|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

(e)

|

Compensatory Arrangements of Certain Officers

|

New Employment Agreement – Richard G. Thornberry, Chief Executive Officer

Employment Agreement

On November 19, 2019, Radian Group Inc. (the “Company”) and Mr. Thornberry entered into a new Employment Agreement (the “2019 Employment Agreement”) pursuant to which Mr. Thornberry will continue to serve as the Company’s Chief Executive Officer through December 31, 2023 (the “Initial Term”) The 2019 Employment Agreement will automatically renew for a period of one year, unless either party provides at least 90 days’ written notice to the other party prior to the end of the Initial Term that the agreement will not be extended (the “Extended Term,” and together with the Initial Term, the “Term”). The 2019 Employment Agreement replaces Mr. Thornberry’s existing employment agreement that was entered into on February 8, 2017 (the “2017 Employment Agreement”), which would have expired by its terms on March 6, 2020.

The primary terms of the 2019 Employment Agreement (as further described below) are generally consistent with the terms of the 2017 Employment Agreement, except as follows:

|

|

•

|

Effective for 2020, Mr. Thornberry’s base salary will be $900,000 and his 2020 STI Target and 2020 LTI Target (each as defined below) will be $1,500,000 and $3,700,000, respectively. During the Term, Mr. Thornberry’s base salary will not be less than $900,000 and his total target compensation (comprised of annual base salary, target award under the Radian Group Inc. STI/MTI Incentive Plan for Executive Employees (the “STI Plan”) and target long-term incentive (“LTI”) award) will not be less than $6,100,000;

|

|

|

•

|

In the event of Mr. Thornberry’s termination without “Cause” or resignation for “Good Reason” (each as defined in the 2019 Employment Agreement), his outstanding equity awards will vest as if he had met the requirements for retirement under the applicable grant agreements;

|

|

|

•

|

In the event the agreement is not renewed by the Company as of December 31, 2023, Mr. Thornberry shall receive severance benefits (as described below), but with the prorated portion of his STI calculated based on the greater of: (1) the Pro Rata STI (as defined below) or (2) the STI amount he would have received for 2023 based on actual performance, as determined in accordance with the STI Plan; and

|

|

|

•

|

In the event of Mr. Thornberry’s termination without Cause or resignation for Good Reason on or after December 31, 2024, he will not receive severance benefits under the Employment Agreement, but he will remain eligible to receive any unpaid incentive award under the STI Plan for the fiscal year 2024, based on performance for such year.

|

Set forth below is a description of the 2019 Employment Agreement, which is qualified in its entirety by reference to the full text of the 2019 Employment Agreement, a copy of which is filed as Exhibit 10.1 and is incorporated by reference in this Current Report on Form 8-K.

As discussed above, the 2019 Employment Agreement provides that, subject to the terms and conditions of the agreement, Mr. Thornberry will serve as the Company’s Chief Executive Officer for the Initial Term, and further provides that after the Initial Term, the 2019 Employment Agreement will automatically renew for a one-year period unless either party provides the other with at least 90 days’ written notice of termination prior to the end of the Initial Term. Pursuant to the 2019 Employment Agreement, Mr. Thornberry will receive: (1) an annual base salary of $900,000 (which will be reviewed annually and may be increased, but not decreased, during the Term); (2) eligibility to earn an incentive award under the STI Plan (including any successor plan) in each fiscal year of

the Term, with his target award for the STI Plan for 2020 equal to $1,500,000 (the “2020 STI Target”); and (3) eligibility to receive long-term equity incentive awards in each fiscal year of the Term under the Company’s LTI program in amounts and on terms established by independent directors of the Board, with his target award for 2020 LTI (“2020 LTI Target”) set at $3,700,000. The 2019 Employment Agreement also provides that for each full fiscal year of the Term, Mr. Thornberry’s total target compensation (comprised of annual base salary, target award under the STI Plan and target LTI awards) will not be less than $6,100,000, with his STI target and LTI target for those years to be established by the independent directors of the Board in accordance with the Company’s process for setting executive compensation (for information on the Company’s process, see the Company’s Compensation Discussion and Analysis Section of the Company’s previously filed proxy statement for the May 15, 2019 annual stockholders’ meeting).

Pursuant to the 2019 Employment Agreement, Mr. Thornberry will receive the following severance benefits, in each case payable in accordance with the terms of the 2019 Employment Agreement, if his employment is terminated without “Cause” or if he terminates employment for “Good Reason” (each as defined in the 2019 Employment Agreement) and he executes and does not revoke a written release of any claims against the Company:

|

|

(1)

|

two times his base salary;

|

|

|

(2)

|

an amount equal to two times the greater of (a) his target incentive award under the STI Plan for the year in which the termination occurs (or if it has not yet been established, the target incentive award for the immediately preceding fiscal year) or (b) the 2020 STI Target;

|

|

|

(3)

|

a prorated target incentive award under the STI Plan equal to a pro rata portion of the greater of (i) his target incentive award for the year in which the termination occurs (or if it has not yet been established, the target incentive award for the immediately preceding fiscal year) or (ii) the 2020 STI Target (the “Pro Rata STI”), provided, however, that if the termination is a result of non-renewal of the agreement by the Company as of December 31, 2023, then Mr. Thornberry will receive the greater of the Pro Rata STI or the STI amount that he would have received based on performance for the 2023 fiscal year, as determined in accordance with the STI Plan;

|

|

|

(4)

|

reimbursement for the monthly cost of continued medical coverage at or below the level of coverage in effect on the date of termination until the earlier of: (x) 18 months after the termination date; (y) the date on which Mr. Thornberry becomes eligible to elect medical coverage under Social Security Medicare or otherwise ceases to be eligible for continued coverage under the Company’s health plan under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”); or (z) the date he is eligible to elect medical coverage under a plan maintained by a successor employer. During any period of continued medical coverage, the Company has agreed to reimburse Mr. Thornberry for the COBRA premiums paid by him, minus the employee contribution rate for such coverage under the Company’s health plan as of the date of termination;

|

|

|

(5)

|

vesting of any outstanding equity grants, including restricted stock units, performance units and stock options, as if Mr. Thornberry had met the requirements for retirement under the applicable grant agreements;

|

|

|

(6)

|

vesting of any retirement benefits under the Company’s Benefit Restoration Plan; and

|

|

|

(7)

|

the Accrued Obligations (as defined in the 2019 Employment Agreement).

|

If the 2019 Employment Agreement is terminated pursuant to its terms on December 31, 2024, Mr. Thornberry will not receive or be entitled to the severance benefits described above. However, if Mr. Thornberry’s employment is terminated for any reason other than “Cause” on or after December 31, 2024, he will remain eligible to receive any unpaid incentive award under the STI Plan for the 2024 year, based on his performance for 2024 and payable at the time that STI awards are paid to other executive officers

The 2019 Employment Agreement does not include any tax gross up for excise taxes. If an excise tax under section 4999 of the Internal Revenue Code of 1986, as amended is triggered by any payments upon a change of control, the aggregate present value of the payments to be made under the 2019 Employment Agreement will be reduced to an amount that does not cause any amounts to be subject to this excise tax so long as the net amount of the reduced payments, on an after-tax basis, is greater than or equal to the net amount of the payments without such reduction, but taking into consideration this excise tax.

The compensation payable to Mr. Thornberry under the 2019 Employment Agreement is subject to the Company’s written policies, including the Code of Conduct and Ethics (which includes the Company’s securities trading policy, the “Code of Conduct”), Incentive Compensation Recoupment Policy, and stock ownership guidelines, as currently in place or as may be amended by the Board. The 2019 Employment Agreement further provides that Mr. Thornberry will comply with the Restrictive Covenants Agreement (described below) and other written restrictive covenant agreements with the Company.

Restrictive Covenants Agreement

In connection with the 2017 Employment Agreement, Mr. Thornberry entered into a Restrictive Covenants Agreement, dated as of February 8, 2017, with the Company (the “RCA”). As further described in the RCA, Mr. Thornberry has agreed that for 18 months following termination of his employment for any reason (the “Restriction Period”) he will not compete with the Company. In addition, during the Restriction Period, he has agreed to restrictions on hiring and soliciting the Company’s employees and on soliciting the Company’s customers. The foregoing description of the RCA is qualified in its entirety by reference to the full text of the RCA, a copy of which is filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K dated February 7, 2017 and filed with the Securities and Exchange Commission on February 13, 2017.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

+

|

Management contract, compensatory plan or arrangement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

RADIAN GROUP INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: November 19, 2019

|

|

|

|

By:

|

|

/s/ Edward J. Hoffman

|

|

|

|

|

|

|

|

Edward J. Hoffman

|

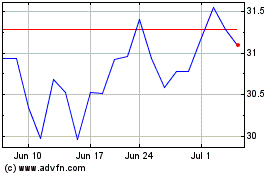

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

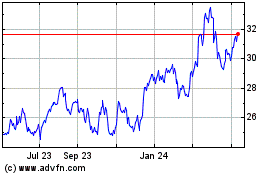

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024