Radian Group Inc. (NYSE: RDN) today reported a net loss for the

quarter ended March 31, 2013, of $187.5 million, or $1.30 per

diluted share, which included combined losses from the change in

fair value of derivatives and other financial instruments of $173.3

million. This compares to a net loss for the quarter ended March

31, 2012, of $169.2 million, or $1.28 per diluted share, which

included combined losses from the change in fair value of

derivatives and other financial instruments of $90.6 million. Book

value per share at March 31, 2013, was $5.39.

“We took the opportunity this quarter to significantly improve

our capital and liquidity positions, providing a competitive

advantage for Radian in an extremely attractive business

environment,” said Chief Executive Officer S.A. Ibrahim. “Building

on our momentum with a strong risk-to-capital ratio, financial

flexibility at the holding company, and the number one mortgage

insurance market share position in the fourth quarter of last year,

we kicked off 2013 with a 69% jump in new mortgage insurance

business written year-over-year.”

Ibrahim continued, “As our strong new business volume continues,

our delinquency inventory decreases and the mix of profitable new

business begins to outweigh our legacy mortgage insurance book, we

are positioning Radian for a return to operating

profitability.”

CAPITAL AND LIQUIDITY UPDATE

In March, Radian improved its capital and liquidity position

through a successful capital raise, resulting in net proceeds of

approximately $689 million. As previously reported, Radian Group

contributed $115 million of capital to Radian Guaranty in the first

quarter, in order to support the company’s strong risk-to-capital

position. Radian Guaranty’s risk-to-capital ratio was 18.6:1 as of

March 31, 2013. After the above-mentioned contribution of $115

million to Radian Guaranty, Radian Group maintains approximately

$815 million of currently available liquidity.

- Radian expects to maintain a

risk-to-capital ratio of 20:1 or below at Radian Guaranty for the

foreseeable future.

- The improvement in the risk-to-capital

ratio from December 31, 2012, was primarily driven by the $115

million capital contribution from Radian Group and a release of

Radian Asset’s contingency reserves of $68 million, partially

offset by an increase to the company’s net risk in force resulting

from strong, new mortgage insurance business volume.

- In order to proactively manage its

risk-to-capital position, Radian Guaranty entered into two quota

share reinsurance agreements in 2012 with the same third-party

reinsurance provider. As of March 31, 2013, a total of $2.4 billion

of risk in force was ceded under those agreements. Beginning April

1, the company reduced the amount of new business that will be

ceded to the reinsurer on a prospective basis from 20 percent to 5

percent. On December 31, 2014, and on December 31, 2015, Radian has

the ability, at its option, to recapture a portion of the business

that was reinsured.

- As of March 31, 2013, Radian Guaranty’s

statutory capital was $1.1 billion compared to $926 million at

year-end 2012, and $920 million a year ago.

FIRST QUARTER HIGHLIGHTS

- New mortgage insurance written (NIW)

was $10.9 billion for the quarter, compared to $11.7 billion in the

fourth quarter of 2012 and $6.5 billion in the prior-year quarter.

Radian wrote an additional $4.1 billion in NIW in April 2013,

compared to $2.5 billion in April 2012.

- The Home Affordable Refinance Program

(HARP) accounted for $2.5 billion of insurance not included in

Radian Guaranty’s NIW total for the quarter. This compares to $2.9

billion in the fourth quarter of 2012 and $929.9 million in the

prior-year quarter. As of March 31, 2013, more than 10 percent of

the company’s total primary mortgage insurance risk in force had

successfully completed a HARP refinance.

- Of the $10.9 billion in new business

written in the first quarter of 2013, 64 percent was written with

monthly premiums and 36 percent with single premiums.

- NIW continued to consist of loans with

excellent risk characteristics, with 75 percent consisting of loans

with FICO scores of 740 or greater.

- The mortgage insurance provision for

losses was $132.0 million in the first quarter of 2013, compared to

$306.9 million in the fourth quarter of 2012, and $234.7 million in

the prior-year period. The loss ratio in the first quarter for

Radian Guaranty was 72.1 percent, compared to 171.0 in the fourth

quarter of 2012 and 135.3 percent in the first quarter of 2012.

Mortgage insurance loss reserves were approximately $2.9 billion as

of March 31, 2013, which decreased from $3.1 billion as of December

31, 2012, and from $3.2 billion as of March 31, 2012. First-lien

reserves per primary default increased to $30,426 as of March 31,

2013, compared to $29,510 as of December 31, 2012, and $27,833 as

of March 31, 2012.

- The total number of primary delinquent

loans decreased by 9 percent in the first quarter from the fourth

quarter of 2012, and by 17 percent from the first quarter of 2012.

The primary mortgage insurance delinquency rate decreased to 10.9

percent in the first quarter of 2013, compared to 12.1 percent in

the fourth quarter of 2012, and 14.1 percent in the first quarter

of 2012. The company’s primary risk in force on defaulted loans was

$4.0 billion in the first quarter, compared to $4.3 billion in the

fourth quarter of 2012, and $4.9 billion in the first quarter of

2012.

- Total mortgage insurance claims paid

were $309.9 million in the first quarter, compared to $263.4

million in the fourth quarter, and $218.2 million in the first

quarter of 2012.

- $38.0 million of other operating

expenses in the first quarter represented compensation expenses

related to an increase in the estimated future value of performance

awards that are impacted by changes in the company’s stock price.

This increased compensation expense primarily reflects Radian’s

higher stock price in the first quarter. In 2012, such compensation

expenses were $13.5 million in the fourth quarter and $8.0 million

in the first quarter.

- Radian Asset Assurance Inc. continues

to serve as an important source of capital support for Radian

Guaranty and is expected to continue to provide Radian Guaranty

with dividends over time.

- As of March 31, 2013, Radian Asset had

approximately $1.2 billion in statutory surplus with an additional

$0.5 billion in claims-paying resources.

- In January, Radian Asset completed the

commutation of its remaining reinsurance risk from Financial

Guaranty Insurance Corporation (FGIC) of $822 million, which

resulted in a $7 million contingency reserve release in the first

quarter.

- In February, Radian Asset received

regulatory approval to release an additional $61 million of

contingency reserves, which benefited Radian Guaranty's statutory

capital position in the first quarter. The reserve release was

based on a reduction in Radian Asset’s net par outstanding,

resulting from the maturing of exposures and other terminations of

coverage.

- Radian Asset has paid a total of $384

million in dividends to Radian Guaranty since 2008, and expects to

pay another dividend of approximately $37 million in 2013.

- Since June 30, 2008, Radian Asset has

successfully reduced its total net par exposure by 76 percent to

$28.2 billion as of March 31, 2013, including large declines in

many of the riskier segments of the portfolio.

CONFERENCE CALL

Radian will discuss these items in its conference call today,

Wednesday, May 1, 2013, at 11:00 a.m. Eastern time. The conference

call will be broadcast live over the Internet at

http://www.radian.biz/page?name=Webcasts or at www.radian.biz. The

call may also be accessed by dialing 800-230-1096 inside the U.S.,

or 612-288-0329 for international callers, using passcode 290876 or

by referencing Radian.

A replay of the webcast will be available on the Radian website

approximately two hours after the live broadcast ends for a period

of one year. A replay of the conference call will be available

approximately two and a half hours after the call ends for a period

of two weeks, using the following dial-in numbers and passcode:

800-475-6701 inside the U.S., or 320-365-3844 for international

callers, passcode 290876.

In addition to the information provided in the company's

earnings news release, other statistical and financial information,

which is expected to be referred to during the conference call,

will be available on Radian's website under Investors >Quarterly

Results, or by clicking on

http://www.radian.biz/page?name=QuarterlyResults.

ABOUT RADIAN

Radian Group Inc. (NYSE: RDN), headquartered in Philadelphia,

provides private mortgage insurance and related risk mitigation

products and services to mortgage lenders nationwide through its

principal operating subsidiary, Radian Guaranty Inc. These services

help promote and preserve homeownership opportunities for

homebuyers, while protecting lenders from default-related losses on

residential first mortgages and facilitating the sale of

low-downpayment mortgages in the secondary market. Additional

information may be found at www.radian.biz.

FINANCIAL RESULTS AND SUPPLEMENTAL INFORMATION CONTENTS

(Unaudited)

For trend information on all schedules, refer to Radian’s

quarterly financial statistics at

http://www.radian.biz/page?name=FinancialReportsCorporate.

Exhibit A: Condensed Consolidated Statements of

Income Exhibit B: Condensed Consolidated Balance Sheets Exhibit C:

Segment Information Quarter Ended March 31, 2013 Exhibit D: Segment

Information Quarter Ended March 31, 2012 Exhibit E: Financial

Guaranty Supplemental Information Exhibit F: Mortgage Insurance

Supplemental Information New Insurance Written Exhibit G: Mortgage

Insurance Supplemental Information Insurance in Force and Risk in

Force by Product Exhibit H: Mortgage Insurance Supplemental

Information Risk in Force by FICO, LTV and Policy Year Exhibit I:

Mortgage Insurance Supplemental Information Pool and Other Risk in

Force, Risk-to-Capital Exhibit J: Mortgage Insurance Supplemental

Information Claims, Reserves and Reserve per Default Exhibit K:

Mortgage Insurance Supplemental Information Default Statistics

Exhibit L: Mortgage Insurance Supplemental Information Captives,

QSR and Persistency

Radian Group Inc. and

Subsidiaries Condensed Consolidated Statements of Income

Exhibit A Quarter Ended March

31,

(In thousands,

except per-share data)

2013 2012

Revenues: Net

premiums written - insurance $ 207,185 $

77,678

Net premiums earned - insurance

$ 192,588 $ 167,365

Net investment income

26,873 34,713

Net (losses) gains on investments

(5,505 ) 67,459

Change in fair value of derivative

instruments (167,670 ) (72,757 )

Net losses on

other financial instruments (5,675 ) (17,852 )

Other income 1,771 1,440

Total

revenues 42,382 180,368

Expenses: Provision for losses 132,059 266,154

Change in reserve for premium deficiency (629

) (20 )

Policy acquisition costs 17,195 28,046

Other operating expenses 80,100 50,154

Interest

expense 15,881 14,148

Total

expenses 244,606 358,482

Equity

in net income (loss) of affiliates 1 (11 )

Pretax loss (202,223 ) (178,125 )

Income

tax benefit (14,723 ) (8,893 )

Net

loss $ (187,500 ) $ (169,232 )

Diluted net loss per share (1) $ (1.30

) $ (1.28 )

(1) Weighted average

shares outstanding (in thousands)

Weighted average common shares outstanding

132,625 132,465

Increase in weighted average shares -

common stock offering 11,730 —

Weighted

average shares outstanding 144,355 132,465

For Trend Information, refer to our Quarterly Financial

Statistics on Radian’s (RDN) website.

Radian Group Inc. and Subsidiaries Condensed

Consolidated Balance Sheets Exhibit B

March 31 December 31

(In thousands,

except per-share data)

2013 2012

Assets: Cash and investments

$ 5,672,888 $ 5,208,199

Deferred policy

acquisition costs 74,601 88,202

Deferred income

taxes, net 17,902 —

Reinsurance recoverables

78,770 89,204

Derivative assets 6,429 13,609

Other assets 520,359 503,986

Total

assets $ 6,370,949 $ 5,903,200

Liabilities and stockholders’ equity: Unearned

premiums $ 673,849 $ 648,682

Reserve for

losses and loss adjustment expenses 2,919,073 3,149,936

Reserve for premium deficiency 3,056 3,685

Long-term debt 906,105 663,571

VIE debt

107,401 108,858

Derivative liabilities 430,898

266,873

Payable for securities purchased 37,491 697

Other liabilities 362,030 324,573

Total liabilities 5,439,903 5,166,875

Common stock 190 151

Additional paid-in

capital 1,450,057 1,075,320

Retained deficit

(542,741 ) (355,241 )

Accumulated other

comprehensive income 23,540 16,095

Total common stockholders’ equity 931,046

736,325

Total liabilities and stockholders’ equity

$ 6,370,949 $ 5,903,200

Book

value per share $ 5.39 $ 5.51

Radian Group Inc. and Subsidiaries Segment

Information Quarter Ended March 31, 2013 Exhibit

C Mortgage

Financial

(In

thousands)

Insurance Guaranty Total Revenues:

Net premiums written - insurance $ 217,286

$ (10,101 )

(1)

$ 207,185 Net premiums earned -

insurance $ 182,992 $ 9,596

(1)

$ 192,588 Net investment income 15,102

11,771 26,873 Net losses on investments

(3,237 ) (2,268 ) (5,505

) Net impairment losses recognized in earnings

— — — Change in fair value of derivative

instruments — (167,670 ) (167,670

) Net losses on other financial instruments

(1,877 ) (3,798 ) (5,675

) Other income 1,712 59

1,771 Total revenues 194,692

(152,310 ) 42,382

Expenses: Provision for losses 131,956

103 132,059 Change in reserve for premium

deficiency (629 ) — (629 )

Policy acquisition costs 11,732 5,463

17,195 Other operating expenses 65,780

14,320 80,100 Interest expense 2,669

13,212 15,881 Total expenses

211,508 33,098 244,606

Equity in net income of affiliates — 1

1 Pretax loss $ (16,816

) $ (185,407 ) $ (202,223

) Income tax benefit (14,723 )

Net loss $ (187,500 ) Cash

and investments $ 3,186,871 $

2,486,017 $ 5,672,888 Deferred policy

acquisition costs 29,920 44,681 74,601

Total assets 3,663,552 2,707,397

6,370,949 Unearned premiums 428,574

245,275 673,849 Reserve for losses and loss

adjustment expenses 2,894,500 24,573

2,919,073 VIE debt 11,062 96,339

107,401 Derivative liabilities —

430,898 430,898

(1)

Reflects the impact of the commutation

of reinsurance business.

Radian Group Inc. and Subsidiaries Segment

Information Quarter Ended March 31, 2012 Exhibit

D Mortgage

Financial

(In

thousands)

Insurance Guaranty Total Revenues:

Net premiums written - insurance $ 196,853 $ (119,175

)

(1)

$ 77,678

Net premiums earned - insurance $

173,451 $ (6,086 )

(1)

$ 167,365

Net investment income 18,011 16,702 34,713

Net

gains on investments 32,178 35,281 67,459

Change in fair

value of derivative instruments 21 (72,778 ) (72,757 )

Net

losses on other financial instruments (709 ) (17,143 ) (17,852

)

Other income 1,344 96 1,440

Total

revenues 224,296 (43,928 ) 180,368

Expenses: Provision for losses 234,729 31,425 266,154

Change in reserve for premium deficiency (20 ) — (20 )

Policy acquisition costs 8,646 19,400 28,046

Other

operating expenses 36,265 13,889 50,154

Interest expense

1,722 12,426 14,148

Total expenses 281,342

77,140 358,482

Equity in net loss of

affiliates — (11 ) (11 )

Pretax loss

(57,046 ) (121,079 ) (178,125 )

Income tax (benefit)

provision (11,799 ) 2,906 (8,893 )

Net loss $

(45,247 ) $ (123,985 ) $ (169,232 )

Cash and

investments $ 3,259,204 $ 2,392,620 $ 5,651,824

Deferred

policy acquisition costs 49,786 58,155 107,941

Total

assets 3,476,732 2,971,789 6,448,521

Unearned premiums

256,809 315,756 572,565

Reserve for losses and loss adjustment

expenses 3,230,938 85,426 3,316,364

VIE debt 8,625

246,609 255,234

Derivative liabilities — 202,100 202,100

(1)

Reflects the impact of the commutation

of reinsurance business.

Radian Group Inc. and Subsidiaries

Financial Guaranty Supplemental Information Exhibit E

Quarter Ended March 31,

(In

thousands)

2013 2012

Net Premiums Earned:

Total Premiums Earned - insurance $ 12,043 $

16,178

Impact of commutations and reinsurance (2,447

) (22,264 )

Net Premiums Earned - insurance $

9,596 $ (6,086 )

Refundings included in

earned premium $ 4,753 $ 8,224

Net premiums earned - derivatives (1) $

4,992 $ 8,648

Claims paid

$ 41,858

(2)

$ 9,000

March 31 December 31

($ in thousands,

except ratios)

2013 2012

Statutory

Information:

Capital and surplus $ 1,206,578 $

1,144,112

Contingency reserve 240,303 300,138

Qualified statutory capital 1,446,881

1,444,250

Unearned premium reserve 233,192

256,920

Loss and loss expense reserve (93,276

) (53,441 )

Total statutory policyholders’ reserves

1,586,797 1,647,729

Present value of installment

premiums 104,913 114,292

Total

statutory claims paying resources $ 1,691,710

$ 1,762,021

Net debt service

outstanding $ 36,412,556 $ 42,526,289

Capital leverage ratio (3) 25 29

Claims paying leverage ratio (4) 22 24

Net

par outstanding by product: Public finance direct

$ 9,531,501 $ 9,796,131

Public finance

reinsurance 4,646,397 5,542,217

Structured direct

13,405,544 17,615,383

Structured reinsurance

635,210 787,758

Total (5) $

28,218,652 $ 33,741,489

(1)

Included in change in fair value of

derivative instruments.

(2)

Primarily related to commutation of

reinsurance business.

(3)

The capital leverage ratio is derived

by dividing net debt service outstanding by qualified statutory

capital.

(4)

The claims paying leverage ratio is

derived by dividing net debt service outstanding by total statutory

claims paying resources.

(5)

Included in public finance net par

outstanding is $0.9 billion and $1.0 billion at March 31, 2013 and

December 31, 2012, respectively, for legally defeased bond issues

where our financial guaranty policy has not been extinguished but

cash or securities have been deposited in an escrow account for the

benefit of bondholders.

Radian Group Inc. and Subsidiaries Mortgage

Insurance Supplemental Information Exhibit F

Quarter Ended March 31, 2013

2012

($ in

millions)

$ % $ %

Primary new

insurance written

Prime $ 10,905 100.0

% $ 6,460 99.9 %

Alt-A and A minus and below 1

— 5 0.1

Total

Flow $ 10,906 100.0 %

$ 6,465 100.0 %

Total primary new

insurance written by FICO score

>=740 $ 8,210 75.3 % $ 4,920

76.1 %

680-739 2,398 22.0 1,400 21.7

620-679 298 2.7 145

2.2

Total Flow $ 10,906

100.0 % $ 6,465 100.0 %

Percentage of

primary new insurance written

Monthly premiums 64 % 64 %

Single

premiums 36 % 36 %

Refinances

48 % 47 %

LTV 95.01% and above

1.7 % 1.8 %

90.01% to 95.00% 39.8

% 38.7 %

85.01% to 90.00% 39.3 % 41.6 %

85.00% and below 19.2 % 17.9 %

Radian Group Inc. and Subsidiaries Mortgage Insurance

Supplemental Information Exhibit G

March 31 March 31

2013 2012

($ in

millions)

$ % $ %

Primary insurance

in force

Flow $ 133,693

92.4 % $ 115,127 90.3 %

Structured

10,950 7.6 12,399

9.7

Total Primary $

144,643 100.0 % $ 127,526

100.0 %

Prime $

128,361 88.8 % $ 108,507 85.1 %

Alt-A

10,027 6.9 11,828 9.3

A minus and below

6,255 4.3 7,191

5.6

Total Primary $

144,643 100.0 % $ 127,526

100.0 %

Primary risk in

force

Flow $ 33,027 93.2 % $ 28,348

91.3 %

Structured 2,419

6.8 2,691 8.7

Total

Primary $ 35,446

100.0 % $ 31,039 100.0 %

Flow Prime $ 30,146 91.3

% $ 24,962 88.1 %

Alt-A 1,780 5.4 2,104

7.4

A minus and below 1,101

3.3 1,282 4.5

Total

Flow $ 33,027 100.0

% $ 28,348 100.0 %

Structured Prime $ 1,419 58.7

% $ 1,570 58.3 %

Alt-A 535 22.1 608

22.6

A minus and below 465

19.2 513 19.1

Total

Structured $ 2,419

100.0 % $ 2,691 100.0 %

Total Prime $ 31,565 89.1

% $ 26,532 85.5 %

Alt-A 2,315 6.5 2,712

8.7

A minus and below 1,566

4.4 1,795 5.8

Total

Primary $ 35,446

100.0 % $ 31,039 100.0 %

Radian Group Inc. and Subsidiaries Mortgage

Insurance Supplemental Information Exhibit H

March 31 March 31

2013 2012

($ in

millions)

$ % $ %

Total primary

risk in force by FICO score

Flow >=740 $

17,556 53.2 % $ 12,889 45.5 %

680-739

9,865 29.9 9,184 32.4

620-679 4,801

14.5 5,328 18.8

=740 $ 647 26.7

% $ 712 26.5 %

680-739 698 28.9 781

29.0

620-679 642 26.5 721 26.8

=740

$ 18,203 51.3 % $ 13,601 43.8 %

680-739 10,563 29.8 9,965 32.1

620-679

5,443 15.4 6,049 19.5

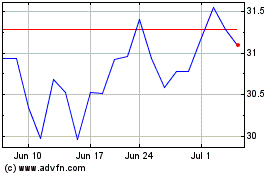

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

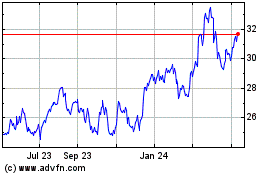

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024