Current Report Filing (8-k)

April 09 2013 - 8:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported) April 9, 2013

Radian Group Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

1-11356

|

23-2691170

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1601

Market Street, Philadelphia, Pennsylvania

|

19103

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(215) 231 - 1000

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General

Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On April 9, 2013, Radian Group Inc. (the “Company”) issued a news

release announcing, among other things:

-

The delinquency data for its mortgage insurance business for March

2013;

-

During the monthly period ending March 31, 2013, Radian Guaranty Inc.,

the Company’s principal mortgage insurance subsidiary, wrote $3.63

billion of new insurance written.

The Company also announced that after giving effect to a contribution of

$115 million to Radian Guaranty in March 2013, it currently maintains in

excess of $800 million of currently available liquidity and that it

expects to maintain a risk-to-capital ratio of 20:1 or below at Radian

Guaranty for the foreseeable future.

A copy of this news release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

The information included in, or furnished with, this report shall not be

deemed "filed" for purposes of Section 18 of the Securities Exchange Act

of 1934 (the "Exchange Act"), nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933 or the Exchange

Act, except as shall be expressly set forth by specific reference in

such filing.

Forward-looking Statements

Some of the statements in this Current Report on Form 8-K may constitute

“forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities and Exchange Act

of 1934 and the United States Private Securities Litigation Reform Act

of 1995. Words such as "will," "expects," "believes" and similar

expressions are used to identify these forward-looking statements. These

forward-looking statements, which may include without limitation,

projections regarding our future performance and financial condition,

are made on the basis of management’s current views and assumptions with

respect to future events. Any forward-looking statement is not a

guarantee of future performance and actual results could differ

materially from those contained in the forward-looking statement. These

statements speak only as of the date they were made, and we undertake no

obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. We

operate in a changing environment. New risks emerge from time to time

and it is not possible for us to predict all risks that may affect

us. The forward-looking statements, as well as our prospects as a

whole, are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in the forward-looking

statement, including the following:

-

changes in general economic and political conditions, including high

unemployment rates and continued weakness in the U.S. housing and

mortgage credit markets, a significant downturn in the U.S. or global

economies, a lack of meaningful liquidity in the capital or credit

markets, changes or volatility in interest rates or consumer

confidence and changes in credit spreads, each of which may be

accelerated or intensified by, among other things, legislative

activity or inactivity or actual or threatened downgrades of U.S.

credit ratings;

-

the application of existing federal or state laws and regulations, or

changes in these laws and regulations or the way they are interpreted,

including, without limitation: (i) the resolution of existing, or the

possibility of additional, lawsuits or investigations; and (ii)

legislative and regulatory changes (a) impacting the demand for

private mortgage insurance, (b) limiting or restricting our use of (or

increasing requirements for) additional capital and the products we

may offer or increasing the amount of capital we are required to hold,

(c) affecting the form in which we execute credit protection, or (d)

otherwise impacting our existing businesses; and

-

the possibility that we may fail to estimate accurately the

likelihood, magnitude and timing of losses in connection with

establishing loss reserves for our mortgage insurance or financial

guaranty businesses or premium deficiencies for our mortgage insurance

business, or to estimate accurately the fair value amounts of

derivative instruments in determining gains and losses on these

contracts.

For more information regarding these risks and uncertainties as well as

certain additional risks that we face, you should refer to the Risk

Factors detailed in Item 1A of Part I of our Annual Report on Form 10-K

for the year ended December 31, 2012 and subsequent reports and

registration statements filed from time to time with the Securities and

Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1* Radian Group Inc. News Release dated

April 9, 2013.

_____________________

* Furnished herewith.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

RADIAN GROUP INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

|

April 9, 2013

|

By:

|

/s/ C. Robert Quint

|

|

|

|

|

C. Robert Quint

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

|

|

|

|

No.

|

|

Description

|

|

|

|

|

|

99.1*

|

|

Radian Group Inc. News Release dated April 9, 2013

|

|

|

|

|

|

* Furnished herewith.

|

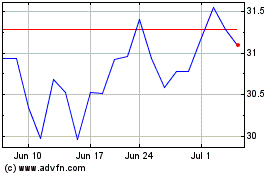

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

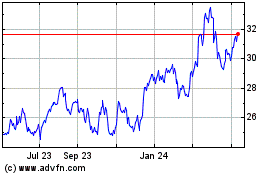

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024