender—316,197 shares; Mr. Conner—9,962 shares; Mr. Culang—183,436 shares; Ms. Debra Hess—15,730 shares; Ms. Lisa Hess—119,528 shares; Ms. Mumford— 9,962 shares; Mr. Muzio—90,899 shares; Mr. Serio—108,694 shares; Mr. Spiegel—129,490 shares; Mr. Thornberry—251,186 shares; Mr. Brummer—54,156 shares; Mr. Hall—46,655 shares; Mr. Hoffman—46,665 shares; Mr. Ray—16,176 shares; and all current directors and executive officers as a group—1,442,303 shares.

■For our directors, the amounts referenced in the table for the conversion of stock-settled RSUs include shares payable upon: (1) the vesting of time-based RSUs issued in 2020; (2) the conversion of vested RSUs for which conversion remains subject to a director’s departure from the Board; and (3) for those directors who are or will be eligible to retire within 60 days of March 15, 2021, the conversion of unvested RSUs for which conversion remains subject to a director's departure from the board. For Mr. Wender, Ms. Lisa Hess and Mr. Muzio, excludes 27,044, 9,962, and 17,795 RSUs, respectively, that have been deferred pursuant to the Radian Voluntary Deferred Compensation Plan For Directors and with respect to which Mr. Wender, Ms. Lisa Hess and Mr. Muzio have no voting or investment power until such shares are distributed in accordance with the plan.

■For our executive officers, the amounts referenced in the table for the conversion of stock-settled RSUs include shares payable upon: (1) the vesting of time-based RSUs and (2) the conversion of vested RSUs subject to a one-year post vest hold.

|

|

|

|

|

|

|

Beneficial Ownership of Common Stock

|

■Shares that may be issued within 60 days of March 15, 2021 upon the conversion of phantom stock awards granted to our non-employee directors as follows: Mr. Wender—59,365 shares; Mr. Culang—60,667 shares; and all current directors and executive officers as a group—120,032 shares. All vested phantom stock awards granted to a director will be converted into shares of our common stock upon the director’s departure from our board.

|

|

|

|

|

Security Ownership of Certain Stockholders

|

The following table provides information concerning beneficial ownership of our common stock by the only persons shown by our records or the SEC’s public records as beneficially owning more than 5% of our common stock. For purposes of determining the existence and identity of, and the amount of common stock owned by, any stockholder, we rely on filings with the SEC of Schedules 13D, 13F and 13G (or any similar filings) as of any date, subject to our actual knowledge of the ownership of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Business Address

|

Shares

Beneficially

Owned (#)

|

Percent

of Class*

|

|

FMR LLC (1)

245 Summer Street

Boston, MA 02210

|

17,220,405

|

|

|

8.99

|

%

|

|

|

The Vanguard Group (2)

100 Vanguard Blvd.

Malvern, PA 19355

|

17,174,864

|

|

|

8.97

|

%

|

|

|

BlackRock, Inc. (3)

55 East 52nd Street

New York, NY 10055

|

16,235,333

|

|

|

8.50

|

%

|

|

*Based on shares of common stock outstanding at December 31, 2020.

(1)Based on a Schedule 13G/A filed with the SEC on February 5, 2021. These securities are beneficially owned by FMR LLC and various investment management subsidiaries and affiliates of FMR LLC. FMR LLC reports that it has sole dispositive power with respect to 17,220,405 shares and sole voting power with respect to 2,307,480 shares. Members of the Johnson family, including Abigail P. Johnson, a Director, Chairman and the Chief Executive Officer of FMR LLC, may be deemed to control FMR LLC.

(2)Based on a Schedule 13G/A filed with the SEC on February 8, 2021, The Vanguard Group reports that it has sole dispositive power with respect to 16,820,624 shares, shared dispositive power with respect to 354,240 shares and shared voting power with respect to 194,863 shares. These shares are beneficially owned by funds and accounts managed by The Vanguard Group, Inc. and its subsidiaries.

(3)Based on a Schedule 13G/A filed with the SEC on February 5, 2021, BlackRock, Inc. reports that it has sole dispositive power with respect to 16,235,333 shares and sole voting power with respect to 15,302,141 shares. These shares are beneficially owned by funds and accounts managed by BlackRock, Inc. and its subsidiaries.

|

|

|

|

|

Delinquent Section 16(a) Reports

|

Section 16(a) of the Exchange Act requires our executive officers and directors and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC and to furnish copies of these reports to us. Based on our review of the copies of the reports we have received, and written representations received from our executive officers and directors with respect to the filing of reports on Forms 3, 4 and 5, we believe that all filings required to be made during 2020 were made on a timely basis except: two Form 4s for each of Messrs. Wender and Culang that were each filed one day late reporting dividend equivalents accrued on previously awarded phantom stock units, and one Form 4 for each of our NEOs and Messrs. McMahon and Quigley in connection with the vesting of one tranche of time-based restricted stock units and associated tax withholding of shares which transactions were subsequently reported on a Form 5 filed on behalf of each of the NEOs and Messrs. McMahon and Quigley.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

|

|

|

|

|

Compensation Discussion and Analysis

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CD&A Roadmap

|

|

I.

|

|

|

The following Compensation Discussion and Analysis includes “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the U.S. Private Securities Litigation Reform Act of 1995. These statements, which may include, without limitation, projections regarding our future performance and financial condition, are made on the basis of management’s current views and assumptions with respect to future events and are not a guarantee of future performance. For more information regarding these risks and uncertainties as well as certain additional risks that we face, you should refer to the Cautionary Note Regarding Forward Looking Statements—Safe Harbor Provisions and the Risk Factors detailed in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020. We caution you not to place undue reliance on these forward-looking statements, which are current only as of the date of this Compensation Discussion and Analysis. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason.

|

|

II.

|

|

|

|

III.

|

|

|

|

IV.

|

|

|

|

V.

|

|

|

|

VI.

|

|

|

|

VII.

|

|

|

|

VIII.

|

|

|

In this CD&A, we discuss the executive compensation program for our NEOs, including our Chief Executive Officer, our Chief Financial Officer and our three other most highly compensated executive officers. For 2020, our NEOs were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Named Executive Officers*

|

|

Richard G. Thornberry

Chief Executive Officer

(principal executive officer)

|

J. Franklin Hall

Senior EVP,

Chief Financial Officer

(principal financial officer)

|

Derek V. Brummer

President, Mortgage

|

Edward J. Hoffman

Senior EVP,

General Counsel and Corporate Secretary

|

Eric R. Ray

Senior EVP,

Chief Digital Officer and Co-Head of Real Estate

|

*Please see “Executive Officers” above for additional information regarding our NEOs.

I. Compensation Principles and Objectives

Our executive compensation program is designed under the direction of the Compensation and Human Capital Management Committee of our Board (the “Committee”) to attract, motivate and retain high quality executive officers and to align our pay-for-performance philosophy with our overall business and strategic objectives. This pay-for-performance philosophy is intended to ensure that our NEOs’ interests are aligned with those of our stockholders, while not encouraging inappropriate actions, including unnecessary or excessive risk taking. The Committee has developed a set of principles and objectives to guide decisions about how to compensate executive officers appropriately for their contributions toward achieving our strategic, operational and financial objectives. Specifically, the Committee believes our executive compensation program should:

■Support the execution of our business strategy and performance, taking into consideration our ESG related initiatives and objectives;

■Focus executives on long-term performance that aligns with stockholders’ interests;

■Maintain an appropriate balance between short-term and long-term compensation, while weighting total compensation in favor of longer-term variable pay;

■Manage risk with appropriate protection and controls;

■Maintain pay practices that are externally competitive and reasonable; and

■Remain flexible to respond to changes in our businesses, strategies and current market developments.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

II. Executive Summary

As background for the discussion that follows, we provide the following highlights regarding our 2020 performance and the material decisions affecting the 2020 compensation program for our NEOs.

Our 2020 Financial Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$393.6 million

Net Income

|

|

41% decrease compared to net income of $672.3 million in 2019. The COVID-19 pandemic had a significant negative impact on our 2020 results of operations, primarily driven by losses associated with a material increase in mortgage insurance defaults, substantially all related to defaults of loans subject to mortgage forbearance programs implemented in response to the COVID-19 pandemic

|

|

|

11.0 million

Shares Repurchased

|

|

Purchased $226 million or 11.0 million shares of Radian Group common stock before the onset of the COVID-19 pandemic in 2020

|

|

|

|

$105.0 billion

New Insurance

Written

|

|

47% increase compared to $71.3 billion in 2019. New Insurance Written ("NIW") for the full year 2020 set a Company record for the fifth consecutive year for NIW written on a flow basis

|

|

$2.00

Diluted Net Income

Per Share

|

|

38% decrease compared to diluted net income per share of $3.20 in 2019

|

|

|

$246.1 billion

Primary Insurance

in Force

|

|

2% increase compared to $240.6 billion as of December 31, 2019

|

|

$1.74

Adjusted Diluted Net

Operating Income

Per Share (1)

|

|

46% decrease compared to adjusted diluted net operating income per share of $3.21 in 2019

|

|

|

11% increase

in Book Value per

Share

|

|

Book value per share of $22.36 as of December 31, 2020, compared to $20.13 as of December 31, 2019

In addition, dividends and dividend equivalents declared in 2020 were $98.8 million, or 2.4% of book value per share as of December 31, 2019

|

|

9.4%

Return on Average Equity

|

|

Compared to 17.8% return on equity in 2019

|

|

|

$1.1 billion

Available Holding Company Liquidity

|

|

Compared to $652.6 million as of December 31, 2019. Available liquidity includes the minimum liquidity requirement under the Company's unsecured revolving credit facility of $35 million

|

|

8.2%

Adjusted Net Operating

Return on Average Equity (1)

|

|

Compared to 17.9% adjusted net operating return on equity in 2019

|

|

|

$1.3 billion

PMIERs Excess Available Assets (2)

|

|

Compared to $804.1 million as of December 31, 2019

|

(1)On a consolidated basis, adjusted pretax operating income, adjusted diluted net operating income per share and adjusted net operating return on equity are non-GAAP financial measures. See pages 82 through 84 of our Annual Report on Form 10-K for the year ended December 31, 2020, for definitions of our non-GAAP financial measures, including reconciliations of the most comparable GAAP measures of consolidated pretax income, diluted net income per share and return on equity, to our non-GAAP financial measures of adjusted pretax operating income, adjusted diluted net operating income per share and adjusted net operating return on equity, respectively.

(2)Represents Radian Guaranty’s excess of Available Assets over its Minimum Required Assets (MRA) or “cushion,” calculated in accordance with the PMIERs financial requirements in effect for each date shown.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

Our 2020 Strategic Performance

Navigated COVID-19 Pandemic

We Kept our Employees Safe and Engaged. We seamlessly transitioned almost our entire workforce to a work-from-home model, launched new employee communications and engagement channels, revised our benefits programs, and focused on employee well-being through surveys, town-halls and CEO-led roundtables. We adjusted our talent development and recruiting strategies, ultimately hiring over 700 positions virtually. We also proactively addressed the myriad of complex issues presented by the social unrest in 2020 by further advancing our Diversity, Equity and Inclusion Initiative, encouraging dialogue and reconstituting our Employee Resources Groups.

We Supported Mortgage Borrowers. To support borrowers impacted by COVID-19, we aligned our policies and procedures with GSE initiatives, including mortgage forbearance programs, foreclosure and eviction moratoriums, changes to underwriting documentation requirements, and flexibilities related to home appraisals and loan closings. In our Real Estate businesses, we restructured our offices to allow our essential workers to continue to process real estate and mortgage closings safely, while adopting innovative solutions such as remote notarizations and “drive-through” closings.

We Served our Corporate Purpose. Our business model is designed to withstand economic cycles by continuously serving as a permanent source of first-loss risk protection for mortgage credit and a facilitator of real estate transactions, regardless of the environment. There was no better test of this model than in 2020, during which we were confronted with the unprecedented economic volatility caused by the COVID-19 pandemic as well as the largest mortgage market in history. Our business model effectively managed these dueling stresses, as we successfully absorbed significant losses while continuing to produce earnings and returning capital to stockholders, and at the same time, wrote the most annual NIW on a flow basis ($105.0 billion) in our history.

Maintained our Focus on Risk Management

We Grew our Insured Portfolio with Record, High-Quality NIW. In our Mortgage business, we leveraged our RADAR Rates pricing platform to quickly respond to the changing economic and competitive environment, successfully shifting the profile of 2020 NIW towards stronger risk characteristics with lower levels of layered risks. We made these changes without sacrificing volume (writing a record of $105.0 billion of NIW on a flow basis) or projected returns on required capital (15.6% on 2020 NIW), resulting in a growth in insurance-in-force in 2020 to $246.1 billion and an increase in the overall economic value of our insured portfolio.

Managed our Capital and Liquidity Positions

We Improved our Capital and Liquidity Positions. At the onset of the pandemic, recognizing the significant future uncertainty it presented, we reacted with urgency by temporarily suspending our share repurchase program, issuing $525 million in new senior debt, extending our credit facility into 2022 and working with the GSEs to develop an appropriately tailored amendment to the PMIERs to reflect the unprecedented economic environment. We further enhanced our capital position in 2020 by distributing risk through two mortgage insurance-linked note transactions of approximately $879 million and a new quota share reinsurance transaction for our single premium policies. As a consequence, we finished 2020 with $1.1 billion in available holding company liquidity and $1.3 billion of Available Assets in excess of PMIERs requirements at Radian Guaranty.

We Remained Focused on Returning Value to Stockholders. Prior to the onset of the COVID-19 pandemic, we used $226.3 million to purchase 11.0 million shares of our outstanding common stock and increased our quarterly dividend significantly to $0.125 per share. We maintained this dividend throughout the pandemic, ultimately issuing $97.5 million in dividend payments to stockholders in 2020.

Executed our Strategy to Grow and Diversify our Businesses

and Digitally Transform our Businesses

We Continued to Grow our Real Estate Market Presence and Capabilities. Despite a challenging pandemic environment, we grew our Real Estate revenues by 14% in 2020, with strong momentum in our Title business, including a 238% year-over-year increase in closed title insurance orders and a strong sales pipeline of large customers going into 2021. We remained focused on optimizing and validating our Real Estate businesses by driving competitively differentiated, data-driven, digital products and services to our target customers and by eliminating products and services, including our loan due diligence business and our traditional appraisal business, that were not well aligned with our strategy.

We Embraced Technology to Enhance the User Experience and Drive Process Efficiencies. We continued to prioritize digital transformation across our businesses by completing a long-term Mortgage operating platform modernization project to retire legacy systems and databases, enhancing our RADAR Rates MI pricing platform, launching myRadian

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

(a new digital platform for customers to access our entire suite of Valuation and Asset Management services), launching the Radian Home Price Index a home price analysis platform, implementing and increasing our use of Robotic Process Automation to drive automation and efficiency in our real estate businesses, market testing innovative technology solutions in our Real Estate business and redesigning and launching a new One Radian website.

Please see “—IV. Primary Components of Compensation—B. Short-Term Incentive Program—2020 Short-Term Incentive Analysis” for additional information regarding our 2020 performance.

Our 2020 Executive Compensation Program

We Did Not Change our Compensation Programs in light of the COVID-19 Pandemic.

The COVID-19 pandemic had a significant impact on our financial results and the demand for certain of our products and services. This impact in turn had a negative impact on certain components of our executive compensation programs, including certain metrics under our 2020 STI program and our outstanding LTI awards. Throughout 2020, the Committee reviewed our compensation programs to ensure that they remained suitable for measuring performance and motivational for driving the performance of our NEOs. As discussed below under “—IV. Primary Components of Compensation—B. Short-Term Incentive Program—2020 Short-Term Incentive Analysis” the Committee used the existing discretion available within our 2020 STI program to account for the impact of the COVID-19 pandemic on our financial results and in assessing our strategic performance under the 2020 STI program, but the Committee made no structural changes to our 2020 STI program or to our outstanding LTI award as a result of the COVID-19 pandemic and the unprecedented economic, market and operational environments it produced. We believe the fact that our 2020 STI program remained suitable for evaluating performance despite the significant disruptions caused by the COVID-19 pandemic is a strong validation of its design, including importantly, the limited flexibility built into the 2020 STI program, which allows for a modest amount of discretion to address unplanned events impacting overall performance.

We Have Implemented Strong Governance and Compensation Practices; We Do Not Engage in Problematic Pay Practices.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What We Do

|

|

What We Don't Do

|

ü

|

Heavily weight NEO compensation towards performance-based, variable compensation

|

|

V

|

Do not provide gross-ups for excise taxes

|

|

ü

|

Utilize a fully independent compensation committee and compensation consultant to oversee NEO compensation

|

|

V

|

Do not allow hedging or other speculative transactions in Radian stock

|

|

ü

|

Impose a “double-trigger” for payments upon a change of control

|

|

V

|

Do not employ retirement plans exclusively for executive officers

|

|

ü

|

Impose a strong compensation clawback policy in the event of a material restatement of the Company’s financial results and for other reasons

|

|

V

|

Do not provide for liberal share recycling under our equity incentive plan

|

|

ü

|

Impose rigorous stock ownership and share retention requirements, including a one-year post- vest hold for performance-based equity awards

|

|

V

|

Do not pay dividends on unvested equity awards (dividends are accrued until awards have vested)

|

|

ü

|

Provide limited perquisites

|

|

|

|

|

ü

|

Encourage and solicit stockholder feedback regarding our executive compensation program

|

|

|

|

NEO Compensation Heavily Weighted Towards Performance-Based, Variable Compensation.

Fixed compensation continues to represent a limited portion of our NEOs’ total compensation. Base salary represented only 15% of Mr. Thornberry’s 2020 total target compensation and, on average, only 24% of the total target compensation for our other NEOs. The remaining target compensation of our NEOs was tied to, and is contingent upon, Company and individual performance. The following charts highlight, for the CEO and our other NEOs, the percentage of 2020 total target compensation that was attributable to each primary component of compensation (average of each

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

component for the other NEOs). The information presented is based on components of compensation at target, and therefore, is not directly comparable to amounts set forth in the 2020 Summary Compensation Table.

2020 STI Awards Funded Slightly Above Target, Reflecting Record Level of NIW Volume, Strong NIW Returns and Exceptional Strategic Performance, Including Successfully Navigating the COVID-19 Pandemic.

As discussed above, the COVID-19 pandemic had a significant negative impact on our results of operations, with the increase in COVID-19 pandemic-related defaults driving a 268% year-over-year increase in our provision for losses. Despite these financial results, we believe 2020 represented an exceptionally strong performance year for our NEOs. Operating under the unifying strength of our One Radian brand, we wrote a record level of NIW on a flow basis of $105.0 billion, grew our insurance-in-force to $246.1 billion and our book value per share by 11%, improved Radian Guaranty’s capital position under the PMIERs and our overall financial strength and flexibility, and remained focused on returning value to stockholders by significantly increasing our quarterly dividend and repurchasing 11.0 million of our common shares. Strategically, we continued to diversify our businesses. We grew our Real Estate revenues by 14% in a difficult operating environment, built strong momentum in our Title business, and continued to invest in growing and optimizing our other Real Estate businesses. Our core enterprise risk management competencies were instrumental in addressing the COVID-19 pandemic environment. In our Mortgage business, we were able to leverage our RADAR Rates pricing platform to quickly respond to the changing economic and competitive environment and successfully shift the profile of 2020 NIW towards stronger risk characteristics with lower levels of layered risks. Most importantly, we reacted quickly to the unprecedented environment created by the COVID-19 pandemic, keeping our employees safe and engaged while we supported homeowners impacted by the COVID-19 pandemic by aligning our policies and procedures with GSE initiatives, and demonstrated the strength and resilience of our business model as a permanent source of first-loss, through-the-cycle risk protection for mortgage credit and a facilitator of real estate transactions, regardless of the economic and operating environment. In recognition of these achievements, the independent directors awarded Mr. Thornberry a STI award of 116% of target and the Committee awarded STI awards to our other NEOs of between 116% and 117% of target. See “—IV. Primary Components of Compensation—B. Short-Term Incentive Program—2020 Short-Term Incentive Analysis” for additional information regarding the 2020 STI awards.

STI Awards Have Consistently Demonstrated Strong Correlation Between Pay and Performance. For 2020, the Impact of the COVID-19 Pandemic on our Financial Performance Resulted in Lowest Level of STI Payouts Since 2015.

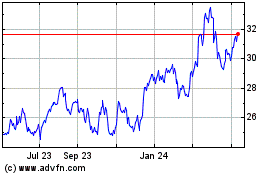

As demonstrated in the following chart, over the past ten years, the Committee's decisions regarding STI awards as a percentage of target have demonstrated a strong correlation between pay and performance throughout various business cycles.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

Recovering from Financial Crisis (1)

|

Growing

Traditional MI (2)

|

Growing and Diversifying (3)

|

|

2009 - 2011

|

2012 - 2014

|

2015 and Ongoing

|

(1)Recovering from Financial Crisis. This period followed the 2008 Financial Crisis and was characterized by overcoming significant losses, preserving capital and flexibility, retaining customer relationships and GSE eligibility and protecting employee morale and motivation. STI awards during this period generally reflected our poor financial performance following the financial crisis. In 2009, following the financial crisis, the Committee replaced our short-term bonus plan with the Radian Group Inc. Short-Term and Medium Term Incentive Plan for Executive Employees (the “STI/MTI Plan”). The STI/MTI Plan includes short-term cash incentive awards and provides the Committee with the flexibility to include medium-term cash incentive awards (an "MTI component") based on a medium-term (two-year) performance period, during which our executive officers would continue to have pay at risk associated with actions taken (e.g., the credit performance and projected profitability of insurance written) during the short-term performance period. The Committee included an MTI component in our cash-based incentive programs for awards granted in 2009 through 2017. See “IV. Primary Components of Compensation—B. Short-Term Incentive Program—Overview of Annual Program Design.”

(2)Growing Traditional MI. This period was characterized by rebuilding customer relationships, divesting our former financial guaranty business, improving financial strength and flexibility, modernizing our operations and technology, enhancing our risk capabilities to take into consideration lessons learned from the 2008 Financial Crisis and new data sources and technologies, and growing our talent base. STI awards during this period generally reflected: (1) a return to operating profitability; (2) on-going compliance with PMIERs; and (3) improvement in our capital and liquidity positions and corresponding rating agency upgrades.

(3)Growing and Diversifying. This period is characterized by: (1) continuing to enhance our traditional Mortgage business through innovative customer solutions, operational excellence and service; (2) applying our mortgage credit expertise to pursue opportunities outside of traditional mortgage insurance; (3) expanding our presence throughout the mortgage and real estate value chain to include Title and other real estate services; and (4) unifying the collective strength of our products and services under the One Radian brand to provide unique, data- and analytics- driven solutions to our customers that differentiate us in the marketplace. Other than in 2015 when we underperformed relative to our financial plan, STI awards during this period generally have reflected: (i) growth in our insured portfolio (multiple years of record-breaking volumes of flow NIW) and the transformation of our traditional Mortgage business to succeed in the evolving and dynamic pricing and competitive landscape; (ii) significant enhancements to our capital and liquidity positions, including enhanced risk distribution strategies to increase returns on capital and reduce “through the cycle” volatility; and (iii) our

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

ongoing efforts to diversify our revenue sources, including through acquisitions aimed at increasing our presence throughout the mortgage, title and real estate value chain.

Sixty-Percent of 2020 Annual LTI Awards are Performance-Based, Requiring Strong Absolute Growth in Book Value.

Our 2020 LTI awards provide for meaningful payouts only if we produce strong growth in book value. The performance-based RSUs, which represent 60% of the total target value of our NEOs' 2020 LTI awards, have an absolute book value growth metric. The Company must achieve at least a 25% increase in LTI Book Value per Share (as defined below in “—IV. Primary Components of Compensation—C. Long-Term Incentive Program—LTI Awards Granted in 2020—2020 Performance-Based RSUs”) over a three-year performance period for a NEO to be eligible to receive an award at target.

Time-Based RSUs vs Performance-Based RSUs

2020 Performance-Based RSUs

Book Value Per Share Growth Measures

beginning 3/31/2020

Failure to Perform Over the Long-Term Significantly Diminishes our NEOs’ Realized Pay.

A failure to achieve our long-term objectives will have a significant, negative effect on our NEOs’ realized pay. For example, the performance-based RSUs granted to our NEOs in 2013 and 2015 resulted in no payout at the end of their three-year performance periods in 2016 and 2018, respectively, and those granted in 2014 resulted in only a 4% of target payout for our NEOs upon the conclusion of the three-year performance period in 2017. Because these performance-based RSUs represented between 31% and 42% of 2013 through 2015 total target compensation for the CEO and between 24% and 32% of such compensation, on average, for our other NEOs who received these grants, realized pay for these NEOs was well below target compensation for these years. The following table illustrates, for the most recent five years, the payout levels (as a percentage of target payout) of our NEOs’ performance-based LTI awards following the conclusion of the three-year performance period in the years presented.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

III. Compensation Process and Oversight

A. Committee Process and Role

The Committee provides direction and oversight for our compensation and human resources programs, processes and functions. The Committee is supported by our Chief People Officer (“CPO”) and our General Counsel, who serve as liaisons to the Committee. The Committee has the sole authority to engage and terminate consulting firms and legal counsel as it deems appropriate to advise it and the Board with respect to executive compensation and human resources matters, including the sole authority to approve the compensation and other terms related to their engagement. The Committee currently retains Korn Ferry as its sole independent compensation consultant. Korn Ferry provides compensation advisory services to the Committee relating to the compensation of executive officers and non-executive directors. Generally, these services include advising the Committee on the principal aspects of our compensation programs and evolving industry practices and providing market information, risk assessments and other analyses regarding our program design and incentive plan practices, including our CEO performance assessment process. Other than this work, Korn Ferry performs no services for the Company. The Committee chair approves the payment of all work performed by the independent compensation consultant for the Company, and the Committee annually reviews the independence and performance of Korn Ferry. The Committee also engages, from time to time, external legal counsel to provide legal advice in connection with executive compensation matters. In 2020, the Committee assessed the independence of Korn Ferry and the Committee’s primary external counsel and concluded that the work performed by these advisors does not raise any conflict of interest. For a complete discussion of the responsibilities delegated by our Board to the Committee, please see the Committee charter, which is available on our website at www.radian.com.

B. Consideration of Stockholder Input Regarding our Executive Compensation Program

As part of our commitment to engage with our investors, management frequently meets with stockholders to discuss matters of significance to them, including our executive compensation program. These meetings are conducted in the ordinary course of business regardless of the level of stockholder support we receive for our executive compensation program in any given year. In addition, to the extent stockholders indicate a concern with respect to any aspects of our executive compensation program (through negative say-on-pay votes or otherwise), management will seek to identify those stockholders and better understand their concerns. This may occur as part of our solicitation efforts in connection with our annual meeting of stockholders or by other means.

Through our stockholder engagement process, we learn about our stockholders’ voting considerations, influences and processes, as well as their perspectives and priorities with respect to executive compensation, human capital management and other matters, including their perspectives on ESG and how our programs are designed to support our corporate purpose. Management shares this information with the Committee and with our Governance Committee, as relevant, and our Board committees regularly report to the full Board. Management and the Committee consider the outcome of our most recent say-on-pay vote and the information we learn from our solicitation and outreach efforts in

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

designing our executive compensation program each year. At our 2020 Annual Meeting of Stockholders, approximately 97.5% of the votes cast were voted in support of our executive compensation program. We very much appreciate this support from our stockholders.

C. Setting Compensation

To set compensation for the NEOs, we utilize different compensation tools, including external benchmarking, internal equity, and wealth accumulation analyses. These collectively represent our “primary compensation tools” for establishing appropriate compensation levels for our NEOs. In addition, when evaluating a NEO’s compensation, the Committee typically will assess the NEO’s overall performance, skill sets, experience and current and potential future career path within the Company. For the compensation of the NEOs other than the CEO, the main participants in our compensation process are the Committee, its independent compensation consultant and two members of management—the CEO and the CPO. The Committee has ultimate authority over compensation decisions for the NEOs other than the CEO. The process for establishing the compensation of our NEOs other than the CEO is as follows.

We believe that management’s participation in the compensation process is critical to an equitable program that is effective in motivating our NEOs, and to ensure that the process appropriately reflects our pay-for-performance culture, current strategies and our focus on risk management. Our NEOs annually develop a set of shared performance goals and associated metrics, which are predominantly based on the Company’s annual operating plan that is approved by our Board, including those annual objectives that are intended to further drive our long-term strategic vision. In addition, each NEO develops a set of individual performance goals and presents them to the CEO, who reviews and adjusts them, as necessary, and then presents them to the Committee. These shared and individual performance goals and metrics serve as the primary basis for determining a NEO’s STI award. The process for assessing performance against these objectives is discussed in greater detail below. See “—IV. Primary Components of Compensation—B. Short-Term Incentive Program—2020 Short-Term Incentive Analysis.”

With respect to the CEO, the independent directors of our Board have the ultimate authority over compensation decisions. The process for establishing the compensation of our CEO is as follows.

Benchmarking Compensation

We consider external benchmarking to be an important analytical tool to help us establish competitive points of reference for evaluating executive compensation. We benchmark each executive officer position annually and, if necessary, when a search for a new executive officer position is undertaken. It has been our practice to collaborate with

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

the Committee’s independent compensation consultant in this process to apply a consistent and disciplined approach in our benchmarking methodology and philosophy.

For 2020 compensation, we benchmarked each of the primary components of our 2020 compensation program, as well as the 2020 total target cash and direct compensation for each NEO, to external market reference points. In benchmarking a NEO’s total target cash compensation, we consider base salary plus cash-based short-term incentives. Total target direct compensation consists of target cash compensation plus the annualized accounting value of long-term incentives. To the extent information was available, our NEOs’ compensation was benchmarked against similarly situated executive positions at other companies using one or all of the following three reference points (collectively referred to as the “benchmark references”), as appropriate:

Primary Compensation Peer Group. On an annual basis, management prepares, and the Committee reviews and approves, a group of peer companies to serve as the primary compensation peer group that is relevant for evaluating executive officer compensation. For 2020 benchmarking, the Committee made the following changes to, and approved, the following peer group.

2020 Peer Group Changes

|

|

|

|

|

|

|

|

Changes from 2019 Peer Group

|

Rationale

|

|

Removed: Fidelity National Financial, Inc.

|

The Committee concluded that removing Fidelity National Financial, Inc. would improve the equivalence of the peer group to the Company from a revenue prospective and that the remaining Title peer companies would be sufficient for comparative purposes.

|

|

Added: Assured Guaranty Ltd.

|

The Committee concluded that adding Assured Guaranty was appropriate given its size, business focus, and their overall exposure to mortgage credit. The Committee also noted that Assured Guaranty was a commonly referenced peer among the Company’s peers.

|

2020 Peer Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 Peer

|

Mortgage Insurance Competitor

|

Real Estate and Other

Competitor

|

List Radian

as a Peer

|

Business

|

|

Assured Guaranty Ltd.

|

|

X

|

|

Insurance & Other Real Estate Services

|

|

Arch Capital Group Ltd.

|

X

|

|

X

|

Mortgage Insurance

|

|

Black Knight, Inc.

|

|

X

|

|

Mortgage & Real Estate Services

|

|

CoreLogic, Inc.

|

|

X

|

X

|

Mortgage & Real Estate Services

|

|

Essent Group Ltd.

|

X

|

|

X

|

Mortgage Insurance

|

|

First American Financial Corporation

|

|

X

|

|

Title & Other Real Estate Services

|

|

Genworth Financial, Inc.

|

X

|

|

X

|

Mortgage Insurance

|

|

MGIC Investment Corporation

|

X

|

|

X

|

Mortgage Insurance

|

|

Mr. Cooper Group, Inc.

|

|

X

|

X

|

Mortgage Servicing & Lending

|

|

NMI Holdings, Inc.

|

X

|

|

X

|

Mortgage Insurance

|

|

Old Republic Title Insurance Group, Inc.

|

|

X

|

|

Title & Other Real Estate Services

|

|

PennyMac Loan Services, LLC

|

|

X

|

X

|

Mortgage Servicing & Lending

|

|

Stewart Information Services Corp.

|

|

X

|

X

|

Title & Other Real Estate Services

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

2020 Peer Median (1)

|

Radian (1)

|

|

Revenue

|

$1,452

|

$1,345

|

|

Market Cap

|

$4,402

|

$4,753

|

(1)Determined as of August 2019 in connection with the Committee's assessment of our Primary Compensation Peer Group for benchmarking 2020 compensation.

We believe the companies included within our 2020 primary compensation peer group were appropriate to consider in evaluating 2020 compensation based on the following:

■In most cases, the roles and responsibilities of our NEOs were sufficiently similar to the equivalent executive positions within the primary compensation peer group;

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

■They represented our primary competition for talent; and

■We considered them a primary competitor of our Mortgage or Real Estate businesses, or otherwise having significant operations in the mortgage and real estate industry.

From time to time, third parties such as proxy advisory institutions establish peer groups for the Company for the purpose of assessing the Company’s relative performance and compensation. The Committee reviews these peer groups in the ordinary course but does not utilize these peer groups for the purpose of evaluating our NEOs’ compensation and the Company’s performance, mainly because the Committee believes the primary compensation peer group approved by the Committee represents the most appropriate compensation peer group for the Company for the reasons discussed above.

Financial Services and General Industry Reference Points. Because we compete for talent in markets other than those in which we compete for business, we also use broader financial services and general industry compensation reference points.

For benchmarking 2020 compensation, the financial services data and the general industry data were compiled by Willis Towers Watson, an independent third-party, from 224 organizations that participate in Willis Towers Watson’s Financial Services Executive Compensation Database (Financial Services) and from 811 organizations across a range of industries that participate in Willis Towers Watson’s General Industry Executive Compensation Database (General Industry).

For these two benchmark references, we used pre-established subsets of companies contained in the databases of Willis Towers Watson, so that we compared our NEOs’ compensation to that of companies of reasonably similar size to us. The subsets were based on standard revenue ranges that are provided in published compensation surveys. We did not select or have any influence over the companies that participated in these surveys, and we were not made aware of the companies that constituted these reference points. The subset of companies we used consists of a broad array of companies in the financial services industry, including property/casualty insurance, life/health insurance, and investment, brokerage and retail and commercial bank organizations. The financial services data was focused on companies with assets of less than $15 billion and revenues of less than $2 billion, while the general industry data was composed of companies with revenues of less than $3 billion.

We use benchmarking to identify a competitive compensation range for each executive officer position. From a quantitative perspective, we generally consider an executive officer’s compensation to be market competitive if it is within a 15% range of the median of the applicable benchmark references. However, because executive officer roles and responsibilities often vary within the industries in which we participate and in the broader financial services segment, our benchmarking process is tailored for each executive officer position, with an emphasis on benchmark data for comparable positions and, in particular, comparable positions in our primary compensation peer group, if available. For each executive officer, the Committee may use one or more of the three benchmark references or, in some cases, a subset of the primary compensation peer group, depending on its judgment concerning the comparability of executive officer roles to these benchmark references. As a result, the Committee’s assessment of market competitiveness, in addition to the quantifiable benchmark data, may take into consideration other factors such as the scale and scope of the companies as well as specific roles against which our executive officer positions are being compared and the potential market demand for such positions.

For each of the NEOs, the results of the benchmarking conducted by the independent compensation consultant in November 2019 for the purpose of setting 2020 total target direct compensation (expressed as a percentile of the benchmarked group) were as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Officer

|

Primary Compensation

Peer Group Reference Point

|

Financial

Services Reference Point

|

General

Industry Reference Point

|

|

Mr. Thornberry

|

Below 50th

|

At 50th

|

Between 50th and 75th

|

|

Mr. Hall

|

Below 50th

|

Below 50th

|

At 50th

|

|

Mr. Brummer

|

Below 50th

|

Between 50th and 75th

|

Between 50th and 75th

|

|

Mr. Hoffman

|

Below 50th

|

Between 50th and 75th

|

Above 75th

|

|

|

|

|

|

|

|

Mr. Ray

|

N/A

|

(1)

|

Between 50th and 75th

|

Above 75th

|

(1) Positions within the relevant benchmarked group were not sufficiently similar to the NEO’s role to provide an appropriate benchmark for compensation evaluation purposes.

As our benchmarking process for 2020 illustrates, while the Committee considers benchmarking a valuable reference point for assessing the competitiveness of the NEOs’ compensation, the Committee does not set compensation for the NEOs to adhere strictly to any specific benchmarked reference point.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

Internal Equity

While external benchmarking is important in assessing the overall competitiveness of our executive compensation program, we believe that our compensation program must also be internally consistent and equitable to reflect an executive’s responsibilities and contributions to value creation and to ensure teamwork and coordination across the organization. As a result, in addition to benchmarking, our CEO and the Committee have sought to achieve internal equity among our executive officer group, as appropriate, when setting the components of compensation.

For 2020 compensation, the Committee compared the compensation for each NEO (other than the CEO) against his peers in the executive officer group, making changes as appropriate to preserve internal equity among the executive officers other than the CEO. Although we monitor the difference in pay between the CEO and the other executive officers, given the uniqueness of the CEO position and the breadth of his responsibilities, we do not perform a formal internal equity analysis of the CEO relative to other executive officer positions.

Wealth Accumulation

The Committee regularly reviews “total reward” tally sheets for each of the NEOs and considers the current value and potential future value of existing equity awards as factors in evaluating a NEO’s compensation.

IV. Primary Components of Compensation

Our executive compensation program provides a balanced mix of pay through the following primary components, as highlighted by our CEO’s pay mix:

|

|

|

|

|

|

|

|

|

Base Salary (15% of CEO’s target compensation)

•Established to provide a competitive level of compensation for day-to-day performance of job responsibilities

Short Term Incentive (26% of CEO's target compensation)

•100% performance-based

•Ensures that significant portion of annual compensation is at risk

•Performance metrics designed to incent achievement of short-term corporate and individual performance goals that are critical to our strategic plan

Long-Term Incentive (59% of CEO's target compensation)

•Designed to drive sustained business performance, encourage retention, and align executives' interests with stockholders’ long-term interests through time-based and performance-based RSUs

•Performance-based RSU awards (60% of LTI) are payable in stock and only if performance targets are met

•Time-based RSU awards (40% of LTI) vest in equal installments over three years

|

A. Base Salary

Base salaries are paid to executive officers to provide them with a competitive level of compensation for the day-to-day performance of their job responsibilities. As discussed above, base salaries for the NEOs primarily are established based on competitive market compensation data and internal equity.

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

The following table provides the 2020 and current base salaries for each of the NEOs.

|

|

|

|

|

|

|

|

|

|

|

Executive Officer

|

2020 Base Salary (1)

|

2021 Base Salary (2)

|

|

Mr. Thornberry

|

$900,000

|

$1,000,000

|

|

Mr. Hall

|

$450,000

|

$475,000

|

|

Mr. Brummer

|

$500,000

|

$525,000

|

|

Mr. Hoffman

|

$450,000

|

$475,000

|

|

|

|

|

|

Mr. Ray

|

$425,000

|

$450,000

|

(1)Mr. Thornberry’s salary was increased for 2020 to improve competitiveness against the primary compensation peer group established for 2020 compensation. Mr. Brummer’s salary was increased for 2020 to reflect his additional responsibilities following his promotion to President, Mortgage. Base salaries for Messrs. Hall and Hoffman were increased in 2020 to improve market competitiveness against our 2020 primary compensation peer group and to reflect an increase in their responsibilities.

(2)Each of the NEO's salary was increased for 2021 to continue to improve competitiveness against the primary compensation peer group established for 2021 compensation benchmarking, as discussed above.

B. Short-Term Incentive Program

This discussion refers to the 2020 performance objectives for the Company and the NEOs as well as to the Company’s and NEOs’ actual 2020 performance results. These objectives and results are disclosed in the limited context of our compensation programs. We specifically caution investors not to apply these statements to other contexts.

Overview of Annual Program Design

Each year, the Committee brings a fresh perspective to designing our STI program, with a primary focus on creating a program that appropriately motivates the NEOs to achieve those financial and strategic objectives that are critical to driving long-term value for our stockholders. In designing the STI program each year, the Committee is guided by the following principles:

■Metrics should align with and support our strategic plan, taking into consideration our ESG initiatives and objectives

■Metrics should be appropriately tailored to drive long-term value creation, and should not incent excess risk-taking

■STI metrics should not overlap with LTI metrics

■To ensure a continuity of focus, we should avoid significant year-to-year changes, unless changes are necessary to align our compensation programs with changing business needs and priorities

■We should avoid unnecessary complexity wherever possible to increase transparency and a line-of-sight for the NEOs and others

■Discretion should be limited and used only where necessary

Our STI/MTI Plan allows the Committee to design cash incentive programs for performance periods of up to two years, with the STI period covering the first calendar year in which the award is granted, and if included, an MTI period covering the full two-year performance period (from January 1 of the year of grant through December 31 of the second performance year). Management and the Committee annually assess whether to include an MTI component as part of this cash incentive program. Consistent with its approach over the last two years, for 2020, the Committee determined not to include an MTI component, primarily to avoid the discretion and complexity associated with MTI and to promote a unified and consistent “One Radian” approach for all of our business lines.

2020 Short-Term Incentive Analysis

2020 STI Corporate Funding Level

The Committee (or the independent directors in the case of the CEO) retains ultimate authority with respect to amounts awarded to the NEOs under the STI/MTI Plan. The NEOs’ STI awards are determined based on the Company’s financial and strategic performance over the performance period (represented by the “STI Corporate Funding Level”) and each NEO’s performance against their individual performance goals. See “—III. Compensation Process and Oversight—C. Setting Compensation” above for a discussion of how each NEO’s individual performance objectives are established.

As discussed below for 2020 STI awards, each year, the Committee approves the STI Corporate Funding Level based on the NEOs’ collective performance against a shared set of financial and strategic goals approved by the Committee. The STI Corporate Funding Level serves as a baseline payout level for the NEOs’ STI awards, and therefore, is the

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

primary consideration for the amount to be awarded to each NEO. However, the amount of STI ultimately awarded to each NEO is determined based on how the NEO performs against their individual performance objectives. In making this determination for each NEO, the Committee or the independent directors may weigh the NEO’s various performance objectives differently in light of the NEO’s role, giving appropriate consideration to the degree to which each NEO impacted our performance and contributed to the STI Corporate Funding Level. Based on this assessment, the Committee or the independent directors may, depending on the circumstances, award the NEO an STI award at a level relative to the NEO’s target that is different than the STI Corporate Funding Level. See “2020 STI Payouts for NEOs” below for more information.

For 2020, the STI Corporate Funding Level for the NEOs’ STI awards was determined based on the Committee’s assessment of the Company’s performance against a shared set of financial and strategic performance metrics. As compared to the 2019 STI program, the Committee made the following changes to the 2020 STI program:

■Further reduced discretion in the program by increasing the weighting of the financial performance metrics to 70% (as compared to 65% in 2019) and decreasing the weighting of the strategic performance metrics to 30% (as compared to 35% in 2019);

■Emphasized that the value of the NIW we produce depends on both the amount of NIW we write and the returns on required capital that we expect to achieve on this NIW by equally weighting these financial performance metrics under “Value Achieved on NIW.” We believe that balancing these key components, rather than relying solely on volume, is critical to an effective Mortgage business strategy that is appropriately tailored to drive the economic value of our insured portfolio. The weightings of these metrics within the financial performance metrics were increased from 20% to 25%;

■Reduced the complexity of the STI program by:

■Reducing our financial performance metrics by eliminating Adjusted Operating Leverage and relying on Adjusted Diluted Net Operating EPS as the primary financial performance metric for driving expense management. The weighting for Adjusted Diluted Net Operating EPS within the financial performance metrics was increased from 40% to 50% in recognition of this greater reliance and focus.

■Consolidating our strategic performance metrics from five to three metrics and emphasizing the Company's focus on executing our strategic plan to grow and diversify our businesses.

Financial Performance Metrics

The following table highlights: (i) the 2020 metrics with corresponding targets and weightings; (ii) the Company’s actual performance against these targets; and (iii) the percentage payout for each area of performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Area and Weighting

|

Metric

|

2020 Performance Level (1)

|

2020

|

Metric

|

% of

|

|

Threshold

|

Target:

Low End

|

Target

|

Target:

High End

|

Maximum

|

Result

|

Weighting

|

Target

Achievement

|

|

Financial Performance Metrics

(70% Weighting)

|

Adjusted Diluted Net Operating EPS

|

$2.19

|

$2.80

|

$3.02

|

$3.10

|

$3.30

|

$1.74

|

50%

|

0

|

%

|

|

Value Achieved on NIW

|

|

|

|

|

|

|

|

|

|

NIW Volume

|

$40B

|

$55B

|

$60B

|

$65B

|

$70B

|

$107B

|

25%

|

200

|

%

|

|

Return on Capital

|

10%

|

14%

|

15%

|

16%

|

18%

|

15.6%

|

25%

|

106

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan Permitted Discretionary Adjustment (2):

|

7.5

|

%

|

|

Final Achievement of Financial Performance Metrics:

|

84

|

%

|

|

Weighted Achievement of Financial Performance Objectives (84% x 70%):

|

59

|

%

|

(1)Measured quantitatively, with performance relative to target resulting in the following funding levels: at or below Threshold = 0%; Target Low End = 90%; Target = 100%; Target High End = 110%; at or above Maximum = 200%. Funding percentages are interpolated for results between the referenced funding levels.

(2)For the financial performance metrics, within the parameters of the annual STI program design structure, the Committee has discretion to adjust the quantitative results negatively or positively by up to 15%, primarily to reflect factors impacting results that were not contemplated at the time targets were established. For 2019, the Committee used this structural program discretion to reduce the quantitative performance results by 5% to account for certain unplanned events that positively impacted our financial results. For 2020, the Committee again chose to utilize this structural program discretion, applying a 7.5% positive adjustment to our quantitative results to reflect the Company’s efforts in driving Adjusted Diluted Net Operating EPS throughout 2020. The 7.5% positive adjustment equates to a modest 15% of target achievement for Adjusted Diluted Net Operating EPS. In making this adjustment, the Committee recognized that absent the significant

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

negative impact of the COVID-19 pandemic on our MI loss provision, which as discussed above was primarily driven by mortgage defaults related to COVID-19 forbearance programs, the Company would have achieved its financial plan objectives for Adjusted Diluted Net Operating EPS.

|

|

|

|

|

Adjusted Diluted Net Operating EPS (0% Achievement)

|

|

Measured as (A) adjusted pretax operating income attributable to common stockholders, net of taxes computed using the Company’s statutory tax rate, divided by (B) the sum of the weighted average number of common shares outstanding and all dilutive potential common shares outstanding.

On a consolidated basis, adjusted pretax operating income and adjusted diluted net operating income per share are non-GAAP financial measures. See pages 82 to 84 of our 2020 Form 10-K for definitions of our non-GAAP financial measures including reconciliations of the most comparable GAAP measures of consolidated pretax income and diluted net income per share to our non-GAAP financial measures of adjusted pretax operating income and adjusted diluted net operating income per share.

|

|

2020 Target Setting

|

|

The target for 2020 STI ($3.02 per share) represented a 6% decrease over our 2019 actual performance of $3.21 per share, based on a corresponding projected decrease of $51 million in adjusted pretax operating income for 2020 over 2019.

Before consideration of the impacts of the COVID-19 pandemic, our 2020 target was expected to be particularly challenging given: (1) our aggressive targeted reduction in operating expenses to support investment in new business initiatives; (2) the positive impact on our 2019 Adjusted Diluted Net Operating EPS from a one-time adjustment to our earned premiums; and (3) the favorable loss development in 2019 that was not expected to continue for 2020. In evaluating our 2019 STI program, the Committee applied a 5% negative adjustment to our financial performance results given, among other factors, the one-time adjustment to our earned premiums in 2019.

|

|

|

|

|

|

Value Achieved on NIW — NIW Volume (200% Achievement)

|

|

Measured as new, traditional Mortgage business and the NIW equivalent of new insurance written through non-traditional Mortgage executions such as our participation in the GSEs credit risk transfer transactions.

|

|

2020 Target Setting

|

|

NIW targets for any particular year are not directly comparable to actual NIW performance in the immediately prior year given that NIW expectations largely are reset each year based on the projected size and composition of the mortgage market, among other variables.

The NIW target for 2020 STI ($60 billion) represented a 16% decrease compared to our 2019 actual performance of $73 billion. Our target for 2020 was established primarily based on: (i) the projected size of the mortgage market (using an average of estimates from the Mortgage Bankers Association, Fannie Mae and Freddie Mac), which projected a 5% decrease in total mortgage originations; (ii) our estimate of the private MI industry’s share of the mortgage origination market (i.e., the use of private MI as compared to FHA or other forms of credit enhancement); (iii) our projection regarding our market share, taking into consideration competition in the MI industry and our strategic focus on writing only NIW that we viewed as generating an acceptable level of economic value.

|

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

|

|

|

|

|

Value Achieved on NIW — Return on Capital (106% Achievement)

|

|

Measured as the after-tax, projected return on PMIERs-required capital with respect to traditional mortgage insurance after giving effect to projected investment income and the impact of reinsurance that is in place at the time the insurance was written, but excluding debt leverage.

|

|

2020 Target Setting

|

|

The target for 2020 STI of 15% represented a decrease compared to our 2019 actual performance of 20%. Our 2019 returns were benefited significantly by our execution of ILN reinsurance on a portion of our 2019 NIW, which increased our overall returns for 2019 NIW above our 2019 targeted level of 15%. As noted above, for 2020 STI awards, we excluded from our Return on Capital calculation the impact of reinsurance that is not in place at the time NIW is originated, effectively eliminating the potential benefit of ILN risk distribution transactions, which as currently conducted, provide reinsurance on NIW that is already in place. As a result, our 2020 STI target is not directly comparable to 2019 actual performance.

|

Strategic Objectives

Strategic objectives are measured qualitatively, taking into consideration the various factors that influence our NEOs’ decision-making throughout the performance period. The following tables highlight: (i) the strategic performance metrics and their weightings; and (ii) the percentage payout achieved for each performance metric.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Area

and Weighting

|

Metric

|

Metric Weighting

|

% of Target Achievement

|

|

Strategic Objectives

(30% Weighting)

|

Strategic Execution(1)

|

33.3

|

%

|

|

175

|

%

|

|

|

Risk Management(2)

|

33.3

|

%

|

|

200

|

%

|

|

|

Capital and Liquidity(3)

|

33.3

|

%

|

|

200

|

%

|

|

|

|

|

|

|

|

|

|

Achievement of Strategic Objectives:

|

192

|

%

|

|

|

Weighted Achievement of Strategic Objectives (192% x 30%):

|

57

|

%

|

|

(1)Defined as execution of the Company’s strategic plan to grow and diversify the Company’s Mortgage and Real Estate businesses through innovative business models that leverage the power of “One Radian” and the exponential value of operating excellence.

(2)Defined as ensuring the Company maintains comprehensive enterprise risk management, including credit, operational, underwriting, and counterparty risk/return discipline based on sound data and analytics, with an emphasis on risk culture, positive economic value, compliance and long-term profitability.

(3)Defined as optimizing our capital and liquidity to achieve strategic objectives by ensuring ongoing compliance with PMIERs, increasing our financial flexibility and aligning our credit ratings with our business objectives.

Please see “II. Executive Summary—Our 2020 Strategic Performance” above for information regarding our 2020 strategic performance.

Total 2020 STI Corporate Funding Level

The STI Corporate Funding Level for the 2020 STI awards was derived based on the combined percentages achieved for the financial performance metrics and strategic performance objectives, weighted 70% and 30%, respectively. As described above regarding 2020 performance against the metrics, the 2020 STI Corporate Funding Level was calculated as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 STI Corporate Funding Level

(as a percent of target)

|

Financial Performance Objectives

|

+

|

Strategic Performance

Objectives

|

=

|

STI Corporate

Funding Level

|

|

84% x 70% = 59%

|

192% x 30% = 57%

|

116%

|

2020 STI Payouts for NEOs

The amount of STI awarded to a NEO is based on the NEO’s achievement of specified performance goals for the applicable year. Corporate and business unit/departmental goals are established each year in the context of our annual business planning process and are approved by our Board. Using these objectives, individual performance goals are

|

|

|

|

|

|

|

Compensation of Executive Officers and Directors

|

established by each NEO and adjusted and approved by the CEO and the Committee (or the independent directors in the case of the CEO), as discussed in “—III. Compensation Process and Oversight” above. By tying the STI award to our annual operating plan, the Committee aims to ensure accountability, focus and alignment throughout the Company with respect to those matters determined to be most critical to driving long-term stockholder value.

At the end of each performance year, each NEO (other than the CEO) provides a performance self-assessment to the CEO and the CEO provides a similar self-assessment to the Committee, in each case including his level of attainment of the specified performance goals. The CEO reviews the performance of each NEO (other than himself) against his respective performance goals and makes specific recommendations to the Committee regarding the amount of STI, if any, to be awarded. Maximum achievement can result in an STI award of up to 200% of the target amount, while performance below expectations can result in a below-target award or no award.

The following tables set forth, for each NEO: (i) the maximum amount that could have been awarded under the STI/MTI Plan for 2020 STI performance; (ii) the NEO’s target 2020 STI award; (iii) the total amount actually awarded to the NEO based on 2020 STI performance; and (iv) individual performance highlights for each NEO supporting their 2020 STI award relative to the STI Corporate Funding Level.

2020 STI Awards

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

2020 Maximum