MGIC Investment and Radian Group Shares Rise After Preliminary Deal Between MGIC and Freddie Mac Announced

November 02 2012 - 8:20AM

Marketwired

Mortgage insurers have experienced a resurgence in 2012 as the U.S.

housing market has continued its steady recovery. Recent data from

the Commerce Department has shown that home sales in the U.S. are

at its fastest annual pace in over two years. Five Star Equities

examines the outlook for companies in the Property & Casualty

Insurance Industry and provides equity research on MGIC Investment

Corp. (NYSE: MTG) and Radian Group Inc. (NYSE: RDN).

Access to the full company reports can be found at:

www.FiveStarEquities.com/MTG www.FiveStarEquities.com/RDN

"All the things that were really holding back housing are

finally starting to lift," said Guy Berger, a U.S. economist at RBS

Securities Inc. "It really is tough to find any bad signs here.

Inventories are very, very lean. Assuming the economy remains on

track, housing should continue to improve for the rest of the year

and into 2013."

Mortgage guarantors have also received a lift from a preliminary

deal between MGIC Investment and Freddie Mac resolving a coverage

dispute, which would have prevented the insurer from backing some

loans. As was the case with MGIC, soured home loans have caused

some insurers to breach the 25-to-1 ratio of risk relative to

capital preventing them from selling new coverage.

Five Star Equities releases regular market updates on the

Property & Casualty Insurance Industry so investors can stay

ahead of the crowd and make the best investment decisions to

maximize their returns. Take a few minutes to register with us free

at www.FiveStarEquities.com and get exclusive access to our

numerous stock reports and industry newsletters.

Under the agreement MGIC will make payments to Freddie Mac over

the next four years. "While there can be no guaranty the open

matters can be successfully resolved, I am hopeful we will continue

to make progress," CEO Curt Culver said in a statement. For the

first half of the year the company had recorded a net loss of

$293.4 million. The company is scheduled to release third quarter

results on November 9, 2012.

Radian Group is a credit enhancement company with a focus on

domestic, first-lien residential mortgage insurance. Shares of the

company jumped sharply after reporting a profit for the first time

in 2012. For the third quarter of 2012 Radian reported a net income

of $14.3 million, or 11 cents per share, analysts had estimated a

loss of $0.59 per share according to FactSet.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

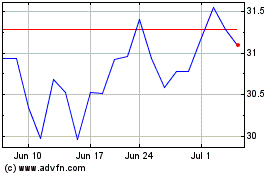

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

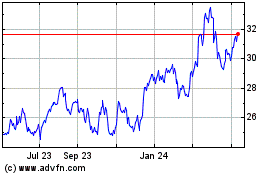

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024