Prudential Notes Gets Rating - Analyst Blog

March 25 2013 - 10:20AM

Zacks

Prudential Financial Inc.’s (PRU) recently

issued $500 million 5.20% fixed-to-floating rate junior

subordinated notes have been conferred a debt rating of “bbb” by

A.M. Best Co.

The rating agency has kept unchanged other ratings which

include – financial strength, issuer credit and existing debt

ratings of Prudential Financial and its subsidiaries.

All the ratings carry a stable outlook. A stable outlook

reflects that Prudential is experiencing stable financial and

market trends, and that therefore a rating change in the near term

is unlikely.

Though the notes will mature in 2044, Prudential has the

option to pay back the notes on or after Mar 15, 2024. It can also

make payment on the notes at any time within 90 days after the

occurrence of a ’tax event,’ ’a rating agency event‘ or a

’regulatory capital event.’

The funds gathered from the notes issue will be used primarily

for general corporate purposes which includes redemption of the

company’s 9% junior subordinated notes due in 2068.

Prudential’s operating results, debt servicing capability,

capital strength as well as reliance on both short and long-term

external debt were all taken into account by the rating agency for

the rating action.

The rating agency takes into account Prudential’s repeated

issuance of debt in the last month. The company has in total issued

$1.2 billion of junior subordinated notes.

On the flip side, Prudential’s high financial leverage ratio

of 35% continues to be a cause of concern for the rating agency. It

was also concerned with the company’s Total Financing and

Commitments ratio of 1.4x, which was above its peer group average

due to high use of debt within the insurer’s capital

structure.

Nevertheless, Prudential’s robust statutory capitalization

gives the rating agency adequate confidence in the company. The

rating agency expects higher earnings and coverage ratios going

forward.

Prudential’s stock retains a Zacks Rank #3 (Hold).

Other stocks within our coverage Assurant

Inc. (AIZ), CIGNA Corp. (CI),

Radian Group Inc. (RDN) all carrying a Zacks Rank

#2 (Buy) are worth considering.

ASSURANT INC (AIZ): Free Stock Analysis Report

CIGNA CORP (CI): Free Stock Analysis Report

PRUDENTIAL FINL (PRU): Free Stock Analysis Report

RADIAN GRP INC (RDN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

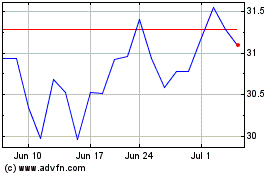

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

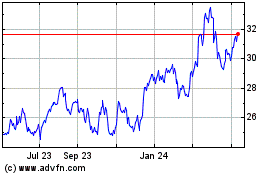

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024